Note: Updates to this page are discontinued. The material—last updated on November 30, 2023—remains on the site for reference.

The Coronavirus (COVID-19) pandemic affected the U.S. economy, including the farm sector and farm households. Farm businesses experienced disruptions to production because of lowered availability of labor and other inputs, and output prices were affected by changes in demand for commodities in certain market segments. In response to the economic turmoil from COVID-19, the U.S. Congress passed six economic relief and stimulus bills in 2020 to provide financial assistance to farm businesses and farm households. USDA and other Government agencies worked to implement authorized programs and disburse payments in 2020–23.

- Farm Sector Income During the Pandemic

- Federal Financial Assistance to the Agriculture Sector

- COVID-19 Related Assistance for Family Farm Households

- Farm Household Income and the Pandemic

Farm Sector Income During the Pandemic

The USDA Economic Research Service (ERS) releases calendar year farm income and financial forecasts three times per year. The latest estimates through 2022 and forecasts for 2023 were released on November 30, 2023, and they reflect the observed effects of the pandemic. To learn more, visit the Farm Sector Income and Finances topic page.

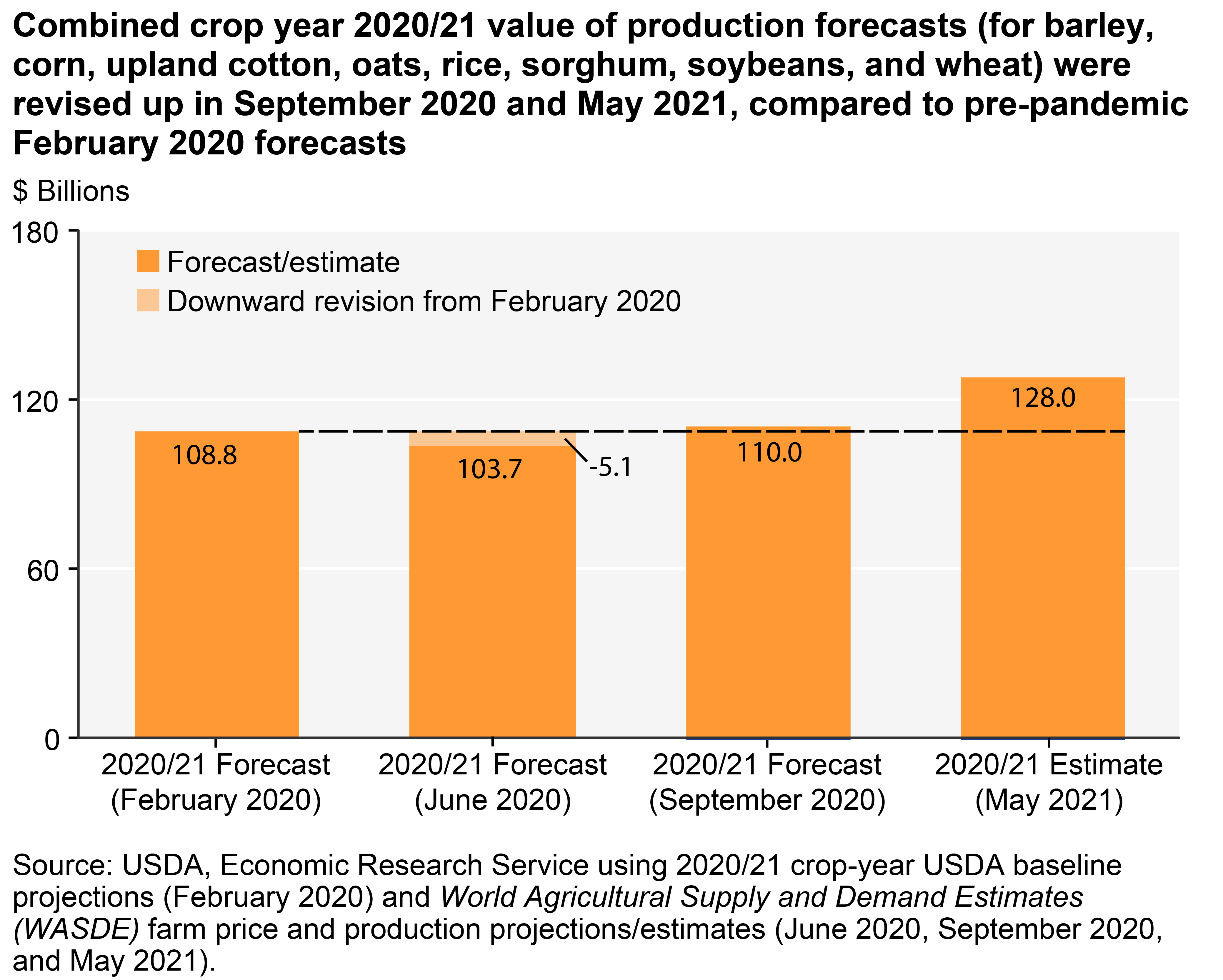

The farm income outlook evolved during the pandemic because of changing conditions, including changes in commodity prices, production, and Government support. For example, projections for the combined value of production for eight major crops—barley, corn, upland cotton, oats, rice, sorghum, soybeans, and wheat—for crop year 2020/21 shifted considerably throughout 2020 and 2021. In early February 2020, just before the outbreak of the pandemic in the United States, the combined value of production was forecast at $108.8 billion based on price and production quantity projections from USDA Agricultural Projections to 2029. Starting in May 2020, the World Agricultural Supply and Demand Estimates (WASDE) report had price and production projections for crop year 2020/21. With the June 2020 WASDE report, the combined value of production forecast was revised down by 5 percent to $103.7 billion. Three months later, in September 2020, the forecast was revised up to $110 billion, 1 percent above the pre-pandemic February 2020 forecast. With the May 2021 WASDE report, the 2020/21 crop year price and production projections became estimates, and the value of production was estimated at $128.0 billion, 18 percent above the February 2020 forecast. Most of the upward revisions in September 2020 and May 2021 were because of higher commodity prices rather than changes in production quantities.

