ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, January 30, 2024

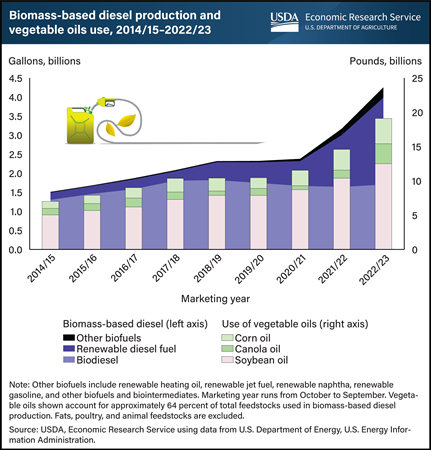

U.S. policies aimed at reducing greenhouse gas emissions have encouraged the production of biofuels—fuels derived from crops and animal fats. The policy framework has supported expansion in the production of biomass-based diesel. Biomass-based diesel includes biodiesel and renewable diesel, which now captures the second-largest share of biofuel production, after ethanol. With vegetable oils as the main feedstock in biomass-based diesel production, demand for major vegetable oils (soybean, corn, and canola) for the 2022/23 marketing year (October-September) reached a high of 19.1 billion pounds, up nearly 4.5 billion pounds from 2021/22. Use of soybean oil accounts for more than 40 percent of total feedstocks used for biomass-based diesel production. It increased from 5 billion pounds in 2014/15 to 12.5 billion pounds in 2022/23. Corn and canola oils also are increasingly used in biofuel production, though in lesser amounts. To date, U.S. production of soybean, corn, and canola oils has not been sufficient to cover the rise in domestic use. Rising domestic demand is supported by increasing imports, which now supply more than 29 percent of domestic vegetable oil consumption. This chart is drawn from USDA, Economic Research Service’s Oil Crops Outlook, December 2023.

Tuesday, December 5, 2023

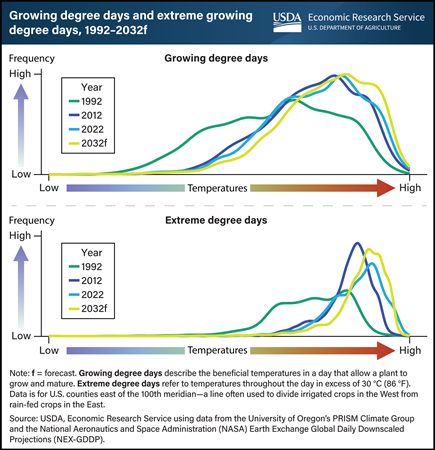

According to weather data from National Aeronautics and Space Administration (NASA), temperatures in the Corn Belt, a region spanning across Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Ohio, and Wisconsin, have trended higher in recent years and are projected to continue to rise through the end of this century. Two measures can be used to capture how rising temperatures affect crops’ growth—growing degree days and extreme degree days. Growing degree days describe the beneficial temperatures in a day that allow a plant to grow and mature. With rising temperatures, the growing degree days for corn and soybeans increase. A crop’s exposure to added growing degree days is not necessarily harmful; after all, crops need heat and precipitation to grow. However, extreme degree days, which refer to temperatures throughout the day in excess of 30 °C (86 °F), cause heat stress that is harmful for a plant. Each decade since 1992, both growing degree days and extreme degree days have steadily increased with rising temperatures in the Corn Belt, where about 80 percent of all U.S. corn and soybeans are grown. In the decade leading to 2032, both measures are projected to continue to increase. This chart first appeared in the USDA, Economic Research Service report, Estimating Market Implications From Corn and Soybean Yields Under Climate Change in the United States, published in October 2023.

