ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, March 5, 2024

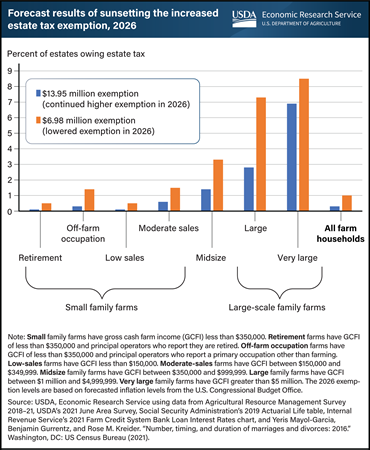

The 2017 Tax Cuts and Jobs Act (TCJA) made significant changes to Federal individual income and estate tax policies, though some policies were temporary. In 2018, the TCJA increased the estate tax exemption amount from $5.49 million to $11.18 million. This increase is set to expire at the end of 2025. The exclusion amount will revert in 2026 to the pre-TCJA level, adjusted for inflation, of $6.98 million per deceased person. For married couples, a portability provision in estate tax law allows the surviving spouse to use any unused portion of the deceased spouse’s exemption. Researchers with the USDA, Economic Research Service (ERS) estimated the expiring increased exemption would be $13.95 million per person at the time of the expiration. Lowering the level of the estate tax exemption in 2026 is estimated to increase the percent of farm operator estates taxed from 0.3 to 1.0. This means that of the estimated 40,883 estates that are expected to be created in 2026, the expiration of the increased exemption would raise the number of estates that owe tax from 120 to 424. Large farms (gross cash farm income between $1 million and $5 million) would experience the largest increase in the share of estates owing estate tax, increasing from 2.8 to 7.3 percent. Total Federal estate taxes for farm estates would be expected to more than double to $1.2 billion if the provision were allowed to expire. The information in this chart appears in the ERS publication An Analysis of the Effect of Sunsetting Tax Provisions for Family Farm Households published in February 2024.

Monday, May 22, 2023

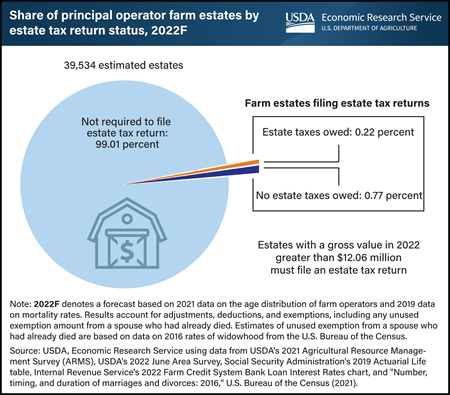

Created in 1916, the Federal estate tax is a tax on the transfer of property to a person’s heirs upon death. In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. Under the present law, the estate of a person who owns assets above the exemption amount at death must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests will pay Federal estate tax. Researchers from USDA, Economic Research Service (ERS) estimate that in 2022, 39,534 estates were created from principal operator deaths. Of those estates, ERS forecasts that 305 (0.77 percent) will be required to file an estate tax return, and a further 87 (0.22 percent) will likely owe Federal estate tax. Total Federal estate tax liabilities from the 87 farm estates owing taxes are forecast to be $566 million in 2022. The exemption amount was increased to $12.92 million per person in 2023. This chart appears in the ERS Topic Page, Federal Estate Taxes, published in April 2023.

