ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, January 4, 2023

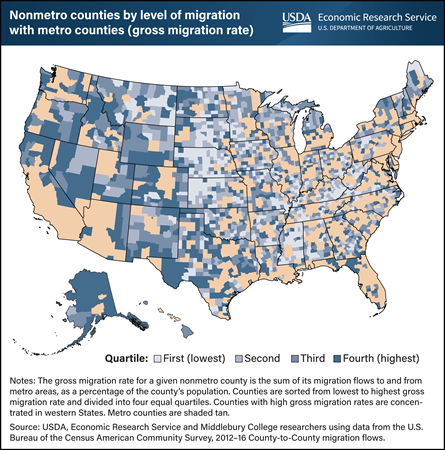

Human movements between places vary considerably across space, so their contribution to the spread of COVID-19 also varied spatially. For instance, some rural communities have long histories as recreation or tourist destinations and more established migration connections to larger cities. In examining county-to-county migration patterns, researchers organized nonmetropolitan (nonmetro) counties into four equal groups, or quartiles, based on the rate at which people moved to or from metropolitan (metro) counties. The counties in the lowest quartile (lightest blue on the map) have the weakest migration connections with metro regions, meaning few people move back and forth proportionately. Remote counties far from any metro region, such as in the central and northern Great Plains, fall in the lowest quartile. Those counties in the fourth quartile (darkest blue) have the strongest migration connectivity and are typically adjacent to metro centers, such as southern New Hampshire, along the Front Range in Colorado, and in parts of Texas adjacent to Houston, Dallas-Fort Worth, and San Antonio. However, some very remote areas have high migration ties to metro counties, such as areas of Wyoming, Idaho, and North Dakota. These are places that have unique economic conditions that tie them to urban areas. Western North Dakota had a burgeoning energy sector from 2012 to 2016 (when these migration flows were measured), and there are established amenity destinations in the Colorado Rockies; Sun Valley, Idaho; Jackson, Wyoming; and along the Washington and Oregon coasts. Nonmetro counties with higher migration connectivity to metro areas were more likely to experience outbreaks of COVID-19 during the first few weeks and months of the pandemic compared with less-connected nonmetro counties. This chart appears in the USDA, Economic Research Service report COVID-19 Working Paper: Migration, Local Mobility, and the Spread of COVID-19 in Rural America, published in November 2022.

Tuesday, January 3, 2023

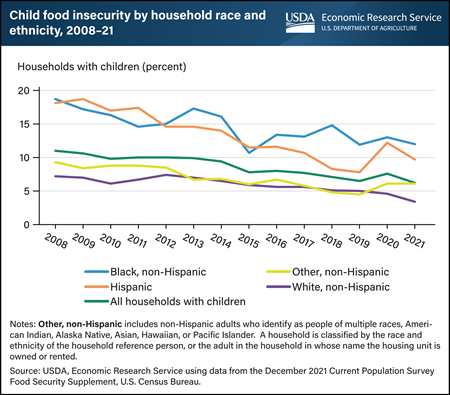

Households with food insecurity among children are defined as those that were unable at times to provide adequate, nutritious food for their children because of a lack of resources. In 2021, food insecurity among children showed an overall statistically significant decline for U.S. households with children. A household is classified by the race and ethnicity of the household reference person, or the adult in whose name the housing unit is owned or rented. The prevalence rates of child food insecurity for Hispanic and Black, non-Hispanic households with children historically have been higher than the rate for all households with children, a trend that continued in 2021. For households with children headed by Hispanic reference persons, food insecurity among children fell to 9.7 percent from 12.2 percent in 2020, a statistically significant decline. For Black, non-Hispanic households with children, the 12 percent rate of food insecurity among children in 2021 was not significantly different from the 13 percent reported in 2020. Food insecurity among children in households with White, non-Hispanic reference persons also had a significant decline. Households that fall into the Other, non-Hispanic category are headed by reference persons that identify as Native American, Asian American, multiple-race American, or other. Other, non-Hispanic households experienced food insecurity rates among children near the national average in 2021 and not significantly different from 2020. This chart appears in USDA, Economic Research Service’s Interactive Charts and Highlights.