Thursday, June 15, 2023

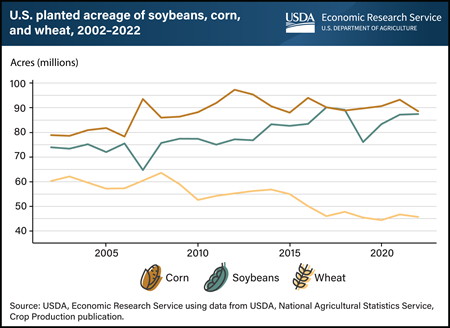

Between 2002 and 2022, soybeans were the second-most planted crop in the United States, behind corn. The exception was in 2018 when acreage planted to soybeans surpassed corn. While the total acres planted to soybeans generally have been less than to corn, the rate of growth in soybean sowings has exceeded corn since the early 2000s. Soybean planted acreage grew by 18 percent, from 74 million in 2002 to 87 million in 2022, while corn planted acreage increased by 12 percent in the same period. In contrast to this growth, wheat planted acres declined 22 percent over the same 20-year period—with some wheat acres shifting into soybeans. While net gains in soybean acres planted have been sizable, growth over the past two decades has not been steady. From 2002 to 2006, gains were modest, followed by a sharp decline in 2007 when biofuel policy increased the demand and price for corn. Increased profitability for corn shifted many acres out of soybeans and into corn production. After 2007, and for the next several years, generally improving profit margins reinvigorated soybean plantings, which continued their upward trajectory, peaking in 2017 at 90 million acres. Acreage fell slightly in 2018 and more sharply in 2019 to 76 million acres—the lowest since 2011—after China’s trade restrictions reduced global demand for U.S. soybeans, which caused soybean prices to fall. Heavy spring rains in 2019 contributed further to the reduction in soybean plantings, but planted acreage partially recovered in the following years. This chart is drawn from the USDA, Economic Research Service report, Characteristics and Trends of U.S. Soybean Production Practices, Costs, and Returns Since 2002, published in June 2023.

Wednesday, March 29, 2023

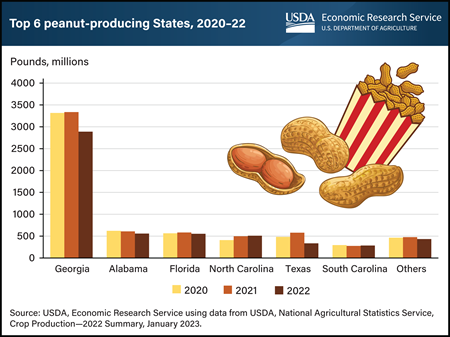

In the United States, peanuts are grown mainly in the South, where the climate is warmer and growing seasons are longer than in northern zones. Most U.S. peanut production comes from six States: Georgia, Florida, Alabama, North Carolina, South Carolina, and Texas. According to USDA’s National Agricultural Statistics Service (NASS), the U.S. peanut crop in 2022 was estimated at 5.57 billion pounds. Accounting for more than 50 percent of all U.S. peanut production, Georgia produced the most peanuts of any State, with a 2022 peanut crop estimated at 2.9 billion pounds. With production of 559 million pounds in 2022, Alabama’s peanut harvest was a distant second to Georgia, followed closely by Florida with 554 million pounds. The 2022 U.S. peanut crop was nearly 13 percent smaller than in 2021 because of lower acreage and yields. Smaller crops were estimated in all States except North Carolina, where production was pegged at 510 million pounds, a 3-percent increase from 2021. Production for Georgia was affected by a 9-percent year-to-year reduction in planted area that combined with reduced peanut yields because of an outbreak of the tomato spotted wilt virus. Moreover, NASS’s Weekly Crop Report indicated peanut growers in Texas and Oklahoma experienced above-average temperatures and below-average rainfall in the critical development months of June, July, and August that negatively impacted yield and harvested area. This chart is drawn from USDA, Economic Research Service’s Oil Crops Outlook, January 2023.

Thursday, October 27, 2022

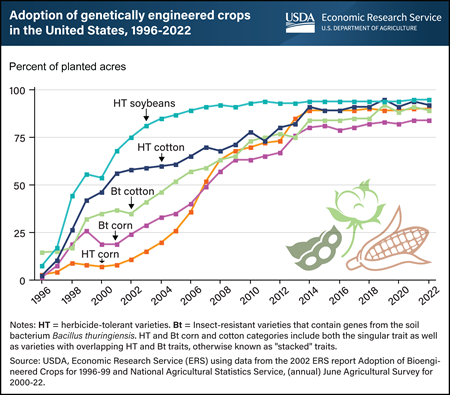

Genetically engineered (GE) seeds were commercially introduced in the U.S. for major field crops in 1996, with adoption rates increasing rapidly in the years that followed. By 2008, more than 50 percent of corn, cotton, and soybean acres were planted with genetically engineered seeds. The total planted acreage with GE seeds has only increased since then, and now more than 90 percent of U.S. corn, upland cotton, and soybeans are produced using GE varieties. GE crops are broadly classified as herbicide-tolerant (HT) only, insect-resistant (Bt) only, or stacked varieties that combine both HT and Bt traits in a single seed. In the chart, both HT and Bt lines include stacked varieties which are a combination of both type of traits. Although other GE traits have been developed, such as virus and fungus resistance, drought resistance, and enhanced protein, oil, or vitamin content, HT and Bt traits are the most commonly used in U.S. crop production. While HT seeds are also widely used in alfalfa, canola, and sugar beet production, most GE acres are planted to three major field crops: corn, cotton, and soybeans. This chart appears in the ERS Topic Page Recent Trends in GE Adoption, published in 2022.