Wednesday, October 6, 2021

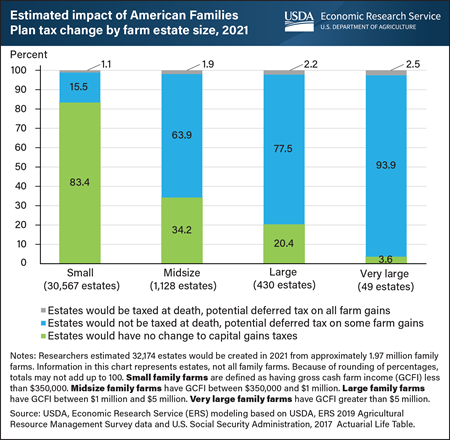

A proposal to change the way capital gains are taxed at death would affect family farm estates differently according to the size of the farm. Under current law, most inherited assets receive a step-up in basis, which means the tax basis—the amount for determining gain or loss—of property transferred to an heir at death is increased to its current fair market value at the date of death, eliminating any capital gains tax liability on those inherited gains. The change, which was included in the American Families Plan (AFP), would end stepped-up basis for gains above $1 million for the estates of individuals or $2 million for married couples. Gains above these exemption amounts would be subject to tax at death. However, the transfer of a family farm to a family member who continues the operation would not result in a tax at death. Farm and business assets exceeding the exemption amounts would receive a carry-over basis deferring capital gains tax until the assets are sold, or until the farm is no longer family owned and operated. USDA, Economic Research Service (ERS) researchers, using modeling to evaluate potential effects of the AFP proposal, found that as family farm size increased, the estimated share of estates owing no tax at death and receiving stepped-up basis on all assets decreased, while the estimated share of estates that would receive carry-over basis increased. For small farm estates, with gross cash farm income (GCFI) less than $350,000, 83.4 percent would owe no capital gains tax at death and would receive a stepped-up basis on all assets, resulting in no change to their capital gains tax liability. Under the ERS model, that share would drop to 34.2 percent for midsize farms (those with GCFI of $350,000 to $1 million), 20.4 percent for large farms (with GCFI of $1 million to $5 million), and 3.6 percent for very large farms (with GCFI of more than $5 million). Some estates would be taxed on nonfarm gains at death and potentially could owe deferred taxes on farm gains if the heirs stop operating the farm. For those estates, the estimated share increased from 1.1 percent for small farms to 2.5 percent for very large farms. Other estates would not have to pay tax at death but could see deferred taxes on farm gains if the heirs stop operating the farm. For that group, the estimated share increased from 15.5 percent for small farms to 93.9 percent for very large farms. This chart can be found in the ERS report The Effect on Family Farms of Changing Capital Gains Taxation at Death, published September 2021.

Wednesday, September 22, 2021

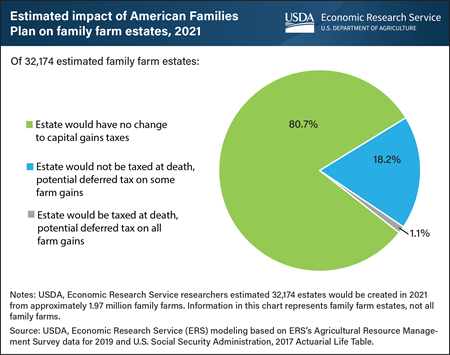

The American Families Plan (AFP) that President Joe Biden announced in April 2021 included a proposal to make accumulated gains in asset value subject to capital gains taxation when the asset owner dies. Under current law, asset value gains can be passed on to heirs without being subject to capital gains taxation because the value of the assets are reset to the fair market value at the time of inheritance. This adjustment in asset valuation, known as a “stepped-up basis,” eliminates capital gains tax liabilities on any gains incurred before the assets were transferred to the heirs. AFP also included a provision that would exempt from capital gains taxes $1 million in gains for the estates of individuals and $2 million in gains for the estates of married couples, as well as for gains on a personal residence of $250,000 for individuals and $500,000 for married couples. Gains above these exemption amounts would be subject to tax at death. However, the transfer of a family farm to a family member who continues the operation would not result in a tax upon the death of the principal operator. Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers any capital gains tax until the assets are sold or until the farm is no longer family-owned and operated. Using 2019 Agricultural Resource Management Survey data, USDA, Economic Research Service (ERS) researchers estimated that of the 1.97 million family farms in the United States, 32,174 estates would result from principal operator deaths in 2021. From these farm estates, the ERS model used to evaluate potential effects of the AFP proposal estimated that heirs of 80.7 percent of family farm estates would have no change to their capital gains tax liability upon death of the principal operator. Heirs of 18.2 percent of family farm estates would not owe taxes at the time of the principal operator’s death but could be subject to a future potential capital gains tax obligation on inherited farm gains if the heirs stop farming. Heirs of 1.1 percent of estates would owe tax on nonfarm gains upon death of the principal operator and have a future potential capital gains tax obligation resulting from inherited farm gains if the heirs stop farming. This chart can be found in the ERS report The Effect on Family Farms of Changing Capital Gains Taxation at Death, published September 2021.

