Taxable U.S. net income from farming remained negative in 2013

- by James Williamson and Ron Durst

- 4/14/2016

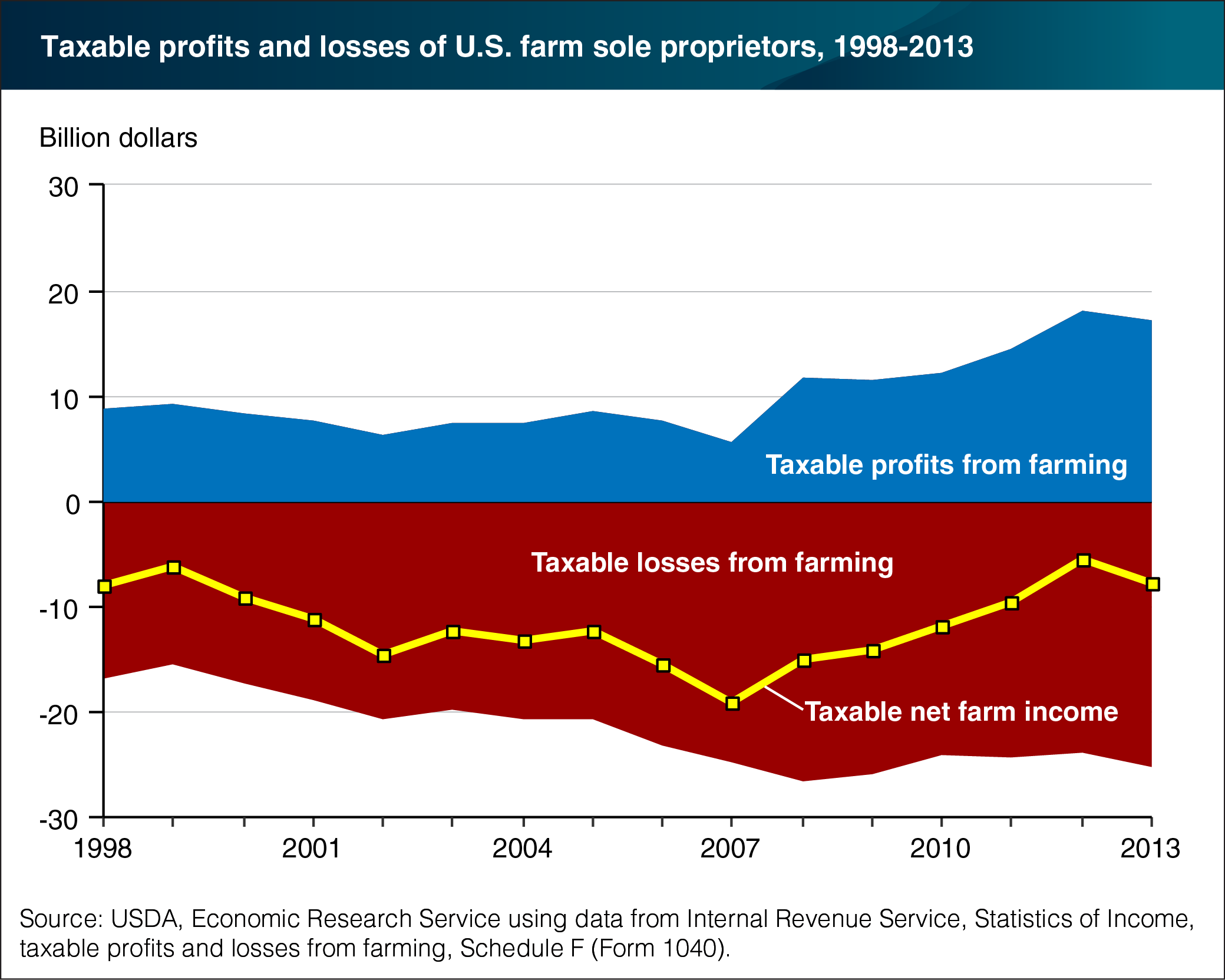

U.S. farm households generally receive income from both farm and off-farm activities, and for many, off-farm income largely determines the household’s income-tax liability. Since 1980, farm sole proprietors, in aggregate, have reported negative net farm income for tax purposes. From 1998 to 2008, both the share of farm sole proprietors reporting losses and the total amount of losses reported generally increased, due in part to deduction allowances for capital expenses. Since 2007, strong commodity prices bolstered farm-sector profits and the net losses from farming declined, leading to a peak in taxable profits (though still a negative taxable amount on net) in 2012. In 2013, the latest year for which complete tax data are available, U.S. Internal Revenue Service data showed that nearly 68 percent of farm sole proprietors reported a farm loss, totaling $25 billion. The remaining farms reported profits totaling $17 billion. This chart is found on the ERS Federal Tax Issues topic page, updated April 2016.