ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Thursday, February 15, 2024

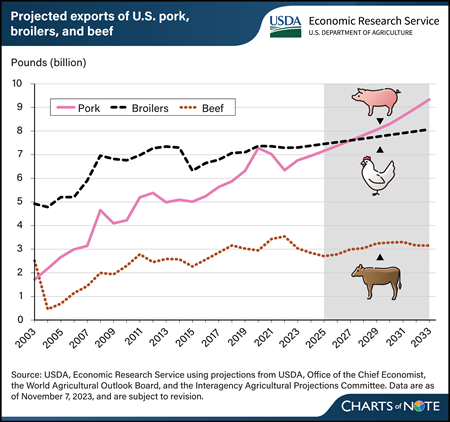

The volume of U.S. meat exports in major categories is projected to grow through 2033, according to USDA long-term projection data. Rising incomes abroad and a moderately declining real exchange rate of the U.S. dollar against the currencies of major agricultural trade partners lend support to U.S. red meat and poultry exports. Notably, by 2028, pork exports are set to exceed exports of broiler chickens for the first time since 1976. Steady growth in U.S. pork production, driven by a combination of increasing slaughter weights, rising pigs per litter, and higher inventories, is projected to support rapid growth in exports. New environmental policies in the European Union (EU) are expected to impact regional pork production and reduce growth of EU’s exports, enhancing U.S. competitiveness. U.S. pork exports are projected to increase 34 percent from an expected 6.95 billion pounds in 2024 to a projected 9.34 billion pounds by 2033. By 2026, U.S. pork exports are expected to surpass the previous record of 7.28 billion pounds set in 2020, when import demand in China spiked at the height of China’s African swine fever epidemic. This chart appears in the USDA, Economic Research Service Amber Waves article, U.S. Pork Export Volumes Projected to Surpass Chicken in the Next Decade, February 2024.

Wednesday, February 14, 2024

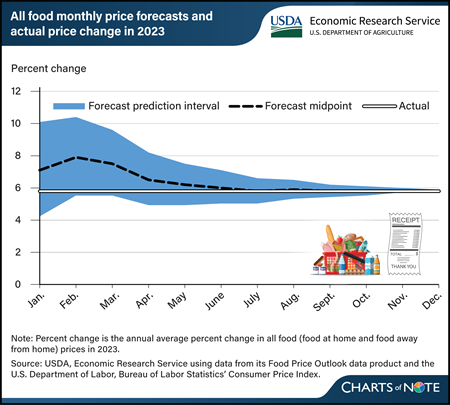

In 2023, all food prices (representing both food at home and food away from home) increased by 5.8 percent on average compared with 2022. The USDA, Economic Research Service (ERS) publishes food price forecasts in the Food Price Outlook (FPO) data product. Each month, the FPO forecasts the annual average change in prices for the current year, and the forecasts are presented as a midpoint and a prediction interval. The prediction interval, which represents uncertainty of the forecast, starts out wider at the beginning of the year and narrows as forecasts incorporate more months of observed data and the forecast period shortens. In January of each year, final data are available to assess the performance of the forecasts from the previous year. During the first few months of 2023, the all-food forecast midpoints were higher than the actual annual average change in all food prices, but the prediction interval from each forecast developed in 2023 contained the actual annual average change in prices. By July, the forecast midpoint converged on the actual average change in prices and remained within 0.1 percent through the remainder of the year. ERS researchers project all food prices to increase 1.3 percent in 2024, with a prediction interval of -1.4 to 4.2 percent. This chart is based on data from the ERS Food Price Outlook, updated January 25, 2024.

Tuesday, February 13, 2024

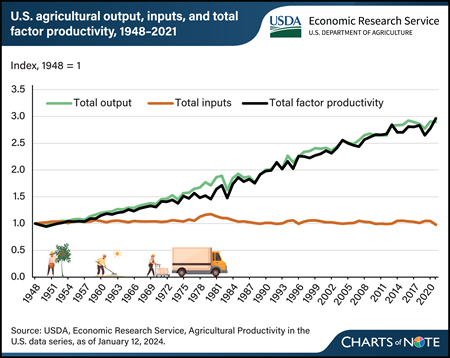

Technological developments in agriculture have enabled continued output growth without requiring much additional inputs. Innovations in animal and crop genetics, chemicals, equipment, and farm organization have made it possible for total agricultural output to nearly triple between 1948 and 2021. During that period, the amount of inputs used in farming declined slightly over time, meaning that the growth in agricultural output over the long term has depended on increases in total factor productivity (TFP). TFP measures the amount of agricultural output produced from the combined inputs (land, labor, capital, and intermediate inputs) employed in farm production. Therefore, growth in TFP indicates positive changes in the efficiency with which inputs are transformed into outputs. It can also be seen as an indicator of technical change. In the short term, total output growth and estimated TFP growth can be affected by random events, such as adverse weather. In the most recent TFP calculation period spanning 2020–21, agricultural output grew, which was due entirely to TFP growth, even as the amount of inputs used in farming fell. This figure appears in the Agricultural Productivity in the U.S.: Summary of Recent Findings updated in January 2024.

