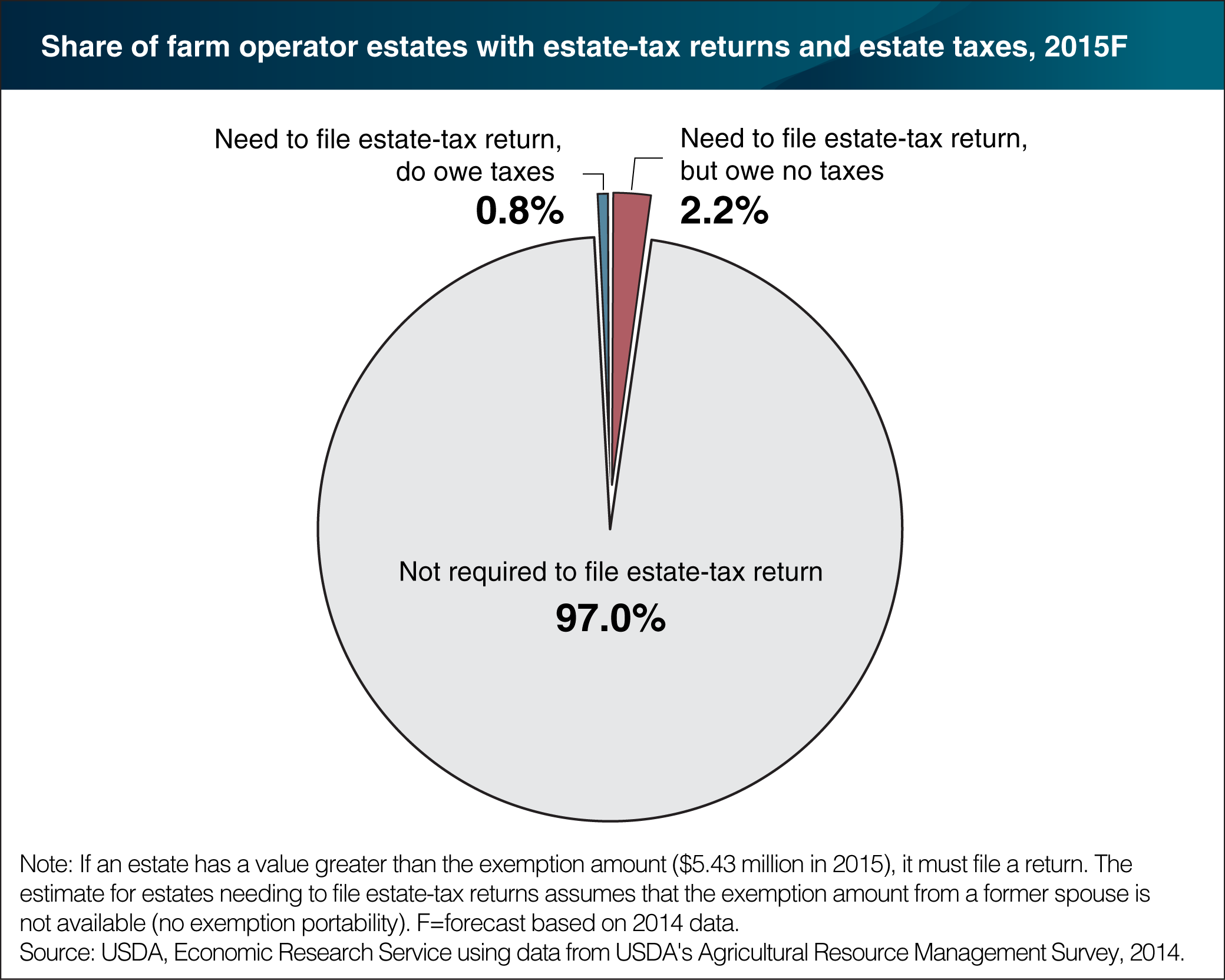

Most U.S. farm estates exempt from Federal estate tax in 2015

- by James Williamson

- 6/20/2016

The Federal estate tax applies to the transfer of property at death. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate-tax exemption amount ($5.43 million in 2015) must file a Federal estate-tax return. However, only those returns that have a taxable estate above the exempt amount (after deductions for expenses, debts, and bequests to a surviving spouse or charity) are subject to tax at a graduated rate, up to a current maximum of 40 percent. Based on simulations using farm-level survey data from USDA’s 2014 Agricultural Resource Management Survey (ARMS), about 3 percent of farm estates would have been required to file an estate tax return in 2015, while 0.8 percent of all farm estates would have owed any Federal estate tax. This chart is based on the ERS topic page on Federal Estate Taxes.