Global Fertilizer Market Challenged by Russia’s Invasion of Ukraine

- by Jennifer Kee, Lila Cardell and Yacob Abrehe Zereyesus

- 9/18/2023

Highlights

- The Russian invasion of Ukraine in February 2022 exacerbated already high food and fertilizer prices, which had increased during the COVID-19 pandemic.

- In the aftermath of Russia’s invasion of Ukraine, global powers imposed trade restrictions such as bans, quotas, and duties on fertilizer, affecting fertilizer trade and agricultural production, particularly for staple grains.

- After price spikes in April 2022, fertilizer prices returned to price levels seen before the invasion of Ukraine. As of March 2023, prices remained above 2021 levels and uncertainties remained, especially for low-income countries.

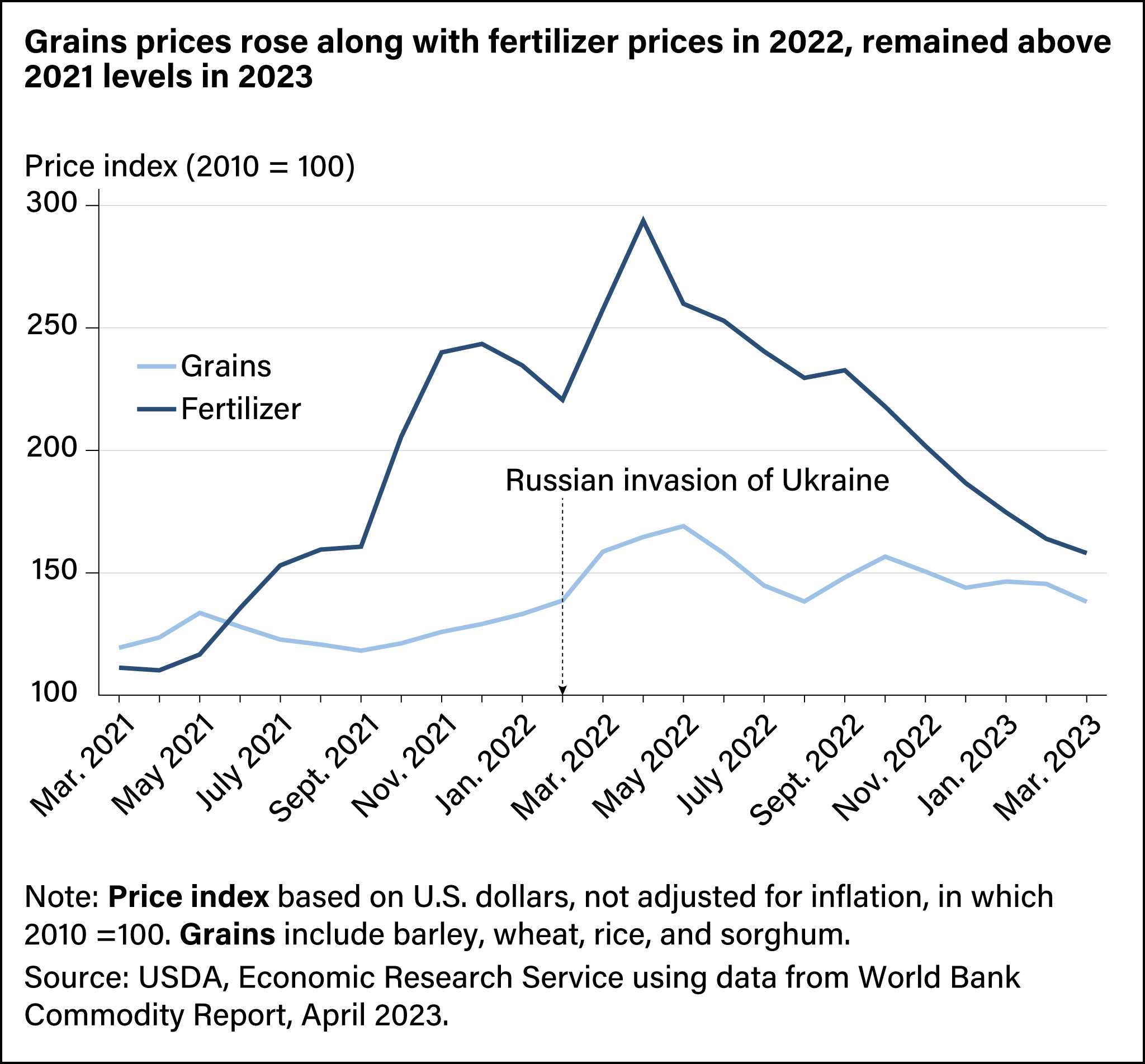

When Russia invaded Ukraine in February 2022, fertilizer prices already were on the rise. The Coronavirus (COVID-19) pandemic, with its ensuing supply chain disruptions and transportation bottlenecks, had challenged the world’s ability to produce and deliver fertilizer. In August 2021, most fertilizer prices were 25 percent above those in March 2021. The Russian invasion in early 2022 led to additional transportation interruptions in the Black Sea region and enactment of new trade restrictions. That curtailed already short fertilizer supplies, driving up prices over 50 percent from February to April 2022.

Because fertilizer is important for grain production, shortages and high prices affect the entire food supply chain. According to the 2022 Commodity Costs and Returns data from USDA’s Economic Research Service, fertilizer costs account for nearly 45 percent of operating expenses for U.S. wheat and corn farms compared with 23 percent for U.S. soybean farms. In response to high fertilizer prices, farmers may adjust their production practices. They might use fertilizer remaining from the previous growing season, reduce planted acreage of some crops, or shift acreage to crops such as soybeans that require less fertilizer. For example, in 2022, U.S. planted acreage decreased for corn and wheat but increased for soybeans. Some may simply reduce the use of fertilizer altogether, which can result in lower yields, potentially contributing to higher commodity prices.

As the Black Sea region conflict continues in its second year, fertilizer prices have fallen, but trade challenges continue to contribute to uncertainty in global markets. As of June 2023, USDA showed increases in planted acreage for corn and wheat, while soybean acreage remained steady. In addition, commodity prices have risen, supporting those projections.

Russia’s Invasion of Ukraine Resulted in Further Restrictions in Fertilizer Trade

