ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, May 24, 2023

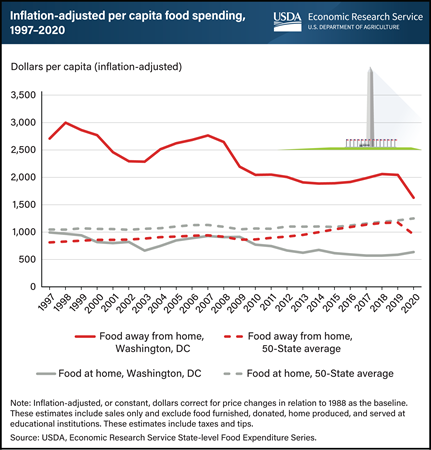

Food spending estimates for Washington, DC, differ widely from the 50-State average estimates. From 1997 to 2020, Washington, DC, had higher inflation-adjusted per capita sales at food-away-from-home (FAFH) establishments, such as restaurants, than the State average, although the gap narrowed over time. In 1997, FAFH spending in Washington, DC, was more than 3 times the 50-State average and 1.7 times the 50-State average in 2019 and 2020. The difference could be attributed to nonresident workers commuting into Washington, DC, and spending more at FAFH establishments. FAFH spending per capita in 2019 was 24 percent higher in Washington, DC, than in the highest State (Hawaii). Meanwhile, sales at food-at-home (FAH) outlets, such as grocery stores and supercenters, across the 50 States have steadily increased, with an average annual growth rate of 0.8 percent since 1997. However, FAH spending in Washington, DC, has been more volatile and has trended downward over time. Inflation-adjusted per capita spending on FAH in Washington, DC, was 40.8 percent lower in 2019 than in 1997, before increasing 8.2 percent in 2020 during the Coronavirus (COVID-19) pandemic. FAH spending in Washington, DC, was roughly equal to the 50-State average in 1997 but fell to approximately half the average from 2017 to 2020. FAH spending per capita in Washington, DC, in 2019 was 37 percent lower than the lowest State (Arkansas). This chart is drawn from the USDA, Economic Research Service’s State-level Food Expenditure Series, which launched in May 2023 and provides annual data on food spending for each State and Washington, DC, from 1997 to 2020.

Wednesday, May 17, 2023

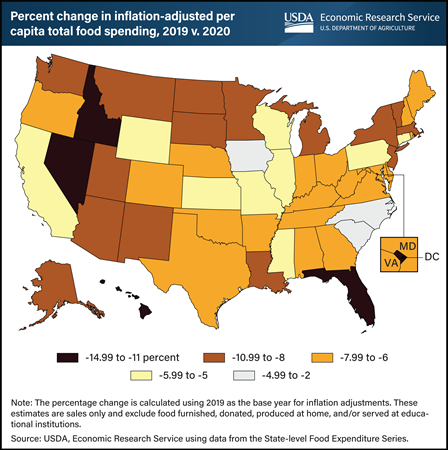

The Coronavirus (COVID-19) pandemic in the United States disrupted the food industry in 2020. Inflation-adjusted total U.S. food expenditures were 6.6 percent lower in 2020 than in 2019. However, individual States experienced varying degrees of food spending decline during this period. The USDA, Economic Research Service’s (ERS) newly developed State-level Food Expenditure Series helps to illustrate annual food spending changes across States since 1997, including Washington, DC. From 2019 to 2020, each State saw decreases in inflation-adjusted, per capita total food spending. The smallest decreases in food spending were in Iowa (2.2 percent), South Carolina (2.6 percent), and North Carolina (4.1 percent). The States that saw the largest decreases in inflation-adjusted, per-capita food spending were Hawaii (15 percent), Washington, DC (13.9 percent), Florida (11.8 percent), and Nevada (11.6 percent). These States typically have large out-of-State population inflows from nonresident workers and tourists. The median change of total food spending occurred in Delaware, with a decrease of 7.2 percent. These spending changes occurred as health concerns and mobility restrictions during the first year of the pandemic led consumers to spend less at restaurants and other eating out establishments in favor of relative cost-efficient outlets, such as grocery stores and supercenters. This chart is drawn from ERS’ State-level Food Expenditure Series, which launched in May 2023 and provides annual data on food spending for each State and Washington, DC, from 1997 to 2020.

