Trade Agreements Change Japan’s Markets for U.S. Pork and Beef

- by Eric C. Davis and Ethan Sabala

- 9/7/2023

Highlights

- From 2018 to 2021, Japan entered into four trade agreements with regions that together have supplied roughly 98 percent of Japan’s beef and pork imports every year for the last 10 years.

- When the trade agreements are fully implemented, tariff reductions on beef and pork imports are expected to reduce Japan’s domestic production of beef and pork products. Conversely, Japan’s imports of those same commodities are expected to increase.

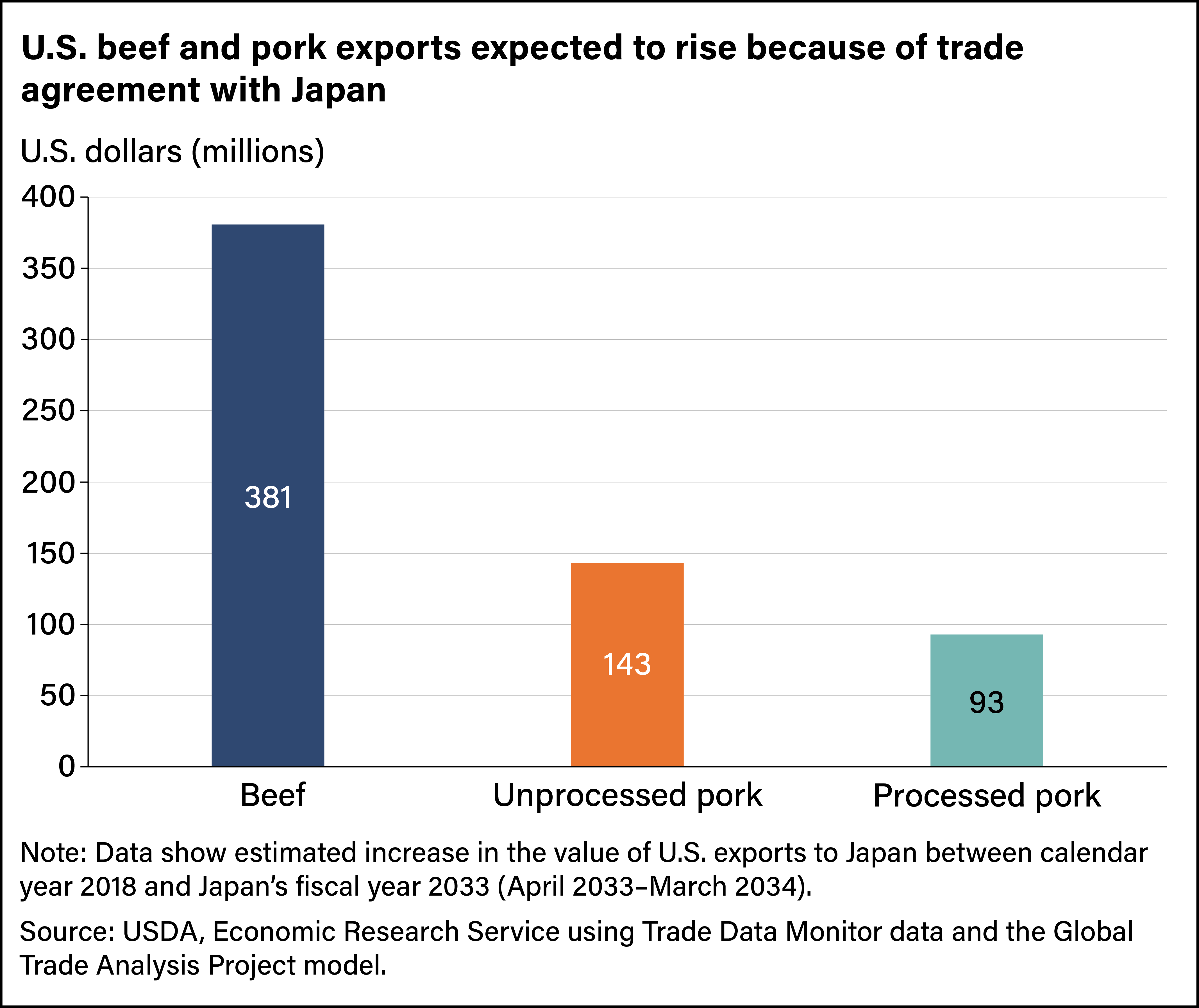

- The trade agreements are estimated to increase U.S. exports of beef and pork to Japan over the next decade. By Japan’s fiscal year 2033, U.S. beef exports to Japan are estimated to increase by $380.8 million, processed pork exports by $93.1 million, and unprocessed pork exports by $143.0 million, compared with levels seen in 2018.

