ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Thursday, October 26, 2023

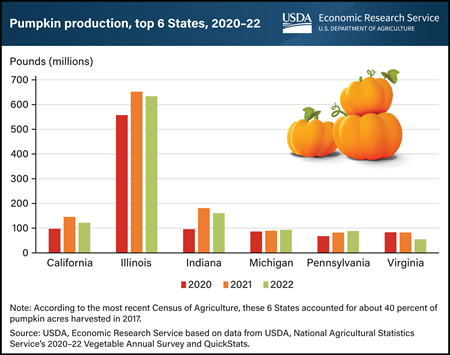

Pumpkins were one of the earliest cultivated crops in the Americas and have become one of the most distinctive symbols of fall. With a variety of uses, from pies and spiced coffee drinks to festive jack-o’-lanterns, pumpkins are grown commercially in every U.S. State. Production has trended up over the past two decades. In the early 2000s, about 4 pounds of the gourd were available per person, increasing to about 6 pounds per person in the 2020s. In the top 6 pumpkin-growing States, farms produced about 1.2 billion pounds in 2022. Illinois alone harvested 630 million pounds. The next 5 largest pumpkin-producing States by weight were Indiana with 160 million pounds, California with 120 million pounds, Michigan and Pennsylvania with 90 million pounds each, and Virginia with 50 million pounds. Most pumpkins are grown for decorative purposes, with a smaller amount processed into puree to be used in food products such as pies, muffins, or breads. However, in Illinois—the largest producer by both acres and weight—about 80 percent of the State’s harvested pumpkin acres are used for processing. This chart is drawn from the USDA, Economic Research Service’s Trending Topics Pumpkins: Background & Statistics page.

Thursday, September 14, 2023

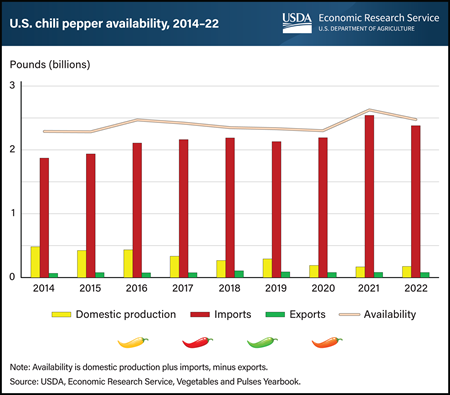

Although domestic chili pepper production has been falling for more than a decade, the rate of reduction has accelerated in recent years. In 2014, U.S. producers in Arizona, California, New Mexico, and Texas grew more than 480 million pounds of chili peppers. By 2022, production had dropped to about 175 million pounds. Generally, this 60-percent decrease can be attributed to reduced acreage and yields. To offset decreasing domestic production and to meet rising demand, many U.S. companies and consumers have purchased imported peppers, most of which are grown in Mexico. In 2014, about 2 out of every 10 chili peppers consumed domestically were produced domestically. By 2022, this share had fallen to less than 1 out of every 10. From 2014 to 2022, the number of peppers exported remained steady, ranging from 66 million pounds to 106 million. However, the share of U.S. peppers exported more than tripled, increasing from 14 percent in 2014 to 46 percent in 2022. Although 8 percent more chili peppers were available in 2022 than in 2014, fewer were grown by U.S. producers. This chart is drawn from USDA, Economic Research Service’s Vegetables and Pulses Yearbook.