Wednesday, April 14, 2021

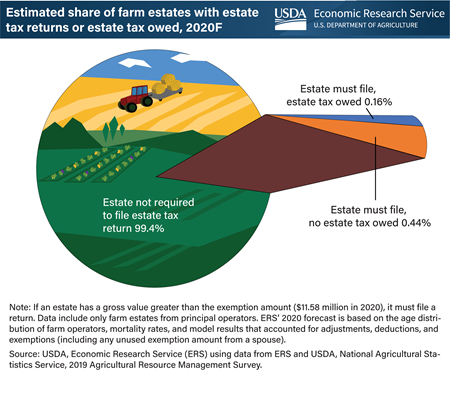

Created in 1916, the Federal estate tax is a tax on the transfer of property from a deceased person to their heirs at death. Legislation enacted over the last several years has greatly reduced the Federal estate tax by increasing the exemption amount from $675,000 in 2000 to $11.58 million in 2020. Under the present law, the estate of a person who owns assets above the exemption amount at death must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at a rate of 40 percent. Researchers from USDA, Economic Research Service (ERS) estimated that about 31,000 principal farm operators died in 2020. Of those estates, an estimated 189 (0.6 percent) will be required to file an estate tax return—and only 50 (0.16 percent) will owe Federal estate tax. Total Federal estate tax liabilities from farm estates owing taxes were forecasted to be $130.2 million in 2020 from a total estimated estate value of $56.3 billion. This chart appears in the April 2021 Amber Waves finding, “Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in 2020.”

Thursday, April 11, 2019

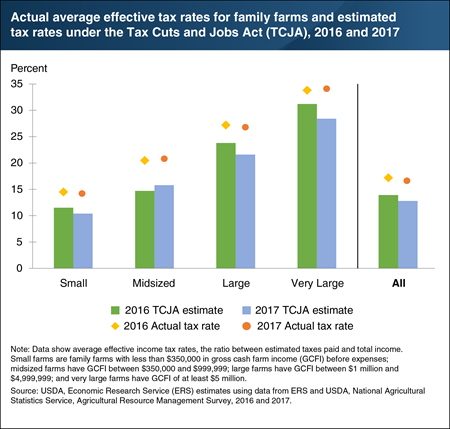

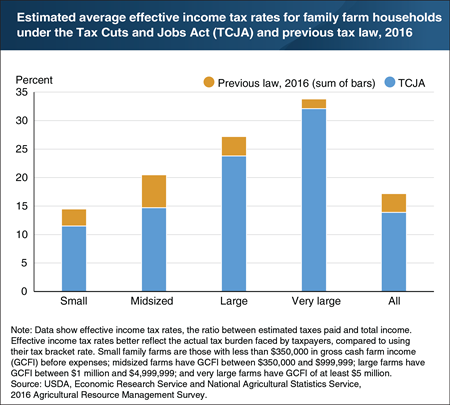

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, eliminates or modifies many itemized deductions and tax credits, while lowering Federal income tax bracket rates on individual and business income. Had the TCJA been in place in 2016, family farm households would have faced an estimated average effective tax rate of 13.9 percent, compared to the actual 17.2 percent effective tax rate that year. Had the TCJA also been in effect in 2017, the average effective tax rate would have been 12.8 percent, more than a percentage point lower than had it been in effect in 2016. By comparison, the actual effective tax rate in 2017 was 16.8 percent. The estimates vary by farm size. For example, small family farms would experience the lowest average effective tax rates, at 11.5 percent in 2016 and 10.4 percent in 2017. Only midsized family farms would have experienced an increase in their average tax rate, from 14.7 percent in 2016 to 15.8 percent in 2017. Those rates are still below the actual tax rates midsized farms experienced: 20.5 percent in 2016 and 20.8 percent in 2017. This chart updates data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households. For more on this topic, see “The Tax Cuts and Jobs Act Would Have Lowered Average Income Tax Rates for Farm Households between 2016 and 2017” in the April 2019 edition of Amber Waves.

