ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Monday, October 4, 2021

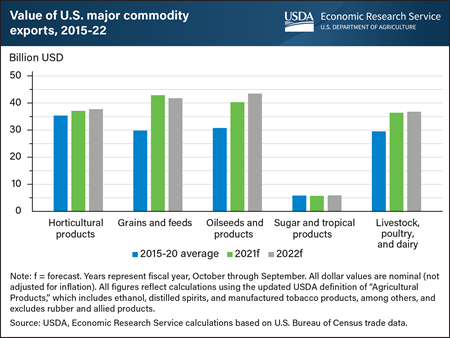

USDA, Economic Research Service (ERS) projects the total value of U.S. agricultural exports to reach an all-time high in fiscal year (FY) 2022 (October–September). Higher shipments of major categories of commodities including grains and feeds, oilseeds and products, and livestock, poultry, and dairy products are primarily driving the increase in value. Total U.S. agricultural export values are projected to reach $177.5 billion in FY 2022, up from their previous high of $173.5 billion in FY 2021. Grains and feeds export values are projected up from their 5-year average, reflecting higher international demand for corn, wheat, and feeds. Oilseeds and products are projected to reach a record $43.5 billion in FY 2022. International demand for soybeans coupled with higher prices is projected to drive export values to a record high for FY 2021 before increasing further in FY 2022. Soybean meal exports also are projected to reach record value. Livestock, poultry, and dairy exports, which have averaged $29.5 billion from 2015 to 2020, are forecast to rise to $36.8 billion in FY 2022. This projected increase is led by a rise in export value for all product groups except pork, with especially strong exports in beef and dairy. Higher prices and higher traded volumes for many commodities along with the reconciliation of trade disputes all contribute to the growth in export value. This chart is drawn from data in ERS’s Outlook for U.S. Agricultural Trade, August 26, 2021, and reflects USDA’s new definition of “Agricultural Products,” which includes ethanol, distilled spirits, and manufactured tobacco products and excludes rubber and allied products.

Friday, September 17, 2021

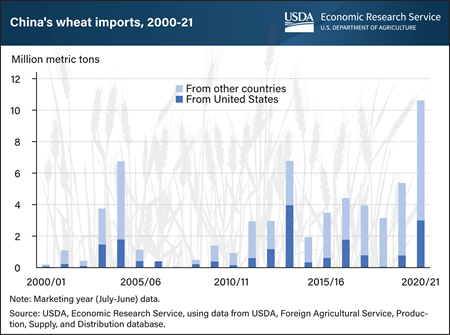

China is the world’s largest consumer of wheat, accounting for 19 percent of global wheat consumption in marketing year 2020/21 (July–June), more than four times the U.S. share. China also became a leading importer during 2020/21, with purchases estimated at 10.6 million metric tons, China’s highest import total since the 1990s. USDA forecasts China’s 2021/22 imports at 10 million metric tons. Before the 2010/11 marketing year, China’s wheat imports typically totaled 1 million metric tons or less. More recently, wheat imports totaled 3 to 5 million metric tons most years between marketing years 2011/12 to 2019/20. The surge in imports in 2020/21 can be attributed to China’s strong demand for wheat use in animal feed, replenishment of the Chinese Government reserves with high-quality wheat, and efforts to meet import commitments in the U.S.-China Phase One trade agreement. According to China’s customs data, the United States supplied 3 million metric tons of 2020/21 wheat imports—approximately a 28-percent share. This chart first appeared in the USDA, Economic Research Service (ERS) report, Potential Wheat Demand in China: Applicants for Import Quota, August 2021, and includes updated data from ERS’ Wheat Data product.