Thursday, June 2, 2022

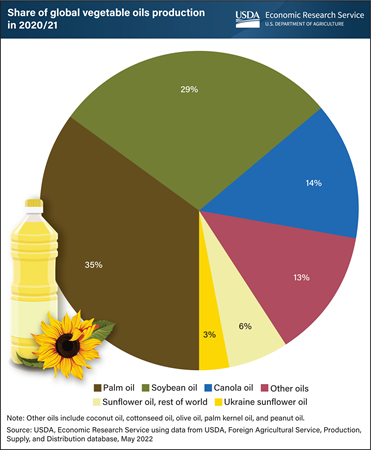

Sunflower oil is one of the top four vegetable oils produced and consumed around the world. Commonly found in salad dressings, sunflower oil is widely used by consumers, likely for its light taste and healthy dosage of vitamin E. In the 2020/21 marketing year, sunflower oil accounted for 9 percent of major vegetable oils produced globally. Ukraine is the major global producer and exporter of sunflower oil, producing a total of 5.9 million tons in 2020/21, or 31 percent of all sunflower oil output, and 3 percent of major vegetable oils produced globally. Furthermore, Ukraine exported roughly 90 percent of its sunflower oil production in 2020/21 to trade partners such as the European Union, India, China, Egypt, and Turkey. These destinations together accounted for 65 percent of global sunflower oil exports. Market uncertainty about sunflower oil supplies from Ukraine has created additional demand for other vegetable oils, such as palm, soybean, and canola. Supplies of these alternatives are expected to be tight in the 2021/22 marketing year, contributing to elevated vegetable oil prices. This chart is drawn from USDA, Economic Research Service’s Oil Crops Outlook, April 2022.

Wednesday, April 27, 2022

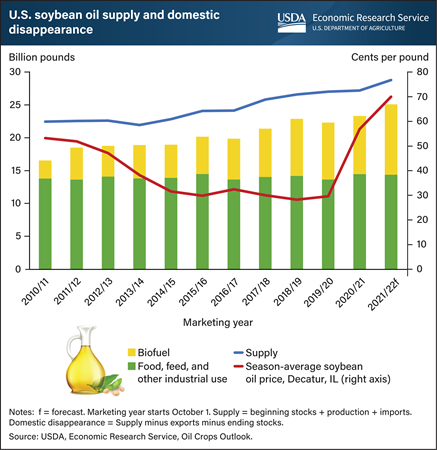

In the United States, soybean oil is frequently used for frying and making pastry crust flaky, among numerous other commercial food preparations. Soybean oil—produced by crushing soybeans and extracting the oil—is also used in the production of industrial products like fatty acid, animal feeds, biodiesel and increasingly, renewable diesel. As the most widely used vegetable oil, soybean oil use has typically accounted for over 50 percent of total domestic disappearance of all vegetable oil used in the United States. In early 2021, demand for biofuels increased—driven in part by Federal and State biofuels policy. Given the versatility of soybean oil and the limited supplies of substitute oils such as canola, sunflower, and palm oil, steady growth in food and industrial demand for soybean oil has caused domestic prices to rise. In March 2022, USDA’s Agricultural Marketing Service reported that average monthly soybean oil prices in Decatur, IL—a leading indicator market for soybean oil—had reached 76 cents per pound, more than 40 percent higher than a year earlier. Rising monthly prices have contributed to increases in the 2021/22 U.S. season-average soybean oil price, currently projected at $0.70 per pound, an increase of 23 percent, or 13 cents, from the prior marketing year. Higher prices have in turn supported increased soybean crush (processing) volumes. Consequently, domestic soybean oil supply is expected to grow to 28.8 billion pounds in 2021/22, up 6 percent from the year prior. This chart is drawn from USDA’s Economic Research Service’s Oil Crops Outlook, March 2022.