Monday, February 12, 2024

The USDA’s Economic Research Service (ERS) routinely forecasts U.S. farm sector financial health. For each calendar year, there are four forecasts of profitability measures before ERS releases an official estimate. The first forecast for each year occurs in February and is partially based on historical data and trends since planting intentions of crops such as corn and soybeans are unknown. It also incorporates early commodity price and production projections from USDA and projections by other entities, such as energy price forecasts by the Energy Information Administration. In 2022, for instance, the initial forecast of 2022 farm income occurred on February 4, 2022, and the forecast projected net farm income of $113.7 billion. The second forecast occurs in late August/early September and is based on observed data from the production cycle, such as input and output price information and planting areas with related output projections. The second forecast also includes revised projections of direct Government payments and insurance indemnities and projections from USDA’s World Agricultural Supply and Demand Estimates (WASDE) report. For calendar year 2022, Forecast 2 occurred on September 1, 2022, and the forecast projected net farm income of $147.7 billion. The third data release, in late November/early December, further refines the forecast based on the most recent data and projections, including additional administrative data on direct Government payments. The last forecast is made in February of the following year. It is still a forecast because the data are still being collected and refined. The first official estimate of 2022 farm income (of $183.0 billion) was published on August 31, 2023, and completed a 19-month cycle. That data release incorporated the first information available from the USDA’s most recent annual Agricultural Resource Management Survey (ARMS), which improves analysis of production expenses. State-level farm income data for the calendar year are released for the first time as a part of the estimates. Adjustments to the U.S. and State-level estimates may be made in future data releases, but they are typically small. On February 7, 2024, ERS released the first forecast of 2024 and the last forecast of 2023 U.S. farm sector financial health. The first estimates of calendar year 2023 will be published on September 5, 2024, together with Forecast 2 for calendar year 2024. A version of this chart appears in the ERS report, The Evolution of U.S. Farm Sector Profitability Forecasts in 2020.

Thursday, February 8, 2024

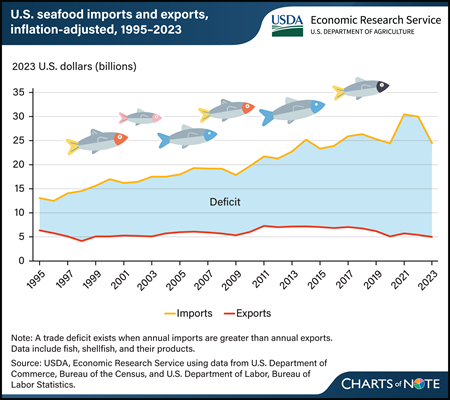

Consumer demand for seafood in the United States has risen over the last three decades. According to the National Oceanic and Atmospheric Administration, per capita consumption of seafood products (includes canned, fresh, frozen, and cured) reached an estimated 20.5 pounds per person in 2021. To meet rising consumer demand, the United States increasingly relies on global suppliers to supplement domestic production. About 80 percent of estimated U.S. consumption of seafood comes from abroad—primarily from Canada, Chile, India, Indonesia, and Vietnam. From 1995 to 2023, the value of U.S. seafood imports, adjusted for inflation, trended upward, with notable exceptions related to the global economic recession and the Coronavirus (COVID-19) pandemic. U.S. seafood exports dropped about 23 percent, while imports expanded about 87 percent during the same period. The expanding deficit in trade value (imports minus exports) peaked in 2021 at $25.8 billion (in 2023 dollars) and was recorded at $20.3 billion in 2023. As a supplier, the United States ranked 10th in 2022 in seafood exports worldwide. This chart is drawn from the USDA, Economic Research Service topic page on aquaculture.