Monday, October 15, 2018

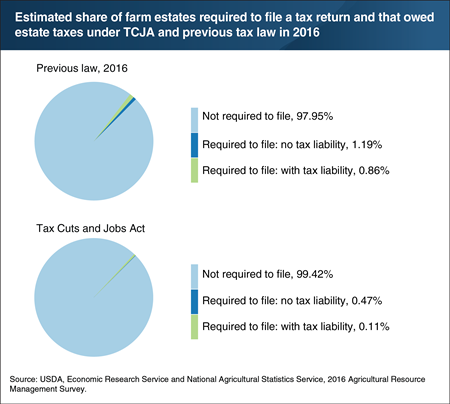

The Tax Cuts and Jobs Act (TCJA), passed in December 2017, doubled the Federal estate tax exemption amount to $11.18 million per individual. The estate tax exemption amount has increased significantly since 2000, when the exemption was $675,000, resulting in fewer farm estates that must file a tax return and that owe estate taxes. ERS researchers estimated that 39,214 farm estates were created in 2016 and, had the TCJA been in effect in 2016, only 0.58 percent of these farm estates would have been required to file an estate tax return. After accounting for adjustments, deductions, and expenses, 0.11 percent would have owed estate taxes, with an aggregate estate tax liability estimated at $104 million. By comparison, ERS estimated that under the previous law, 2.05 percent of farm estates were required to file an estate tax return in 2016 and that 0.86 percent owed estate taxes. The aggregate liability was estimated at $496 million. This chart uses data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

Wednesday, August 22, 2018

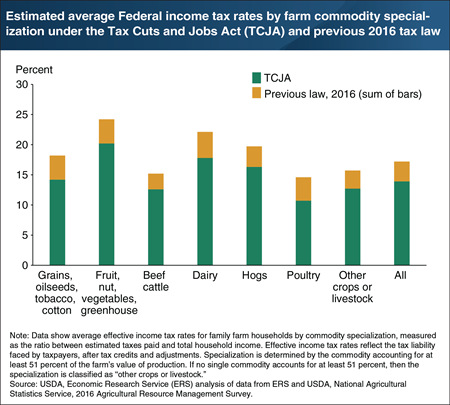

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax bracket rates on individual and business income. Had the TCJA been in place in 2016, ERS estimates that family farm households would have experienced a decline of 3.3 percentage points on average in their effective tax rate—the share of income paid in taxes after tax credits and adjustments are taken into account. The effects of the TCJA vary across specializations. Dairy producers would have experienced the largest decline at 4.3 percentage points. This was largely due to the new TCJA deduction for business income, since dairy farmers tend to earn a higher share of total household income from the farm business. Producers of beef cattle, which represented the greatest number of farms of any specialty in 2016, would have experienced the smallest decline at 2.6 percentage points. Beef cattle producers generally operate small farms with farm income making up a lower share of their total household income, which results in smaller tax reductions than for farm households with a higher share of farm income. This chart uses data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

Friday, June 29, 2018

In 2016, family farm households faced an estimated income tax rate of 17.2 percent on average. However, the recently passed Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax rates on individual and business income. The TCJA also expands some business provisions. Had the TCJA been in place in 2016, ERS estimates that family farm households would have faced a lower average income tax rate of 13.9 percent. The effects of the TCJA varies by farm size, with the greatest reduction for households operating midsized farms. The average income tax rate for households of midsized farms would have decreased by 5.8 percentage points. By comparison, the average income tax rate for households operating large farms would have decreased by 3.4 percentage points, for small farms by 3.0 percentage points. The expansion of the standard deduction is a primary reason households operating smaller farms are estimated to face lower income tax rates, while those operating large farms benefit more from reductions in individual tax rates and a new provision allowing a portion of farm income to be excluded from household taxable income (income from farming is taxed at the individual level for family farms). Midsized farms are expected to benefit from all these provisions. This chart appears in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