Friday, July 23, 2021

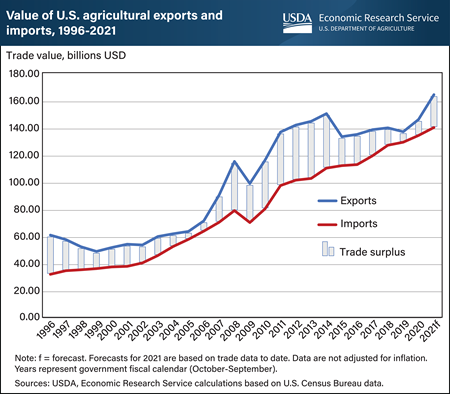

After reaching a 5-year high in 2020, the value of U.S. agricultural exports is forecast to reach an all-time high in fiscal year (FY) 2021, which ends September 30. Led by strong shipments of corn and soybeans, as well as livestock, poultry, and dairy products, total export values are projected to reach $164.0 billion. Based on trade data to date and expectations for reduced competition from Brazil, which has intensified already strong demand, U.S. corn exports are forecast to reach record levels totaling $17.2 billion in FY 2021. Likewise, expectations for continued robust export demand of U.S. soybeans in FY 2021, mainly from China, support a record-high export value of $28.9 billion. Since 1996, U.S. agricultural exports have nearly tripled because of a range of factors, including China’s joining the World Trade Organization in 2001 and the advent of the North American Free Trade Agreement in the mid-1990s (succeeded by the United States–Mexico–Canada Agreement). Like exports, in FY 2021, imports are projected to reach an all-time high, largely driven by observations of surging imports to date of fresh and processed fruits and vegetables, as well as alcoholic beverages. This chart is drawn from data in USDA, Economic Research Service’s Outlook for U.S. Agricultural Trade, May 26, 2021.

Wednesday, June 16, 2021

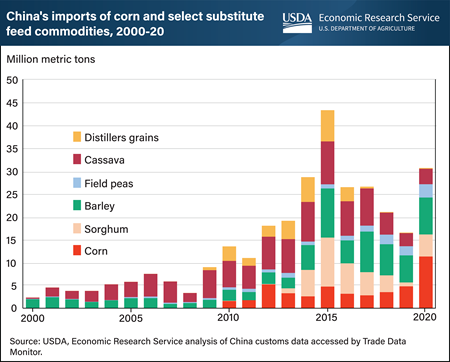

China’s corn imports jumped to a record 11.3 million metric tons in 2020, more than twice the volume imported in past years. The increase reflected rapidly increasing Chinese corn prices and China’s commitment to buy U.S. agricultural products under the Phase One trade agreement between China and the United States. Corn is the predominant ingredient in China’s growing animal feed production and is widely used in other food, starch, and alcohol products. In past years, a cumbersome import quota made it difficult for Chinese feed mills and processors to import corn, so they often imported substitutes such as sorghum, barley, distillers’ grains, cassava, and field peas that have low prices and no quotas. Imports of all feed ingredients were relatively low during 2019 because of high tariffs on U.S. commodities and a lull in feed demand due to a disease epidemic that reduced China’s swine herd. In 2020, imports of corn and its substitutes increased to a combined total of more than 30 million metric tons. Large purchases by Chinese state-owned companies and a rapid increase in Chinese corn prices appear to have driven the increase in corn imports—which exceeded the quota for the first time. Rebuilding of the swine herd and waivers of retaliatory tariffs on U.S. sorghum may have contributed to the increase in imports of substitutes. However, imports of U.S. distillers’ grains were still constrained by high duties imposed by a 2016 Chinese anti-dumping investigation. This chart appeared in the USDA, Economic Research Service’s Feed Outlook, May 2021.