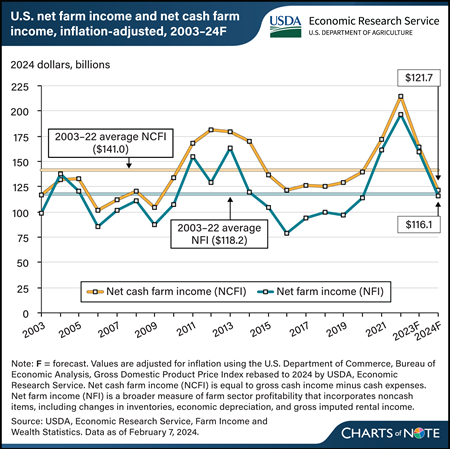

Wednesday, February 7, 2024

USDA’s Economic Research Service (ERS) forecasts that U.S. net cash farm income (NCFI), defined as gross cash income minus cash expenses, will decrease by $42.2 billion (25.8 percent) to $121.7 billion in 2024 in inflation-adjusted dollars. This is after NCFI decreased in 2023 by a forecast $50.2 billion to $163.9 billion. Net farm income (NFI) is forecast to decrease by $43.1 billion (27.1 percent) to $116.1 billion from 2023 to 2024. NFI is a broader measure of farm sector profitability that incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income. The forecasted 2024 NFI decrease follows a decrease of $37.2 billion from 2022 to $159.2 billion in 2023. These decreases are from record levels in 2022, and if forecasts are realized, NCFI and NFI would fall below their respective 2003–22 averages in 2024. Underlying these forecasts, cash receipts for farm commodities are projected to fall by $32.2 billion (6.2 percent) to $485.5 billion in 2024. During the same period, production expenses are expected to increase by $7.2 billion (1.6 percent) to $455.1 billion in 2024. Also, total commodity insurance indemnity payments are forecast to fall by $1.5 billion (6.6 percent) in 2024, and direct Government payments to farmers are projected to fall by $2.2 billion (17.7 percent) from 2023 levels to $10.2 billion in 2024. Find additional information and analysis on the USDA, ERS topic page for Farm Sector Income and Finances, reflecting data released on February 7, 2024.

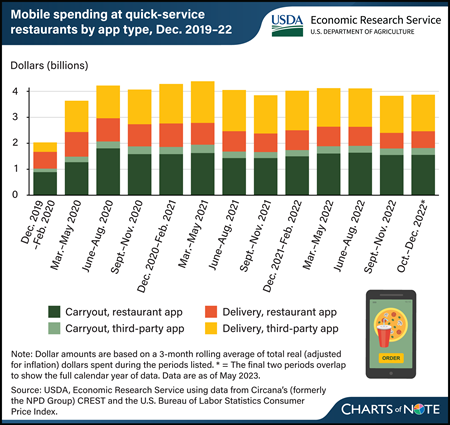

Tuesday, February 6, 2024

Through the end of 2022, consumer spending at quick-service restaurants on carryout and delivery remained persistently higher than the first observable Coronavirus (COVID-19) pandemic period (March–May 2020). USDA, Economic Research Service (ERS) researchers recently examined consumer spending trends on carryout and delivery from quick-service restaurants by mobile application types (including mobile website equivalents) from December 2019–February 2020 through October–December 2022. Consumers quickly adopted alternative methods to spend money on and acquire food at the beginning of the pandemic. In June–August 2020, carryout spending at quick-service restaurants via restaurant-specific apps doubled from prepandemic levels, and spending on delivery via third-party apps more than tripled. Third-party apps typically offer food from a variety of restaurants, while restaurant-specific apps are operated by the restaurant or establishment. App spending on carryout and delivery peaked in March–May 2021, reaching a total of $4.4 billion, with third-party app delivery and restaurant-specific app carryout spending each reaching about $1.6 billion. Most recently, total app spending on both carryout and delivery reached roughly $3.9 billion, where restaurant-specific carryout spending and third-party app delivery spending accounted for $1.6 and $1.4 billion, respectively. This chart appears in the ERS Amber Waves article, Pandemic-Related Increase in Consumer Restaurant Spending Using Mobile Apps Continued Through 2022, published January 2024.