Monday, April 24, 2023

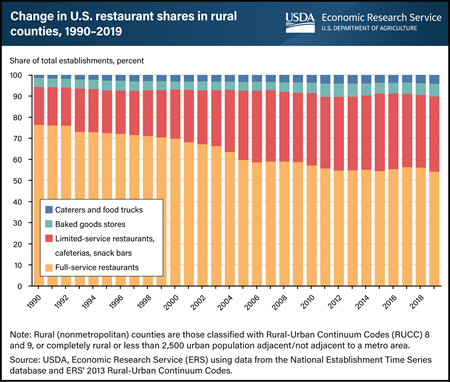

The food-away-from-home retail landscape continues to evolve. USDA, Economic Research Service (ERS) researchers recently examined the changing food-away-from-home landscape in nonmetropolitan counties between 1990 and 2019, with a focus on the most rural counties. As of 1990, full-service restaurants were the most common restaurant type, making up 76 percent of all food-away-from-home establishments in these counties. However, over the last several decades, this composition has shifted. While full-service restaurants remain the most common in rural counties, their prominence has fallen from about 75 percent of establishments to about 50 percent of establishments in 2019. By contrast, quick-service restaurants have become increasingly popular. Quick-service restaurants accounted for 18 percent of the total number of establishments in rural counties in 1990 but have since doubled, making up 36 percent of all food-away-from-home establishments in 2019. This shift could affect overall food options available for consumers in these rural areas. This chart appears in the ERS report, The Rural Food-Away-from-Home Landscape, 1990–2019, released in March 2023.

Tuesday, April 18, 2023

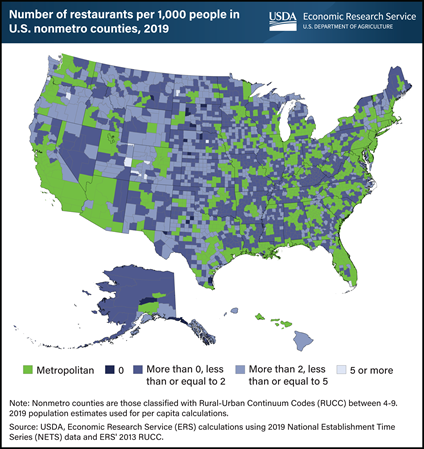

On August 15, the map was updated with the correct non-metro status for Aleutians West, Alaska. The text and other data were not affected.Most U.S. nonmetropolitan (rural) counties had 5 or fewer restaurants per 1,000 people in 2019, and many had fewer than 2. This means people in rural areas had fewer food-away-from-home options when wanting to dine out or grab a quick, convenient meal. Nonmetropolitan areas occupy more land in the United States away from the coasts, so residents of the Great Plains and Northern Plains regions may not only be limited in their own counties, but also would have to travel farther to reach a more urban location where restaurant and other food-away-from-home options are varied and available. A select number of counties are both nonmetropolitan and offer more than 5 options for food away from home per 1,000 people. The primary industry in these counties may explain some of these differences. Counties whose economies are most reliant on tourism/recreation typically host more food-away-from-home establishments per capita than other nonmetropolitan counties. An example of recreation-dependent counties with larger numbers of restaurants per 1,000 people can be found in the Rockies, on the western side of Colorado. This map appears in the USDA, Economic Research Service report The Rural Food-Away-from-Home Landscape, 1990–2019, released March 29, 2023.