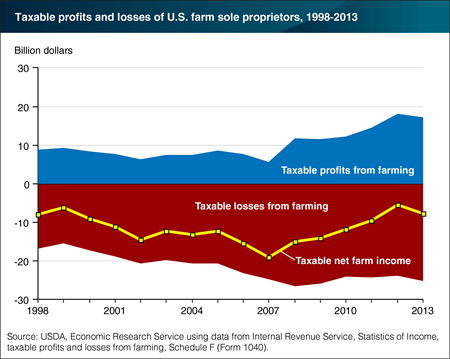

Tuesday, April 18, 2017

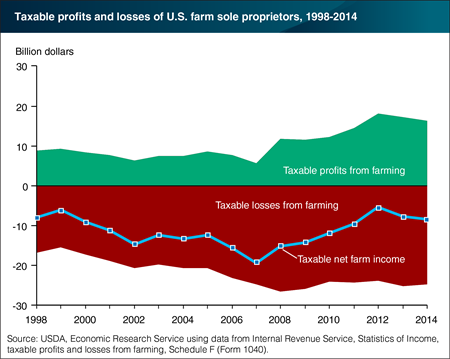

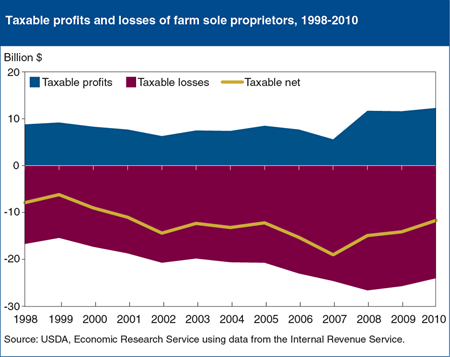

Nearly 90 percent of family farms are structured as sole proprietorships. These entities are not subject to pay income tax themselves; rather, the owners of the entities (farmers) are taxed individually on their share of income. Numerous Federal income tax law provisions allow farmers to reduce their tax liabilities by reporting losses. From 1998 to 2008, for example, taxable losses from farming (the red area of the chart) rose from $16.7 billion to $24.6 billion. This was due, in part, to changes in the tax code beginning in 2001 that expanded the ability of farms to deduct capital costs—such as tractors and machinery—in the year the equipment was purchased and used. Between 2007 and 2014, strong commodity prices bolstered farm-sector profits (the green area), but taxable net farm income (the blue line) remained negative. Farm sole proprietors, in aggregate, have reported negative net farm income since 1980; in other words, they’ve reported a farm loss due to higher farm expenses than income. In 2014, the latest year for which complete tax data are available, U.S. Internal Revenue Service data showed that nearly 67 percent of farm sole proprietors reported a farm loss. This chart appears in the ERS topic page for Federal Tax Policy Issues, updated January 2017.

Monday, August 8, 2016

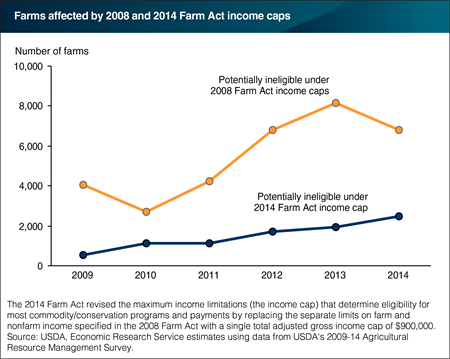

The 2014 Farm Act revised the maximum income limitations (the income cap) that determine eligibility for most commodity and conservation programs and payments by replacing the separate limits on farm and nonfarm income specified in the 2008 Farm Act with a single total adjusted gross income cap of $900,000. Based on data for 2009-14--a period of overall increasing farm sector income--a comparison of the impact of the income caps imposed by the 2008 and 2014 Farm Acts finds that the number of potentially ineligible farms increases over the period under both income caps. The potential number of farms affected by the 2014 income cap is below the number affected by the 2008 income caps, averaging 1,500 farms per year (about 0.1 percent of all farms) for the period 2009-14. This chart is found in the August 2016 Amber Waves feature, "Farm Bill Income Cap for Program Payment Eligibility Affects Few Farms."