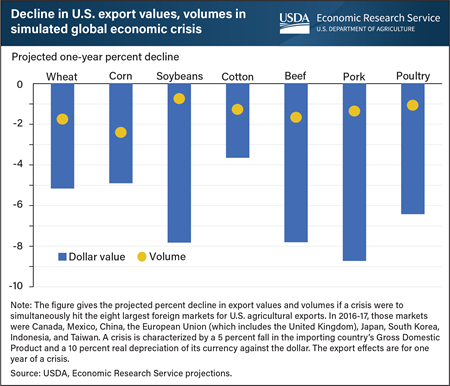

Tuesday, May 4, 2021

The United States is a major exporter of agricultural products, with about 20 percent of its farm output sold abroad. Economic crises in foreign markets typically reduce U.S. export sales. Economic crises decrease countries’ Gross Domestic Product (GDP) and consumer demand, including demand for imported agricultural goods. Crises also often weaken, or depreciate, countries’ currency against the U.S. dollar, which lowers their imports by making foreign products more expensive compared with domestically produced substitutes. To examine how a worldwide economic crisis might affect U.S. agricultural exports, researchers at USDA’s Economic Research Service (ERS) simulated a hypothetical economic crisis in the eight largest U.S. foreign agricultural markets. The exercise indicated that the value of U.S. exports of the seven commodities given in the chart could decline in the year of an economic crisis by $4 billion, an export drop of 6.6 percent (using average 2017-19 export volumes as the base). Model results show the value of U.S. exports of soybeans, beef, and pork falling by around 8 percent, and exports of wheat and corn by about 5 percent. The export value for a good equals its export volume multiplied by the trade price. Export values in the ERS exercise drop by a greater percentage than export volumes because the global economic crisis substantially decreases world demand, and thereby lowers prices, for traded agricultural products. The results of this exercise can provide insight into how the current world economic crisis caused by Coronavirus COVID-19 is affecting U.S. agricultural exports. This chart appears in the Economic Research Report Economic Crises and U.S. Agricultural Exports, released in April 2021.

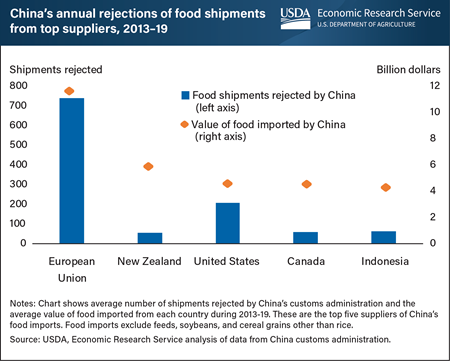

Friday, April 9, 2021

China’s inspectors destroy or turn away almost 3,000 foreign food shipments annually for reasons such as lacking proper documentation, failing to meet labeling requirements, or having obvious damage or sanitation problems. Research conducted by USDA’s Economic Research Service shows China is more likely to reject consumer-ready packaged items such as baking products, snacks, health food, wine, and other beverages. These consumer-oriented items comprise a relatively large share of food imports from the European Union (EU) and United States, the two countries with the largest average annual number of rejections. China rejected an average of 207 U.S. food shipments annually during 2013–19, far fewer than the 740 European Union (EU) shipments refused annually. The large number of EU rejections is consistent with its status as leading supplier of China’s food imports with an average of $11.6 billion annually. The United States was the third-leading supplier, with an average of $4.6 billion (excluding soybeans, feeds and other agricultural items not used directly as food). However, the average annual number of rejected shipments (fewer than 60) from New Zealand, Canada, and Indonesia was low compared with the value of China’s imports from those countries. A factor influencing the number of China’s rejections is the mix of food products China imports from the EU and the United States. Consumer-ready products such as those from the EU and the United States tend to be rejected with higher frequency than products shipped in bulk such as powdered milk, canola, fresh fruit, and vegetable oil that China imports from other major food-supplying countries. This chart is drawn from the USDA, Economic Research Service report, China’s Refusal of Food Imports, March 2021.

Monday, January 11, 2021

Dairy consumption is on the rise in Southeast Asia, a region characterized by rapid economic growth, urbanization, and changing food consumption patterns. To meet rising demand, many dairy products must be imported because the region’s climate limits its ability to produce milk. The value of imported dairy products in Southeast Asia grew from $3.8 billion in 2006 (adjusted for inflation) to $6.3 billion in 2018. Dairy products imported from the United States grew from $401 million to $738 million over that time, and dairy imports from most other trading partners rose as well. Imports from Australia, however, declined after years of drought resulted in lower milk yields and smaller dairy herds, and the United States overtook Australia in rank, rising from the fourth to the third largest dairy import supplier for the region. Southeast Asian countries also import dairy products from their regional neighbors and the rest of the world. The top dairy products imported by Southeast Asian nations are skim milk powder, whole milk powder, infant formula, butterfat products, cheese, and whey products. The United States is a major supplier of skim milk powder, whey products, cheese, and lactose to the region. This chart was drawn from the Economic Research Service report, Prospects for Growth in U.S. Dairy Exports to Southeast Asia.