- The United States is likely to face higher tariff rates on beef than countries in other trade agreements.

Japanese consumers are adding more pork and, to a lesser extent, beef to their diets. The country produces roughly half the pork products it consumes and around one-third of its beef. Imports supply the rest, with the United States one of the top two suppliers for both commodities. From December 2018 to January 2021, Japan entered into four trade agreements with countries including the United States that are changing Japan’s markets for pork and beef. Trading partners now have more favorable access than they had under World Trade Organization (WTO) rules, and as a result, U.S. beef and pork exports to Japan are expected to grow over the next decade.

From 1990 to 2020, Japan’s annual consumption of beef increased from 6.0 kilograms (13.2 pounds) per capita to 7.6 kilograms (16.8 pounds), a 27.4-percent increase. Annual pork consumption grew 24.3 percent from 13.0 kilograms (28.6 pounds) to 16.1 kilograms (35.5 pounds) per capita, making pork, among the animal proteins, the second largest source of calories for Japan’s consumers, behind only fish and shellfish, according to Japanese Government data.

Japan’s pork and beef producers are protected by tariff mechanisms that shield the market from imports. This has allowed much of the pork and beef that Japan consumes to be produced domestically, despite the relatively high cost to do so. In 2021, Japan produced more than 37 percent of the beef it consumed and about 50 percent of its pork, with the rest of its needs met through imports. Japan’s pork imports in the 21st century have come primarily from two countries: the United States, with an average market share of about 38 percent, and Canada, with an average market share of nearly 20 percent. As for beef, Australia and the United States are Japan’s two major suppliers. In 2021, Australian beef accounted for 41 percent of Japan’s beef imports, followed by 40 percent from the United States. Over the last 30 years, Australia and the United States have averaged a combined share of more than 90 percent of Japan’s beef import market.

Between 2018 and 2021, Japan ratified four new trade agreements, which may reshape its markets for beef and pork. With the completion of these four agreements, essentially all of Japan’s beef and pork imports now originate in trade agreement partner countries.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). This started as the Trans-Pacific Partnership (TPP) and included 12 countries that together composed around 40 percent of the global economy. The United States, however, withdrew in January 2017, and the agreement was renamed the CPTPP. As of September 2022, the CPTPP was fully in effect for Australia, Canada, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. Membership for Brunei and Chile will go into effect 60 days after their respective agreements are ratified.

- Japan-EU Economic Partnership Agreement (Japan-EU EPA). This agreement is between Japan and the 27 European Union (EU) countries and entered into force in February 2019.

- U.S.-Japan Trade Agreement (USJTA). This bilateral agreement between Japan and the United States entered into force in January 2020.

- Japan-UK Comprehensive Economic Partnership Agreement (Japan-UK EPA). This agreement between Japan and the United Kingdom (UK) entered into force in January 2021.