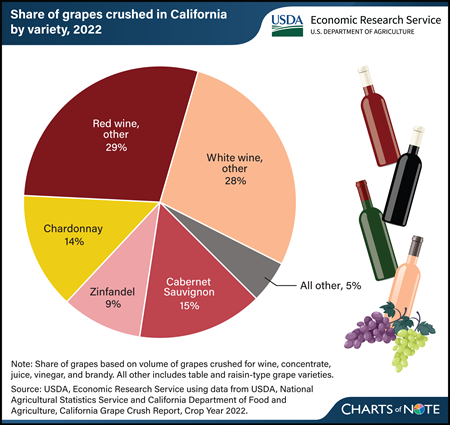

Monday, February 5, 2024

Red or white wine? Red wine varieties accounted for the largest share of grapes crushed in 2022 in California, the top wine grape-producing State. California growers raise more than 100 different varieties of wine grapes, according to the annual California Grape Crush Report. In 2022, Cabernet Sauvignon, a red varietal, accounted for California’s largest share of grapes crushed at 15 percent. White varietal, Chardonnay, came in second among wine grape varieties at 14 percent and was the top white wine variety by volume crushed. Other table grape and raisin-type grape varieties collectively represented 5 percent of the 3.7 million tons of grapes crushed for wine, concentrate, juice, vinegar, and brandy. California producers grow about 94 percent of the total U.S. grape crop, with nearly 70 percent of the State’s grape acreage dedicated to wine-type grapes. In the past few seasons, the value of the wine grape crop, both red and white, in California exceeded $3.6 billion. This chart is based on the USDA, Economic Research Service Fruit and Tree Nuts Outlook Report, released September 2023.

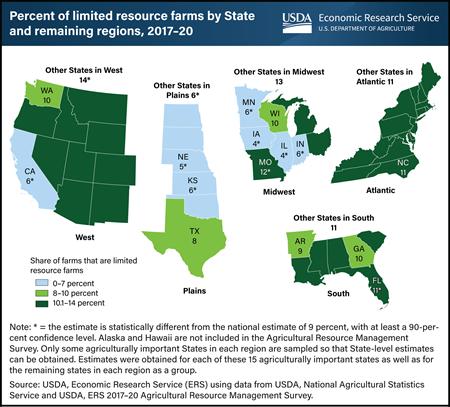

Friday, February 2, 2024

USDA identifies farmers and ranchers as limited resource (LR) producers as those who, for two consecutive years, operate a farm with gross farm sales less than $180,300 (in 2020 dollars) and have total household income either below the Federal poverty level for a family of four or less than half of the median household income in the county where they live. Between 2017 and 2020, 9.3 percent of all U.S. farms had an LR principal operator, according to the Agricultural Resource Management Survey (ARMS). Of the remaining farms, 76.3 percent had farm sales low enough to meet LR status, but did not meet other requirements, while 14.3 percent had gross farm sales above the LR threshold. The ARMS data also reveal that the share of farms that were LR varied geographically, with lower proportions in the Plains region and higher proportions in the Atlantic and West regions. There were also within-region differences in the share of farms that were LR farms, such as the Midwest, where 4 percent of farms in Iowa and Illinois were LR while Missouri had roughly 12 percent. This highlights differences in the scale of production, as well as differences in off-farm income and county median incomes. ARMS is the only nationally representative survey that collects the information needed to determine whether the principal operator on a farm meets the LR criteria. This chart is found in the USDA, Economic Research Service’s report An Overview of Farms Operated by Socially Disadvantaged, Women, and Limited Resource Farmers and Ranchers in the United States, published in February 2024.

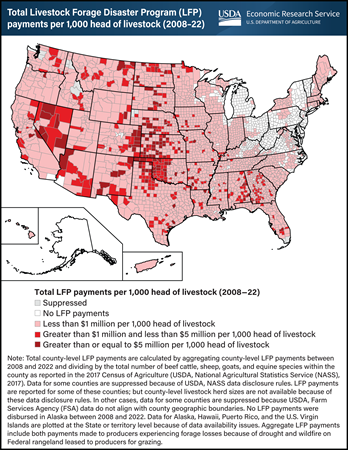

Wednesday, January 31, 2024

Drought imposes significant costs on the U.S. agricultural sector, particularly for livestock producers who rely on precipitation to grow forage. USDA’s Farm Service Agency’s (FSA) provides payments to livestock producers whose pastures and rangeland are impacted by drought through the Livestock Forage Disaster Program (LFP). The LFP was established by the 2008 Farm Bill and uses eligibility criteria based on county-level drought conditions reported by the U.S. Drought Monitor. FSA annually sets species-specific per head LFP payment rates designed to cover about 60 percent of monthly feed/forage costs for livestock. Livestock species eligible for LFP payments include traditional livestock, such as beef and dairy cattle, as well as more exotic varieties, such as reindeer and ostriches. Between 2008 and 2022, the program disbursed more than $12 billion (in 2022 dollars) of payments to livestock producers. Counties with the largest aggregate LFP payments per 1,000 head of livestock are concentrated primarily in the Western, Southern, and Central United States, where drought conditions are generally more severe and common. About 20 percent of counties in the continental United States received no LFP payments between 2008 and 2022. These counties are primarily located in urban regions and the relatively more humid Eastern United States. This chart was drawn from the USDA, Economic Research Service report The Stocking Impact and Financial-Climate Risk of the Livestock Forage Disaster Program, published January 2024.