Thursday, December 15, 2022

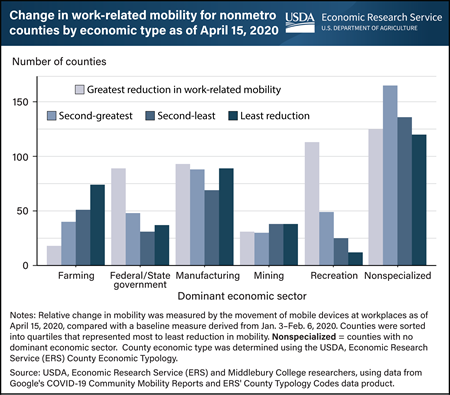

In the early weeks of the Coronavirus (COVID-19) pandemic, when local and State authorities were issuing stay-at-home orders, employees in farming-dependent counties maintained a relatively high level of onsite work and commuting. Researchers at USDA, Economic Research Service (ERS) and Middlebury College divided all rural (nonmetro) counties into four equal groups based on how much work-related local travel was reduced. The four groups were: greatest reduction, second-greatest, second-least, and least reduction. Those in the “least reduction” group had mobility levels similar to pre-pandemic levels. In mid-April 2020, 7 weeks after the virus first arrived in a rural county and a month after stay-at-home orders were issued, there were three times as many farming-dependent counties in the “least reduction” group as in the “greatest reduction” group. Counties dependent on government and recreation jobs showed the greatest mobility reductions during the early months of the pandemic. These differences in mobility reduction help explain differences in the initial spread of COVID-19 within counties. By the third week of April 2020, “least reduction” counties were experiencing infection rates nearly double those in counties with greater reductions in work-related mobility. This chart appears in the ERS report Migration, Local Mobility, and the Spread of COVID-19 in Rural America, published in November 2022.

Wednesday, December 14, 2022

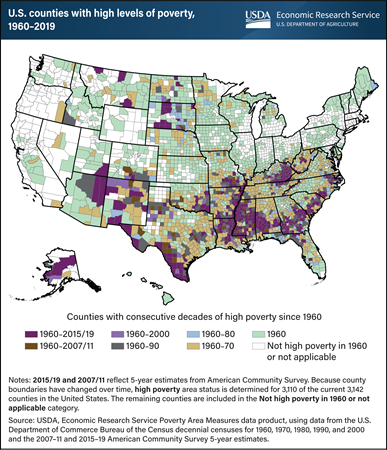

In 1960, 78 percent (2,412) of U.S. counties had poverty rates of 20 percent or more. Among them, 28 percent (680) continued to have high poverty through 1980. After enactment of the Economic Opportunity Act of 1964, commonly known as the War on Poverty initiatives, many counties reported reduced poverty rates. Between 1980 and 2019, poverty rates were relatively stable, mainly fluctuating with cyclical changes in the macroeconomy. As of 2019, there were 304 counties—13 percent of the counties with high poverty in 1960—that consistently had poverty rates of 20 percent or more over the last 60 years. The majority—264 counties—are rural counties and are clustered in the Appalachian States; the Black Belt in the South; the Mississippi Delta; the Ozarks region of Missouri, Arkansas, Oklahoma, and southeast Kansas; the Southwest; and in counties with large American Indian and Alaska Native populations. This chart is a version of an interactive map on USDA, Economic Research Service’s Poverty Area Measures data product, updated November 2022.

Tuesday, December 13, 2022

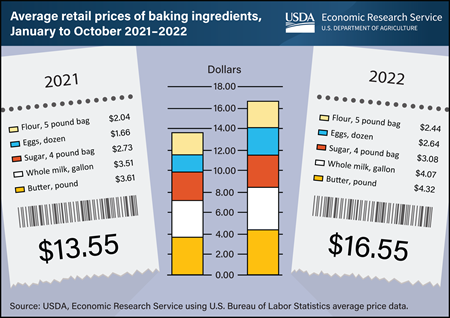

As people sift through holiday baking recipes and head to the store, they will find key ingredients cost more this year. The total cost for five baking staples – flour, sugar, milk, butter, and eggs – was about 22 percent higher through the first 10 months of 2022 compared with the same period in 2021. A 5-pound bag of flour, 4-pound bag of sugar, gallon of whole milk, pound of butter, and a dozen eggs cost a total $16.55 in 2022, compared with $13.55 in 2021, an increase of $3.00. Egg prices increased the fastest (60 percent) and cost about $0.98 more per dozen compared with 2021, as the egg industry was affected by the highly pathogenic avian influenza outbreak. Prices for flour and butter each rose by about 20 percent, adding about $0.40 to the price of a bag of flour and $0.71 to a pound of butter. Prices increased more slowly for milk (16 percent) and sugar (13 percent) in 2022, although price increases for all products were above historical averages. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, which predicts food-at-home prices will increase between 11 and 12 percent in 2022.