Tuesday, August 29, 2023

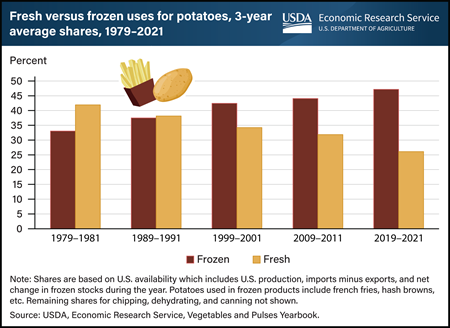

The majority of potatoes in the United States are now sold in processed forms such as frozen, chipped, dehydrated, or canned. With the introduction of french fries as a key side dish in quick-service restaurants, the share of potatoes that go into frozen products has risen in each decade since 1979. As a result, almost half of all potatoes going into food in the United States are now used to create frozen products—most of which are french fries. Meanwhile, the share of potatoes used as fresh table potatoes has declined decade by decade. Even the favorable trend in french fries has seen some bumps along the way. After peaking in the late 1990s and early 2000s, the long-run upward trend in frozen potato availability slowed as many consumers embraced low-carb diets or sought alternative food choices and cuisines. However, by the mid-2010s, frozen potato availability once again turned upward, with per capita availability during the pandemic-influenced 2019–21 period up 8 percent from a decade earlier (2009–11). According to industry data and USDA, Economic Research Service (ERS) research in the early 2000s, about 90 percent of frozen french fries move through various food service venues. Quick-service restaurants alone account for about two-thirds of french fry usage. This chart is drawn from the ERS data product Vegetables and Pulses Yearbook Tables.

Monday, July 31, 2023

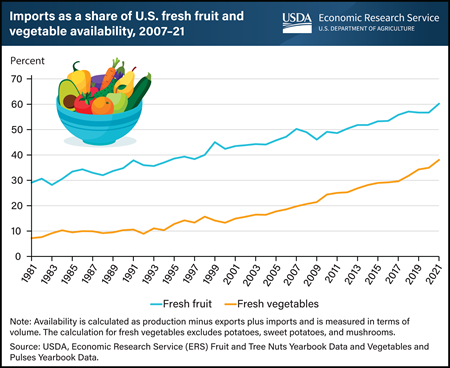

Imports play a vital and increasingly important role in ensuring that fresh fruit and vegetables are available year-round in the United States. Since the 2008 completion of the transition to tariff- and quota-free trade among Mexico, Canada, and the United States under the North American Free Trade Agreement (NAFTA), U.S. fresh fruit and vegetable imports have increased with few interruptions. Between 2007 and 2021, the percent of U.S. fresh fruit and vegetable availability supplied by imports grew from 50 to 60 percent for fresh fruit and from 20 to 38 percent for fresh vegetables (excluding potatoes, sweet potatoes, and mushrooms). The import share increased by more than 20 percentage points during this period for 10 crops: asparagus, avocados, bell peppers, blueberries, broccoli, cauliflower, cucumbers, raspberries, snap beans, and tomatoes. The United States-Mexico-Canada Agreement (USMCA), implemented on July 1, 2020, continues NAFTA’s market access provisions for fruit and vegetables. In 2022, Mexico and Canada supplied 51 percent and 2 percent, respectively, of U.S. fresh fruit imports, and 69 percent and 20 percent, respectively, of U.S. fresh vegetable imports in terms of value. This chart is drawn using data from the USDA, Economic Research Service (ERS) data products Fruit and Tree Nuts Yearbook Data and Vegetables and Pulses Yearbook Data. Also refer to the ERS report, Changes in U.S. Agricultural Imports from Latin America and the Caribbean, published in July 2023, and ERS’s Amber Waves feature, U.S. Fresh Vegetable Imports From Mexico and Canada Continue To Surge, published in November 2021.

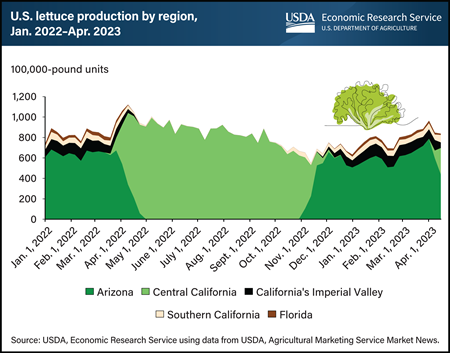

Thursday, May 18, 2023

Lettuce—the main ingredient in many salads and a popular sandwich topper—is the most widely consumed leafy green in the United States. In 2022, lettuce accounted for nearly one-fifth of the $21.8 billion that U.S. growers received in cash receipts from sales of vegetables and melons. Romaine lettuce sales totaled $1.54 billion, iceberg lettuce sales were $1.33 billion, and leaf lettuce sales trailed at $1.25 billion. An estimated 85 percent of the lettuce available for consumption in the United States was produced domestically in 2022. While production of lettuce occurs year-round, areas of production shift with the growing seasons. From mid-November through early April, most lettuce sold in the United States is sourced from the irrigated desert valleys of Southern California’s Imperial County and the Yuma area of Arizona. Shipments of lettuce from Florida help fill in regional market gaps during winter and spring months. From late April through mid-November, production shifts to Central California. From spring through fall, local production in most other States serves farmers markets, regional/local retail and restaurant demand, and community-supported agriculture. This chart is drawn from an article titled, “Lettuce Trends: Conventional, Organic Growth, and Production,” from USDA, Economic Research Service’s Vegetables and Pulses Outlook, April 2023.