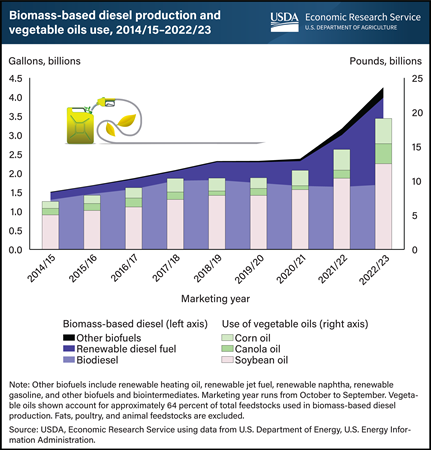

Tuesday, January 30, 2024

U.S. policies aimed at reducing greenhouse gas emissions have encouraged the production of biofuels—fuels derived from crops and animal fats. The policy framework has supported expansion in the production of biomass-based diesel. Biomass-based diesel includes biodiesel and renewable diesel, which now captures the second-largest share of biofuel production, after ethanol. With vegetable oils as the main feedstock in biomass-based diesel production, demand for major vegetable oils (soybean, corn, and canola) for the 2022/23 marketing year (October-September) reached a high of 19.1 billion pounds, up nearly 4.5 billion pounds from 2021/22. Use of soybean oil accounts for more than 40 percent of total feedstocks used for biomass-based diesel production. It increased from 5 billion pounds in 2014/15 to 12.5 billion pounds in 2022/23. Corn and canola oils also are increasingly used in biofuel production, though in lesser amounts. To date, U.S. production of soybean, corn, and canola oils has not been sufficient to cover the rise in domestic use. Rising domestic demand is supported by increasing imports, which now supply more than 29 percent of domestic vegetable oil consumption. This chart is drawn from USDA, Economic Research Service’s Oil Crops Outlook, December 2023.

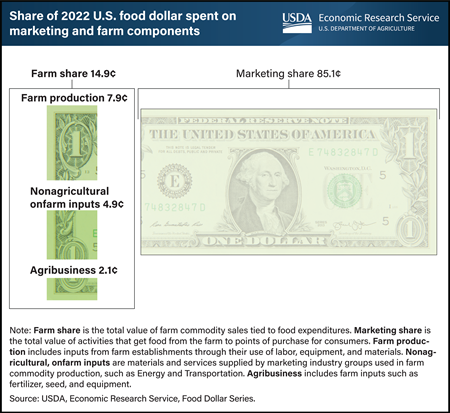

Monday, January 29, 2024

In 2022, farm establishments received 14.9 cents per dollar spent by consumers on domestically produced food for the sale of farm commodities. However, this amount, called the farm share, does not all remain on the farm. Farm commodity production requires many inputs from nonfarm establishments. Some inputs, such as fertilizer, seed, and equipment, are supplied by establishments in the Agribusiness industry group. These inputs to farm commodity production cost 2.1 cents per dollar spent on food in 2022. Inputs from industry groups such as Energy and Transportation are also used on the farm and throughout the food supply chain. In 2022, the cost of these inputs at the farm level was 4.9 cents per dollar spent on food. The remaining 7.9 cents from the farm share (just more than half) are for farm production, which is equal to the value added by farm establishments through their use of labor, equipment, and materials. The remaining 85.1 cents per dollar spent on food in 2022 went to industries to get food to various points of purchase after it left the farm. This portion is called the marketing share. This chart was drawn from the Amber Waves data feature “ERS Food Dollar’s Three Series Show Distributions of U.S. Food Production Costs,” published in December 2023.

