Global suppliers competed on price in 2020 for China's beef market

- by Christopher G. Davis

- 3/1/2021

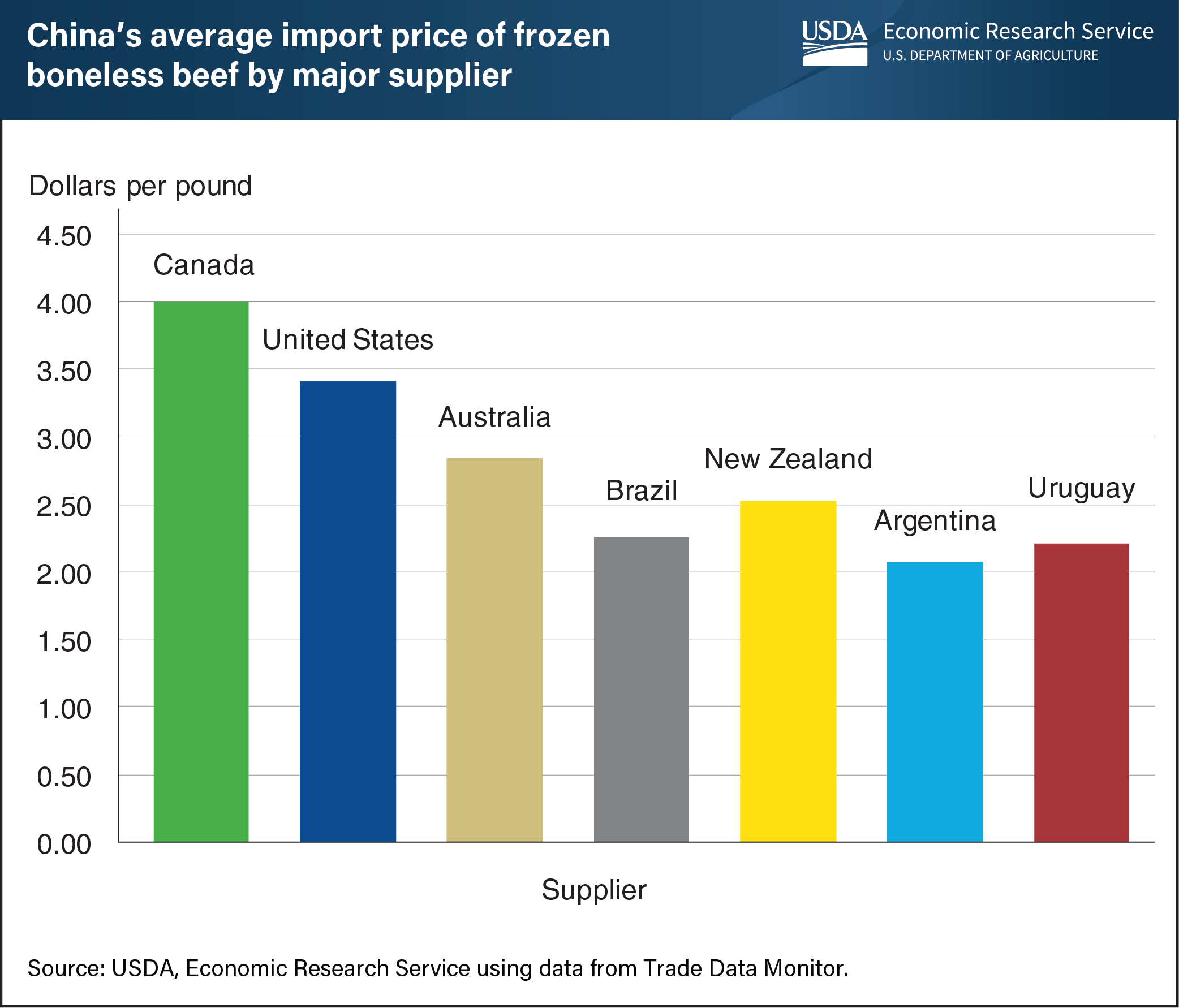

Despite shipping record-breaking volumes of U.S. beef to China from July to December 2020, the United States supplied only 1.3 percent of China’s total imports of beef. Beef-exporting competitors of the United States—Canada, Brazil, Argentina, Australia, Uruguay, and New Zealand—account for the vast majority (93 percent) of the total volume of China’s total beef imports worth $9.518 billion. This may be in part because the U.S. value per pound of beef shipped to China is higher than most of its competitors in the China beef market, with the exception of Canada. Both the United States and Canada primarily export a grain-fed product distinct from what China typically imports from other countries. In 2020, the U.S. unit value per pound of frozen boneless beef—the product the United States has been exporting to China in recent years—averaged $3.42. Canada’s unit value for beef imported in China exceeded that of the United States at $4.01 per pound, while other competitors’ unit values ranged from $2.08 to $2.85. Despite a higher unit price of U.S. beef, China’s commitment to purchase an additional $200 billion of American-made goods and services over 2020 and 2021 under the United States–China Phase One trade deal could lead to continued growth of U.S. beef exports. This chart is drawn from the USDA, Economic Research Service’s January 2021 Livestock, Dairy, and Poultry Outlook.