Thursday, March 30, 2023

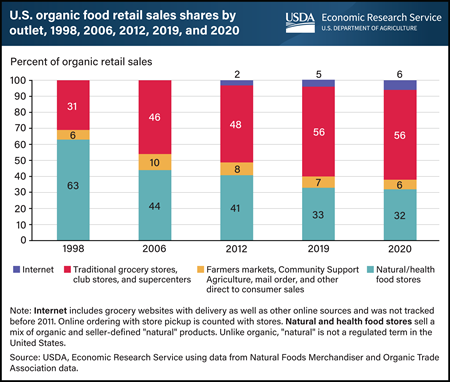

Markets for organic food began emerging in the 1970s as consumers became concerned about the growing use of synthetic fertilizers and pesticides and their effect on the environment and health. At that time, standards were developed on a State-by-State basis, and organic foods were largely sold in natural food stores. Natural food stores, both large and small, remained the major outlet for organic food sales until the mid-2000s. In 2000, USDA established the National Organic Program and set organic standards for production, along with consistent national labeling. Organic retail food sales moved into conventional grocery retailers, and made up almost 60 percent of retail sales in 2020. Organic food subscriptions such as seasonal fruit baskets, online meal boxes, and other internet sales have created new supply chains for organic food. In 2019, internet sales jumped to 5 percent from 2 percent of total sales in 2012 and rose again in 2020 as consumers responded to the Coronavirus (COVID-19) pandemic. This chart appears in the USDA, Economic Research Service report, U.S. Organic Production, Markets, Consumers, and Policy, 2000–21, published March 2023.

-FAFH-monthly-outlets_450px.png?v=685.8)

Tuesday, February 28, 2023

In April 2020, as effects of the Coronavirus (COVID-19) pandemic on the U.S. economy unfolded, spending at full-service restaurants declined 71 percent compared with April 2019. Spending at limited-service—or fast-food—restaurants fell 32 percent, and spending at all other food-away-from-home establishments, such as drinking places, hotels, and motels, dropped 41 percent over the same period. Full-service restaurants typically offer food and alcohol to seated customers who pay after eating and include amenities such as ceramic dishware and non-disposable utensils. Limited-service restaurants prioritize convenience and have limited menus, sparse dining amenities, and no waitstaff. The limited physical interaction with customers made it easier for fast-food establishments to adapt to COVID-19 restrictions, and by the second half of 2020, they managed to recover to pre-pandemic spending levels. Despite efforts by many full-service restaurants to expand takeout and delivery services, these outlets took slightly longer to bounce back, and returned to pre-pandemic spending in March 2021. By December 2021, both full-service and limited-service restaurant spending had fully recovered and were each about 10 percent higher than in December 2019. The data for this chart were first included in the USDA, Economic Research Service’s Food Expenditure Series data product in February 2023 and will be updated with 2022 data in June 2023.

-FPO-Forecasts-2-23_450px.png?v=685.8)

Thursday, February 23, 2023

USDA, Economic Research Service (ERS) publishes price forecasts in the monthly Food Price Outlook (FPO) data product. The FPO forecasts food-at-home (FAH) prices will increase 8.6 percent in 2023, with a prediction interval of 5.6 to 11.8 percent. ERS updated the FPO forecasting methods in January 2023, and forecasts now include a midpoint and a prediction interval to represent the expected price change and range of likely price changes, respectively. The prediction interval conveys uncertainty about the forecast, starting out wider at the beginning of the year and narrowing as forecasts incorporate more months of observed data and the forecast period shortens. The prediction intervals vary in size across food categories based on price volatility and available information. In 2023, egg prices are forecast to grow the fastest (37.8 percent, with a prediction interval of 18.3 to 62.3 percent) while fresh fruit prices are predicted to experience little change (0.1 percent) and have a prediction interval of -5.6 to 6.4 percent. In general, food prices are expected to grow more slowly in 2023 than in 2022 but remain above historical average rates. FAH prices grew 11.4 percent in 2022, the largest annual increase since 1974, compared with a historical annual average of 2.5 percent from 2003–22. This chart is updated from the Amber Waves article, ERS Refines Forecasting Methods in Food Price Outlook, published February 2023.