Monday, December 12, 2022

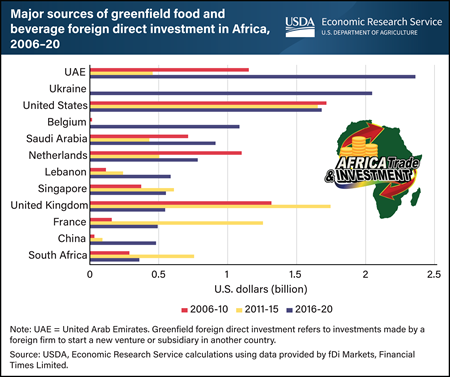

Increasing incomes, populations, and urbanization in Africa have generated new agricultural investment opportunities for foreign firms. Foreign direct investments (FDI) in the food and beverage sector are one mechanism to build and extend Africa’s agricultural value chains, the processes connecting food production, delivery, and the consumer. A key type of these investments is greenfield FDI, which are investments made by a foreign firm to start a new venture or subsidiary in another country. From 2016 to 2020, the United Arab Emirates, Ukraine, United States, and Belgium were the largest sources of greenfield FDI in the food and beverage sector in Africa. U.S. food and beverage greenfield FDI has been consistent over time, ranging between $1.5 to $2 billion during each 5-year period from 2006 through 2020. Investments made by companies in Saudi Arabia, the Netherlands, and Lebanon from 2016 to 2020 were also sizable, followed by Singapore and the United Kingdom. Notably, China’s greenfield FDI activity in this sector was relatively small, reaching just under $500 million in 2016 to 2020. This chart is drawn from the USDA, Economic Research Service report Foreign Direct Investment in Africa: Recent Trends Leading up to the African Continental Free Trade Area (AfCFTA).

Friday, December 9, 2022

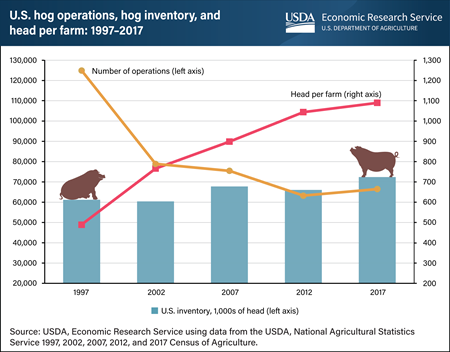

The structure of the U.S. hog sector changed between 1997 and 2017, shifting hog production to fewer, but larger, farms. According to data from the Census of Agriculture, which is administered by the USDA, National Agricultural Statistics Service, the number of hog operations with inventory declined 37 percent between 1997 and 2002 and continued to drop through 2012. Despite ticking upward in 2017, the number of operations with inventory ended at roughly 66,000 operations, 47 percent less than in 1997. In contrast, the average farm size roughly doubled over those two decades, as measured by the number of head of hogs in inventory per farm. The share of the U.S. hog inventory on farms with 5,000 or more head rose from 40 percent in 1997 to 73 percent in 2017. Overall, the U.S. hog inventory increased by 18 percent over the period, and the average hog farm size rose to more than 1,000 head of hogs. Reductions in the number of hog operations and increases in hog farm size have occurred alongside increases in production contract use. For example, by 2017, the percentage of hogs sold under a production contract rose to more than 50 percent in Iowa and Minnesota (combined) and in North Carolina, three hog-producing States that together contributed to more than half the hogs sold in the United States. From 2012 to 2017, contract production rose from 51 to 59 percent in Iowa and Minnesota and from 83 to 91 percent in North Carolina. This chart appears in the USDA, Economic Research Service report U.S. Hog Production: Rising Output and Changing Trends in Productivity Growth, published in August 2022.