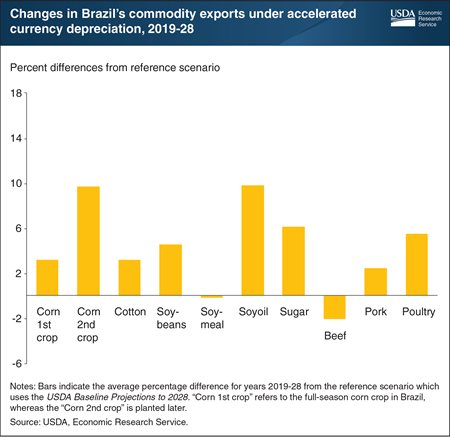

Wednesday, October 14, 2020

Brazil has emerged as a major competitor for the United States in global agricultural markets, and is now the world’s third largest exporter of agricultural products behind the European Union (EU) and the United States. Brazil’s macroeconomic policies—currency devaluation, in particular—have played an important role in its position as one of the top exporters of agricultural products, including soybeans, corn, cotton, sugar, coffee, orange juice, and meat. Because exported Brazilian commodities are priced in dollars, depreciation of Brazil’s local currency, the real (BRL), has meant that Brazilian farmers have received more BRL for each dollar of export revenues. Export sales therefore have become more profitable, thus encouraging expansion of cropland and adoption of techniques to increase productivity. Brazilian agricultural production and exports, which are poised to continue flourishing over the next decade, according to the USDA Agricultural Projections to 2029 report, could grow even faster under accelerated currency depreciation. Simulations show that if the BRL weakens more than previously expected, exports of major commodities could be an aggregate 5.6 percent greater than previously projected, with Brazil’s exports increasing for each major commodity except beef and soybean meal. This chart is drawn from Economic Research Service (ERS) report, Brazil’s Agricultural Competitiveness: Recent Growth and Future Impacts Under Currency Depreciation and Changing Macroeconomic Conditions, and was highlighted in the ERS October issue of Amber Waves, in the feature article, “Brazil’s Currency Depreciation and Changing Macroeconomic Conditions Determine Agricultural Competitiveness and Future Growth.”

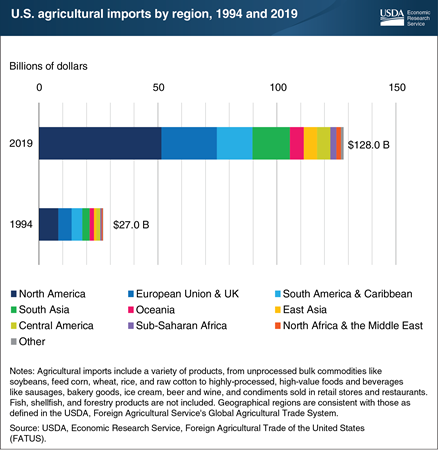

Monday, August 31, 2020

Errata: On September 4, 2020, this chart was reposted to correct a unit error in the y-axis label.

Over the last quarter century, the United States has become one of the largest agricultural importers in the world. During this time, imports have grown significantly from $27 billion in 1994 to $128 billion in 2019. The role of the North American Free Trade Agreement (NAFTA) in 1994—superseded by the United States-Mexico-Canada Agreement (USMCA) in July 2020—has played a central role in this surge, with U.S. imports from the North American region increasing more than six-fold from $8.2 billion in 1994 to $52 billion in 2019. The volume of imports from all regions has risen across all commodities, but consumer-oriented products, such as fresh fruits and vegetables, beef products, and wine and beer products have led the increase. Even as overall imports have grown, imports from Europe, as well as South America and the Caribbean, have dipped, reflecting the decreasing share of berries and other fruits provided by these countries, as well as additional sources of alcoholic beverages imported from USMCA trading partners. These charts are drawn from the Economic Research Service product, U.S. Agricultural Trade at a Glance.

Wednesday, July 29, 2020

The United States is the world’s second largest agricultural trader after the European Union. U.S. agricultural exports have grown significantly over the last quarter century, from $46.1 billion in 1994 to $136.7 billion in 2019. The elimination of agricultural trade barriers as a result of the 1994 North American Free Trade Agreement (NAFTA)—superseded by the United States-Mexico-Canada Agreement (USMCA) in July 2020—nearly quadrupled exports (by value) to Canada and Mexico. Coinciding with policy developments, rising household incomes and changing trade policies in developing East and Southeast Asia have driven export growth, especially for China, whose share of U.S. agricultural exports more than quadrupled from 3 percent during 1994-2000 to 14 percent during 2010-19. Meanwhile, there has been a sharp decline in the share going to Europe and high-income East Asia, particularly Japan. These charts are drawn from the Economic Research Service product, U.S. Agricultural Trade at a Glance.

