Crop insurance indemnities rise with drought

- by Economic Research Service

- 11/22/2013

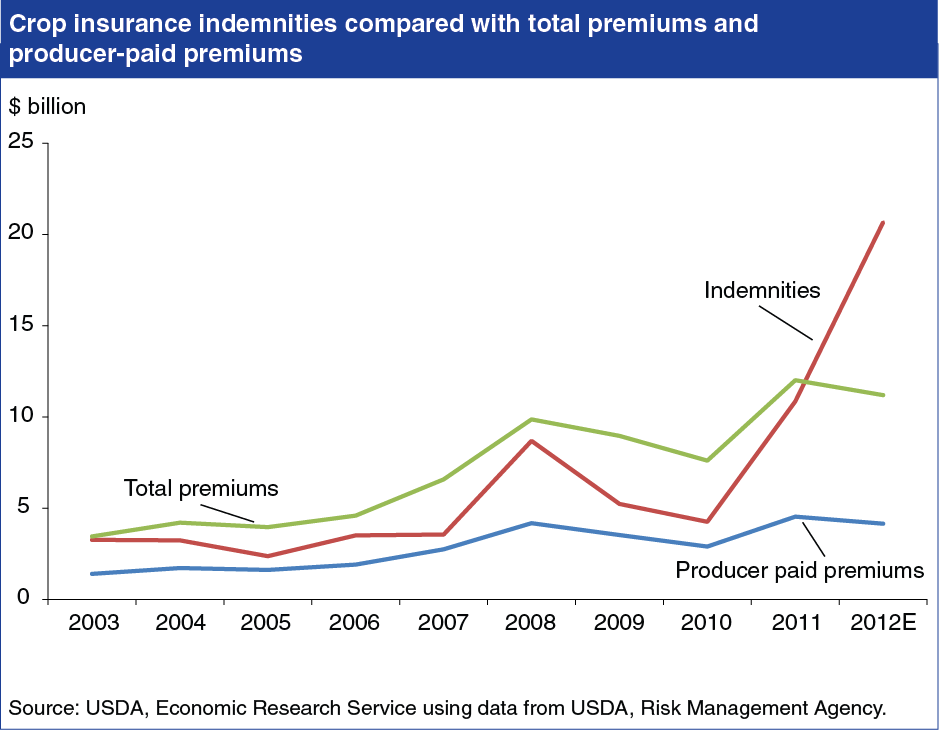

Federal crop insurance has become a key component of producer risk management in the United States. Producers participate by purchasing policies from private insurance companies to cover possible losses on the commodities they expect to harvest in a particular crop year, with premium rates set by the Federal Government. Most producers choose revenue loss policies, which cover potential losses to both their average yield and the expected price of the commodity at harvest. The Federal Government pays a share of the producer’s premium. In most years, total premiums (including both the producer and government shares) have been above indemnities (outlays for losses). Severe drought and other weather losses in 2011 and 2012 caused indemnities to rise above premiums in those years. In any given year, individual producers may pay more for their premium than they receive in indemnities, but even in years of low losses, total indemnities have been higher than the premiums paid by producers. For additional information, see the Risk Management topic pages.