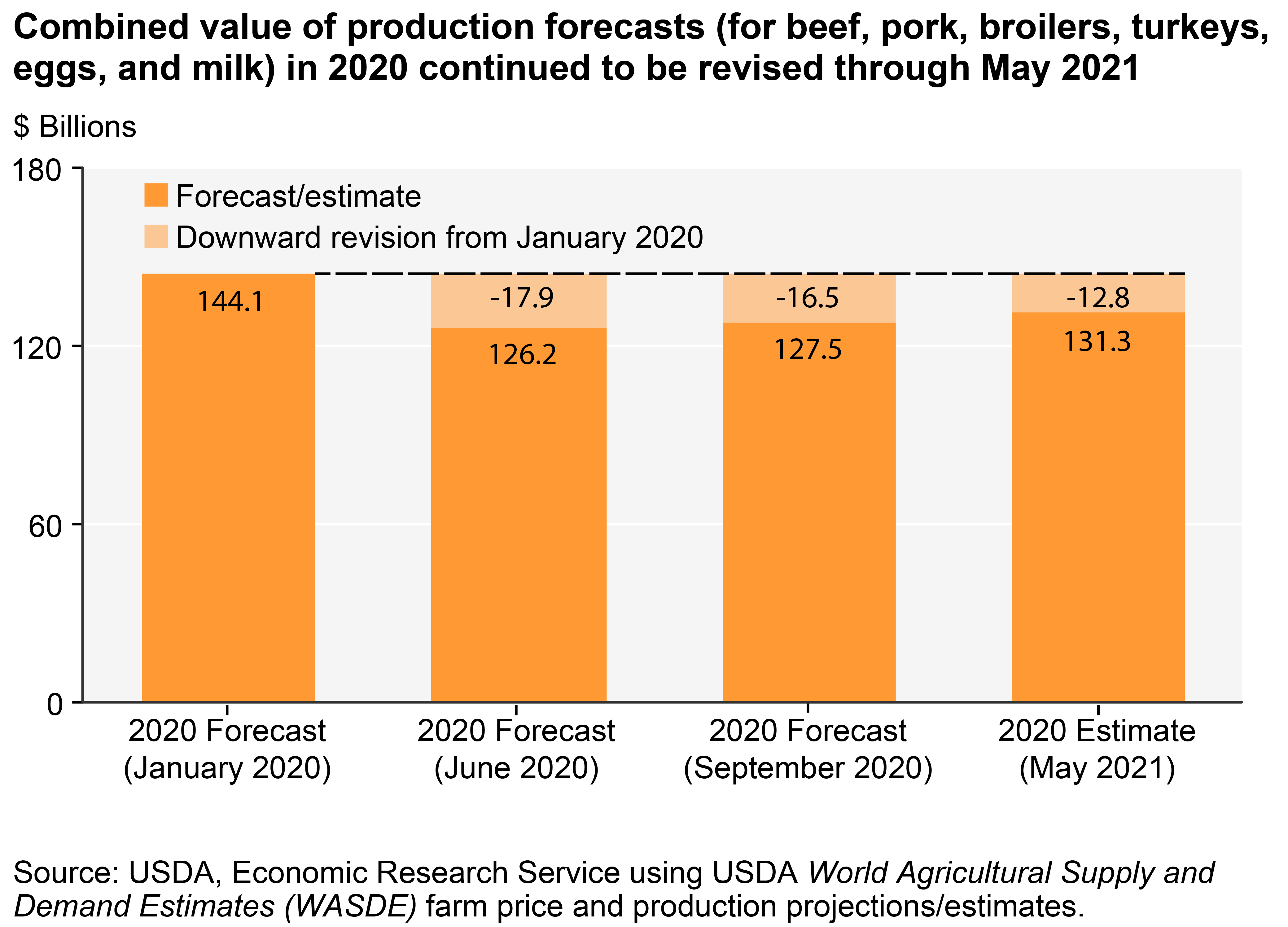

The 2020 forecast for the combined value of production of six major animal/animal products (beef, pork, broilers, turkeys, eggs, and milk) also fluctuated throughout the 2020 calendar year but remained lower than the pre-pandemic forecast. The pre-pandemic January 2020 forecast of the combined value of production for beef, pork, broilers, turkeys, eggs, and milk was $144.1 billion. In June 2020, that forecast was revised down by $17.9 billion (12 percent) to $126.2 billion. The September 2020 forecast was slightly higher than the June forecast at $127.5 billion. By May 2021, the value of production was estimated at $131.3 billion, 9 percent below the pre-pandemic January 2020 forecast.

For the farm income forecasts, ERS creates calendar-year forecasts of cash receipts and value of production based on the World Agricultural Supply and Demand Estimates and other data.

For more information on evaluating trends in the value of production forecasts using monthly data and how the ERS farm income forecasts evolved in 2020, see:

COVID-19 Working Paper: A Timely Tool for Evaluating Financial Conditions in Agriculture: USDA Forecasts of the Value of Production in the Face of COVID-19

COVID-19 Working Paper: The Evolution of U.S. Farm Sector Profitability Forecasts in 2020

Highlights from the Farm Income Forecast covers the most recent net cash income and net farm income forecasts for the farm sector.

Federal Financial Assistance to the Agriculture Sector

Using the authority from the COVID-19 relief and stimulus bills passed by the U.S. Congress, USDA created the Coronavirus Food Assistance Program specifically for farm operations. Other Federal departments and agencies created more general programs that some farm operations were eligible for, such as the Paycheck Protection Program, or expanded eligibility to the agriculture sector, such as the Economic Injury Disaster Loan Program.

Further information and analysis on calendar year 2020 payments is available, see:

COVID-19 Working Paper: Financial Assistance for Farm Operations and Farm Households in the Face of COVID-19

COVID-19 Working Paper: Distribution and Examination of Coronavirus Food Assistance Program Payments and Forgivable Paycheck Protection Program Loans at the State Level in 2020

Coronavirus Food Assistance Programs

The Coronavirus Food Assistance Program (CFAP) provided direct payments to producers who faced market disruptions, increased production costs, and reduced farm-level prices. USDA developed and implemented two rounds of funding for CFAP (CFAP 1 and CFAP 2). As of August 13, 2023, both rounds totaled $31.3 billion ($11.8 billion from CFAP 1 and $19.5 billion from CFAP 2) in direct payments to farmers and ranchers.

The USDA website provides details and data about CFAP programs, including current levels of payments under CFAP1 and CFAP2 by commodity and State.

For information on producers with unpriced inventory and eligible to receive a CFAP1 payment, see:

COVID-19 Working Paper: Unpriced Commodity Inventory and COVID-19 Pandemic Assistance

USDA Pandemic Assistance to Producers

On March 24, 2021, USDA announced the USDA Pandemic Assistance to Producers, a new initiative to provide financial assistance to producers who felt the effects of COVID-19 market disruptions. USDA dedicated at least $6 billion to this initiative that aimed to reach a broader set of producers than in previous COVID-19 relief programs. USDA has made additional payments to producers under existing Coronavirus Food Assistance programs and rolled out new programs under the initiative. More information about USDA Pandemic Assistance to the sector, including direct payments to producers, is on the farmers.gov website.

Although much of the assistance was paid directly to farmers, the initiative included some provisions not targeted for farm operations for research, training, and outreach. In the USDA, Economic Research Service farm income statistics, only direct, financial assistance to agricultural producers is included as income.