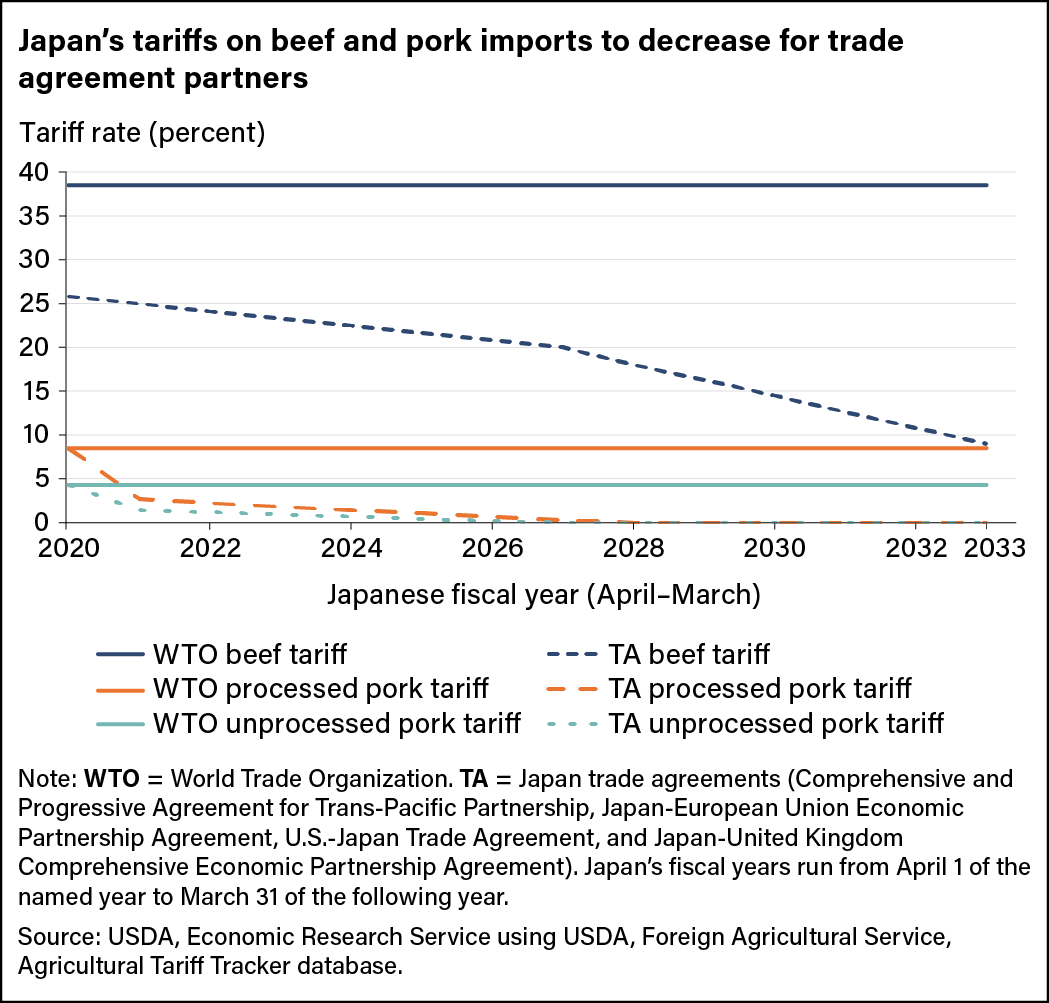

These agreements will reduce the import tariffs for these signatory countries from the current WTO rates in annual steps through Japan’s fiscal year (JFY) 2033, which runs from April through March. Japan’s WTO tariff rate on beef imports, for example, is set at 38.5 percent, but trade-agreement signatories will face a smaller tariff rate of 23.3 percent in JFY 2023, and that tariff rate will fall to 9.0 percent by JFY 2033. Similarly, Japan’s tariff rate on pork imports from WTO member countries is set at 8.5 percent for processed pork and 4.3 percent for unprocessed pork. From JFY 2028 onward, however, the tariff rate on imports of these products from trade-agreement signatories will drop to zero.

