Wholesale Beef Costs Rose as Cattle Prices Dropped During Supply-Chain Disruptions in 2020

- by Kate Vaiknoras and William Hahn

- 5/2/2022

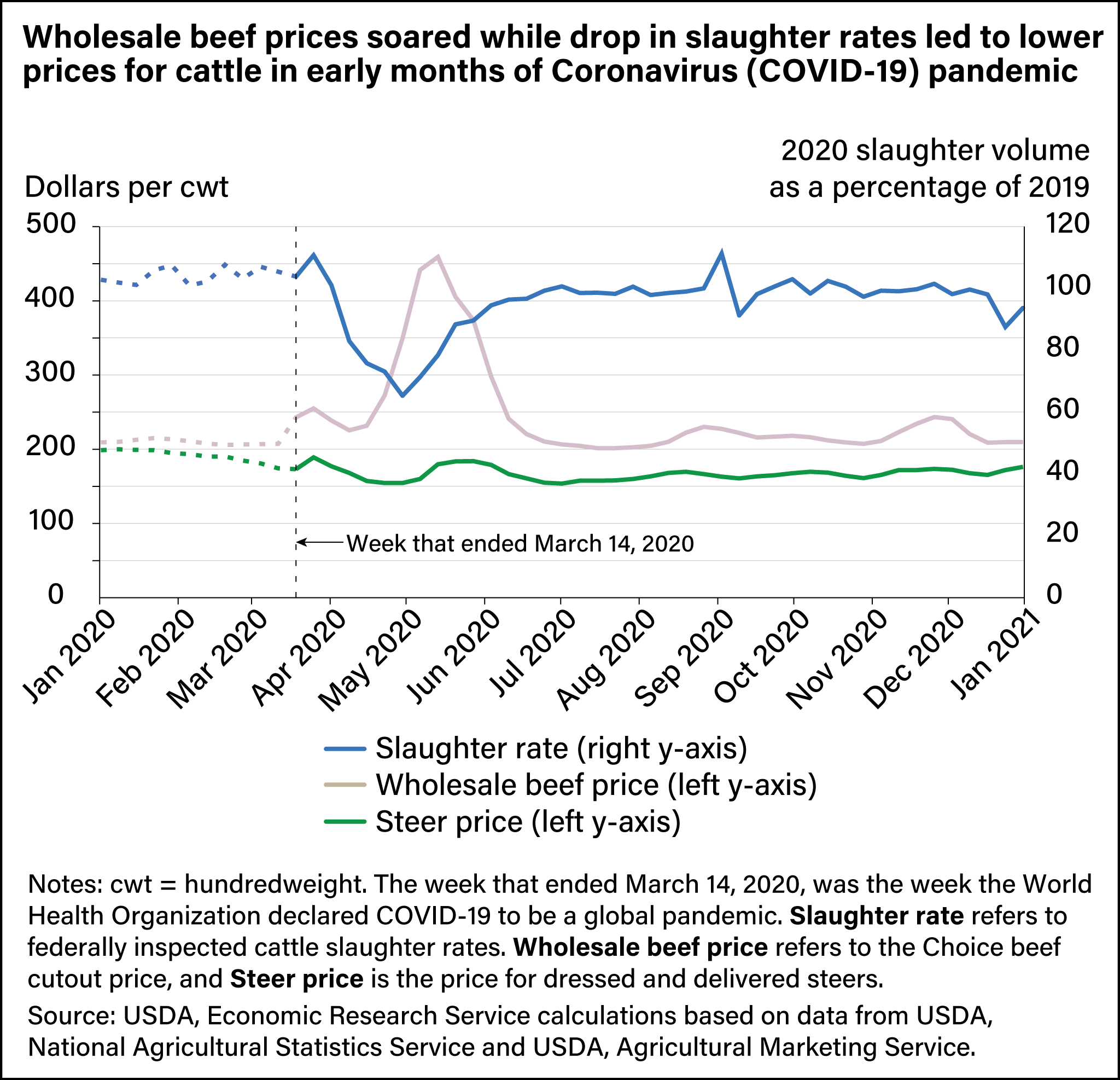

The Coronavirus (COVID-19) pandemic caused significant disruption to U.S. meat supply chains in the spring and summer of 2020, according to a recent USDA, Economic Research Service report. In the early months of the pandemic, COVID-19 infections caused worker absences at beef packing plants, leading to a slowdown in slaughter rates and even some temporary plant shutdowns. From mid-April to mid-June 2020, the decrease in slaughter rates—combined with a surge in retail demand—drove a historically wide gap between wholesale meat and livestock prices. Wholesale beef prices rose, while cattle prices remained low. The price changes affected the entire supply chain. Cattle producers struggled with low prices for their market-ready animals and consumers paid more for beef at grocery stores.

In the first 3 months of 2020, weekly slaughter rates of cattle were higher than in the corresponding periods of 2019. As beef-packing plants faced increasing COVID-related labor constraints, relative slaughter rates fell after the week ending March 28, 2020. Within 2 weeks, weekly slaughter had fallen below 2019 levels. The week ending May 2, 2020, marked a low point when slaughter was 65 percent of the same week in 2019. Slaughter rates subsequently began to recover. By early June 2020, slaughter levels for cattle were above 90 percent of 2019 levels and continued to rise. They remained at near-2019 levels for most of the rest of 2020.

Prices for dressed steers (male beef cattle) began 2020 at just under $200 per hundredweight (cwt), but as processor demand for cattle dropped, prices followed suit throughout April 2020. They rebounded slightly in May and fell again in July, reaching their lowest point of the year at $154 per cwt. In contrast to low steer prices, the price of Choice beef cutout—a measure of wholesale beef prices—increased steadily from mid-April to mid-May before peaking at $459 per cwt the week ending May 16, 2020. The adoption of social distancing guidelines reduced demand for beef in restaurants and other food service outlets but increased demand for meat products at retail venues such as grocery stores. Soaring retail demand increased demand for wholesale beef, and, as reduced slaughter cut into supplies, beef prices rose.

The increase in the wholesale beef prices combined with relatively low steer prices widened the price margin between the two. At the start of 2020, the price margin was about $10 to $15 per cwt. The margin peaked at $282 in early May. This meant that livestock producers received low prices for their cattle even as beef prices were high. Even when slaughter rates began to pick up again, a backlog of market-ready animals remained on farms, and supply chain problems persisted past the spring of 2020. As slaughter rates began to recover in June, Choice beef cutout prices began to fall before stabilizing between $200 per cwt and $250 per cwt from mid-June through the rest of 2020. At the same time, the price margin also shrank, remaining between about $40 and $70 per cwt for the rest of the year.

This article is drawn from:

- Vaiknoras, K., Hahn, W., Padilla, S., Valcu-Lisman, A. & Grossen, G. (2022). COVID-19 Working Paper: COVID-19 and the U.S. Meat and Poultry Supply Chains. U.S. Department of Agriculture, Economic Research Service. AP-098.

You may also like:

- Padilla, S., Schulz, L.L., Vaiknoras, K. & MacLachlan, M. (2021). COVID-19 Working Paper: Changes in Regional Hog Slaughter During COVID-19. U.S. Department of Agriculture, Economic Research Service. AP-095.