Crop Insurance: Title XI

Provides insurance products through the Federal Crop Insurance Program (FCIP) to indemnify producers against losses in yield, crop revenue, margin, whole farm revenue, and other types of losses. FCIP is administered by the Federal Crop Insurance Corporation (FCIC). Under FCIP, private-sector insurance companies sell and service the policies, while USDA’s Risk Management Agency (RMA) approves the premium rates, administers premium and expense subsidies, approves and supports products, manages FCIC, and reinsures the companies. RMA also develops new crop insurance policy offerings, which may occur in collaboration with private-sector insurance companies.

FCIP is permanently authorized under the Agricultural Adjustment Act of 1938 (7 U.S.C. 1281) and the Federal Crop Insurance Act of 1980 (7 U.S.C. 1505). The Agriculture Improvement Act (Farm Act) of 2018 modifies specific provisions in the authorizing legislation to update product offerings, direct action to develop new products, and to make changes in how FCIP is administered.

Highlights

- Continues the trend of emphasizing support for farm risk management and expanding coverage within FCIP established in the 2014 Farm Act.

- Keeps programs from the crop insurance title of the 2014 Farm Act in effect, with no repeals of older programs and no introduction of new programs.

- Introduces limited changes to existing FCIP products and policies.

New Programs and Provisions

The 2018 Farm Act introduces no new programs under the crop insurance title. However, the new Farm Act emphasizes expanding coverage for existing and new product offerings for priority crops, including, but not limited to:

- irrigated grain sorghum,

- irrigated rice production,

- citrus crops, and

- hops.

The Act also requires the FCIC to conduct research and development on:

- the effectiveness of whole farm revenue insurance plans;

- policies to insure crops from losses due to tropical storms or hurricanes;

- differences in rates, yields, and coverage levels of grain sorghum policies vis-à-vis other feed grains within the same county;

- policies to insure greenhouse production;

- policies to insure local foods;

- establishing insurance for subsurface and limited irrigation practices;

- policies to insure commodity crop production on batture lands (i.e., active floodplains adjacent to levees along the Mississippi River); and

- alternative methods of adjusting for quality losses that do not impact the actual production history (APH) of producers.

Several provisions in the 2018 Farm Act modify the terms of existing FCIP product offerings used by farmers and ranchers, including provisions to:

- Allow for enterprise units to include acres in one or more counties. Previously, enterprise units were restricted to acreage within a single county. RMA developed the Multi-County Enterprise Unit (MCEU), which is available for crops with a November 30, 2018, and later contract change date for barley, wheat, corn, grain sorghum, soybeans, cotton, peanuts, rice, canola, and sunflowers. This policy allows producers to combine acreage of an insured crop in two contiguous counties by irrigation practice if the acreage in one county qualifies for enterprise unit coverage while the acreage in the second does not.

- Expand coverage for forage and grazing by allowing for separate insurance policies on acreage that will be both grazed and mechanically harvested within the same growing season. For example, producers will be able to purchase an Annual Forage policy for winter wheat for grazing prior to its dormancy and also purchase yield or revenue coverage for the harvested grain. Producers may purchase separate policies for each intended use, and indemnities paid under those policies will be considered as separate losses. Also, FCIC is allowed to offer catastrophic coverage (Catastrophic Risk Protection Endorsement, or CAT) for crops and grasses used for grazing.

- Increase the fee for CAT policies from $300 per crop per county to $655 per crop per county.

- Add industrial hemp to the list of insurable commodities.

- Expand the Sodsaver program requirements by applying the penalties to native sod acreage tilled for the production of any insurable crop. Previously, the Sodsaver program penalties applied only to native sod tilled for production of an insurable annual crop (for example, the previous language included the possibility of a producer avoiding these penalties by planting a perennial crop). The penalties can be imposed up to four cumulative years over the time window when penalties are applicable. Penalties apply for acreage in Minnesota, Iowa, North Dakota, South Dakota, Montana, and Nebraska.

- Includes a new section on Cover Crops Under Good Farming Practices Determination Review:

- Establishes a new definition of cover crop termination to mean a practice that historically and under reasonable circumstances results in the termination of growth of the cover crop.