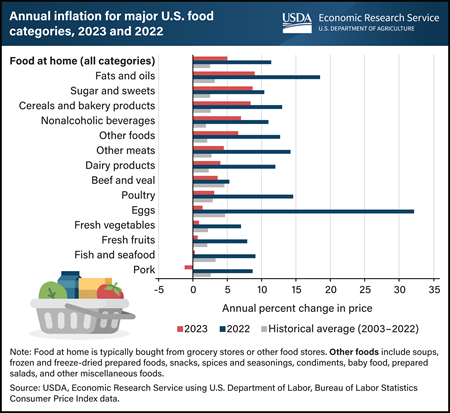

Thursday, January 25, 2024

Food-at-home prices increased by 5.0 percent in 2023, much lower than the growth rate in 2022 (11.4 percent) but still double the historical annual average growth from 2003 to 2022 (2.5 percent). All product categories shown grew more slowly in 2023 compared with 2022. Food price growth slowed in 2023 as economy-wide inflationary pressures, supply chain issues, and wholesale food prices eased from 2022. In 2023, prices for fats and oils grew the fastest (9.0 percent), followed by sugar and sweets (8.7 percent), and cereals and bakery products (8.4 percent). Pork prices declined 1.2 percent in 2023, and prices for several categories grew more slowly than their historical averages, including beef and veal (3.6 percent), eggs (1.4 percent), fresh vegetables (0.9 percent), fresh fruits (0.7 percent), and fish and seafood (0.3 percent). Egg price growth receded in 2023 after a highly pathogenic avian influenza (HPAI) outbreak affected the industry in 2022. USDA, Economic Research Service (ERS) researchers project overall food-at-home prices will decrease 0.4 percent in 2024, with a prediction interval of -4.5 to 4.0 percent. ERS tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, updated January 25, 2024.

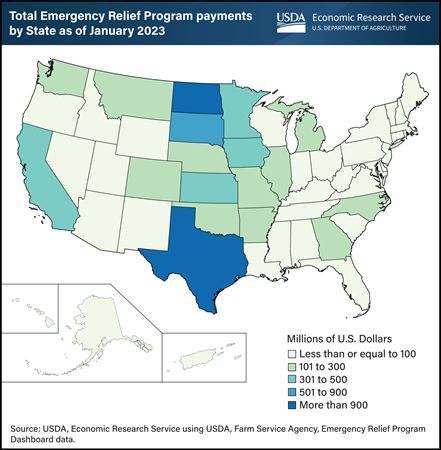

Wednesday, January 24, 2024

In 2020 and 2021, the United States experienced 42 disaster events that each resulted in damages of at least $1 billion, including hurricanes, drought, and wildfires. The Emergency Relief Program (ERP) provides funds to assist commodity growers who suffered losses from natural disasters in 2020 and 2021. As of January 2023, cumulative payments made through the ERP totaled $7.3 billion. USDA disbursed a large portion of this total, $1.16 billion, to North Dakota producers of corn ($322 million), soybeans ($309 million), and wheat ($268 million) who experienced flooding in 2020 and drought in 2021. Texas producers also received a sizable portion of payments, with cotton farmers receiving $510 million of the $909 million disbursed in that State. Producers in North Dakota and Texas received most ERP payments for losses in revenue, quality, or production as a result of moisture and drought that occurred during the 2020 and 2021 crop years. The remaining top States receiving ERP payments were South Dakota ($567 million), Minnesota ($463 million), and Iowa ($408 million), which, together with North Dakota and Texas, represented approximately 48 percent of the total ERP payments disbursed as of January 2023. In early 2023, USDA launched a second phase of the ERP program, but disbursements from this phase are not included in these totals. This chart first appeared in the USDA, Economic Research Service report U.S. Agricultural Policy Review, 2022, published in November 2023.

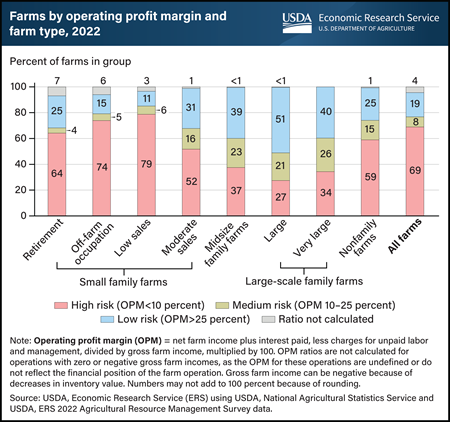

Tuesday, January 23, 2024

Small family farms were more likely to have greater financial vulnerability than other farms, according to data from the 2022 Agricultural Resource Management Survey (ARMS). Researchers with USDA, Economic Research Service (ERS) calculated the operating profit margin (OPM), one of many financial risk measures, by taking the ratio of profit to gross farm income to find that in 2022, between 52 and 79 percent of small family farms—depending on the farm type (retirement, off-farm occupation, low sales, moderate sales)—were at the high-risk level. If OPM is less than 10 percent, the operation is considered at high financial risk. When OPM is between 10 and 25 percent, the operation is considered at medium financial risk, and if OPM is above 25 percent, the operation is at low financial risk. A majority of small-scale family farms, which have a gross cash farm income (GCFI) of up to $350,000, earn most of their income from off-farm sources. For these farms, farm profitability is not necessarily essential to the survival of the household. Small family farms make up 88 percent of all farms but account for only 19 percent of the total value of production. Large family farms (GCFI of $1 million to $5 million) in 2022 were most likely to have low financial risk at 51 percent and least likely to be at high financial risk at 27 percent. Midsize farms (GCFI of $350,000 to $999,999) were also most likely to be in the low-risk zone at 39 percent and least likely to be in the medium-risk zone at 23 percent. This chart appears in the ERS report America’s Farms and Ranches at a Glance, published December 2023.