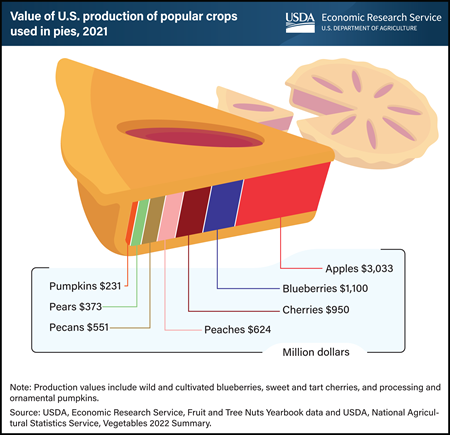

Tuesday, March 14, 2023

March 14 is known to many as Pi Day. The date resembles the mathematical constant π, roughly equal to 3.14, and for that reason, many celebrate the day by enjoying their favorite type of pie. In 2021, the United States grew $6.9 billion worth of seven popular fruits, vegetables, and tree nuts often used as the main ingredient in pie making. The value of production of these seven commodities in 2021, as measured by U.S. cash receipts, was the highest for apples, which are produced abundantly in the United States both in terms of volume and production value. The U.S. apple crop exceeded $3.03 billion in 2021, whereas production of blueberries reached $1.1 billion. Cash receipts for other fruit pie ingredients, cherries and peaches, were valued at $950 million and $624 million, respectively. Pecans, a tree nut, were valued at $551 million in terms of U.S. cash receipts. The pear crop of 2021 was valued at $373 million, while production of pumpkins, the fall icon and mainstay of the holiday table, was valued at $231 million. This chart is drawn from USDA, Economic Research Service’s Fruit and Tree Nuts and Vegetables and Pulses Yearbook Tables.

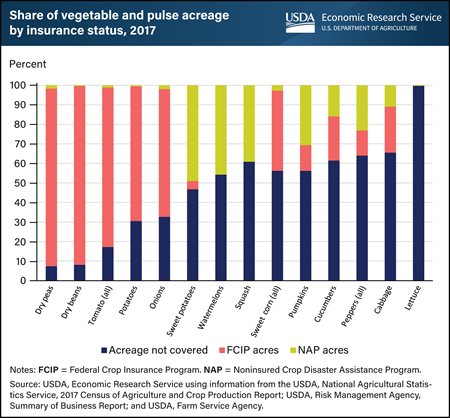

Monday, March 6, 2023

Insurance coverage of vegetable and pulse production varies widely by crop among the two Federal options for protection against losses from natural disasters. USDA, Economic Research Service (ERS) researchers examined USDA, Risk Management Agency (RMA) data on the acres covered under the Federal Crop Insurance Program (FCIP) and the Noninsured Crop Disaster Assistance Program (NAP) to understand how vegetable and pulse producers have used Federal risk management options. For instance, RMA and Census of Agriculture data from 2017 shows that dry peas, dry beans, and tomatoes heavily used FCIP. Around 20 percent of cucumber and cabbage acreage was also covered by FCIP. When USDA does not offer FCIP policies in a county because of insufficient data to create an actuarially sound policy, farmers can still protect a crop through NAP. NAP provides protection against yield losses, though not revenue losses and covers a large portion of the acreage for some crops, such as sweet potatoes, pumpkins, and peppers but is used less frequently by lettuce growers. Cucumber and cabbage crops accounted for 11 percent and 16 percent of total acreage covered under NAP. Because there are no FCIP policies available for watermelon, lettuce, and squash crops, producers of those crops either enrolled in NAP or did not insure their crop. Slightly less than half of watermelon and squash acres were covered under NAP. Farmers who did not protect with either FCIP or NAP likely employ other management practices, such as crop rotations, irrigation, or growing in a protective structure, to maintain production and revenue. This chart appears in the Economic Research Service bulletin Specialty Crop Participation in Federal Risk Management Programs, published in September 2022.