Thursday, February 16, 2023

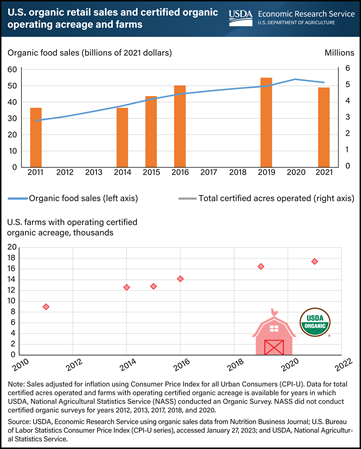

The organic market has seen continued growth in retail sales in the past decade. U.S. organic retail sales increased by an average of 8 percent per year and surpassed $53 billion in 2020 (inflation-adjusted to 2021 dollars). In 2021, sales were $52 billion, which was a 6-percent annual decline when adjusted for inflation, but a slight increase when not inflation-adjusted. Additionally, the number of certified organic acres operated increased gradually from 3.6 million in 2011 to 4.9 million acres in 2021. The number of certified farms with operating organic acres in the United States nearly doubled over the past decade to 17,409 from about 8,978. Between 2019 and 2021, the number of certified organic farms in the United States increased 5 percent, while total organic land decreased by 11 percent, driven by a 36-percent decrease in pasture and rangeland. These latest data were released in the 2021 Certified Organic Survey on December 15, 2022, by USDA, National Agricultural Statistics Service with cooperation from USDA's Risk Management Agency, which is the first organic survey released by USDA since 2019. The U.S. organic retail sales data provided by Nutrition Business Journal were adjusted for inflation and are available on USDA, Economic Research Service’s Organic Agriculture topic page, updated February 2023.

Thursday, February 2, 2023

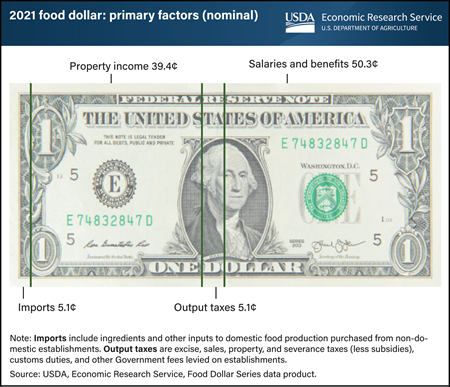

In 2021, the average dollar spent by U.S. consumers on domestically produced food returned 39.4 cents as property income. Property income is income received by owners of capital assets such as land, equipment, and intellectual property after they pay for intermediate inputs, labor, and output taxes. The 39.4 cents as property income marked a 0.3-cent increase from a revised 2020 estimate of 39.1 cents and the second year in a row in which property income’s share of the food dollar set a record high for USDA, Economic Research Service’s Food Dollar Series. The share of the food dollar that compensates labor through salaries and benefits was 50.3 cents in 2021, a 1.2-cent decrease from 2020. The remaining food dollar shares were each at 5.1 cents for output taxes (excise, sales, property, and severance taxes less subsidies, customs duties, and other government fees) and imports, which include imported ingredients and other inputs needed for domestic food production. Annual shifts in the primary factor shares of the food dollar may occur for a variety of reasons, including changes in the mix of foods consumers buy, the balance of food consumed at home and away from home, and changes in primary factor markets for non-food production. The data for this chart are available for the years 1997 to 2021 and can be found in Food Dollar Series, updated November 17, 2022.