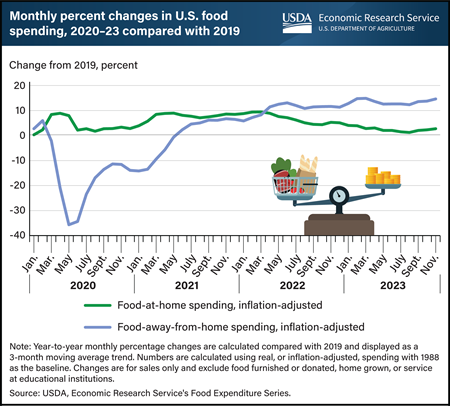

Monday, January 22, 2024

Following shifts in U.S. food spending during the Coronavirus (COVID-19) pandemic, food-at-home (FAH) spending was only 2.7 percent higher in November 2023 compared with November 2019, while food-away-from-home (FAFH) spending remained elevated at 14.6 percent higher. After an initial jump in inflation-adjusted FAH spending in March through May 2020, FAH spending leveled off, averaging just 2.8 percent higher in December 2020 compared with 2019. Even as FAH prices increased throughout 2021 and 2022, inflation-adjusted FAH spending increased as well, with monthly FAH spending in these years averaging 7.2 percent higher than the corresponding months in 2019. FAH spending has trended back toward prepandemic levels since the peak difference of 9.5 percent in March 2022. By contrast, FAFH spending initially fell significantly during the pandemic but reversed quickly and outpaced 2019 spending starting in June 2021. From June 2021 through December 2022, monthly inflation-adjusted FAFH spending averaged 8.7 percent higher than the corresponding months in 2019. FAFH spending peaked at 14.8 percent higher in March 2023 compared with March 2019. This chart combines and updates two charts from USDA, Economic Research Service’s (ERS) Amber Waves article U.S. Consumers Spent More on Food in 2022 Than Ever Before, Even After Adjusting for Inflation using data from the ERS Food Expenditure Series data product, updated January 19, 2024.

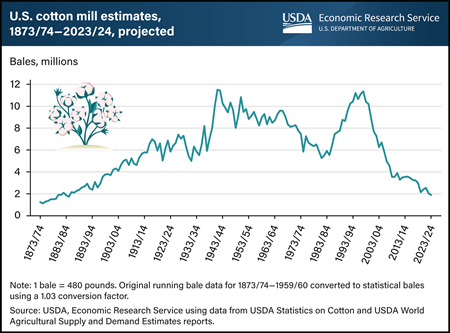

Thursday, January 18, 2024

U.S. cotton mill use—the volume of raw cotton processed into textiles—is estimated at 1.9 million bales for the 2023/24 marketing year (August–July). If realized, cotton used by U.S. textile mills would fall to its lowest level in more than 100 years—since the 1884/85 marketing year, when approximately 1.7 million bales were used. U.S. cotton mill use has been mostly on a downward trend since the early 1940s when cotton use peaked during World War II. Soon after the end of the war, synthetic fibers were developed and began substituting for cotton. Use of synthetics in the production of textiles continued to expand and further reduced cotton mill use through the early 1980s when the downward trend was dramatically reversed. Promotion efforts and programs such as the Caribbean Basin Initiative and later the North American Free Trade Agreement (NAFTA) fostered U.S. cotton yarn and fabric production. U.S. cotton mill use rose, peaking again in the mid-1990s, before the World Trade Organization (WTO) Agreement on Textiles and Clothing began phasing out quotas on developed countries’ textile and apparel product imports. By the early 2000s, cotton mill use in several countries—particularly China—expanded to take advantage of the phased-out quotas on cotton product exports to the United States. Although U.S. raw cotton exports benefited from increased foreign mill demand, U.S. cotton mill use weakened, and the downward trend led to the near historically low 2023/24 U.S. cotton mill use projection. This information is drawn from the USDA, Economic Research Service’s December 2023 Cotton and Wool Outlook.

