Under the Tax Cuts and Jobs Act, average income tax rates are estimated to decline for households across all family farm sizes

- by James Williamson

- 6/29/2018

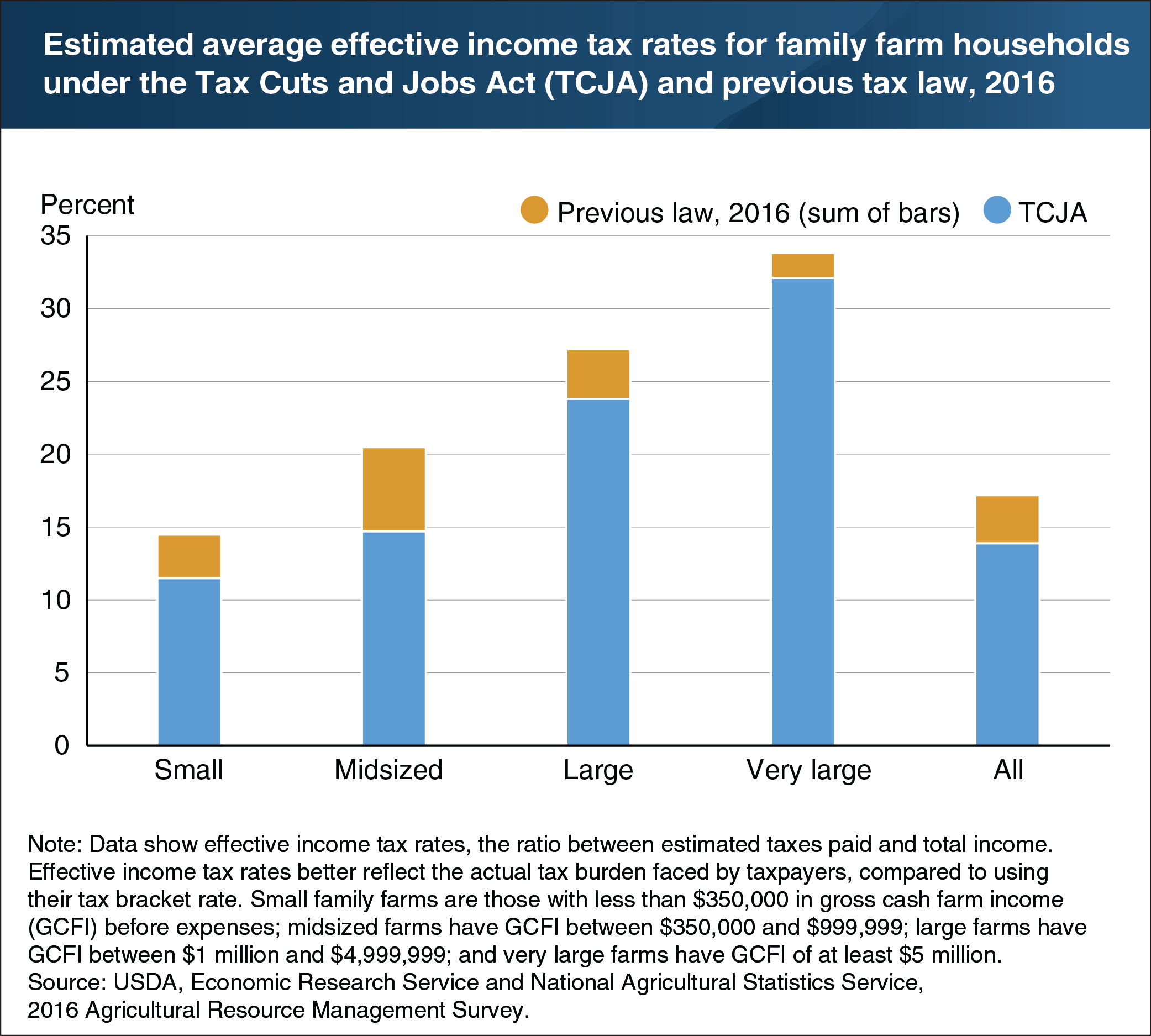

In 2016, family farm households faced an estimated income tax rate of 17.2 percent on average. However, the recently passed Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax rates on individual and business income. The TCJA also expands some business provisions. Had the TCJA been in place in 2016, ERS estimates that family farm households would have faced a lower average income tax rate of 13.9 percent. The effects of the TCJA varies by farm size, with the greatest reduction for households operating midsized farms. The average income tax rate for households of midsized farms would have decreased by 5.8 percentage points. By comparison, the average income tax rate for households operating large farms would have decreased by 3.4 percentage points, for small farms by 3.0 percentage points. The expansion of the standard deduction is a primary reason households operating smaller farms are estimated to face lower income tax rates, while those operating large farms benefit more from reductions in individual tax rates and a new provision allowing a portion of farm income to be excluded from household taxable income (income from farming is taxed at the individual level for family farms). Midsized farms are expected to benefit from all these provisions. This chart appears in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.