Thursday, January 26, 2023

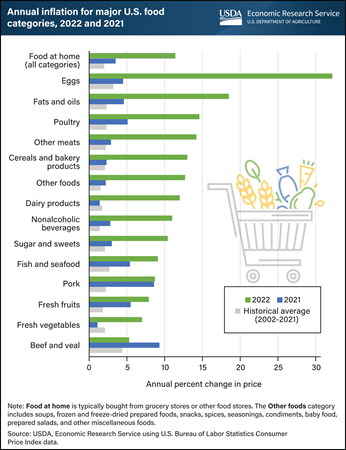

Food-at-home prices increased by 11.4 percent in 2022, more than three times the rate in 2021 (3.5 percent) and much faster than the 2.0-percent historical annual average from 2002 to 2021. Of the food categories depicted in the chart, all except beef and veal grew faster in 2022 than in 2021. In 2022, price increases surpassed 10 percent for food at home and for nine food categories. Egg prices grew at the fastest rate (32.2 percent) after an outbreak of highly pathogenic avian influenza (HPAI) throughout 2022. Prices for fats and oils increased by 18.5 percent, largely because of higher dairy and oilseed prices. Prices also rose for poultry (14.6 percent) and other meats (14.2 percent). Elevated prices for wholesale flour—attributed to the conflict in Ukraine and rising fertilizer prices—and eggs contributed to a 13.0-percent price increase for cereals and bakery products. Prices for beef and veal (5.3 percent), fresh vegetables (7.0 percent), and fresh fruits (7.9 percent) rose more slowly, but all categories exceeded their historical averages. Food prices grew more quickly than the overall rate of inflation (8.0 percent), as the HPAI outbreak, the Ukraine conflict, and economy-wide inflationary pressures contributed specifically to rising food prices. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase 8.0 percent in 2023, with a prediction interval of 4.5 to 11.7 percent. ERS tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, updated January 25, 2023.

Tuesday, January 10, 2023

In 2021, 33.6 cents of an average dollar spent on domestically produced food went to foodservice establishments, which include restaurants and other food-away-from-home outlets. At more than one-third of the 2021 food dollar, the foodservice share increased 3.5 cents over 2020 to reach its highest value in the USDA, Economic Research Service’s (ERS) Food Dollar Series. The share for food services does not include expenses paid to other industry groups, such as food, energy, and financial services. The shares for energy, advertising, finance and insurance, and legal and accounting changed less than 0.1 cent from their 2020 values, while the declines among remaining industry group shares ranged from 0.1 cent lower (packaging) to 1.0 cent lower (food processing). Annual shifts in the food dollar shares between industry groups occur for a variety of reasons, including changes in the mix of foods consumers buy, costs of materials, ingredients, and other inputs, as well as changes in the balance of food at home and away from home. The 2021 changes in the industry group shares reflect shifts toward pre-pandemic trends that were interrupted when consumers spent more on food-at-home during the Coronavirus (COVID-19) pandemic. The industry group shares food dollar chart is available for 1993 to 2021 and can be found in ERS’s Food Dollar Series data product, updated November 17, 2022.

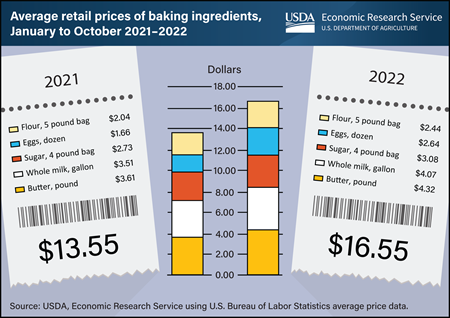

Tuesday, December 13, 2022

As people sift through holiday baking recipes and head to the store, they will find key ingredients cost more this year. The total cost for five baking staples – flour, sugar, milk, butter, and eggs – was about 22 percent higher through the first 10 months of 2022 compared with the same period in 2021. A 5-pound bag of flour, 4-pound bag of sugar, gallon of whole milk, pound of butter, and a dozen eggs cost a total $16.55 in 2022, compared with $13.55 in 2021, an increase of $3.00. Egg prices increased the fastest (60 percent) and cost about $0.98 more per dozen compared with 2021, as the egg industry was affected by the highly pathogenic avian influenza outbreak. Prices for flour and butter each rose by about 20 percent, adding about $0.40 to the price of a bag of flour and $0.71 to a pound of butter. Prices increased more slowly for milk (16 percent) and sugar (13 percent) in 2022, although price increases for all products were above historical averages. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, which predicts food-at-home prices will increase between 11 and 12 percent in 2022.

