Most farm estates would be exempt from Federal estate tax in 2013

- by Economic Research Service

- 11/13/2013

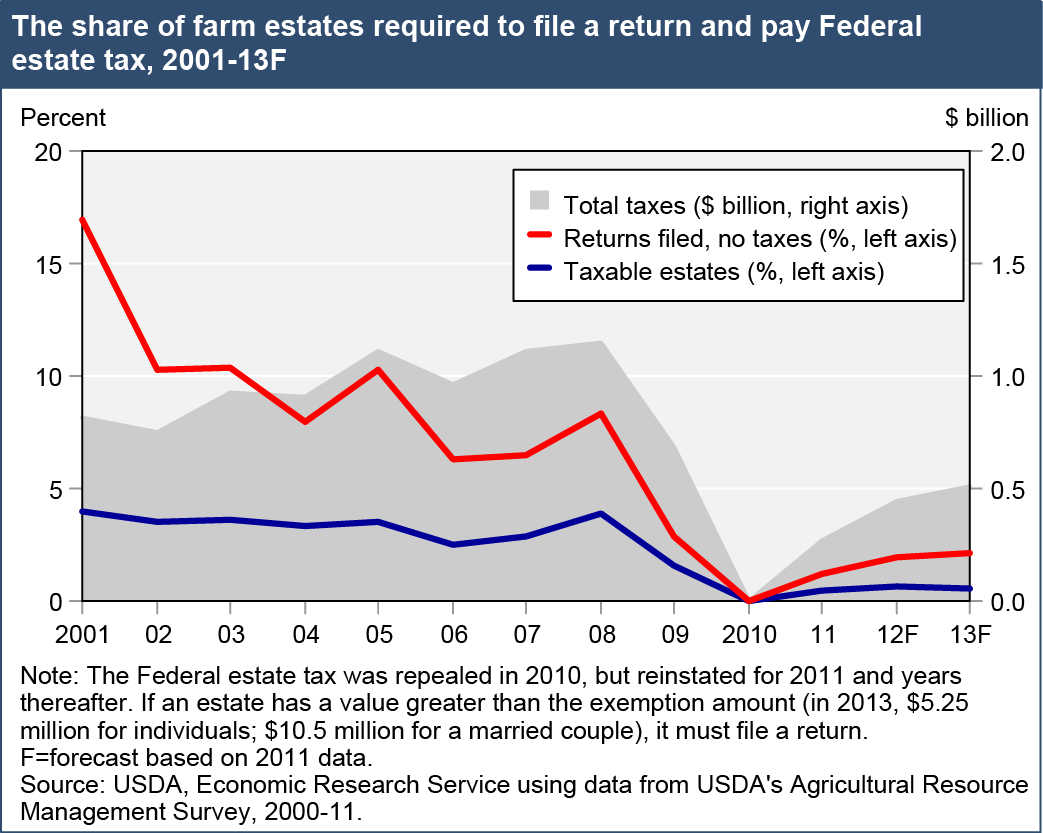

The Federal estate tax applies to the transfer of property after death; it was repealed in 2010 but reinstated for 2011 and years thereafter. Under present law, the estate of a decedent who at death owns assets in excess of the estate tax exemption amount ($5.25 million in 2013 for an individual, $10.5 million for married couples) must file a Federal estate tax return, and those estates are subject to a 40 percent tax rate on the nonexempt amount. Based on simulations using farm-level survey data from the 2011 Agricultural Resource Management Survey (ARMS), in 2013, only about 2.7 percent of farm estates would be required to file an estate tax return, with a much smaller share (about .6 percent) owing any Federal estate tax. Total Federal estate tax liabilities on all farm estates in 2013 are estimated at about half a billion dollars. Historically, these amounts have been much higher. Since 2000, the exemption amount has grown considerably, while the maximum tax rate has fallen. Consequently, the share of estates required to file a return or pay taxes has fallen. This chart is found in the Federal Tax Issues topic page on the ERS website, updated November 2013.