Monday, June 20, 2016

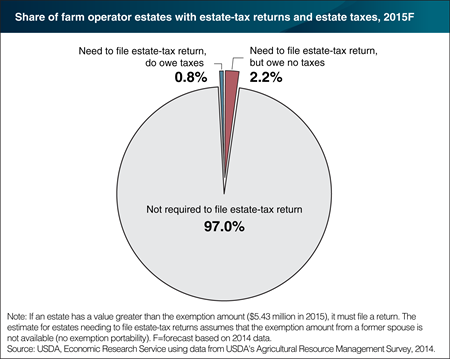

The Federal estate tax applies to the transfer of property at death. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate-tax exemption amount ($5.43 million in 2015) must file a Federal estate-tax return. However, only those returns that have a taxable estate above the exempt amount (after deductions for expenses, debts, and bequests to a surviving spouse or charity) are subject to tax at a graduated rate, up to a current maximum of 40 percent. Based on simulations using farm-level survey data from USDA’s 2014 Agricultural Resource Management Survey (ARMS), about 3 percent of farm estates would have been required to file an estate tax return in 2015, while 0.8 percent of all farm estates would have owed any Federal estate tax. This chart is based on the ERS topic page on Federal Estate Taxes.

Thursday, April 14, 2016

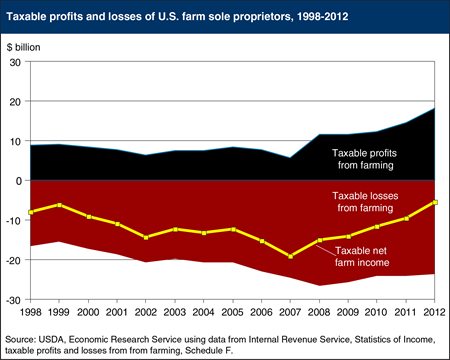

U.S. farm households generally receive income from both farm and off-farm activities, and for many, off-farm income largely determines the household’s income-tax liability. Since 1980, farm sole proprietors, in aggregate, have reported negative net farm income for tax purposes. From 1998 to 2008, both the share of farm sole proprietors reporting losses and the total amount of losses reported generally increased, due in part to deduction allowances for capital expenses. Since 2007, strong commodity prices bolstered farm-sector profits and the net losses from farming declined, leading to a peak in taxable profits (though still a negative taxable amount on net) in 2012. In 2013, the latest year for which complete tax data are available, U.S. Internal Revenue Service data showed that nearly 68 percent of farm sole proprietors reported a farm loss, totaling $25 billion. The remaining farms reported profits totaling $17 billion. This chart is found on the ERS Federal Tax Issues topic page, updated April 2016.

Thursday, June 11, 2015

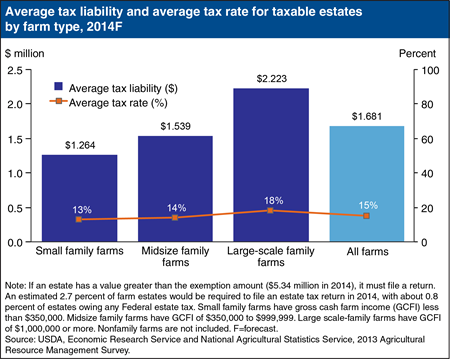

Since 1916, the Federal estate tax has been applied to the transfer of property at death. Under present law, the estate of a decedent, who at death owned assets in excess of the estate tax exemption amount ($5.43 million in 2015), must file a Federal estate tax return; those estates are subject to a 40 percent tax rate on the nonexempt amount. Based on simulations using farm-level survey data from the 2013 Agricultural Resource Management Survey (ARMS), for the 2014 tax year an estimated 2.7 percent of farm estates would be required to file an estate tax return, with a much smaller share of estates (about 0.8 percent) owing any Federal estate tax. On average, a farm estate that owed Federal estate tax had net worth of $11.1 million and a tax liability of $1.68 million, paying an average tax rate of 15 percent. Estates of small family farms (those with gross cash farm income (GCFI) below $350,000) faced the lowest average effective tax rate, while estates of large-scale family farms (those with GCFI of $1 million or more) were taxed at an average effective rate of 18 percent. This chart is found on the ERS topic page on Federal Estate Taxes, updated May 2015.