Pandemic Assistance Revenue Program

On January 9, 2023, USDA announced the Pandemic Assistance Revenue Program (PARP), to assist eligible producers of agricultural commodities who experienced revenue decreases in calendar year 2020 compared to 2018 or 2019 due to the COVID-19 pandemic. PARP was designed to help address gaps in previous pandemic assistance, which was targeted at price loss, additional marketing costs, and/or lack of market access, rather than overall revenue losses. PARP provides financial assistance for producers who suffered at least a 15-percent decrease in allowable gross revenue for the 2020 calendar year, as compared to 2018 or 2019. More information about PARP is at the farmers.gov website.

Paycheck Protection Program

The Paycheck Protection Program (PPP), implemented by the Small Business Administration (SBA), was intended to help small businesses—including farm operations—keep employees on the payroll and/or bring back furloughed or laid-off workers. Businesses with either positive employee payroll costs or positive income were eligible to receive forgivable PPP loans. The loans that met the forgiveness requirements, including using 60 percent of the loan on payroll expenses, were fully forgiven.

As of January 2023, PPP loans to the farm sector that were forgiven totaled more than $5.9 billion in calendar year 2020 and almost $8.6 billion in 2021. The USDA, Agricultural Resource Management Survey data for 2019 indicated that 72 percent of all family farm operations would have been eligible to receive a PPP loan.

More information about the PPP loans, including payments by industry classification, lender, size, and State is on the SBA website.

The Chart of Note, COVID-19 Federal financial assistance to U.S. farms varied by State, provides total aid from CFAP and PPP by State in 2020.

Further information may also be found in the Amber Waves findings:

- U.S. Agriculture Sector Received an Estimated $35 Billion in COVID-19-Related Assistance in 2020

- U.S. Farm Producers Received Almost $6 Billion From the Paycheck Protection Program in 2020

COVID-19 Related Assistance for Family Farm Households

Farm households may be affected by the pandemic through loss of wages and benefits from off-farm jobs or off-farm businesses that supplement income from farming. Family farm households could receive Federal COVID-19-related financial assistance from Economic Impact Payments and Federal Pandemic Unemployment Compensation.

Economic Impact Payments

Economic Impact Payments (EIP) were meant to provide households with an immediate injection of cash to spur demand and mitigate the economic downturn. The full EIP amount in calendar year 2020 was $1,200 for individuals or $2,400 for couples filing jointly; households with dependents received an additional $500 per dependent. The USDA, Economic Research Service (ERS) estimated the amount of these payments using 2020 Agricultural Resource Management Survey data. These estimates indicated the median married and single farm household would have received an EIP equivalent to about a one-third of their average monthly income.

Federal Pandemic Unemployment Compensation

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided assistance through Federal Pandemic Unemployment Compensation (FPUC) to those who were unemployed in 2020 due to the pandemic. These FPUC benefits were in addition to existing State unemployment benefits and were available to anyone who qualified for at least $1 of unemployment benefits. Farm households were eligible and those that applied received FPUC following a pandemic-related job loss or furlough.

Farm Household Income and the Pandemic

The USDA Economic Research Service (ERS) releases calendar year farm household income and wealth three times per year. The latest estimates through 2022 and forecasts for 2023 were released on November 30, 2023, and they reflect the observed effects of the pandemic. To learn more, see the Farm Household Well-being topic page.

