Estate tax liability varies by farm size

- by Kathleen Kassel

- 6/11/2015

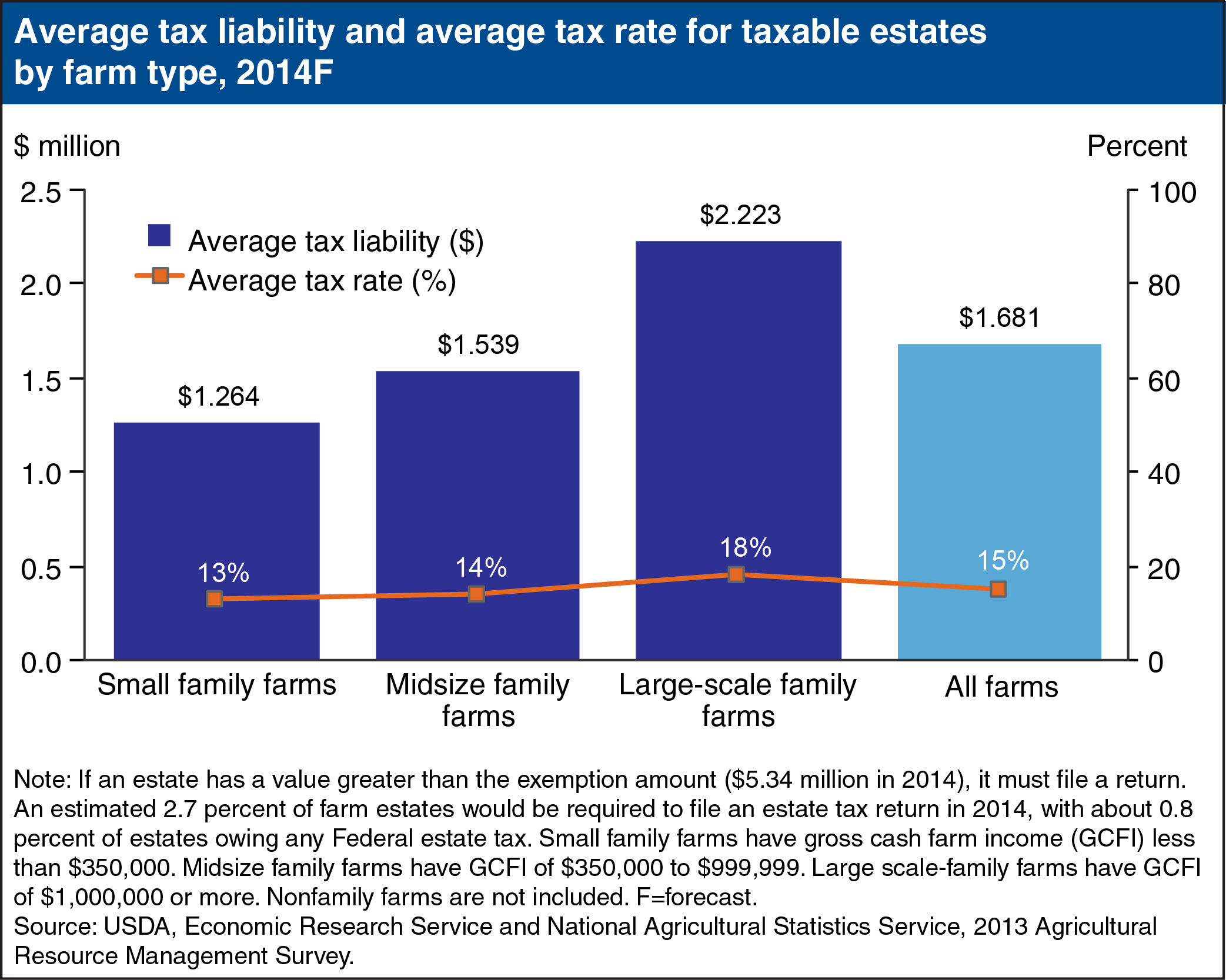

Since 1916, the Federal estate tax has been applied to the transfer of property at death. Under present law, the estate of a decedent, who at death owned assets in excess of the estate tax exemption amount ($5.43 million in 2015), must file a Federal estate tax return; those estates are subject to a 40 percent tax rate on the nonexempt amount. Based on simulations using farm-level survey data from the 2013 Agricultural Resource Management Survey (ARMS), for the 2014 tax year an estimated 2.7 percent of farm estates would be required to file an estate tax return, with a much smaller share of estates (about 0.8 percent) owing any Federal estate tax. On average, a farm estate that owed Federal estate tax had net worth of $11.1 million and a tax liability of $1.68 million, paying an average tax rate of 15 percent. Estates of small family farms (those with gross cash farm income (GCFI) below $350,000) faced the lowest average effective tax rate, while estates of large-scale family farms (those with GCFI of $1 million or more) were taxed at an average effective rate of 18 percent. This chart is found on the ERS topic page on Federal Estate Taxes, updated May 2015.