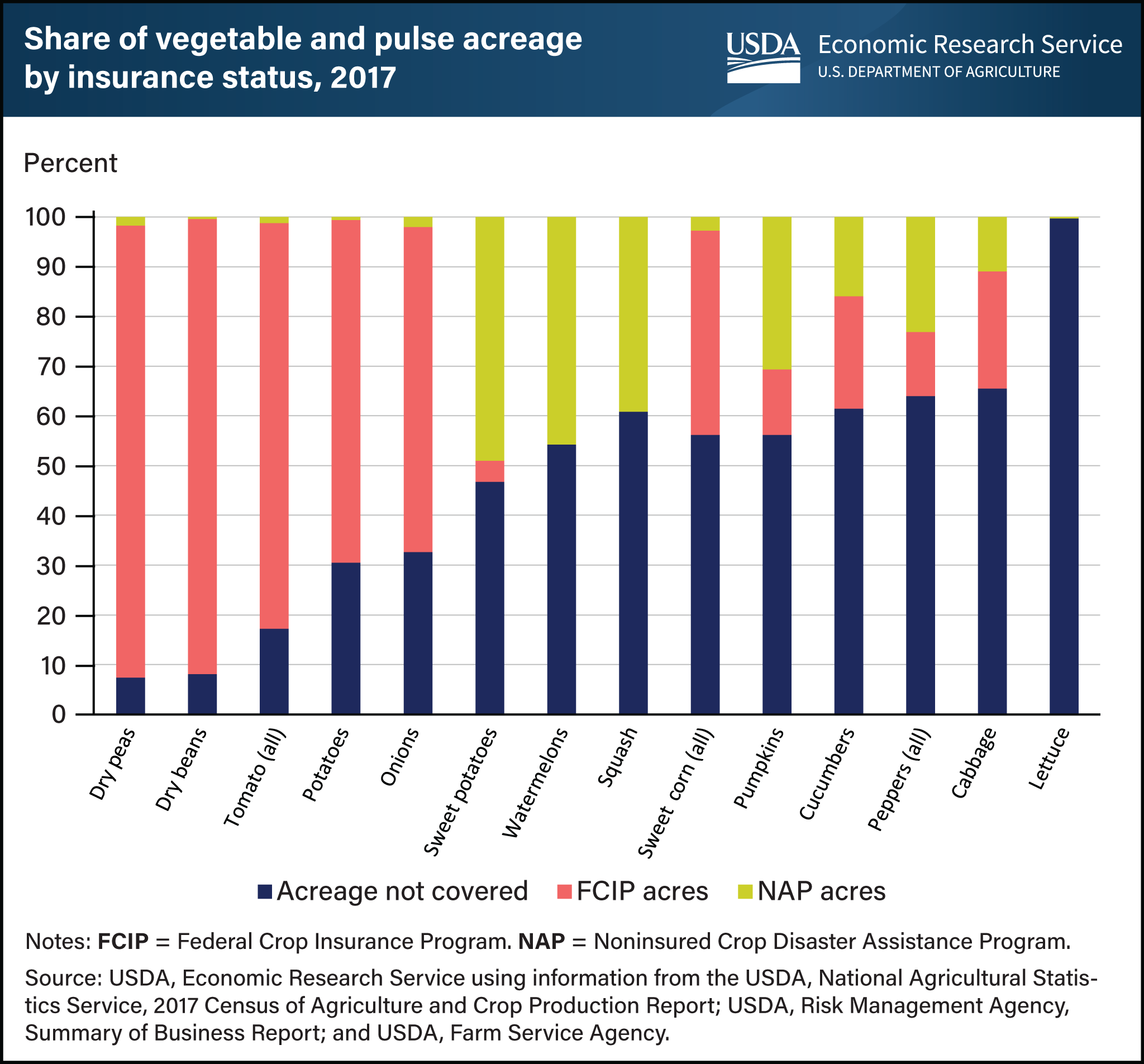

Share of insured acreage varies widely across vegetable and pulse crops

- by Sharon Raszap Skorbiansky

- 3/6/2023

Insurance coverage of vegetable and pulse production varies widely by crop among the two Federal options for protection against losses from natural disasters. USDA, Economic Research Service (ERS) researchers examined USDA, Risk Management Agency (RMA) data on the acres covered under the Federal Crop Insurance Program (FCIP) and the Noninsured Crop Disaster Assistance Program (NAP) to understand how vegetable and pulse producers have used Federal risk management options. For instance, RMA and Census of Agriculture data from 2017 shows that dry peas, dry beans, and tomatoes heavily used FCIP. Around 20 percent of cucumber and cabbage acreage was also covered by FCIP. When USDA does not offer FCIP policies in a county because of insufficient data to create an actuarially sound policy, farmers can still protect a crop through NAP. NAP provides protection against yield losses, though not revenue losses and covers a large portion of the acreage for some crops, such as sweet potatoes, pumpkins, and peppers but is used less frequently by lettuce growers. Cucumber and cabbage crops accounted for 11 percent and 16 percent of total acreage covered under NAP. Because there are no FCIP policies available for watermelon, lettuce, and squash crops, producers of those crops either enrolled in NAP or did not insure their crop. Slightly less than half of watermelon and squash acres were covered under NAP. Farmers who did not protect with either FCIP or NAP likely employ other management practices, such as crop rotations, irrigation, or growing in a protective structure, to maintain production and revenue. This chart appears in the Economic Research Service bulletin Specialty Crop Participation in Federal Risk Management Programs, published in September 2022.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?