Monday, January 24, 2022

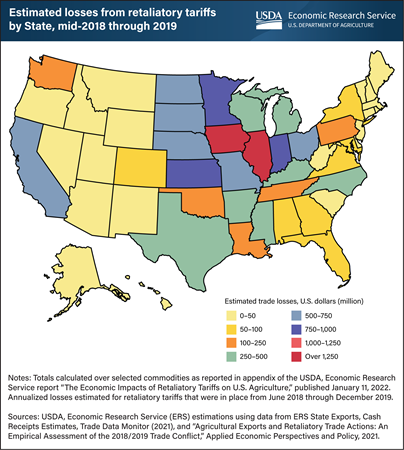

In 2018, six U.S. trading partners—Canada, China, the European Union, India, Mexico, and Turkey—announced retaliatory tariffs affecting agricultural and food products. The agricultural products targeted for retaliation were valued at $30.4 billion in 2017, with individual product lines experiencing tariff increases ranging from 2 to 140 percent. USDA’s Economic Research Service (ERS) estimated trade losses from retaliatory tariffs by State and commodity using data in the ERS State Exports, Cash Receipts Estimates. Estimated annualized losses from mid-2018 through the end of 2019 totaled $13.2 billion across 17 commodity groups, led by soybeans, sorghum, and pork. While retaliatory tariffs affected all States, those in the Midwest experienced the largest losses. ERS researchers estimated Iowa lost $1.46 billion; Illinois, $1.41 billion; and Kansas, $955 million, all on an annualized basis. Iowa and Illinois, which together produce 25 to 30 percent of U.S. soybeans, both experienced trade losses in excess of $1 billion for soybeans alone. The retaliatory tariffs followed the issuance of U.S. tariffs on imports of steel and aluminum from major trading partners and on a broad range of imports from China. This chart can be found in the ERS report, The Economic Impacts of Retaliatory Tariffs on U.S. Agriculture, published in January 2022.

Friday, August 27, 2021

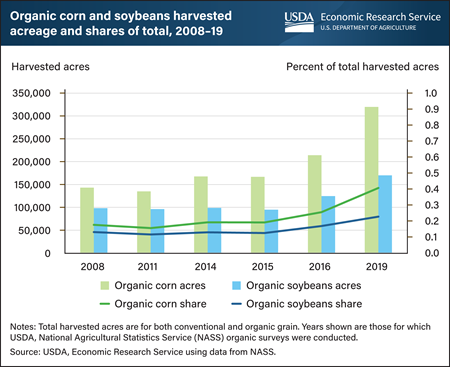

Soaring demand for organic livestock and processed food products has stimulated production of organic corn and soybeans in the United States. Organic farming of these two commodities constitutes a small though growing portion of total corn and soybean harvested acreage. From 2008 to 2019, harvested acreage of organic corn for grain increased 124 percent while acreage for organic soybeans rose 73 percent. Despite the upward trend, the organic share of total domestic corn and soybean acreage accounted for less than 1 percent of total harvested acres for each crop in 2019. Organic farming typically costs more than conventional agriculture because of the production practices required for USDA to certify products as organic. Costs for organic corn are estimated to be $83–$98 higher per acre than their conventional counterparts and costs for organic soybeans are estimated at $106–$125 higher. Organic corn and soybeans normally draw a higher price as well; however, in late 2020, the organic premiums for these two commodities declined. Organic soybean price premiums appear to have recuperated since the beginning of 2021, while the corn premium has yet to do so. This chart is drawn from USDA, Economic Research Service’s Feed Grains Outlook, August 2021.

Monday, July 26, 2021

Errata: On July 28, 2021, the text was revised to correct an error that occurred in data transmission. The chart was not affected by the error.

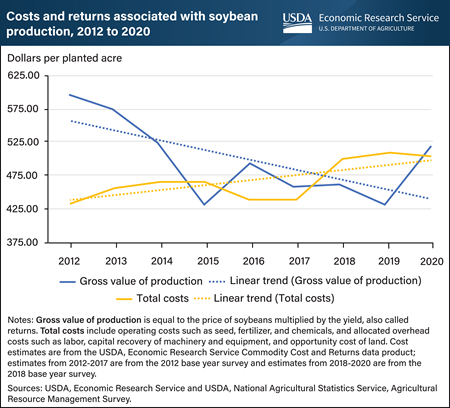

The total cost of producing one acre of soybeans in the United States increased by 14 percent between 2012 and 2020. At the same time, grower revenue—the returns a grower receives from producing an acre of soybeans—decreased by 14 percent. Returns, which equal the price of soybeans multiplied by the yield, fell from $597 an acre in 2012 to $431 in 2015. In 2016, returns rose to $492 before falling to $429 in 2019. In 2020, returns rebounded to $515 an acre, the highest level since 2014. Grower returns are closely associated with soybean prices, which fluctuated between 2012 and 2020. Prices peaked at $14.21 per bushel in 2012 before dropping to $8.61 per bushel in 2018 and 2019, even as yields per acre trended higher. Total costs—which include operating costs such as seed, fertilizer, and chemicals, as well as allocated overhead costs such as labor and capital recovery of machinery and equipment—grew from $438 to $500 between 2012 to 2020. Largely because of an increase in soybean prices, soybean returns in 2020 exceeded costs for the first time in three years. Costs for most aspects of soybean production increased from 2012 to 2020. The biggest cost increases were for capital recovery of machinery and equipment, as well as for the opportunity cost of land—a category that reflects income that might have been earned from renting out the land. This chart is drawn from USDA, Economic Research Service's (ERS) Oil Crops Outlook, June 2021, and is based on data collected from the ERS Commodity Costs and Returns data product.

