Market Outlook

See the latest Livestock, Dairy, and Poultry Outlook report.

Summary

Beef/Cattle: A temporal shift of cattle slaughter from early to late 2024, as well as higher expected fed cattle weights, helped boost the beef production forecast by 130 million pounds to 26.455 billion pounds, though still down 2 percent from last year. Fed cattle prices are raised about $2 from last month to $185.00, about 5 percent above prices in 2023. U.S. beef exports in February were 244 million pounds, almost 3 percent above same-period shipments last year and higher than expectations. This prompted a 20-million-pound increase of the first-quarter export forecast to 740 million pounds, 5 percent less than a year ago. The beef import forecast is unchanged from last month.

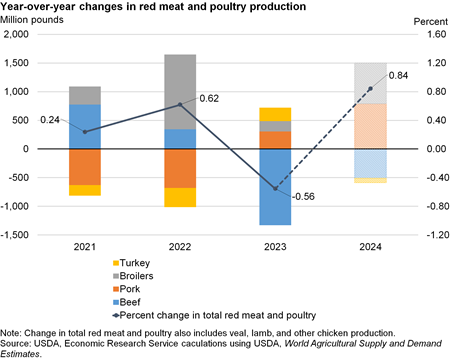

Total Red Meat and Poultry Production Projected To Grow Again in 2024 After Last Year’s Decline

Total red meat and poultry production is forecast to increase 0.84 percent in 2024. This follows a year of decreased production in 2023, the first since 2014. Increased production of pork, broilers, and turkey in 2023 were all offset by a large decline in beef production. Looking to 2024, beef production is again forecast to fall due to tightening cattle supplies, with turkey production expected to be slightly lower as well. However, these decreases are anticipated to be more than offset by higher pork and broiler production, raising total red meat and poultry production by nearly 1 percent.

Download chart data in Excel format.