Thursday, December 8, 2022

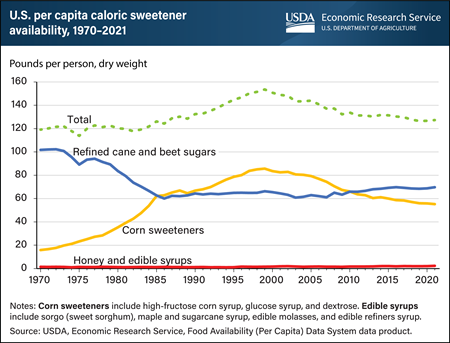

In 2021, the amount of caloric sweeteners available for consumption in the United States was 17 percent less than in 1999, falling to 127.3 pounds per person from 153.6 pounds. According to the USDA, Economic Research Service’s (ERS) Food Availability (Per Capita) Data System, a reduction in the availability of total corn sweeteners (high-fructose corn syrup, glucose syrup, and dextrose) contributed to the drop. The availability of corn sweeteners fell from a peak of 85.7 pounds per person in 1999 to 55.3 pounds in 2021. Shifting preferences among consumers and food manufacturers, high corn prices, and competition with refined cane and beet sugars and other caloric sweeteners have contributed to this decline. The availability of refined cane and beet sugars fell from 102.3 pounds per person in 1972 to 60.0 pounds in 1986 and remained relatively flat for the next two and a half decades. Refined sugar availability began to rise in 2010, surpassing corn sweeteners in 2011 and reaching 69.7 pounds per person in 2021. Per capita honey availability stood at 1.5 pounds and per capita availability of edible syrups was 0.9 pounds in 2021. This chart is from ERS’s Ag and Food Statistics: Charting the Essentials data product, updated December 2022.

Wednesday, December 7, 2022

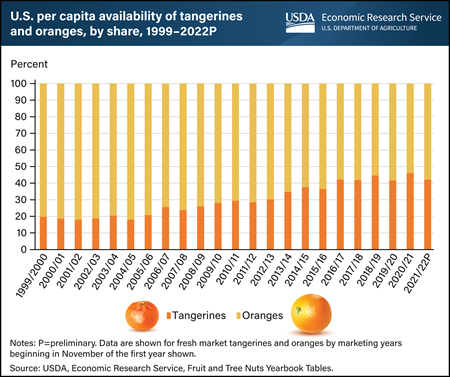

Fresh oranges have long been a favorite fruit of U.S. consumers. They currently rank fourth among fresh fruit in per capita availability (a proxy for consumption) after bananas, melons, and apples. Nonetheless, the U.S. palate has changed over the last several decades. Between 2000 and 2022, domestic availability of fresh oranges fell from 11.7 pounds to 8.3 pounds per person, stabilizing over the last decade between 8 and 10 pounds depending on market conditions. At the same time, the tangerine citrus commodity group has soared in popularity, with per capita availability more than doubling between 2000 and 2022. This broad group includes tangelos, mandarins, clementines, and traditional tangerines. A comparison of per capita fresh tangerine and fresh orange availability over the last 20 years shows the share going to tangerines increasing from 20 to 40 percent. Growth of the U.S. tangerine market coincides with the launch of marketing campaigns for easy-peel seedless mandarins by some of the more prominent citrus supply companies. This chart is based on USDA, Economic Research Service (ERS) Fruit and Tree Nuts Yearbook Tables, released November 2022. The data for this chart do not account for spoilage, waste, and other losses. For data that takes these losses into account, see ERS’ Loss Adjusted Food Availability.