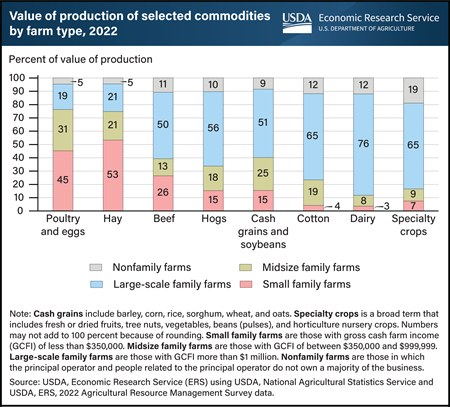

Wednesday, January 17, 2024

Large-scale family farms accounted for a majority of the value of commodity production in 2022, including cash grains and soybeans (51 percent), hogs (56 percent), cotton (65 percent), specialty crops (65 percent), and dairy (76 percent). On the other hand, small family farms accounted for 3 percent of the value of production for dairy, 4 percent for cotton, 7 percent for specialty crops, and 26 percent for beef, but they produced the majority of hay (53 percent) and 45 percent of poultry and eggs. The value of production by nonfamily farms ranged from 5 percent for both hay production and poultry and eggs production to 19 percent for specialty crop production. This chart uses data appearing in America’s Farms and Ranches at a Glance, published December 2023.

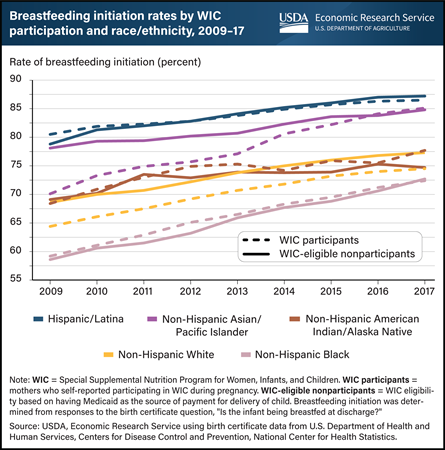

Tuesday, January 16, 2024

Breastfeeding is considered the best source of nutrition for infants and is therefore promoted by USDA’s Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). Initiation, one breastfeeding metric, refers to breastfeeding an infant shortly after birth, including at or before discharge from the hospital. From 2009 to 2017, rates of breastfeeding initiation increased among low-income women regardless of WIC participation status or race/ethnicity. Hispanic women had the highest rates of breastfeeding initiation throughout the study period. Non-Hispanic Black women had the lowest rates of breastfeeding initiation, but they experienced the largest gains (22.3 percent among WIC participants and 24.1 percent among WIC-eligible nonparticipants). Compared with WIC-eligible nonparticipants (80.1 percent), WIC participants (78.5 percent) continued to have lower rates of breastfeeding initiation overall, although the gap in initiation between WIC-eligible nonparticipants and WIC participants closed for some racial/ethnic groups. In 2009, Asian/Pacific Islander women had the largest gap in breastfeeding initiation by WIC status. By 2017, this gap had narrowed and reversed direction because of a greater increase in breastfeeding initiation among WIC participants (21.4 percent) compared with WIC-eligible nonparticipants (8.6 percent). This pattern also was observed for American Indian/Alaska Native women and for non-Hispanic White women. This chart appears in the USDA, Economic Research Service’s Amber Waves article Rates of Breastfeeding Initiation Increased Among Low-Income Women, 2009–17; Racial and Ethnic Disparities Persist, released October 2023.

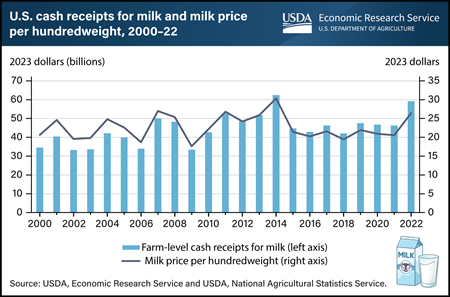

Thursday, January 11, 2024

U.S. milk production, as measured in inflation-adjusted 2023 dollars, grew $13.0 billion (or 28 percent) to $59.2 billion in 2022, the highest level since 2014, according to data from the USDA, Economic Research Service (ERS). ERS annually estimates farm sector cash receipts—the cash income received from agricultural commodity sales. This increase in receipts coincided with the U.S. all-milk price rising to $26.46 per hundredweight, a 28.6-percent gain from 2021. The all-milk price is a gross price dairy farmers receive per hundredweight of milk sold and does not include deductions for items like transportation charges, promotion costs, or co-op dues. In 2014, cash receipts for milk reached an all-time high of $62.4 billion once adjusted for inflation, about 5 percent more than the 2022 total. This chart was created using information found in the ERS Farm Income and Wealth Statistics data product updated in November 2023. Estimates of 2023 milk receipts will be released in August 2024.