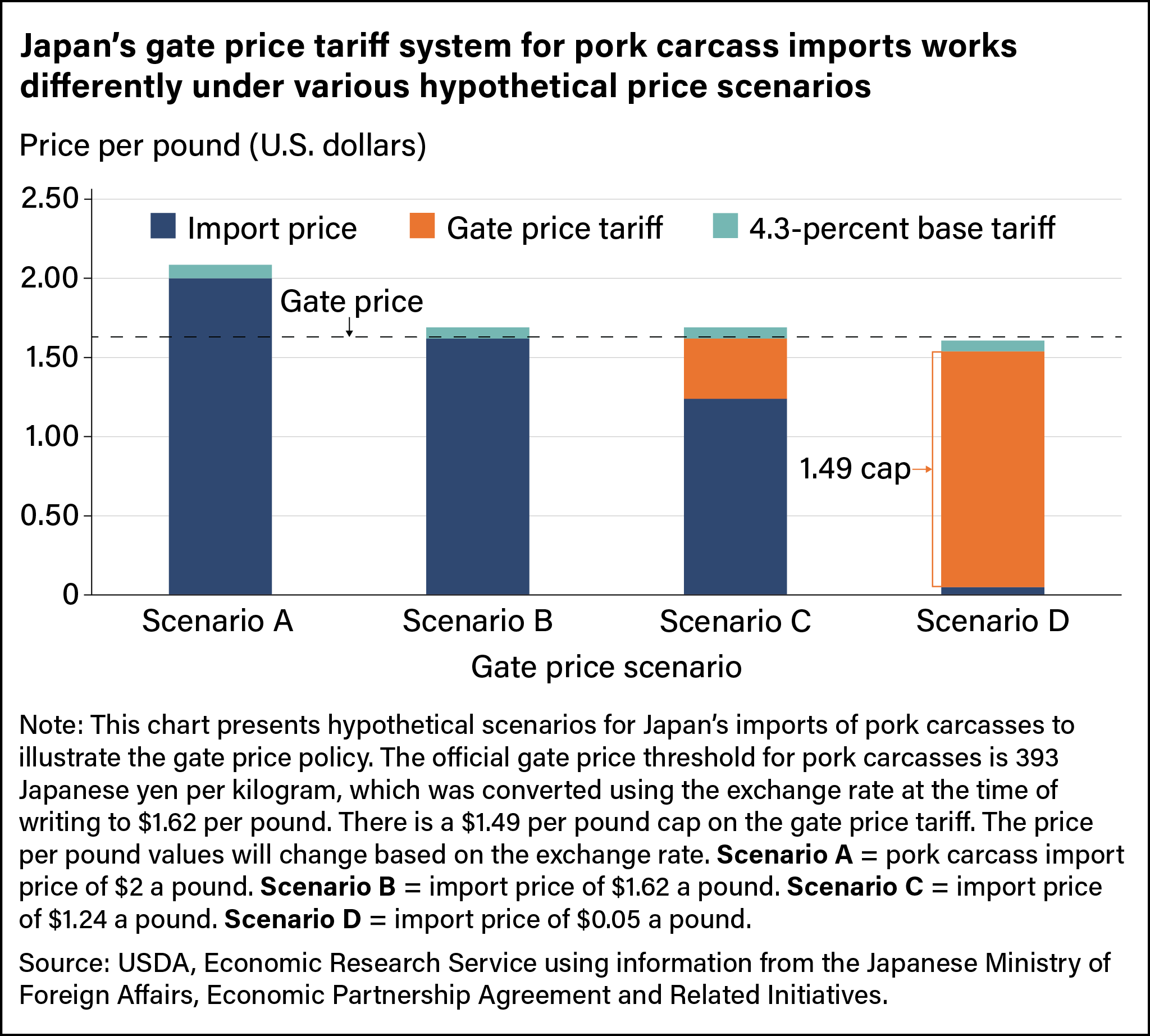

The trade agreements have other varying tariff mechanisms that are designed to regulate Japan’s volume of pork and beef imports. For pork, Japan continues to use a gate-price system. A gate price acts as a minimum price. If the price of imported pork is below that price, the system applies an additional tariff equal to the difference between the gate price and the price of the imported good. To illustrate how the system works, the chart below presents four gate price tariff scenarios for imports of pork carcasses, which face a 4.3-percent import tariff and for which the gate price is $1.62 per pound.

In Scenario A, a shipment of carcasses is imported at $2.00 per pound. Because this price is above the gate price, no gate price tariff is levied, and the importer pays only the 4.3-percent tariff (light blue area). In Scenario B, a shipment of carcasses is imported at the gate price of $1.62 per pound. Here as well, because the import price is not below the gate price, the gate price tariff is not levied, and the importer pays only the 4.3-percent tariff. Scenario C illustrates a case in which a shipment of carcasses is imported at $1.24 per pound. Since this price is below the gate price of $1.62 per pound, the importer pays the gate price tariff (orange area), which in this case amounts to $0.38 ($1.62 - $1.24 = $0.38) per pound. The importer must also pay the 4.3-percent tariff on the cumulative price of $1.62 per pound. Scenario D depicts a situation in which a shipment of pork carcasses is imported at $0.05 per pound. In this case, the difference between the gate price and the shipment is $1.57 ($1.62 - $0.05 = $1.57) per pound, but Japan’s gate price system caps the amount that can be charged at $1.49 per pound. So, in this case the gate price tariff would be that maximum of $1.49 per pound. The importer would also have to pay the 4.3-percent tariff on the cumulative price of $1.54 ($0.05 + $1.49 = $1.54) per pound.