Tuesday, December 6, 2022

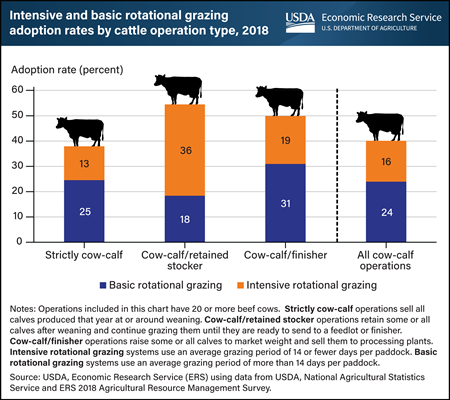

Rotational grazing is a management practice in which ranchers rotate cattle through a series of paddocks. It is an alternative to continuous grazing in which cattle stay on a single pasture. About 40 percent of all cow-calf operations reported using a rotational grazing system, with cow-calf/retained stocker producers leading adoption. Retained stockers keep one or more of their calves through the initial feeder stage for later sale to feedlots. Based on data collected from the 2018 Agricultural Resource Management Survey (ARMS) Cattle and Calves Cost and Returns Report, 54 percent of retained stocker operations have adopted some form of rotational grazing. This adoption rate is more than the rate for strictly cow-calf producers, who sell all calves at or around weaning (38 percent), or retained finisher producers, who retain calves until market weight (50 percent). Retained stockers are much more likely to employ intensive rotational grazing systems, which use an average grazing period of 14 or fewer days per paddock, than strictly cow-calf operations and finishers. Across all forms of cow-calf operations, 16 percent of producers use intensive rotational grazing and 24 percent use basic rotational grazing (using an average grazing period longer than 14 days per paddock). The type of grazing system an operator selects can be part of managing forage production, forage quality, animal health, and environmental quality. This chart appears in the USDA, Economic Research Service report Rotational Grazing Adoption by Cow-Calf Operations, published in November 2022.

Monday, December 5, 2022

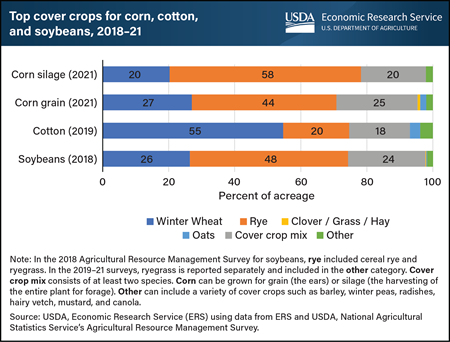

Farmers add cover crops to a rotation to provide living, seasonal soil cover between the planting of two cash (commodity) or forage crops. Including cover crops in a rotation can provide benefits such as improved soil health and water quality, weed suppression, and reduced soil erosion. Data from the field-level USDA Agricultural Resource Management Survey (ARMS) provide information on which cover crops were grown in the fall before planting corn, cotton, and soybeans. Cover crop mixes account for 18 to 25 percent of acres with cover crops. However, the use of single-species cover crops is more common. For corn fields in 2021, almost 75 percent of acres with cover crops used a grass or small grain cover crop, such as cereal rye, winter wheat, or oats. At 44 percent of acreage, cereal rye was almost twice as common as winter wheat (27 percent) as the cover crop on corn for grain fields. Rye and winter wheat were also the most common cover crops on soybean fields in 2018. Winter wheat was the most common cover crop used on cotton fields in 2019. The original version of this chart appears in the USDA, Economic Research Service report Cover Crop Trends, Programs, and Practices in the United States, released in 2021.

Thursday, December 1, 2022

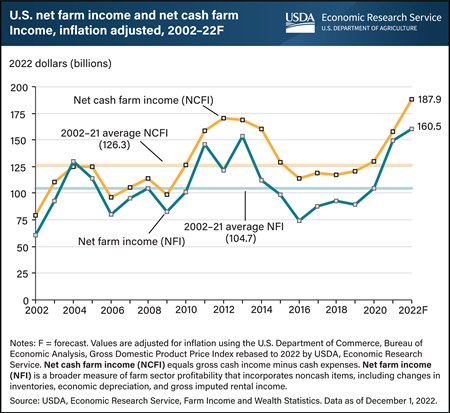

USDA’s Economic Research Service forecasts inflation-adjusted U.S. net cash farm income (NCFI)—gross cash income minus cash expenses—to increase by $30.1 billion (19.1 percent) to $187.9 billion in 2022. This total would be the highest on record for the inflation-adjusted data series. U.S. net farm income (NFI) is forecast to increase by $10.7 billion (7.2 percent) to $160.5 billion in 2022, its highest level since 1973 after adjusting for inflation. Net farm income is a broader measure of farm sector profitability that incorporates noncash items such as changes in inventories, economic depreciation, and gross imputed rental income. Cash receipts from farm commodities drive these income increases, with a projected increase of $78.5 billion (17.0 percent) to $541.5 billion, their highest level on record. In addition, total commodity insurance indemnities paid to farmers are expected to rise by $8.3 billion (70.1 percent) to $20.2 billion, also a record. Production expenses are forecast to increase by $46.6 billion (11.8 percent) to $442.0 billion in 2022, offsetting some income growth. Additionally, direct Government payments to farmers are projected to decrease by $11.0 billion (40.0 percent) from 2021 to $16.5 billion in 2022, mainly because of lower anticipated USDA and non-USDA payments for Coronavirus (COVID-19) pandemic assistance. Find additional information and analysis on the ERS topic page for Farm Sector Income and Finances, reflecting data released on December 1, 2022.