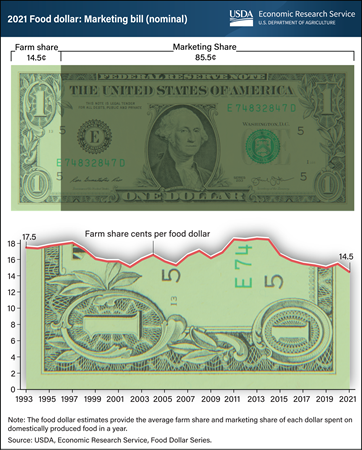

Monday, November 28, 2022

U.S. farm establishments received 14.5 cents per dollar spent on domestically produced food in 2021—a decrease of 1.0 cent from a revised 15.5 cents in 2020—to the lowest recorded farm share value in nearly three decades. The remaining portion of the food dollar—known as the marketing share—covers the costs of getting domestically produced food from farms to points of purchase, including costs related to packaging, transporting, processing, and selling to consumers. One contributor to the 2021 decline in farm share was a shift to food-away-from-home (FAFH) spending. Farm establishments typically receive a smaller share of FAFH spending because of the large amount of value added by FAFH outlets such as restaurants. As a result, the farm share generally decreases when FAFH spending increases faster year-over-year than food-at-home spending. FAFH spending increased markedly in 2021 after a sharp decrease early in the Coronavirus (COVID-19) pandemic. Accordingly, the farm share returned to its pre-pandemic downward trend in 2021 after an increase in 2020. The USDA, Economic Research Service (ERS) uses input-output analysis to calculate the farm and marketing shares from a typical food dollar. The data for this chart can be found in ERS’s Food Dollar Series data product, updated November 17, 2022.

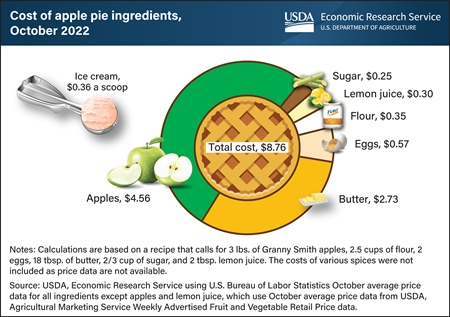

Tuesday, November 22, 2022

Pie is a time-honored staple of Thanksgiving around the country. U.S. consumers baking a homemade apple pie this year can expect to pay about $8.76 for the ingredients, an increase of about 19.5 percent from 2021. Prices increased for all ingredients. Apples comprised about half the cost of a pie ($4.56), and prices for Granny Smith apples increased from an average $1.41 per pound in October 2021 to $1.52 per pound in October 2022. Prices increased the most for eggs (90.0 percent) and flour (34.6 percent), but rising butter costs had the largest impact on the total, adding an additional $0.68 to the cost of a pie between 2021 and 2022. If serving the apple pie a la mode, ice cream adds $0.36 per scoop. The most recent average price data are from October; prices for Thanksgiving week may vary. For example, savings may occur if grocers offer holiday discounts. USDA, Economic Research Service (ERS) used average price data from the U.S. Bureau of Labor Statistics and USDA, Agricultural Marketing Service Weekly Advertised Fruit and Vegetable Retail Price data to derive the cost for the ingredients of an apple pie. Forecasts for aggregate food category prices can be found in ERS’s Food Price Outlook data product, updated November 22.