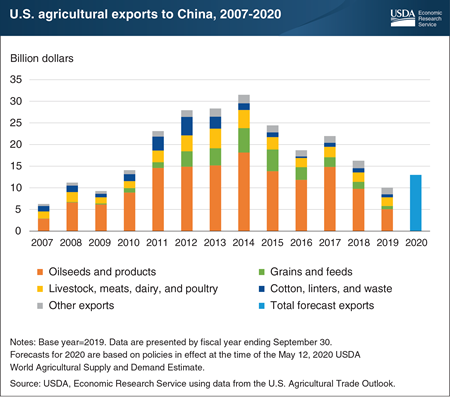

Friday, July 17, 2020

U.S. agricultural exports to China are projected to total $13.0 billion in fiscal year (FY) 2020, up from $10.1 billion in FY 2019. This rise in expected exports is primarily due to growth in Chinese purchases of U.S. soybeans and pork with expected additional purchases of sorghum and cotton also playing a role. This growth, much of which is expected as a result of relaxed barriers in the U.S.-China trade partnership, is projected to prevail in FY 2020 even considering the fiscal strains brought on by COVID-19. Portions of China’s economy are anticipated to continue growing while its economy as a whole is still being negatively affected by the global slowdown, especially with respect to international trade. Even amidst the negative economic effects of COVID-19 on China’s consumption of U.S. agricultural goods, China’s purchases of U.S. pork, soybeans, cotton, and other products rose in the first half of FY 2020. At this pace, U.S. exports to China are expected to increase by $2.9 billion from FY 2019, when the value of U.S. exports to China had fallen to $9.3 billion (in 2019 dollars)—its lowest point since FY 2009. This chart was drawn from the Economic Research Service’s most recent Outlook for U.S. Agricultural Trade, published in May 2020.

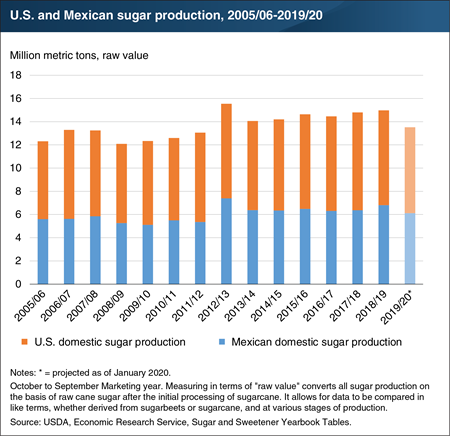

Monday, March 9, 2020

Sugar production in the United States and globally is dependent upon two crops: sugarbeets, grown in higher, typically colder latitudes; and sugarcane, which grows in lower, typically more tropical latitudes. Poor weather conditions have diminished the production outlook for both the U.S. sugarbeet crop—particularly in North Dakota, Minnesota, and Montana—and the sugarcane crop, especially in Louisiana. Sugar output is also expected to be significantly lower for 2019/20 in Mexico—the United States’ largest foreign sugar supplier—as drought conditions in several key sugarcane-producing regions are expected to reduce output considerably. The combined 2019/20 U.S. and Mexican sugar production is projected to be 9.7 percent below that in 2018/19, the lowest collective output since 2011/12. The reduced supply expectations are the main reason why the U.S. sugar market is forecast to be at its tightest since 2010/11, and why current U.S. wholesale refined sugar prices are 19 percent higher for cane sugar and 26 percent higher for beet sugar compared with a year ago. This chart is based on information in the Economic Research Service Sugar and Sweeteners Monthly Outlook Report and the Sugar and Sweetener Yearbook Tables.