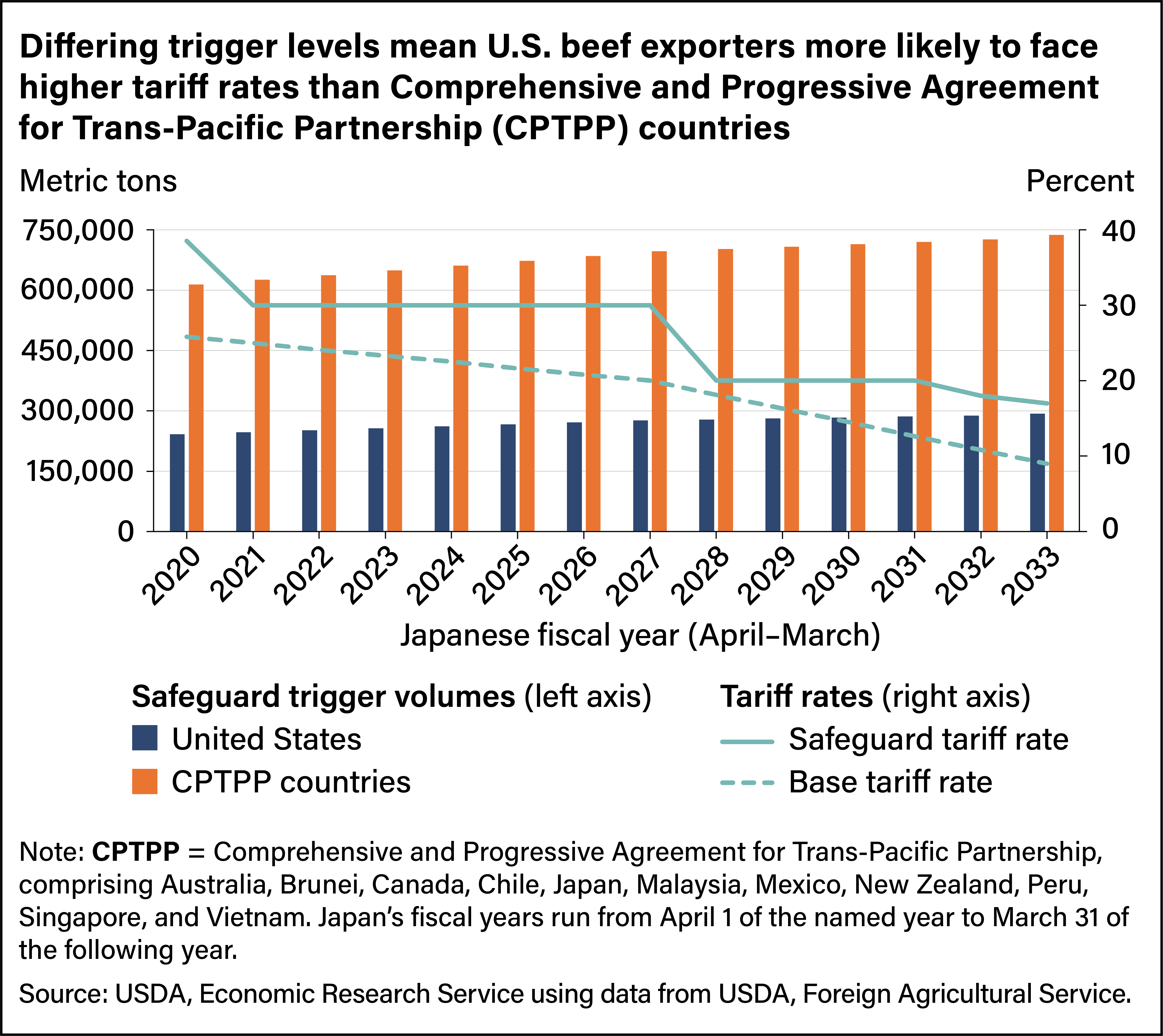

For beef, the trade agreements have put Japan’s major foreign beef suppliers on a relatively even playing field in terms of import tariff rates. Differences, however, exist across the trade agreements in the safeguard mechanisms, which apply an increased tariff rate for a minimum duration of 30 days when imports exceed a trigger volume. This situation may put U.S. exporters at a disadvantage. For example, the safeguards for the United States are triggered at a different level than they are for the CPTPP countries, even though the two regions supply Japan with roughly the same amount of beef. The trigger level for the United States is much lower, which means that the United States is more likely to trigger the safeguard mechanism, as it did in March 2021.

Conversely, the volume of CPTPP beef exports to Japan is unlikely to reach the trigger volume. In JFY 2020, beef exports to Japan from CPTPP trading partners were less than 54 percent of the trigger level. The CPTPP trigger level was set when the agreement was known as the TPP and included the United States and was set based on the combined imports from all TPP partners, including the United States. After the United States withdrew from the agreement, CPTPP exporters were left with extra capacity to increase exports. This presents a challenge not only for U.S. beef exporters but also for Japan's domestic producers, as it reduces their protection from international competition.

Japan and the United States have tried to address this situation. Japan's safeguard for U.S. beef imports was renegotiated in March 2022 to a triple-trigger system in which all three of the following conditions must be met before the tariff rate would increase on U.S. beef imports:

- Imports from the United States must exceed the trigger level outlined in the USJTA for that fiscal year,

- Imports of U.S. beef must exceed imports from the previous year, and

- Japan’s combined imports from the United States and CPTPP countries must exceed the CPTPP trigger level for that fiscal year.

Still, the likelihood of U.S. exports triggering the safeguard mechanism each year remains high, as does the likelihood of CPTPP exports expanding beyond the level originally envisioned.

