Average U.S. farm real estate value remains near its historic high

- by Scott Callahan

- 3/23/2020

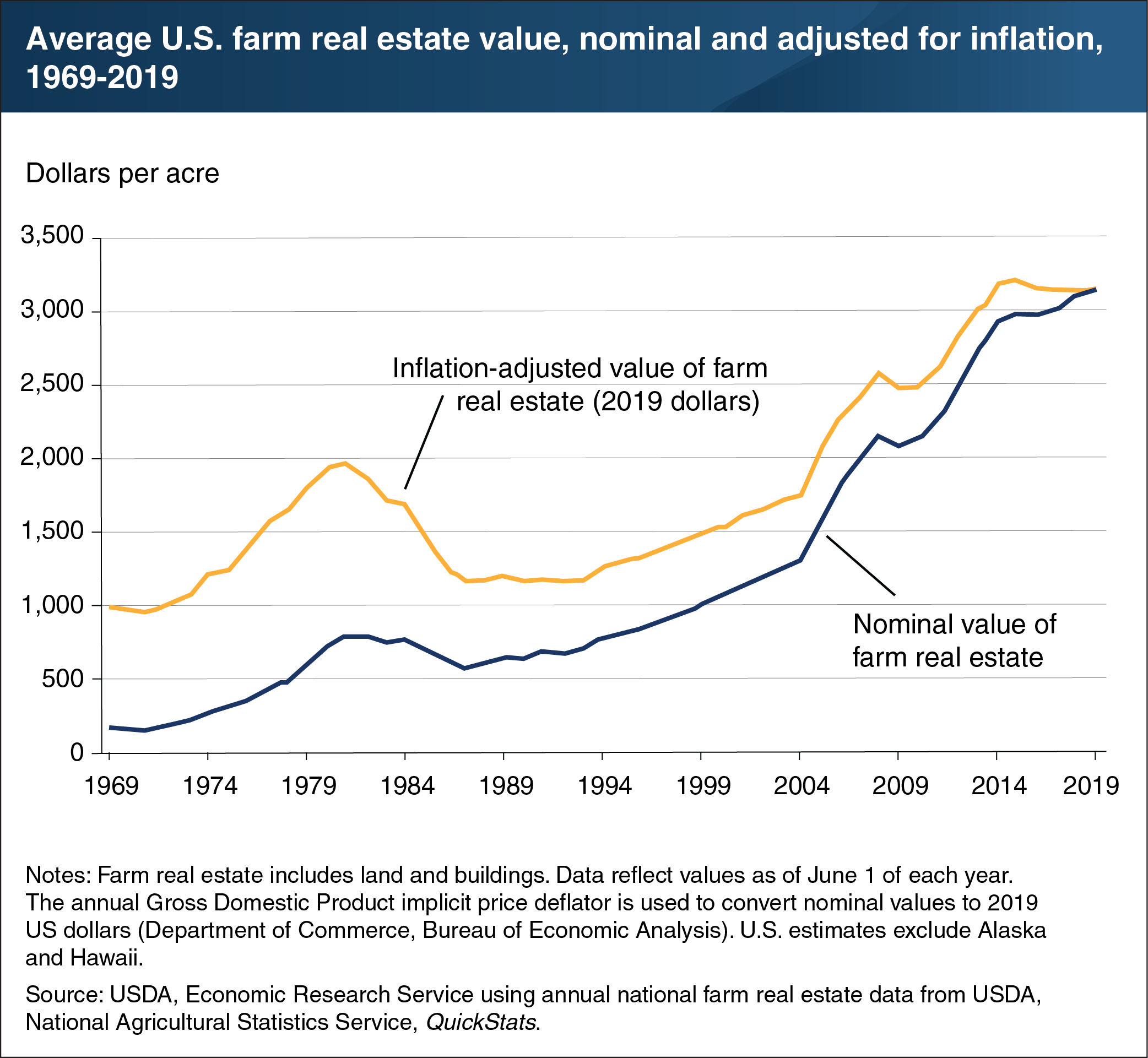

Farm real estate, including land and the structures on that land, typically accounts for more than 80 percent of the total value of U.S. farm sector assets. Farmers often use the value of their real estate as collateral for farm loans. After a long period of appreciation following the farm crisis of the 1980s, farm real estate values have leveled off since 2015. U.S. farm real estate value in 2019 remained near its historic high, averaging $3,160 per acre—a modest increase of 0.2 percent over 2018. The Economic Research Service (ERS) forecast farm income to increase nationwide in 2019. This increase, combined with historically low interest rates, contributes to the ability of the farm sector to support higher farmland values. Regional farmland real estate values vary widely because of differences in general economic conditions, local farm economic conditions, government policy, and local geographic conditions. For example, farm real estate values in the Corn Belt are nearly twice the national average, while values in the Mountain region are less than half the national average. This chart appears in the ERS topic page for Farmland Value, updated March 2020.