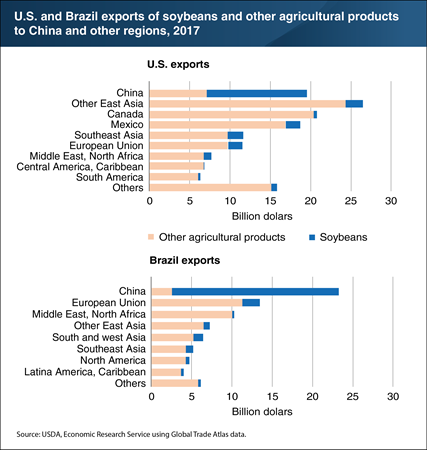

Thursday, July 25, 2019

China is the world’s largest importer of soybeans and represented 65 percent of global soybean imports in 2017. Soybeans are the most prominent agricultural commodity exported to China by both the United States and Brazil. During 2017, prior to the Chinese government’s implementation of tariffs on U.S. soybeans, exports of soybeans were valued at $12.3 billion and accounted for 63 percent of U.S. agricultural exports to China. Conversely, soybeans accounted for less than 20 percent of U.S. agricultural exports to other regions. For example, U.S. soybean exports to Southeast Asia—the second-largest destination—were valued at $1.95 billion but accounted for 17 percent of agricultural exports to that region. The share of soybeans in U.S. agricultural exports was 14 percent for the European Union, 10 percent for the Middle East and North Africa, and 7 percent for other East Asian countries. The share of soybeans in Brazil’s agricultural exports to China was larger. During 2017, $20.3 billion of soybean exports accounted for nearly 88 percent of Brazil’s agricultural exports to China. Soybeans accounted for 14 percent of Brazil’s agricultural exports to the European Union—the second largest destination for Brazil’s soybeans. This chart appears in the ERS report, “Interdependence of China, United States, and Brazil in Soybean Trade,” released in June 2019.

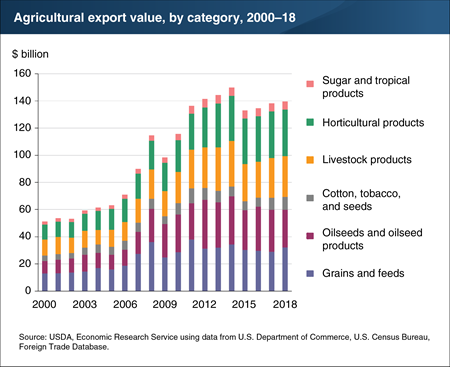

Monday, May 13, 2019

The value of U.S. agricultural exports increased slightly in 2018, driven by gains in all major commodity groups except oilseeds and oilseed products. Overall, U.S. agricultural exports were valued at $139.6 billion. Total growth was limited by an 11 percent decline in oilseed and oilseed product exports in 2018 compared to 2017. The decline in oilseed and oilseed product exports appears to be linked to soybean import tariffs imposed by China for U.S.-sourced soybeans as part of broader U.S.-China trade disputes. With the 2018 decline, oilseed and oilseed product exports fell to the fourth largest export category after ranking second in 2016 and 2017. As a share of total export value in 2018, horticultural product exports represented the largest category with $34.2 billion—or 24 percent of total agricultural exports. Second to horticultural exports in total value was grains and feeds at $32.1 billion. Grains and feeds, which includes corn, had the largest year over year increase in export value at 11 percent. This chart appears in the Agricultural Trade section of the ERS data product, “Ag and Food Statistics: Charting the Essentials,” updated in April 2019.

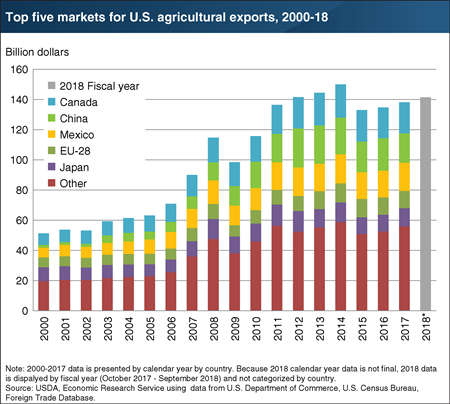

Friday, February 22, 2019

The United States exported $138 billion worth of agricultural goods in 2017. Since 2015, annual export value has increased each year, but is still down from a record of $150 billion in 2014. Although the United States exports agricultural goods to most countries worldwide, for the last 3 decades, close to 60 percent of the value of U.S. agricultural exports has gone to five major trading partners: Canada, China, Mexico, the European Union (EU-28), and Japan. In 2017, this pattern persisted, with 59 percent going to these five markets. The dominance of key U.S. markets occurs for a number of reasons. In the cases of Canada and Mexico, proximity to the United States plays a large role in their trade relationships, and regional trade agreements have further increased trade between the United States and these neighbors. In the cases of China, Japan, and the EU-28, the sheer size of the economies involved is the key factor determining trade shares: after the United States, the EU-28, China, and Japan have the highest gross domestic products, and each of these countries accounts for a significant share of global imports of agricultural goods. While 2018 calendar year data are not yet available, exports for fiscal year 2018 increased to $141.5 billion. This chart is drawn from data in the Foreign Agricultural Trade of the United States (FATUS) data product, updated in February 2019. See also Outlook for U.S. Agricultural Trade: November 2018.