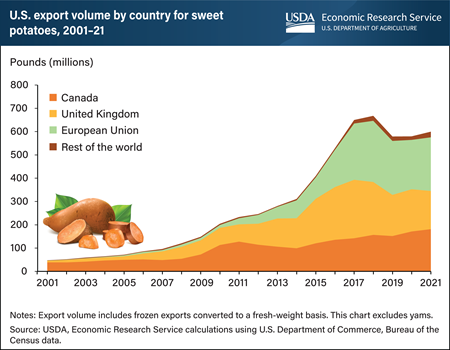

Tuesday, November 8, 2022

The United States is not the only country enjoying U.S. sweet potatoes. According to the Food and Agricultural Organization (FAO) of the United Nations, the United States was the top global exporter, by volume, of sweet potatoes in 2020. U.S. sweet potato exports on a fresh-weight basis increased 1,157 percent from 2001 to 2021, and the annual value of exports grew from $14 million to $187 million in the same period. Promotion of the tuber’s health benefits and food companies’ expanding sweet-potato offerings, such as sweet potato chips and fries, have helped fuel the expansion. Exports to the United Kingdom and European Union experienced strong year-over-year growth from the mid-2000s until 2018. Rising global competition and the damage caused by Hurricane Florence to the 2019 crop in North Carolina—the State leading U.S. production—cooled the export market. From 2018 to 2021, exports declined to the United Kingdom by 28 percent and to the European Union by 12 percent. Meanwhile, exports have continued to increase to Canada, among other destinations. The United States ranks seventh globally in sweet potato production, according to FAO. Over the past 20 years, top-producing U.S. States more than doubled sweet potato production to meet growing international and domestic demand. This trend has plateaued since U.S. sweet potato production reached a record high in 2017. This chart is drawn from USDA, Economic Research Service’s Vegetables and Pulses Outlook: April 2022.

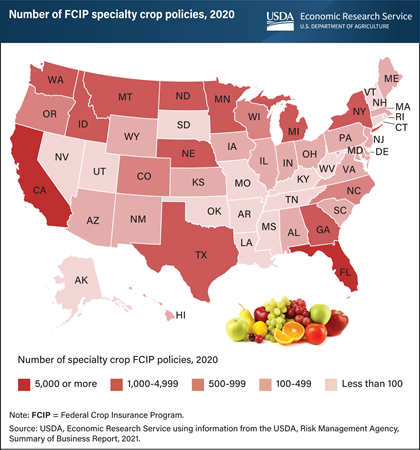

Monday, November 7, 2022

The USDA offers various risk management products to specialty crop farmers through the Federal Crop Insurance Program (FCIP). FCIP policies can mitigate risks by providing payments if insured crops experience losses caused by naturally occurring events (such as weather-related conditions) and market conditions. Specialty crops are a commodity group which includes fresh or dried fruits; tree nuts; vegetables; pulse crops such as dry beans, peas, and lentils; and horticulture nursery crops. California led the country in FCIP policies for specialty crops in 2020 (19,433), followed by Florida (5,060), Washington (4,233), North Dakota (3,860), and Minnesota (2,526). These States also produce the most fruits and vegetables (California, Florida, and Washington) and specialty field crops (North Dakota and Minnesota). California’s policies reflect the variety of specialty crops produced in the State, including almonds, grapes, oranges, walnuts, and raisins. Most North Dakota policies cover field crops—dry beans and dry peas. In 2020, specialty crops accounted for 25 percent of the value of U.S. crop production. This chart appears in the USDA, Economic Research Service bulletin Specialty Crop Participation in Federal Risk Management Programs, published in September 2022.