Monday, March 22, 2021

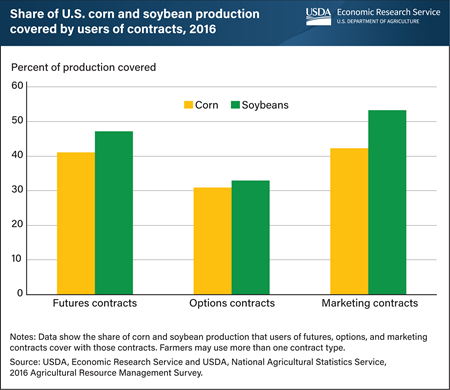

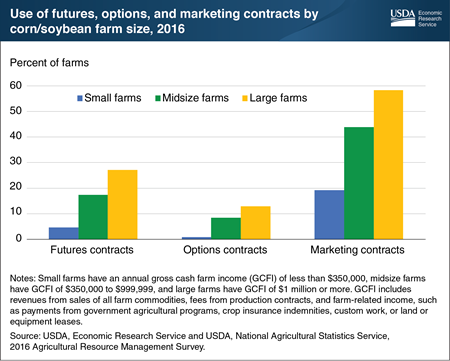

In 2016, corn and soybean producers accounted for about 93 percent of future and options contracts used by U.S. farmers and 60 percent of all production covered by marketing contracts. With a futures contract, a farmer can assure a certain price for a crop that has not yet been harvested. An options contract allows a farmer to protect against decreases in the futures price, while retaining the opportunity to take advantage of increases in the futures price. While futures and options contracts are usually settled without delivery, marketing contracts arrange for delivery of a commodity by a farmer during a specified future time window for an agreed price. Farmers who use these risk management options frequently use more than one contract type. On average, farms that used futures contracts covered 41 percent of their corn production and 47 percent of their soybean production in 2016. Shares were relatively similar for marketing contracts, which covered about 42 percent of corn and 53 percent of soybean production. By comparison, corn and soybean farmers covered a little more than 30 percent of their production with options contracts for both commodities. This chart appears in the Economic Research Service report, Farm Use of Futures, Options, and Marketing Contracts, published October 2020.

Wednesday, March 17, 2021

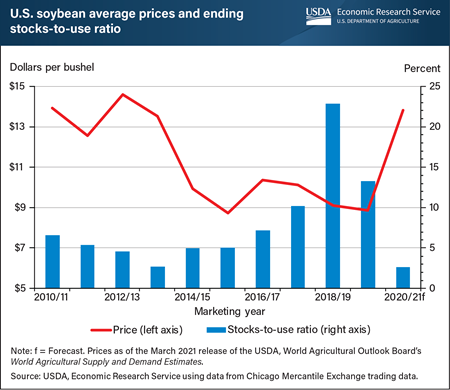

Expanded U.S. soybean exports—led in part by increased Chinese buying under the United States-China Phase One trade deal in combination with greater demand by domestic processors—are tightening the availability of U.S. soybeans this marketing year (September 2020-August 2021). With demand far surpassing increases in supply, USDA forecasts the inventory of soybeans by the end of the current marketing year to plunge to 120 million bushels. If realized, that would be lower than at any point since the historically low stock level of 92 million bushels in 2013–14. The forecast soybean stocks-to-use ratio, which is a measure of the market’s relative balance between ending supplies and total demand, is 2.6 percent—a notable decrease from the 13.3 percent of last year. Commodity prices and stocks have an inverse relationship: lower levels of stocks contribute to higher prices and higher levels of stocks contribute to lower prices. Rapidly declining soybean stocks continue to create the possibility of even higher prices, with February soybean prices already up to $13.82 a bushel, higher than any marketing year since 2012–13. The March Grain Stocks report from the National Agricultural Statistics Service will provide greater information on how fast the situation is changing. This chart is drawn from the USDA, Economic Research Service’s March 2021 Oil Crops Outlook report.