- Deems voluntary cover crops as a good farming practice if the cover crop is terminated within the guidelines established by the Secretary or an exception to the guidelines recommended by USDA’s Natural Resources Conservation Service or an agricultural expert as determined by the FCIC.

- Allows for the planting of cover crops on summer fallow acres when termination guidelines are followed. These provisions protect the insurability of the subsequent crop planted.

The new Farm Act also includes some changes to the partnerships for research and development of new crop insurance products and to the administration and operation of the crop insurance program, including provisions to redefine the term “beginning farmer or rancher” for the purposes of research, development, and implementation of whole-farm insurance policies. The new definition includes individuals who have actively operated and managed a farm or ranch for less than 10 years. Prior to the 2018 Farm Act, the definition of “beginning farmer or rancher” was limited to individuals with no more than 5 years of experience actively operating and managing a farm or ranch. Under this new definition, individuals who are newly eligible to qualify as a “beginning farmer or rancher” for the purpose of whole-farm insurance policies can receive an additional 10 percentage points of premium subsidy on their Whole Farm Revenue Policies.

Economic Implications

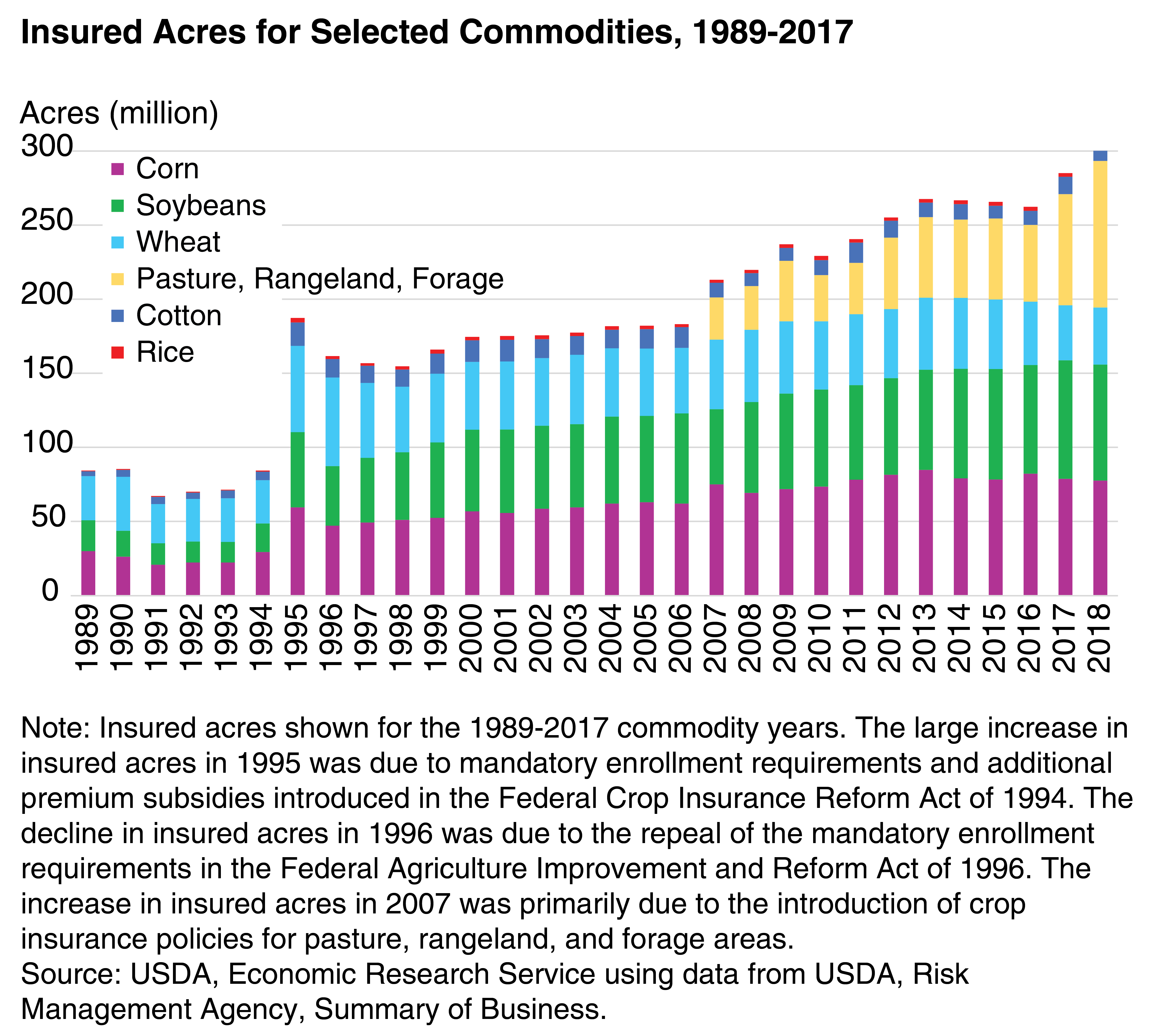

- Since 2007, the largest growth in insured acres has been due to the introduction of coverage for pasture, rangeland, and forage areas (see fig. 1). The 2018 Farm Act introduces a catastrophic coverage option for these policies, which could further increase the total acres insured for pasture, rangeland, and forage areas. Catastrophic coverage policies are fully subsidized (requiring only an administrative fee), while additional coverage options are only partially subsidized. Because catastrophic coverage is less expensive for producers and ranchers to purchase than other options, these lower cost policies may induce additional participation in FCIP. However, RMA reassessed the county base premium rates that are used to calculate the economic value of losses for pasture, rangeland, and forage policies and lowered those rates in 2018 for the 2019 crop year. The resulting lower value of expected losses in 2019 compared to previous years may reduce the demand for pasture, rangeland, and forage area policies.