Wednesday, November 30, 2022

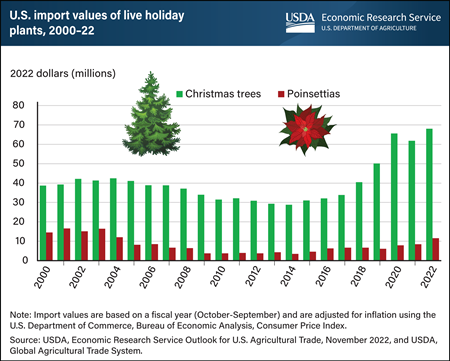

Christmas trees and poinsettias are iconic symbols of the holiday season. While the vast majority are grown in the United States for domestic use, a small share of both plants are imported from Canada. Trade is highly seasonal, with 99 percent of Christmas trees and 95 percent of poinsettias shipping between November and December. From 2000–15, live Christmas tree imports averaged around 2 million trees per year at an inflation-adjusted annual value of $36.1 million. However, by 2022, live tree imports reached nearly 2.8 million trees at a value of $68 million. Import values of live trees had previously spiked in 2020 because of COVID-19 supply chain issues, and prices have remained relatively high since. Poinsettias first grew in popularity as a Christmas flower in the United States after they were brought from Mexico in the 1820s. In the early 2000s, the United States imported as many as 5.9 million live plants per year before that number dipped to 1.2 million in 2011, in parallel to the narrowing of the U.S. to Canadian dollar exchange rate. In recent years, the number of plants has gradually increased with a more significant increase in value. In 2022, live poinsettia imports totaled 2.2 million plants worth $11.5 million. This chart is drawn from the Outlook for U.S. Agricultural Trade published by USDA’s Economic Research Service, November 2022.

Tuesday, November 29, 2022

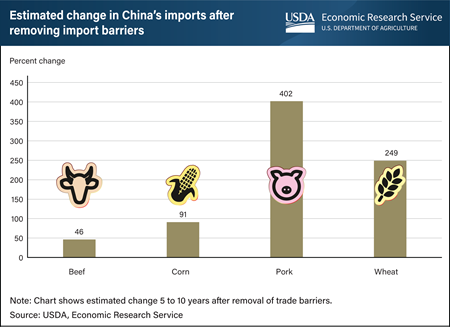

China imported more than $205 billion worth of agricultural products in 2021, including more than $37 billion from the United States, yet trade barriers deterred China’s imports from reaching even higher levels. China’s import barriers create what are called “price wedges,” in which domestic prices for agricultural commodities including beef, corn, pork, and wheat are higher than the world price. Researchers at USDA’s Economic Research Service (ERS) recently found that removing these price wedges would lead to increases in agricultural imports for the four commodities over the subsequent 5 to 10 years. For corn and wheat, removing price wedges was estimated to increase China’s imports by 91 and 249 percent, respectively. Both of these commodities are subject to a tariff-rate quota which could constrain additional imports. Removal of the beef price wedge was estimated to increase China’s beef imports by 46 percent, while for pork, it was estimated to increase China’s pork imports by 402 percent—the largest increase among the commodities considered. Overall, the benefits of removing these trade barriers would be widespread, increasing sales for producers in the United States and other exporting countries and yielding lower food prices for China’s consumers. This chart is drawn from the ERS report China’s Import Potential for Beef, Corn, Pork, and Wheat, published in August 2022.

Monday, November 28, 2022

U.S. farm establishments received 14.5 cents per dollar spent on domestically produced food in 2021—a decrease of 1.0 cent from a revised 15.5 cents in 2020—to the lowest recorded farm share value in nearly three decades. The remaining portion of the food dollar—known as the marketing share—covers the costs of getting domestically produced food from farms to points of purchase, including costs related to packaging, transporting, processing, and selling to consumers. One contributor to the 2021 decline in farm share was a shift to food-away-from-home (FAFH) spending. Farm establishments typically receive a smaller share of FAFH spending because of the large amount of value added by FAFH outlets such as restaurants. As a result, the farm share generally decreases when FAFH spending increases faster year-over-year than food-at-home spending. FAFH spending increased markedly in 2021 after a sharp decrease early in the Coronavirus (COVID-19) pandemic. Accordingly, the farm share returned to its pre-pandemic downward trend in 2021 after an increase in 2020. The USDA, Economic Research Service (ERS) uses input-output analysis to calculate the farm and marketing shares from a typical food dollar. The data for this chart can be found in ERS’s Food Dollar Series data product, updated November 17, 2022.