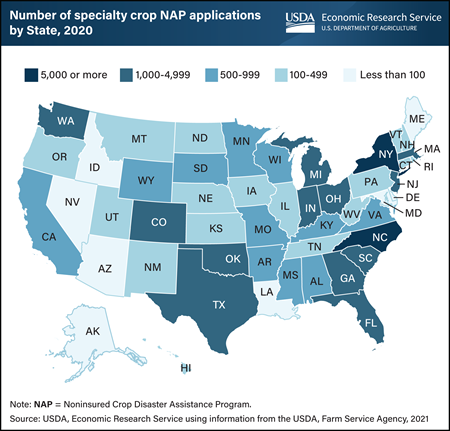

Tuesday, November 1, 2022

USDA operates various Federal crop insurance and disaster aid programs to help producers mitigate the risks of agricultural production such as weather, price, or pests. But when sufficient data is not available to create an actuarially sound insurance product (one in which premiums paid should approximately equal indemnity payments), then producers can apply to the USDA, Farm Service Agency’s Noninsured Crop Disaster Assistance Program (NAP). NAP covered about 115 million total acres in 2017. Specialty crops, which include fruits and vegetables, tree nuts, dried fruits, and horticulture nursery crops, are often grown in areas where there are suitable soil and weather conditions. In 2020, North Carolina and New York had the highest number of specialty crop NAP applications. Each State had more than 5,000 applications. Across the U.S., NAP applications were made for 147 different specialty crops in 2020. This chart appears in the Economic Research Service report Specialty Crop Participation in Federal Risk Management Programs, published in September 2022.

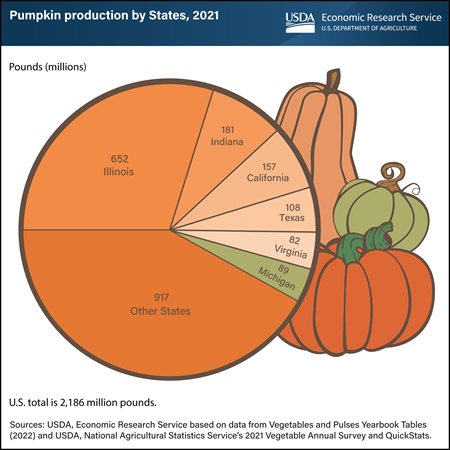

Wednesday, October 26, 2022

Pumpkins are on full display across the United States as part of many fall traditions, such as picking pumpkins at local farms, carving jack-o’-lanterns for Halloween, or baking pumpkin desserts for Thanksgiving. The production of pumpkins, from classic orange Howdens to new varieties like Cinderella, is widely dispersed throughout the United States, with all States producing some pumpkins. However, about 40 percent of pumpkin acres are harvested in only six States. By acreage and weight, Illinois is consistently the Nation’s largest pumpkin producer. In 2021, Illinois produced 652 million pounds, more than a quarter of total U.S. pumpkin production and more than the next five States combined. Unlike all other States, most of Illinois’ pumpkins are used for pie filling and processed for other food uses. Pumpkins from the other States are primarily intended for decorative, or carving, use. In 2021, Indiana produced 181 million pounds of pumpkins, California grew 157 million pounds, Texas grew 108 million pounds, Michigan grew 89 million pounds, and Virginia grew 82 million pounds. Retail prices for pumpkins typically fluctuate week to week leading up to Halloween. In the third week of October 2022, the average retail price for jack-o’-lantern style pumpkins was $5.07 per pumpkin, up 2 percent compared to the same week in 2021. This chart is drawn from Economic Research Service’s Trending Topics page, Pumpkins: Background & Statistics.

Wednesday, August 17, 2022

Food processors, manufacturers, wholesalers, and retailers transform raw agricultural commodities into convenient food products for U.S. consumers. Value added to commodities through these companies’ marketing services and money paid to farmers for their commodities account for a substantial portion of retail food prices. The farm share of the retail price of fresh potatoes—the ratio of what farmers receive to what consumers pay per pound in grocery stores—has fluctuated between 15 percent and 18 percent in recent years. The national monthly average price of fresh potatoes was $0.78 per pound at grocery stores in 2021, and the monthly average price received by farmers was $0.12 per pound. As part of the farm share calculation, the USDA, Economic Research Service (ERS) assumes that farmers supply a little more than 1.04 pounds of fresh potatoes for each pound sold at retail to account for the roughly 4 percent of fresh potatoes that is lost through spoilage or damage. Therefore, at an average farm price of $0.12 per pound, the farm receipt was 12.5 cents for each pound of potatoes sold in 2021, about 16 percent of the retail price. ERS researchers recently hosted a data training webinar on farm-to-retail price spreads and farm share statistics. More information on ERS’s farm share data can be found in the Price Spreads from Farm to Consumer data product, updated June 28, 2022.