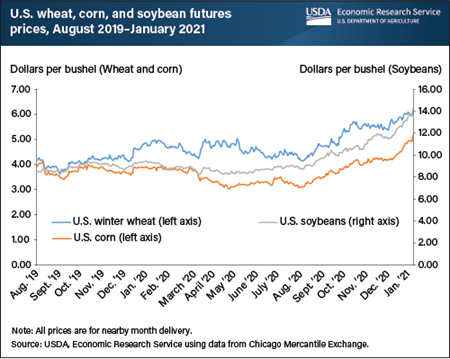

Wednesday, February 10, 2021

Futures prices—the price of a contract to deliver a commodity at a certain time in the future—for wheat, corn, and soybeans have been trending upward since August 2020. This 6-month trend of rising prices accelerated in the first weeks of 2021, demonstrating stronger price gains in anticipation of USDA’s revised production forecasts for major U.S. grains in the World Agricultural Supply and Demand Estimates (WASDE) for January 2021. Hard red winter wheat futures prices for the nearby month (e.g., prices associated with an active futures contract with the shortest time to maturity/delivery) rose 72 cents per bushel (13 percent) during the 30-day period just ahead of the January 12, 2021 release of the WASDE. During the same 30-day period, corn and soybean contracts for nearby month delivery rose 98 cents and $2.69 per bushel, respectively (approximately 23 percent each), and the season average farm price of soybeans reached their highest level since the marketing year of 2013-14. The realization of tightening supplies coupled with robust demand from export markets, most notably China, have stimulated steady price increases for the big three U.S. row crops—wheat, corn, and soybeans. Additionally, dry conditions in key areas of corn and soybean production in South America have reduced regional production prospects and the outlook for global supplies, providing further support to associated U.S. commodity prices. This chart is drawn from the USDA, Economic Research Service’s January 2021 Wheat Outlook, Oil Crops Outlook, and Feed Grains Outlook reports.

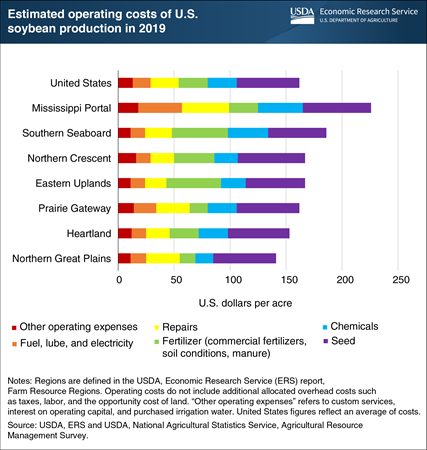

Wednesday, January 6, 2021

To produce soybeans on one acre of U.S. farmland in 2019, a producer would have spent $162 on average on expenses such as seed, fertilizer and fuel. These expenses, known as operating costs, can vary noticeably by region. Operating costs for soybeans are estimated to be highest in the Mississippi Portal region ($226 per acre) and lowest in the Northern Great Plains region ($141 per acre). The high operating costs in the Mississippi Portal region are driven in part by costs associated with irrigation—high repair costs and high fuel, lube, and electricity costs. The Mississippi Portal region irrigates a larger percentage (50 percent) of its soybean acres than any other region; second highest is the Prairie Gateway region (21 percent irrigated), which has the second highest costs for those two categories of expenses. The Mississippi Portal region also has the highest chemical ($40 per acre) and seed costs ($61 per acre) of any region. Operating costs are lowest in the Northern Great Plains region mostly because it has particularly low expenses for chemicals ($16) and fertilizer ($14). This chart is derived from data collected from the USDA, Economic Research Service (ERS) Commodity Costs and Returns data product. The data also can be viewed via ERS’s interactive data visualization product, U.S. Commodity Costs and Returns by Region and by Commodity.

Friday, November 13, 2020

U.S. farmers can use a variety of market tools to manage risks. With a futures contract, the farmer can assure a certain price for a crop that has not yet been harvested. An option contract allows the farmer to protect against decreases in the futures price, while retaining the opportunity to take advantage of increases in the futures price. Futures and options usually do not result in actual delivery of the commodity, because most participants reach final financial settlements with each other when the contracts expire. In a marketing contract, by contrast, a farmer agrees to deliver a specified quantity of the commodity to a specified buyer during a specified time window. Corn and soybean farms account for most farm use of each of these contracts, and larger operations are more likely to use them than small. With more production, larger farms have more revenue at risk from price fluctuations, and therefore a greater incentive to learn about and manage price risks. Fewer than 5 percent of small corn and soy producers used futures contracts, compared with 27 percent of large producers. Less than 1 percent of small corn and soy producers used options, compared with 13 percent of large producers. And about 19 percent of small corn and soy producers used marketing contracts, compared with 58 percent of large producers. This chart is based on data found in the Economic Research Service report, Farm Use of Futures, Options, and Marketing Contracts, published October 2020. It also appears in the November 2020 Amber Waves feature, “Corn and Soybean Farmers Combine Futures, Options, and Marketing Contracts to Manage Financial Risks.”