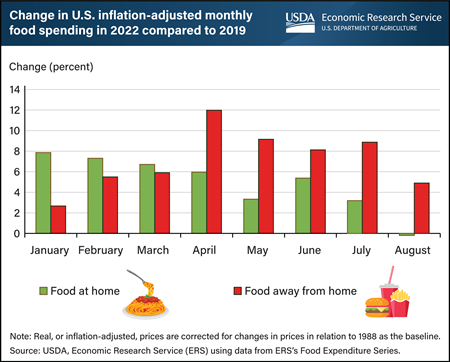

Friday, October 21, 2022

Real, or inflation-adjusted, monthly food spending in the United States has increased in 2022 as compared to the same period in 2019, before the Coronavirus (COVID-19) pandemic. Inflation-adjusted food spending measures the quantity of food spending after removing price increase effects. Real monthly food at home (FAH) spending, or food intended for off-premise consumption from retailers such as grocery stores, increased each month through August 2022 as compared to 2019 except in August, with the highest increase in January at almost 8 percent. This increase may be the result of U.S. consumers purchasing more foods or choosing more expensive grocery store options, such as pre-cut vegetables and fruits, imported out-of-season foods, organic products, and prepared dishes, than they did in 2019. Real monthly food away from home (FAFH) spending, or food consumed at outlets such as restaurants or cafeterias, also increased each month so far in 2022, with the highest increase in April at 12 percent. Similarly, the increase seen in 2022 in real FAFH spending may be the result of U.S. consumers purchasing more FAFH in general or shifting toward more expensive options, such as foods at full-service restaurants. The data for this chart come from the ERS’s Food Expenditure Series data product.

_450px.png?v=685.8)

Thursday, September 29, 2022

National Coffee Day is today, September 29, and according to a National Coffee Association survey, 66 percent of U.S. adults are coffee drinkers. Consumers who get through the daily grind with a 12-ounce cup of black coffee they brewed at home paid, on average, 23.6 cents in the first 8 months of 2022, compared to 19.3 cents in 2021. For those who prefer their daily joe with milk or sugar, adding an ounce of whole milk costs 3.2 cents in 2022, up from 2.7 cents in 2021. Each teaspoon of sugar added 0.7 cents to the cost of a cup of coffee in 2022, compared to 0.6 cents in 2021. Average ground coffee prices through the first 8 months of 2022 were 21.9 percent higher compared to the same period in 2021. Prices rose more slowly for milk (15.9 percent) and sugar (11.0 percent) compared to coffee during those same months. More information on USDA, Economic Research Service’s food price data can be found in the Food Price Outlook data product, updated September 23, 2022.

_450px.png?v=685.8)

Thursday, August 25, 2022

Retail food prices increased 8.9 percent in the first seven months of 2022, higher than the rate over the same period in 2021 (1.9 percent) and 2020 (3.1 percent). The 20-year historical average for the same months from 2001 to 2020 was 1.7 percent. All 13 food categories depicted in the chart experienced faster price increases so far in 2022 compared with both the same period in 2021 and historical average price increases through July. All food categories saw price increases of at least 4 percent in the first seven months of 2022. Prices for three food categories increased by more than 10 percent: eggs (20.9 percent), fats and oils (13.4 percent), and poultry (11.8 percent). Inflationary pressures differ by food category. For example, eggs and poultry prices are currently much higher than their historical average in part because of an outbreak of highly pathogenic avian influenza (HPAI). Fresh vegetables historically experienced higher midyear average price increases compared to most categories, but prices for fresh vegetables increased the least of all categories over the first seven months of both 2022 (4.9 percent) and 2021 (0.4 percent). Prices will continue to change during the remainder of 2022 and may significantly affect the annual inflation rate. For example, prices increased for all food categories in the second half of 2021, and some increased more rapidly than the first half of 2021. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase between 10 and 11 percent in 2022. Forecasts for all food categories, including for 2023, are available in ERS’s monthly Food Price Outlook data product, updated August 25, 2022.