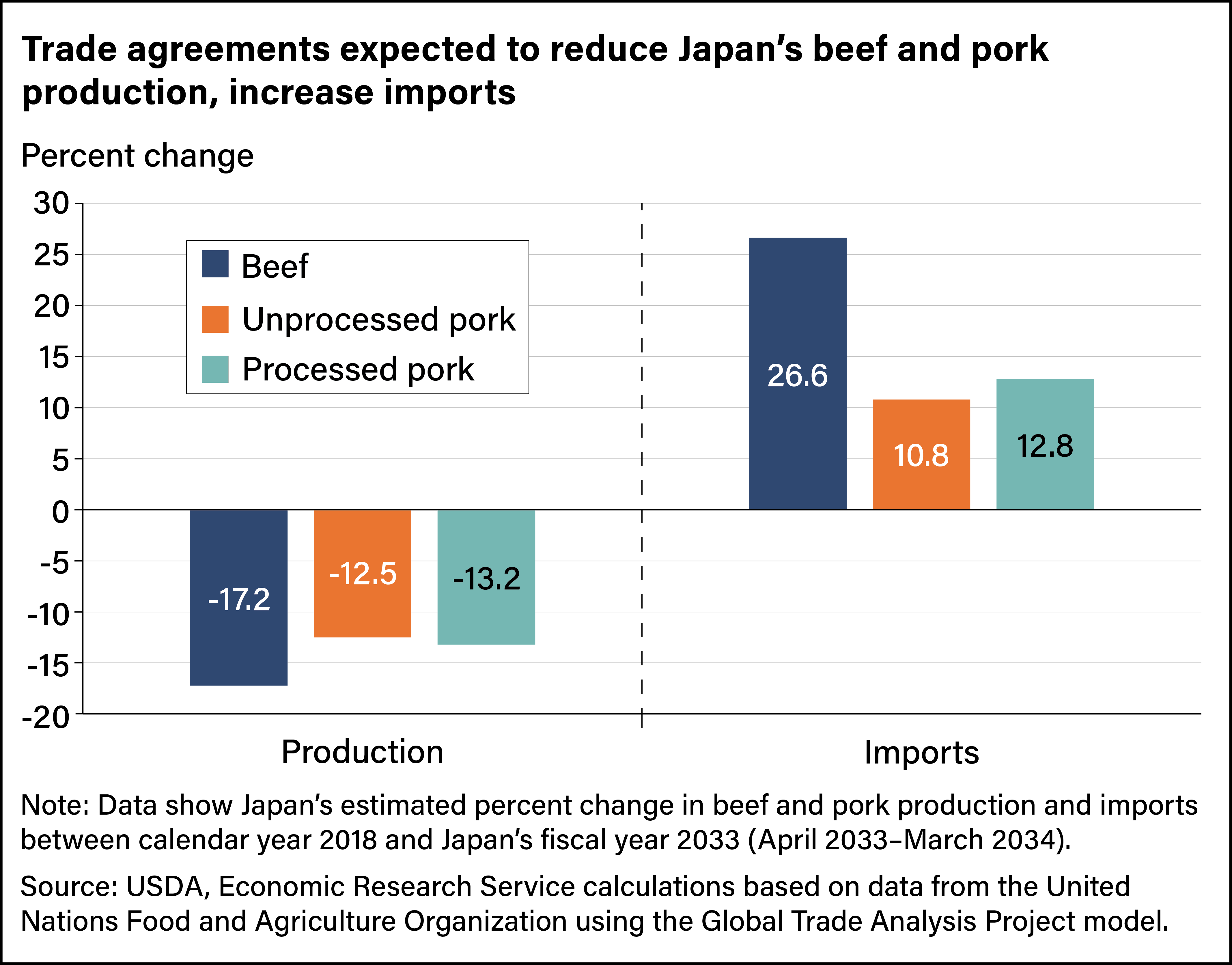

To better understand how the changes negotiated in these various trade agreements will affect Japan’s market for pork and beef, researchers at USDA’s Economic Research Service used the Global Trade Analysis Project (GTAP) model to examine the situation in JFY 2033, when the beef and pork tariff changes both will be fully implemented. Researchers compared the JFY 2033 levels with those seen in 2018, the last year before the trade agreements began to come into force. Japan’s beef production is estimated to decrease 17.2 percent, while unprocessed and processed pork products are estimated to decrease by 12.5 percent and 13.2 percent, respectively. On the other hand, Japan’s imports are estimated to increase 26.6 percent for beef, 10.8 percent for unprocessed pork, and 12.8 percent for processed pork products.

Overall, by JFY 2033, the four trade agreements are expected to increase the volume of pork and beef exported to Japan, but the GTAP model indicates the United States is expected to benefit most, in monetary terms. U.S. unprocessed pork exports to Japan are estimated to increase by $143.0 million and processed pork exports by $93.1 million. U.S. beef exports also are expected to grow, increasing an estimated $380.8 million. While this increase in beef exports is sizeable, the estimated increase is $33.1 million lower than it would have been had the model not accounted for the strong likelihood of U.S. exports triggering Japan’s safeguard mechanism.

Even though the situation for U.S. beef exporters is somewhat constrained because of the safeguard measures that effectively put a ceiling on the volume of U.S. beef that can be exported to Japan, the United States appears likely to maintain or even grow its market share in Japan’s beef and pork markets.

This article is drawn from:

- Davis, E.C., Sabala, E., Russell, D. & Beckman, J. (2023). The Impact of Recent Trade Agreements on Japan’s Pork Market. U.S. Department of Agriculture, Economic Research Service. ERR-317.

- Sabala, E. & Davis, E.C. (2023). The Impact of Japan’s Trade Agreements and Safeguard Renegotiation on U.S. Access to Japan’s Beef Market. U.S. Department of Agriculture, Economic Research Service. ERR-318.

You may also like:

- Countries & Regions. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Japan & South Korea. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Morgan, S., Gale, F., Beckman, J., Sabala, E., Ufer, D.J., Valcu-Lisman, A. & Zeng, W. (2023, March 30). Removing Nontariff Import Barriers Could Increase China’s Imports of Pork, Beef, Corn, and Wheat, ERS Research Shows. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Trade Policy & World Trade Organization (WTO). (n.d.). U.S. Department of Agriculture, Economic Research Service.