Friday, November 25, 2022

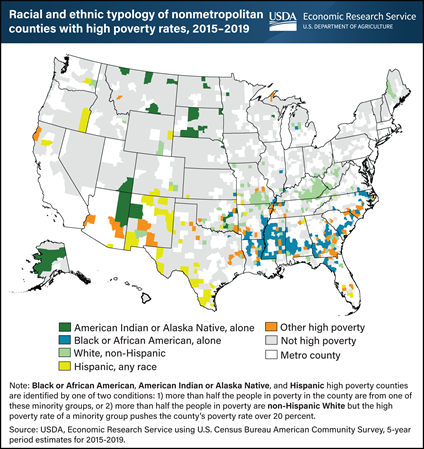

According to U.S. Census Bureau estimates for 2015-19, there were 469 nonmetropolitan (nonmetro) counties with a poverty rate of 20 percent or more, which USDA, Economic Research Service (ERS) designates as high poverty. The high poverty classification in more than half of the counties (236) is characterized by a concentration of poverty within racial and ethnic minority groups, including Black or African American (153 counties), Hispanic (49 counties) and American Indian and Alaska Natives (34 counties). Many of the American Indian and Alaska Native high poverty counties are areas of historic tribal presence or were designated as reservation settlements in the 19th century. The average poverty rate for those 34 counties is 31.5 percent for the total population and 40.5 percent for the American Indian and Alaska Native population alone, a level considered to be extreme poverty. The average poverty rates for the other racial-ethnic high poverty county types are below 30 percent for the total population and below 40 percent for the Black or African American and Hispanic population groups. This chart uses information from the ERS Atlas of Rural and Small-Town America to update information on the Rural Poverty and Well-being topic page and the Amber Waves feature Anatomy of Nonmetro High-Poverty Areas: Common in Plight, Distinctive in Nature, published in February 2004.

Wednesday, November 23, 2022

Certified organic versions of potatoes, sweet potatoes, cranberries, and celery are widely available to consumers for the holidays and beyond. But where are these organic crops produced? Organic potatoes (indicated by the brown State color in the map above) most often come from California, which has 57 percent of U.S. harvested acres, followed by Colorado. Organic sweet potatoes (blue flags on map) come from California and North Carolina, which together have 91 percent of the Nation’s acreage. The top organic cranberry-producing States (red flags) are Massachusetts, with 66 percent of production, and Wisconsin. The U.S. harvest season for cranberries runs from around mid-September until the end of October, just in time for Thanksgiving. Organic celery production (green flag) is almost exclusive to California (91 percent of the U.S. crop). Consumer demand for organically produced food has grown since the 1990s, and certified organic U.S. cropland acres increased by 73 percent from 2011 to 2019, with 3.5 million acres in 2019. USDA implemented national organic standards in 2002 that required certification for all except the smallest (less than $5,000 in sales) organic growers. Organic farming systems rely on practices such as cultural and biological pest management and prohibit nearly all synthetic chemicals in crop production. This map includes data found in USDA, Economic Research Service’s Organic Agriculture topic page and in the ERS State Fact Sheets data product.