_450px.png?v=685.8)

Thursday, August 4, 2022

The share of U.S. consumers’ disposable personal income (DPI) spent on food was relatively steady from 2000 to 2019, rising from 9.93 percent in 2000 to 10.27 percent in 2019. DPI is the amount of money that U.S. consumers have left to spend or save after paying taxes. During the Coronavirus (COVID-19) pandemic, the share of income spent on food dropped to a new low of 9.4 percent in 2020. Food spending rebounded in 2021, however, and the share of income spent on food jumped to 10.27 percent, equaling the share in 2019. Between 2000 and 2019, consumer spending trended toward food away from home (restaurants, fast-food places, schools, and other dining establishments). From 2019 to 2020, this trend reversed as consumers spent more of their incomes on food at supermarkets, convenience stores, warehouse club stores, supercenters, and other retailers (food at home). As COVID-19 vaccines were distributed and many mobility restrictions were lifted in 2021, the share of food-away-from-home spending bounced back to just shy of the food-at-home spending share, signaling a return towards pre-pandemic spending trends. The data for this chart come from the USDA, Economic Research Service’s Food Expenditure Series data product.

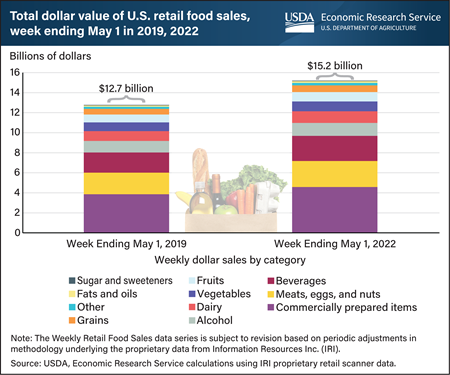

Thursday, June 30, 2022

Total retail food sales in the United States were higher the week ending May 1, 2022, $15.2 billion, compared with May 1, 2019, $12.7 billion, with substantial variation among categories. During the same period, the share of meats, eggs, and nuts increased from 16.8 percent to 17.1 percent, while the share of vegetables fell from 6.8 percent to 6.4 percent. The largest 3-year change was for fats and oils, which were 25.5 percent higher in sales value in 2022 compared with 2019. While the smallest 3-year change was for alcohol, which was 12.3 percent higher in sales value in 2022 compared with 2019. The USDA, Economic Research Service’s (ERS) Weekly Retail Food Sales data product provides a current and detailed picture of U.S. food-at-home retail sales. These data are clustered to food group levels and representative at the national and State levels. Two publicly available sets of the Weekly Retail Food Sales data are updated monthly by ERS: One with national totals and totals by 51 product subcategories (including alcohol), and the other with State totals for 39 States by 10 product categories (including alcohol). The data for this chart are available in ERS’s Weekly Retail Food Sales data product, updated on May 31, 2022.

_450px.png?v=685.8)

Wednesday, June 29, 2022

For Fourth of July cookouts this year, cheeseburgers could cost more than they did in 2021. In May 2022, the ingredients for a home-prepared 1/4-pound cheeseburger totaled $2.07 per burger, with ground beef making up the largest cost at $1.20 and cheddar cheese accounting for $0.35. This represents an increase of 11.3 percent compared to the $1.86 it cost to produce the same cheeseburger in May 2021. Retail prices for one-pound quantities of all ingredients were higher in May 2022 compared with May 2021. Ground beef prices increased 16.9 percent and accounted for 17 cents of the increase between 2021 and 2022. Cheddar cheese and bread costs each rose about 1 cent per burger from 2021 to 2022. Iceberg lettuce prices rose the most, by 23.3 percent, but the relatively small proportion it contributes to the total cost of a burger means it added just 2 cents to the total. This chart uses data from the ERS Food Price Outlook data product, which was updated on June 24, 2022, U.S. Bureau of Labor Statistics Average Price data, and USDA Agricultural Marketing Service Weekly Advertised Fruit and Vegetables Retail Prices.