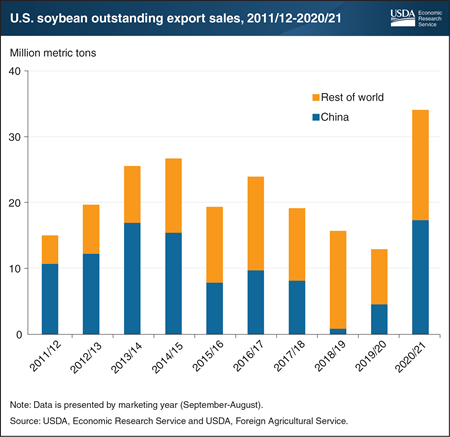

Friday, October 23, 2020

The United States is a leading global producer and exporter of soybeans, and their export represents a significant source of demand for U.S.-produced soybeans. The export of U.S. soybeans in the 2020/21 crop year is already off to a strong start. Total outstanding export sales—the contracts by country that have not been shipped at any given time during the marketing year—totaled 34.2 million metric tons (1,257 million bushels), as of October 8, 2020, nearly three times the level of a year earlier. This surge is likely the result of strengthening livestock feed demand in China and depleted supplies for competing exporters, particularly Brazil. The increase is also a major contributor to the price rally currently underway, with new-crop soybean futures at a two-year high. This chart is drawn from Economic Research Service’s Oil Crops Outlook, October 2020.

Friday, September 11, 2020

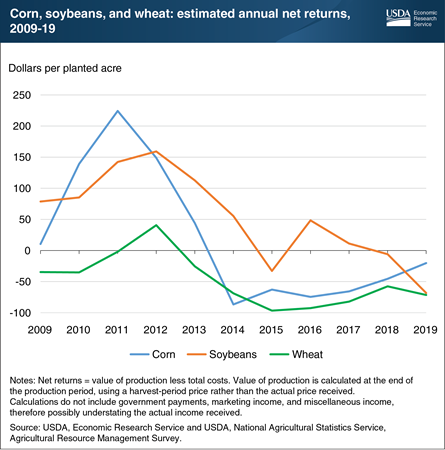

Producers of some of the U.S. major field crops have struggled to cover total costs of production over the past decade. The Economic Research Service’s (ERS) Commodity Costs and Returns product estimates this gap or surplus in the calculation of the value of production less total costs, referred to here as net returns. Total costs comprise operating costs, which include expenses such as fertilizer, seed, and chemicals, and allocated overhead (economic) costs, which include unpaid labor, depreciation, land costs, and other opportunity costs. Although revenue from selling crops can typically cover operating costs each year, net returns have often been negative. This suggests that, in some cases, allocated overhead costs are not covered. Corn’s net returns increased early in the decade, primarily due to a boom in the production of corn-based ethanol. Corn yields and acreage remained high after the boom, leaving supply high and leading, in part, to lower prices and returns over time. Net returns for soybeans shadowed those for corn during the ethanol boom, remaining higher than those for corn up until 2018. Wheat prices and returns also declined, due to strong international competition and several high-yield domestic crops. This chart is derived from data collected from the ERS Commodity Costs and Returns data product. Its data can also be viewed via ERS’s interactive data visualization product, U.S. Commodity Costs and Returns by Region and by Commodity.