_450px.png?v=5622.6)

Wednesday, July 6, 2022

The farm share of the retail price of fresh, field-grown tomatoes—the ratio of what farmers received to what consumers paid per pound in grocery stores—fell from 43 percent in 2020 to 36 percent in 2021. While the national, monthly average price of such tomatoes at grocery stores fell 11 cents to $1.85 per pound in 2021, the monthly average price received by farmers simultaneously fell 16 cents to $0.56 per pound. As part of calculating the farm share, the USDA, Economic Research Service (ERS) assumes that farmers supply a little less than 1.2 pounds of fresh tomatoes for each pound sold at retail, as 15 percent of the fresh tomatoes shipped to grocery stores is lost through spoilage or is otherwise damaged. Farm prices for tomatoes were lower in 2021 as U.S. domestic production of all types of fresh-market tomatoes rose 1.3 percent. This came despite a 4-percent decline in overall fresh vegetable production caused partly by extreme heat in growing regions. More information on ERS’s farm share data can be found in the Price Spreads from Farm to Consumer data product, updated June 3, 2022.

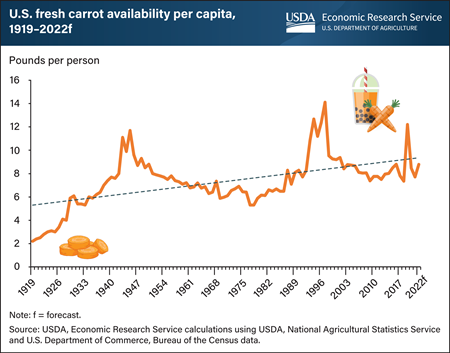

Friday, April 1, 2022

Fresh carrot per capita availability—a proxy used for per capita consumption—has trended upward over the past century, increasing from 2.2 pounds in 1919 to a projection of 8.8 pounds in 2022. Driven by rising fresh-market use, long-run consumer interest in carrots has been strong in the United States. In particular, during the past 35 years, the U.S. carrot industry was transformed by fresh-cut technology, which introduced baby and other fresh-cut carrot products. Per capita availability of fresh carrots peaked in 1997 at 14.1 pounds during the initial introductory period of fresh-cut products. Despite the widespread appeal and convenience of fresh-cut products, after the 1997 peak, availability of all fresh carrots trended downward. This drop may have reflected reduced demand for whole (heavier-weight) carrots, as lighter pre-packaged fresh-cut products shifted demand. It is also plausible the maturation of the fresh-cut industry fostered increased production and processing efficiency within the industry, reducing packinghouse waste and requiring fewer acres and raw carrot production. After 2009, the trend in fresh carrot availability reversed and slowly increased as the general economy recovered from the 2008 Great Recession and consumers had more disposable income. During the 5-year period of 2015–19, per capita availability of fresh carrots returned to the average of 8.9 pounds observed in 2000–04. This chart is drawn from USDA, Economic Research Service’s Vegetables and Pulses Outlook, November 2021.

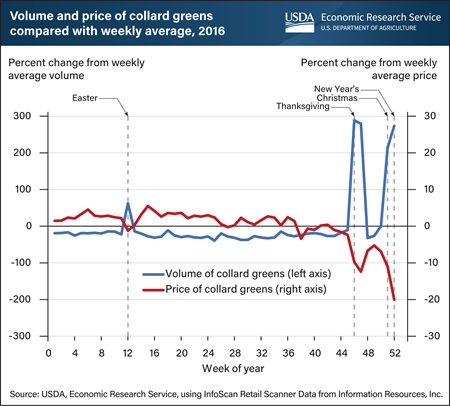

Thursday, January 13, 2022

The market phenomenon known as “countercyclical pricing”—when retail prices decrease in times of increased consumer demand—has been documented by economists in the prices of goods such as tuna during Lent or canned soup during winter. Recent analysis by USDA's Economic Research Service (ERS) provides another example of countercyclical pricing in fresh collard greens, a staple of Southern cuisine sometimes associated with good luck when eaten on the first day of the New Year. Popularity of the leafy green has risen since 2011, with annual availability increasing 43 percent from 0.88 pounds per capita to 1.26 pounds between 2011 and 2020. To observe consumer behavior, ERS researchers used retail scanner data consisting of billions of weekly U.S. retail food transactions captured from 2013 to 2018. They observed consistent annual surges in collard greens purchases during the weeks of Thanksgiving, Christmas, and New Year’s Day, accompanied by a smaller spike around Easter. They noted countercyclical pricing in all years of the available collard greens data, but the trend was most distinct in 2016. The volume of collard greens purchased that year exceeded the weekly average by 62 percent around Easter, 214 percent around Christmas, 274 percent around New Year’s Day, and 289 percent around Thanksgiving. However, collard greens prices fell below the weekly average by about 1 percent for Easter, 11 percent for Christmas, 20 percent for New Year’s, and 10 percent for Thanksgiving. This chart is drawn from ERS’ Vegetables and Pulses Outlook, November 2021.