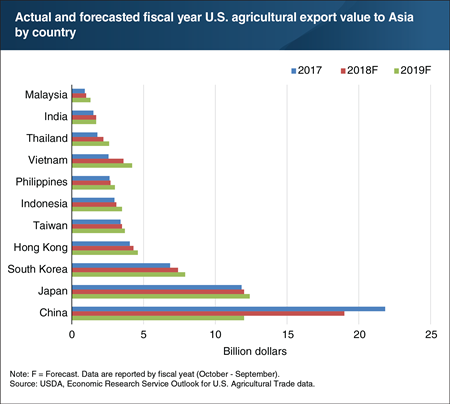

Wednesday, September 19, 2018

The latest quarterly USDA Outlook for Agricultural Trade provided its first agricultural export forecasts for fiscal 2019 (October 2018 – September 2019). Globally, U.S. agricultural exports are forecast to total $144.5 billion, a $500 million increase over the fiscal 2018 forecast. At the regional level, however, exports to Asian countries are forecast to decline by $3.2 billion—the result of an expected decrease of $7 billion in agricultural exports to China from the 2018 forecast of $19 billion. Chinese demand for U.S. soybeans is expected to be sharply lower because of China’s retaliatory tariffs, which also curb demand for other products, including sorghum, pork and products, and dairy products. The remaining Asian countries are all expected to increase their imports from the United States in fiscal 2019 by a collective total of $3.8 billion. The largest gains are anticipated in Southeast Asia as well as Hong Kong and South Korea. This chart is drawn from data discussed in the ERS Outlook for U.S. Agricultural Trade report, released in August 2018.

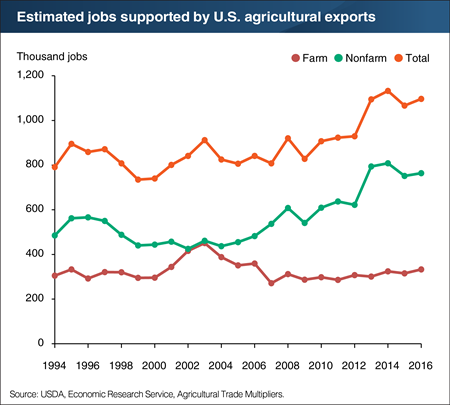

Monday, February 5, 2018

U.S. agricultural exports support output, employment, income, and purchasing power in the farm and nonfarm sectors. ERS estimates that every $1 billion of U.S. agricultural exports in 2016 required approximately 8,100 American jobs throughout the economy. At $134.7 billion in 2016, agricultural exports required 1,097,000 full-time civilian jobs. This included 764,000 nonfarm sector jobs. Starting around 2004, a divergence appeared between the estimated numbers of farm and nonfarm jobs, with the latter accounting for a rising share of total employment supported by agricultural exports. This growing importance of nonfarm jobs is consistent with the upward trend in the job numbers supported by non-bulk exports, which rely on a broader range of businesses (e.g. food processing, services, and other manufacturing) than bulk goods like soybeans, corn, and other feed grains. Non-bulk commodities account for the majority of U.S. agricultural exports and continue to support the majority of jobs dependent on agricultural exports. This chart appears in the ERS data product, Agricultural Trade Multipliers, updated in January 2018.