Wednesday, April 15, 2015

U.S. farm households generally receive income from both farm and off-farm activities, and for many, off-farm income largely determines the household’s income tax liability. Since 1980, farm sole proprietors, in aggregate, have reported negative net farm income for tax purposes. Over the 1998-2008 period, both the share of farm sole proprietors reporting losses and the amount of losses reported generally increased, due in part to deduction allowances for capital expenses. Since 2007, strong commodity prices have bolstered farm sector profits and the net losses from farming have declined. In 2012, the latest year for which complete data are available, U.S. Internal Revenue Service data showed that nearly 70 percent of farm sole proprietors reported a farm loss, totaling almost $24 billion. The remaining farms reported profits totaling $18.2 billion. This chart updates the chart found in the February 2013 Amber Waves feature, “Federal Income Tax Reform and the Potential Effects on Farm Households.”

Tuesday, April 15, 2014

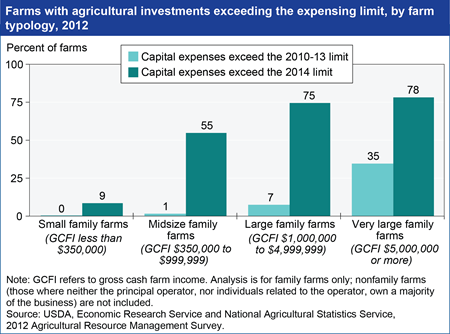

Farming requires large investments in machinery, equipment, and other depreciable capital. Such investments may be treated either as a current expense and deducted from gross farm income immediately, or capitalized and depreciated over time. For the past four years (2010-2013), if the cost was treated as an expense, the maximum deduction a farm could take was $500,000. Unless the 2010-13 expensing limit is extended, it will fall to $25,000 for tax year 2014. This change could increase the cost of capital investment and significantly increase taxable income for some farms. Based on 2012 ARMS data, while 38 percent of U.S. family farms reported a capital purchase, less than 1 percent had expenses exceeding $500,000. Under a $25,000 expensing limit, 13 percent of farms would have exceeded the limit. Smaller family farms, in general, did not make investments exceeding the old limit, but about 9 percent would have exceeded the 2014 limit. Very large family farms (those with gross cash farm income in excess of $5 million) were far more likely to have capital costs exceeding both the old limit (35 percent) and the 2014 limit (78 percent). This chart updates one found in the ERS report, The Potential Impact of Tax Reform on Farm Businesses and Rural Households, EIB-107, February 2013.

Monday, January 6, 2014

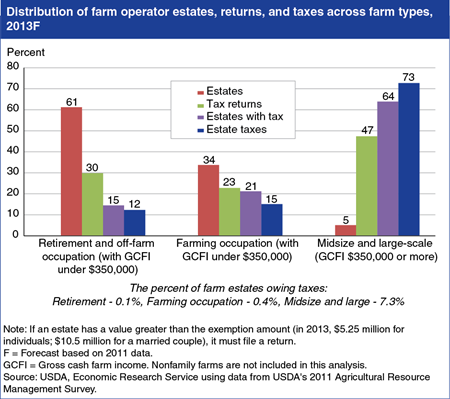

The Federal estate tax applies to the transfer of property after death. Under present law, the estate of a decedent who at death owns assets in excess of the estate tax exemption amount ($5.25 million in 2013 for an individual, $10.5 million for married couples) must file a Federal estate tax return. Based on simulations using farm-level survey data from the 2011 Agricultural Resource Management Survey (ARMS), only about 2.7 percent of family farm estates would be required to file an estate tax return in 2013, with a much smaller share of estates (about .6 percent) owing any Federal estate tax. The impact of the Federal estate tax varies by farm type. Most Federal estate taxes are owed by larger family farm estates. Although these farms account for only about 5 percent of all family farm estates, they account for 73 percent of total family farm estate taxes paid. Only about 7.3 percent of the estimated 2,103 estates involving larger family farms are likely to owe Federal estate taxes in 2013. This chart is found in the ERS topic page on Federal Tax Issues, updated November 2013.