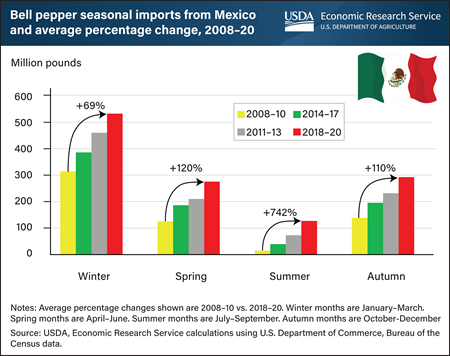

Monday, December 6, 2021

U.S. fresh vegetable imports are higher than ever and help satisfy rising consumer demand for year-round produce, according to reports from USDA’s Economic Research Service. Imports rise during the winter months (January to March) when U.S. production reaches a seasonal lull, but shipments now increasingly overlap with traditional U.S. production seasons. Extension of imports into domestic production seasons, called “market creep,” affects the entire U.S. produce industry, supporting increased shipments from Mexico, Canada, and Central America. For example, winter imports of bell peppers from Mexico increased by 69 percent between the 2008–10 and 2018–20 time periods. Summer (July-September) is historically a prime marketing window for U.S.-grown bell peppers, yet U.S. imports of bell peppers from Mexico increased by 742 percent between the summers of 2008–10 and 2018–20. Liberalized trade agreements, comparatively lower foreign exchange rates, increased per capita consumption, and demand for wider variety of offerings have contributed to the rise in imports. This chart first appeared in the USDA, Economic Research Service Amber Waves feature, U.S. Fresh Vegetable Imports From Mexico and Canada Continue To Surge.

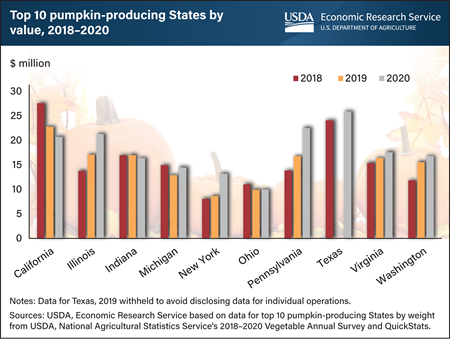

Monday, October 25, 2021

Pumpkins are a staple of fall traditions for many Americans who pick them, carve them into jack-o’-lanterns, or bake pumpkin desserts. Although pumpkins are grown in many States, most of the production comes from only 10 States. By acreage and by weight, Illinois is consistently the Nation’s largest pumpkin producer. However, unlike other States, most of Illinois’ pumpkins are used for pie filling and other processed foods, which receive a lower price per pound than ornamental jack-o’-lantern-style pumpkins. Production value of pumpkins in Illinois was ranked third in 2020 at $21.3 million. In 2020, Texas led the Nation in the value of pumpkins produced at $25.9 million, followed by Pennsylvania at $22.5 million, Illinois, and California at $20.7 million. Dry weather in Texas led to higher quality and lower yields, contributing to prices that exceeded those received by growers in any other State in 2020. Retail prices for pumpkins typically fluctuate week to week leading up to Halloween. In the second week of October 2021, the average retail price for jack-o’-lantern-style pumpkins was $4.09 per pumpkin, up 12 percent compared with the same week in 2020. This chart is drawn from Economic Research Service’s Trending Topics page, Pumpkins: Background & Statistics.