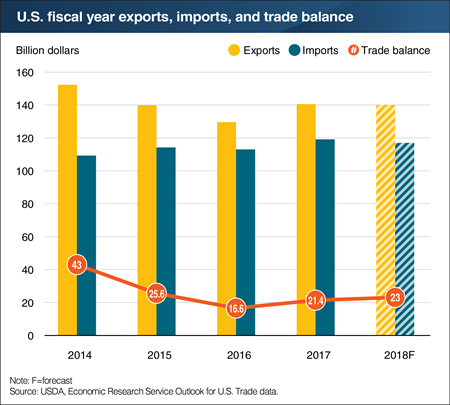

Friday, December 15, 2017

According to the latest USDA trade forecast, the 2018 fiscal year will look similar to 2017, but with a slightly higher trade balance (exports–imports) because of lower imports. Total agricultural exports are expected to value $140 billion dollars along with $117 billion dollars in imports. Taken together, the trade balance would reach a surplus of $23 billion compared with 2017, when the balance was near $22 billion. Both years mark a slight improvement over 2016 when exports and imports both fell, leaving a surplus of just $17 billion. Prior to 2015, the United States had a consistently higher trade balance, driven by lower total imports. This is largely due to appreciation of the U.S. dollar as the country’s economy recovered from the Great Recession. The 2018 forecast is driven by expectations of high demand for U.S. exports of corn and soybeans and their products. This chart is drawn from the Outlook for U.S. Agricultural Trade report, released in November 2017.

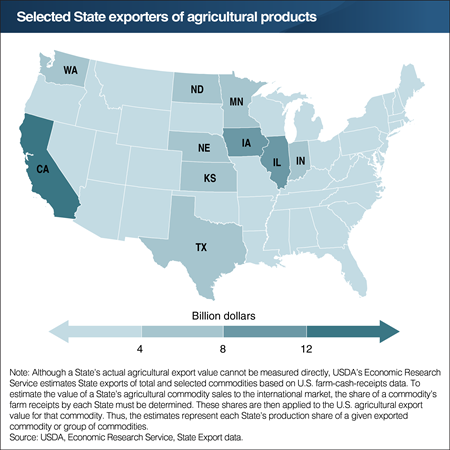

Thursday, November 9, 2017

In October, ERS released its annual update of the State Export Data product, which estimates a State’s agricultural export value for selected commodities and its total export value. Tracking agricultural export products back to their original source of production can be complicated, since U.S. Customs and Border Protection does not collect data on agricultural exports by State. To resolve this, ERS estimates State export values using each State’s share of farm cash receipts for a given commodity. In 2016, California remained the leading State for agricultural exports, totaling over 12 billion dollars in value. The majority of California’s exports come in the form of tree nuts (like almonds), fruits, and vegetables. California’s key commodities are in contrast to other leading States like Iowa, Illinois, and Minnesota, where the majority of export value comes from grains and oilseeds, like corn and soybeans, along with animal products like pork. Total U.S. agricultural export value in 2016 was $134 billion with the selected States representing 58 percent. This chart is drawn from the ERS State Export Data product, updated in October 2017.

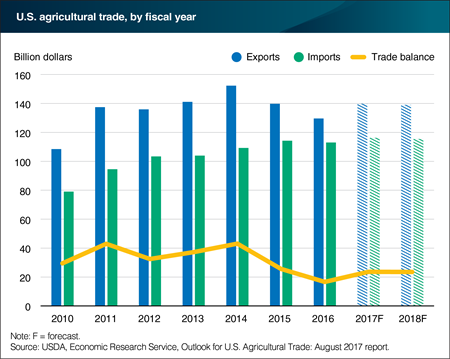

Tuesday, September 12, 2017

The value of U.S. agricultural exports is forecast at $139.8 billion for fiscal year (FY) 2017, up $10.2 billion from FY 2016, and following 2 consecutive years of declining export values. The increase reflects improvement in the global economy, a lower value for the U.S. dollar, and stronger markets for several individual commodities including grains, feed, and soybeans. The initial FY 2018 forecast shows that exports reach $139 billion, still above FY 2016 levels but slightly below current FY 2017 estimates. The value of FY 2017 agricultural imports is forecast at $116.2 billion, up $3.2 billion from last year and the highest level on record. However, the initial FY 2018 forecast reveals a $700 million decline for agricultural imports. The strong export increase and modest import increase for FY 2017 indicates that the agricultural trade surplus will rise to $23.6 billion, up $7 billion from FY 2016. Agricultural trade surplus is expected to remain virtually unchanged in FY 2018 due to the nearly identical declines in the value of exports and imports currently expected. This chart is from ERS’s Outlook for U.S. Agricultural Trade: August 2017.