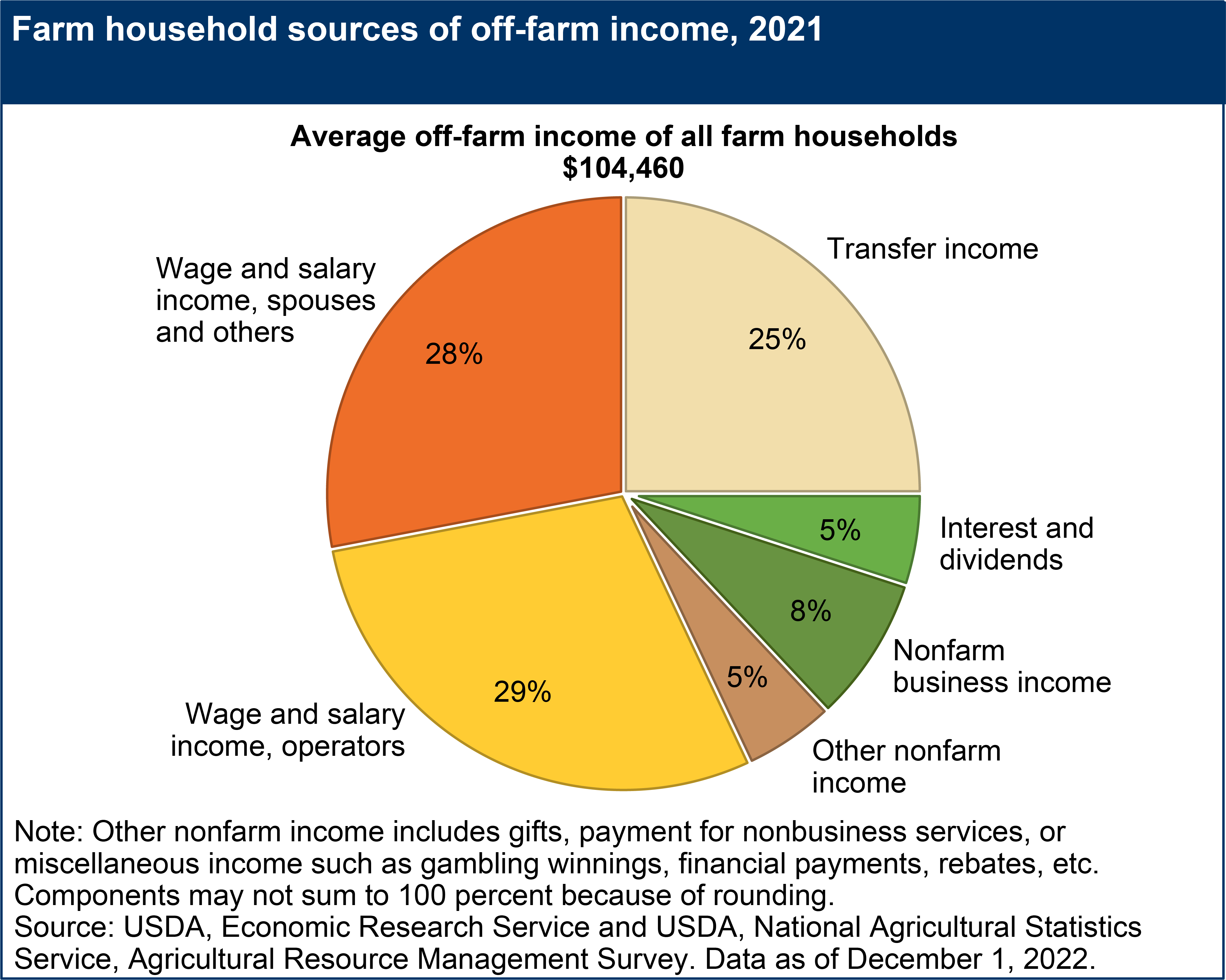

For households that operate a farm, total household income is a combination of income earned from the farm and off-farm sources. Off-farm income sources vary by household. In 2021, the majority (57 percent) came from the wages and salaries of operators and other household members (down from 59 percent in 2020). The remainder came from:

- transfer income (25 percent, up from 23 percent in 2020),

- non-farm business income (8 percent, up from 7 percent in 2020),

- interest and dividend income (5 percent, down from 6 percent in 2020), and

- other sources of income (5 percent, unchanged from 2020).

Of these, the loss of wages and salaries earned off the farm are most likely to result in a decline in household income because of COVID-19.

Download chart image | Chart data

Other information:

- Share of off-farm income varies by commodity specialization

- Principal operator, spouse or both worked off the farm in half of U.S. family farm households in 2019

- Principal farm operators often worked both on and off the farm in 2019

- U.S. Agriculture Labor Expenses Forecast To Increase More Than 4 Percent in 2023

Other Research

- COVID-19 Working Paper: Distribution and Examination of Coronavirus Food Assistance Program Payments and Forgivable Paycheck Protection Program Loans at the State Level in 2020

- COVID-19 Working Paper: Farm Sector Financial Ratios: Pre-COVID Forecasts and Pandemic Performance for 2020

- Health Care Access Among Self-Employed Workers in Nonmetropolitan Counties

- COVID-19 Working Paper: Financial Assistance for Farm Operations and Farm Households in the Face of COVID-19

- COVID-19 Working Paper: A Timely Tool for Evaluating Financial Conditions in Agriculture: USDA Forecasts of the Value of Production in the Face of COVID-19

- Financial Conditions in the U.S. Agricultural Sector: Historical Comparisons

- Family Farm Households Reap Benefits in Working Off the Farm

- Larger Farms and Younger Farmers Are More Vulnerable to Financial Stress

Data Resources

- ARMS Farm Financial and Crop Production Practices

- Farm Household Income and Characteristics

- Farm Income and Wealth Statistics