Tuesday, November 22, 2022

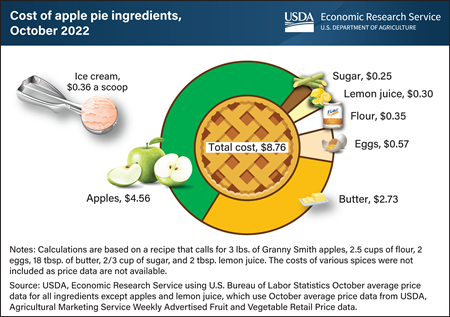

Pie is a time-honored staple of Thanksgiving around the country. U.S. consumers baking a homemade apple pie this year can expect to pay about $8.76 for the ingredients, an increase of about 19.5 percent from 2021. Prices increased for all ingredients. Apples comprised about half the cost of a pie ($4.56), and prices for Granny Smith apples increased from an average $1.41 per pound in October 2021 to $1.52 per pound in October 2022. Prices increased the most for eggs (90.0 percent) and flour (34.6 percent), but rising butter costs had the largest impact on the total, adding an additional $0.68 to the cost of a pie between 2021 and 2022. If serving the apple pie a la mode, ice cream adds $0.36 per scoop. The most recent average price data are from October; prices for Thanksgiving week may vary. For example, savings may occur if grocers offer holiday discounts. USDA, Economic Research Service (ERS) used average price data from the U.S. Bureau of Labor Statistics and USDA, Agricultural Marketing Service Weekly Advertised Fruit and Vegetable Retail Price data to derive the cost for the ingredients of an apple pie. Forecasts for aggregate food category prices can be found in ERS’s Food Price Outlook data product, updated November 22.

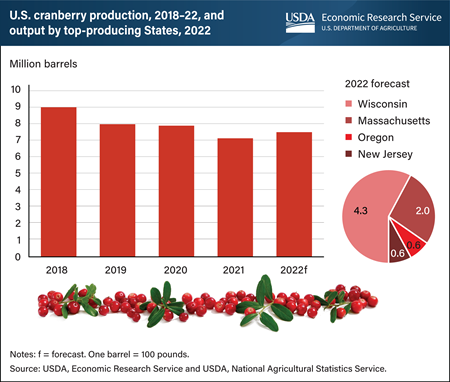

Monday, November 21, 2022

With the 2022 U.S. cranberry harvest wrapping up just in time for Thanksgiving, this year’s crop is forecast to be 5 percent larger than last year’s crop. The 2022 cranberry crop is estimated at 7.44 million barrels but is expected to be smaller than in any of the previous three years (2018–20). Cranberry production, as measured by USDA’s National Agricultural Statistics Service (NASS), comes from four States: Wisconsin, Massachusetts, Oregon, and New Jersey. In Wisconsin, the largest growing State, production is forecast at 4.3 million barrels, up 3 percent from last year. Larger crops are expected in all States but most prominently in Massachusetts, where production is forecast at 2 million barrels, an 11 percent increase from last year. According to NASS, Wisconsin and Massachusetts growers reported the crop experienced cold, wet weather and hail early in the growing season, stalling the planting season. However, warmer temperatures and better weather conditions helped cranberry plants and berries to develop. This chart is drawn from USDA, Economic Research Service’s Fruit and Tree Nuts Outlook, September 2022.

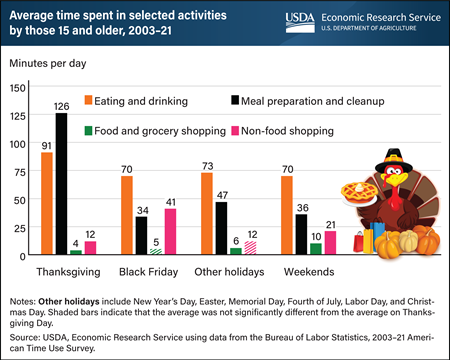

Thursday, November 17, 2022

Do people really spend more time preparing food, eating, drinking, and cleaning up the kitchen on Thanksgiving Day compared with other holidays? Do they really spend more time shopping on Black Friday than on other days? The answer to both questions is “Yes.” Over a survey period from 2003 to 2021, people in the United States spent an average of 91 minutes eating and drinking on Thanksgiving Day. This was 21 minutes greater than the time spent eating and drinking on average for six other major holidays and 21 more minutes than on an average weekend day. Similarly, compared with the average for non-Thanksgiving holidays and weekends, people spent more time preparing meals and cleaning-up on Thanksgiving (126 minutes versus 47 minutes on non-Thanksgiving holidays and 36 minutes on weekends). When it comes to the day after Thanksgiving, people in the United States tend to spend more of their time shopping for items other than food relative to other days. Indeed, people spent 41 minutes shopping for non-food items on an average Black Friday, which is more than 240 percent higher than on an average non-Thanksgiving holiday. For more information, see USDA, Economic Research Service’s (ERS) Eating and Health Module of the American Time Use Survey in ERS’s Eating and Health Module (ATUS) data product.