Wednesday, November 13, 2013

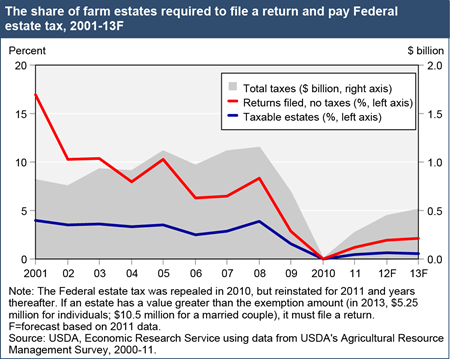

The Federal estate tax applies to the transfer of property after death; it was repealed in 2010 but reinstated for 2011 and years thereafter. Under present law, the estate of a decedent who at death owns assets in excess of the estate tax exemption amount ($5.25 million in 2013 for an individual, $10.5 million for married couples) must file a Federal estate tax return, and those estates are subject to a 40 percent tax rate on the nonexempt amount. Based on simulations using farm-level survey data from the 2011 Agricultural Resource Management Survey (ARMS), in 2013, only about 2.7 percent of farm estates would be required to file an estate tax return, with a much smaller share (about .6 percent) owing any Federal estate tax. Total Federal estate tax liabilities on all farm estates in 2013 are estimated at about half a billion dollars. Historically, these amounts have been much higher. Since 2000, the exemption amount has grown considerably, while the maximum tax rate has fallen. Consequently, the share of estates required to file a return or pay taxes has fallen. This chart is found in the Federal Tax Issues topic page on the ERS website, updated November 2013.

Friday, May 10, 2013

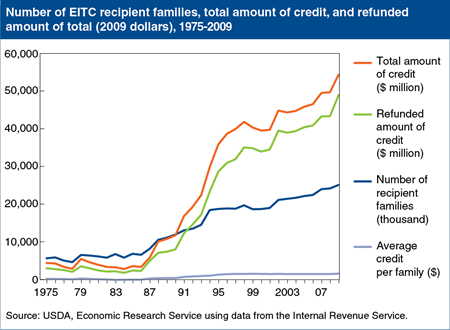

The earned income tax credit (EITC) was enacted in 1975 to reduce the burden of Social Security taxes on low-income workers and to encourage them to seek employment rather than welfare benefits. The amount of the credit depends upon the number of qualifying children in the household and the level of earned and adjusted gross income. As a refundable tax credit, the EITC results in lower tax liabilities for qualifying low-income households that owe Federal income taxes and cash payments to those owing no taxes. The EITC has expanded over the past two decades and represents an increasing share of total Federal support to low-income households. In 2009, the credit provided roughly $55 billion to over 25 million low-income workers and their families. Rural households have historically had lower incomes and higher poverty rates than urban households. As a result, a disproportionately large share of rural taxpayers benefit from the EITC. In 2008, 21.6 percent of rural taxpayers received EITC benefits, compared with 16.9 percent of urban taxpayers. This chart comes from the ERS report, The Potential Impact of Tax Reform on Farm Businesses and Rural Households, EIB-107, February 2013.

Monday, April 15, 2013

U.S. farm households generally receive income from both farm and off-farm activities, and for many, off-farm income largely determines the household’s income tax liability. Since 1980, farm sole proprietors, in the aggregate, have reported negative net farm income for tax purposes, and over the last decade, both the share of farmers reporting losses and the amount of losses reported generally have increased even as farm sector income hits historic highs. In 2010, the latest year for which complete data are available, U.S. Internal Revenue Service data showed that nearly three out of four farm sole proprietors reported a farm loss, for almost $24 billion in losses. The remaining farms reported profits totaling $12.3 billion. Since only about 60 percent of those reporting a farm profit owed any Federal income taxes, only about 19 percent of farm sole proprietors paid any Federal income tax on their farm income in 2010. This chart is found in the February 2013 Amber Waves feature, Federal Income Tax Reform and the Potential Effects on Farm Households.