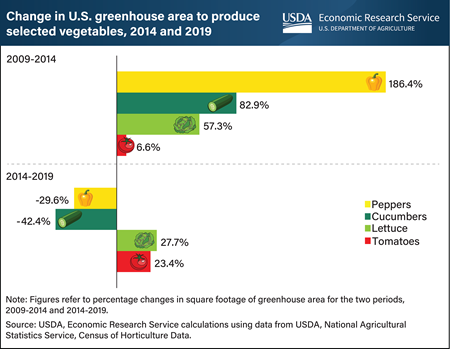

Friday, June 25, 2021

For over a decade, U.S. consumers have increased their demand for year-round availability of tomatoes, peppers, and cucumbers. The domestic produce industry initially responded by increasing protected-culture cultivation of these popular crops, usually through the use of greenhouses. Available data indicate the greenhouse area used to produce U.S. peppers rose 186 percent between 2009 and 2014, and greenhouse cucumber production area increased 83 percent. Subsequently, changes in the area devoted to protected-culture vegetable production have been mixed. For example, greenhouse area devoted to cucumber and pepper production in 2019 was down 42 and 30 percent, respectively, compared to the change between 2009 and 2014. In contrast, lettuce and tomato protected culture area was up 28 and 23 percent, respectively, over the same period. Between 2014 and 2019, imports of greenhouse-grown produce have increased significantly, a factor in the lackluster growth in cultivated area in the United States. Further, imported produce has increased U.S. supplies and pressured domestic prices downward, dampening incentives to expand U.S. greenhouse production. This chart appeared in the Economic Research Service’s April 2021 Vegetable and Pulses Outlook.

Wednesday, May 19, 2021

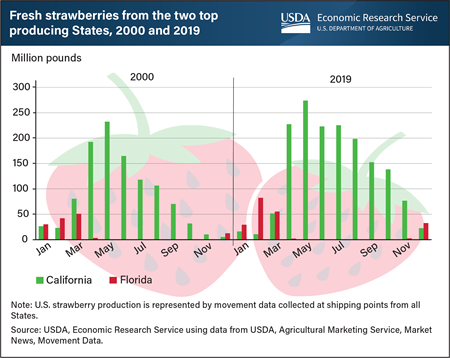

To keep up with growing consumer demand for strawberries, U.S. fresh strawberry production has increased over the last two decades (from 2000-19). In the United States, fresh strawberries are primarily grown in California (roughly 90 percent annually) and Florida (about 8 percent), followed by New York, North Carolina, Oregon, and Washington. With the development of newer varieties, strawberry season has expanded in both California and Florida. California produces strawberries year-round with peak harvest spanning from early spring until fall. California production has now increased from July to October with higher yielding varieties on decreased acreage, and shipments were 220 percent higher in 2019 than in 2000. Florida’s strawberry season typically begins in December and goes through March, but with the use of an early yielding variety, the Florida strawberry season now begins in November with relatively small volumes. Florida’s strawberry shipments more than doubled between 2000 and 2019. From all locations, strawberry supplies in the United States typically begin to rise in the spring, which is the perfect season to pick strawberries since National Pick Strawberries Day is on May 20. This information is from the special article Evolving Trends in the U.S. Fresh Strawberry Market in the Fruit and Tree Nuts Outlook Report: March 2021.

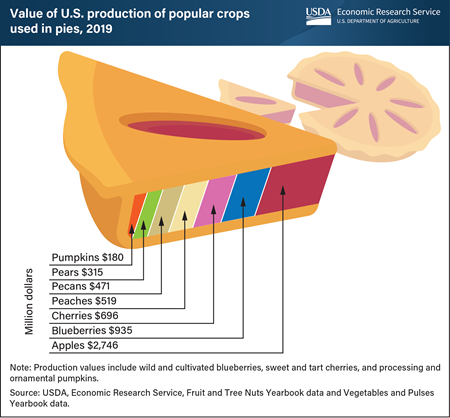

Friday, March 12, 2021

March 14 is known to many as Pi Day. When written as 3.14, the date resembles the mathematical constant, π, and for that reason, many celebrate the day’s circular reference by enjoying their favorite pie. In 2019, the United States grew $5.9 billion worth of seven of the fruits, vegetables, and tree nuts that tend to be popular for use as the main ingredient in pie making. The value of production of these seven commodities in 2019, as measured by U.S. cash receipts, was the highest for apples, which are produced abundantly in the United States both in terms of volume and production value. The U.S. apple crop reached a value of $2.75 billion in 2019, whereas production of blueberries reached $935 million. Cash receipts for other tasty fruit pie ingredients, cherries and peaches, were valued at $696 million and $519 million, respectively. As tree nuts, pecans are possibly one of America’s favorite non-fruit pie ingredients, and were valued at $471 million in terms of U.S. cash receipts. The pear crop of 2019 was valued at $315 million, while production of pumpkins, the ever-popular fall icon and mainstay of the holiday table, was valued at $180 million. This chart is drawn from Economic Research Service’s Fruit and Tree Nuts and Vegetables and Pulses Yearbook Tables.