- The 2018 Farm Act increases the administrative fee charged to producers who purchase CAT policies from $300 per crop per county to $655 per crop per county, a 118-percent fee increase. CAT coverage is used to insure a variety of crops, including commodity crops, specialty crops, tree crops, nursery production, and aquaculture production. This fee increase could lead producers to purchase fewer CAT policies. It could also lead producers to switch some of their riskier acreage to additional coverage (or buy-up) policies as the price gap between CAT and higher coverage levels decreases. Previous increases in the administrative fees for CAT coverage occurred at the same time as other new policies were introduced to induce producers to purchase additional coverage (e.g., increased premium subsidies, introduction of enterprise units), which makes it difficult to infer the exact effect of increased administrative fees on FCIP participation. However, the long-term trend has been a decreasing share of acres insured under CAT policies, decreases in CAT’s share of all policies sold, and a decreasing share of CAT policies paying indemnities (see table 1).

| Period | Administrative fee for CAT coverage (Dollars) | Average share of acres insured under CAT coverage (Percent) | Average share of policies sold covered by CAT (Percent) | Average share of CAT policies paying indemnities (Percent) |

|---|---|---|---|---|

| 1995-1997 | 50 | 43.5 | 45.7 | 5.7 |

| 1998-2000 | 60 | 28.1 | 27.6 | 5.7 |

| 2001-07 | 100 | 14.4 | 13.9 | 4.9 |

| 2008-17 | 300 | 6.4 | 6.8 | 4.4 |

| 2018-on | 655 | -- | -- | -- |

| Source: USDA, Economic Research Service using data from USDA, Risk Management Agency, Summary of Business. | ||||

- The 2018 Farm Act allows for enterprise units to include acres in one or more counties within a State, and RMA has introduced the Multi-County Enterprise Unit, making this available for producers with the 2019 crop year. Combining acres across larger geographic scales reduces the yield risk for the insured units as the impact of weather on yields diminishes over larger geographic areas. Insuring enterprise units that include acres in multiple counties as opposed to units involving smaller geographic areas is expected to reduce the expected yield and revenue losses for the insured acreage, which could result in lower indemnities, and consequently, lower insurance premium costs to producers and lower subsidy expenditures for the Government.

- The Agriculture Improvement Act of 2018 includes industrial hemp on the list of insurable commodities. However, including industrial hemp as an insurable commodity is likely to have modest near-term impacts on FCIP insured acres and liabilities given the limited extent of industrial hemp production in the United States.