Two companies accounted for more than half of corn, soybean, and cotton seed sales in 2018–20

- by Keith Fuglie

- 10/2/2023

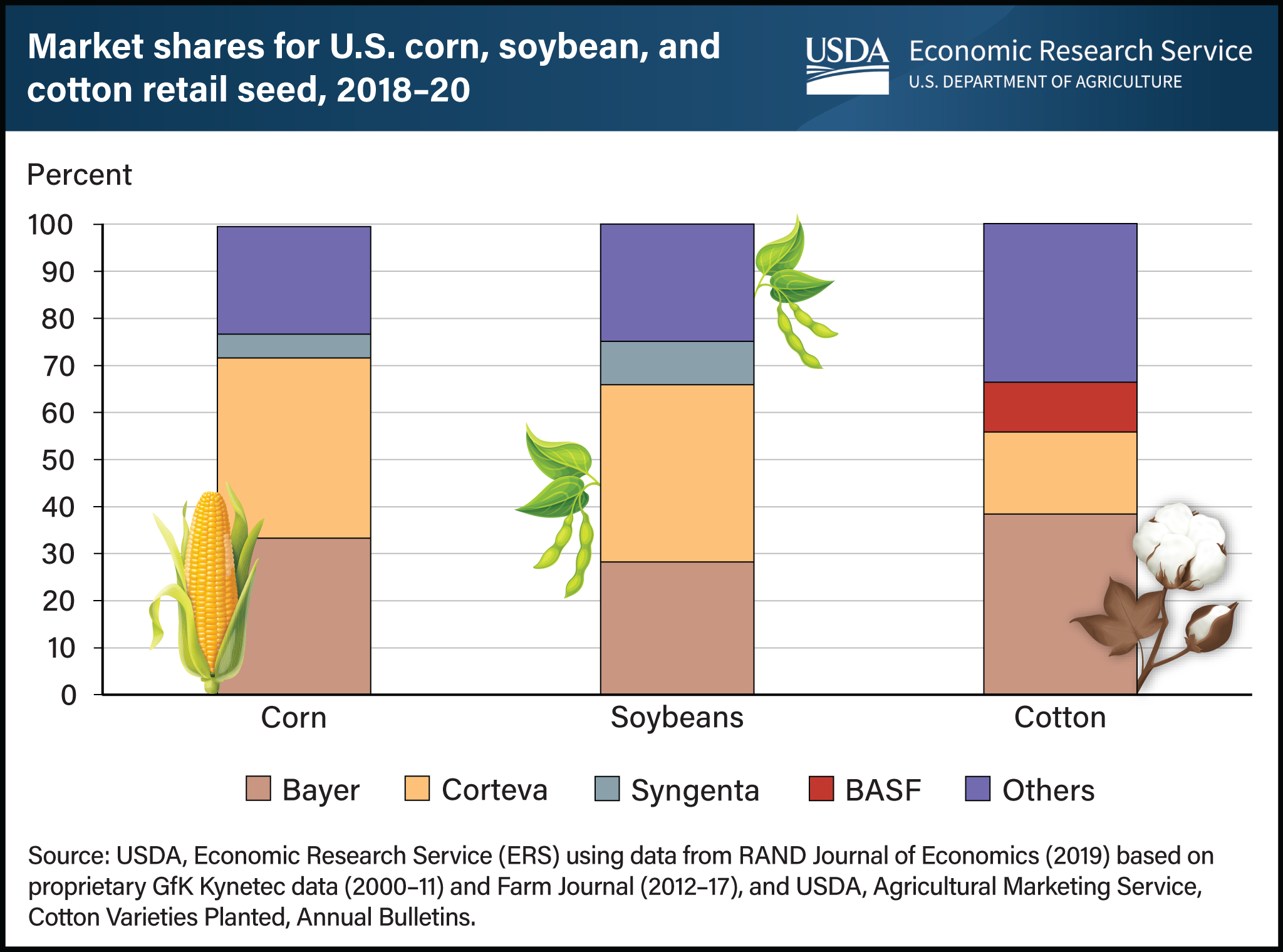

Two companies—Corteva and Bayer—provided more than half the U.S. retail seed sales of corn, soybeans, and cotton in 2018–20, the most recent period for which estimates are available. In recent decades, the U.S. crop seed industry has become more concentrated, with fewer and larger firms dominating seed supply. Today, four firms (Bayer, Corteva, ChemChina’s Syngenta Group, and BASF) control the majority of crop seed and agricultural chemical sales. In 2015, six firms led global markets for seeds and agricultural chemicals. The concentration can be traced to the expansion of intellectual property rights to private companies for seed improvements in the 1970s and 1980s, creating an incentive to research and develop new biotechnology seed traits and seed varieties. As biotechnology advanced, companies created genetically modified (GM) varieties of seed, such as herbicide-tolerant or insect-resistant corn, soybeans, and cotton. Mergers occurred between companies that produced and sold pesticides (primarily herbicides, insecticides, and fungicides), seed treatments (seed coatings to protect against insects or fungi), crop seeds, and seed traits. As a result, the U.S. crop seed sector has become highly integrated with agricultural chemicals and more concentrated. This chart is drawn from data in the USDA, ERS publication Concentration and Competition in U.S. Agribusiness, published in June 2023, and the Amber Waves article Expanded Intellectual Property Protections for Crop Seeds Increase Innovation and Market Power for Companies, published in August 2023.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?