Monday, August 24, 2020

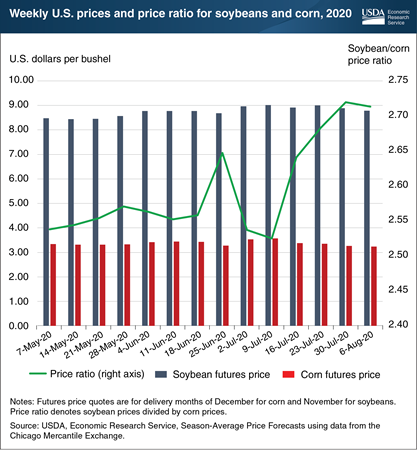

The soybean-to-corn price ratio is often used as one of several tools in measuring profitability of soybeans and corn. The current ratio of U.S. soybean to corn prices has recently risen, sending a signal to farmers that the relative profitability of soybeans has increased over corn. Soybeans and corn are crops that compete for acreage in production and are complements in feed use. Their futures prices—the price of a contract to deliver a bushel of soybeans or corn at a certain time in the future—are used to calculate a ratio through dividing the soybean price by the corn price. Higher price ratios indicate that soybeans are relatively more profitable than corn. This ratio, which averaged 2.51 over the past 20 years, can tell farmers whether planting, harvesting, and storing one or the other crop might be advantageous. The ratio can also be used by livestock producers to indicate the price direction for feed ingredients. When the USDA, National Agricultural Statistics Service's June 2020 Acreage report indicated that less corn acreage had been planted than expected in early spring, futures prices for corn in marketing year 2020/21 increased by 8 percent. Soybean futures prices increased at the same time. Since late June, expectations of higher corn yields eroded the futures price for corn by 2.4 percent, while the price for soybeans increased by 1.1 percent. This differential in prices led to an increase in the soybean-to-corn price ratio from 2.64 to 2.71, a 2.5 percent increase from late June. This chart and associated data are drawn from the Economic Research Service’s Season-Average Price Forecasts data product.

Friday, January 17, 2020

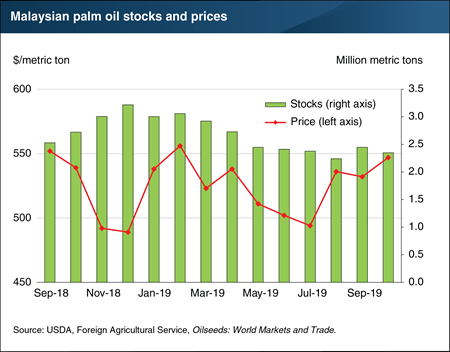

Palm oil is the world’s most widely consumed vegetable oil, used for a multitude of edible goods as well as for industrial applications, including biodiesel. Production of palm oil is dominated by the two top producers—Indonesia and Malaysia. Rising consumption of palm oil by major producing countries and falling output of vegetable oil by major importers, including India, China, and the European Union, have led to recent price increases for Malaysian palm oil. By October 2019, Malaysian prices had climbed to a 13-month high, and further price strengthening is possible next year. In addition to increased demand, palm oil supply and stocks are projected lower due to slowing production. For Malaysia, USDA lowered its estimate of palm oil production for October 2019 through September 2020 to 21 million metric tons. The reduction can be tied to Malaysian rainfall over the last 12 months being significantly below average, which can adversely affect palm oil yields for up to a year. A slower rise in palm oil output coincided with decisions by the Indonesian and Malaysian governments to increase the percentage that biodiesel must comprise in the total fuels supply. Starting in 2020, Malaysia will double its biodiesel requirement to 20 percent. This chart appears in the ERS Oil Crops Outlook newsletter released in November 2019.

Monday, September 30, 2019

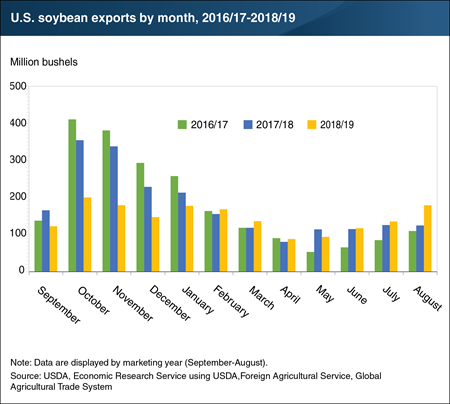

U.S. soybean exports concluded the 2018/19 crop year with a flourish. At 180 million bushels, August export inspections of soybeans totaled an all-time high for the month. The data rounds out the September-August crop marketing year with an atypical export pattern: August shipments were nearly as high as in October and November. In contrast, exports for 2016/17 and 2017/18—as well as in previous years—followed a seasonal pattern with exports peaking in the late-fall and winter before falling to lower levels in the spring and summer. The unseasonably strong revival in U.S. export demand this summer was stimulated by competitive prices and a slowing of shipments from Brazil. China accounted for a majority of the August gain in U.S. soybean shipments, which surged when sales that were booked early this year were actually shipped. The lower 2018/19 export totals in the first half of the crop year were also attributable to China, as exports to the country fell due to tariffs on U.S. soybeans entering the Chinese market. As a consequence, USDA raised its 2018/19 estimate of U.S. exports this month by 45 million bushels to 1.745 billion. This chart appears in the ERS Oil Crops Outlook report released in September 2019.