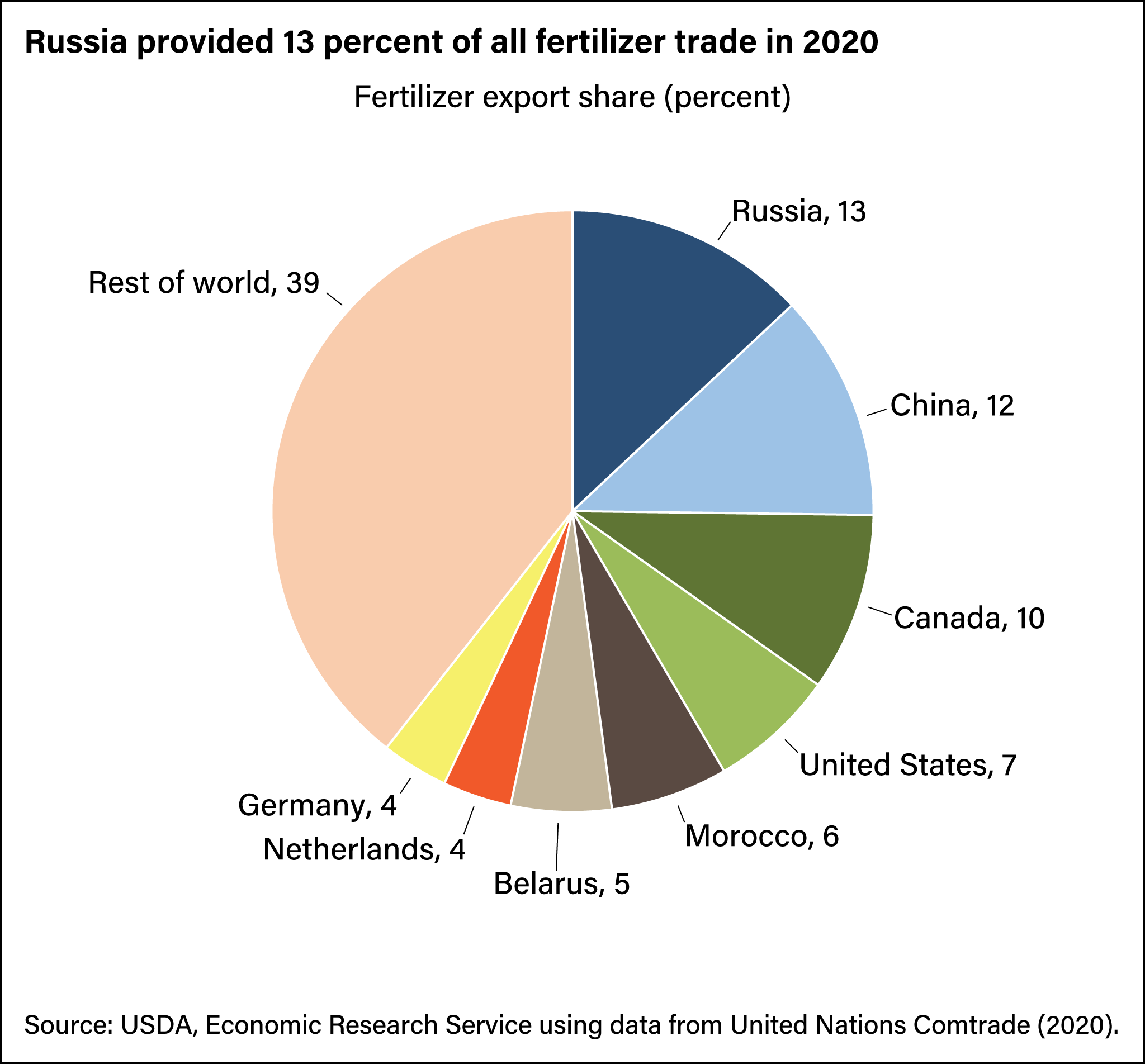

In 2020, the most recent year for which fertilizer trade data are available, Russia and its neighbor Belarus were the world’s top fertilizer exporters, accounting for nearly 20 percent of the three major types traded globally: nitrogen, phosphate, and potash. China had the second largest export share with 12.2 percent, followed by Canada, the United States, and Morocco. According to the World Bank, Russia accounted for 16 percent of urea (a source of nitrogen) exports and 12 percent of phosphate exports. Russia and Belarus combined provided 40 percent of global potash exports. In 2020, the United States was one of the main destinations for Russian and Belarusian fertilizer, along with Brazil, China, and India. While the United States was a top producer of nitrogen and phosphate, it also imported significant amounts of Russian potash.

Trade restrictions already had stymied the flow of fertilizer before the invasion of Ukraine. In 2021, the year before the conflict started, the European Union (EU) and the United States imposed sanctions on imports of potash from Belarus, and China imposed a ban in July 2021 on their exports of phosphates to preserve domestic fertilizer supplies. In February 2022, after Russia’s invasion of Ukraine, the EU imposed sanctions on individual oligarchs who owned fertilizer industries and on Russian potash. It also restricted the transit of fertilizer through EU territory. Canada placed a 35-percent tariff on Russian fertilizers in March 2022. At the same time, Russia prohibited the export of ammonium nitrate fertilizers until May 2022. On the other hand, the United States, seeking to avoid fertilizer supply shortages and price increases, did not impose sanctions on Russian fertilizers. In July 2022, the U.S. Department of Treasury issued a fact sheet to clarify that sales or transport of Russian fertilizers to the United States were exempt from sanctions. With concerns growing about global food insecurity, the EU eased its sanctions in December 2022 by allowing individual EU state members to unfreeze the assets of Russian fertilizer oligarchs to support the transport of food and fertilizer. Meanwhile, Russia set quotas on the export of fertilizers until May 2023 to maintain sufficient fertilizer supplies for its own farmers. As of January 2023, Russia imposed a 23.5-percent duty on all fertilizer exports with a price above $450 per ton.

Fertilizer Prices Rose Even More After Russian Invasion of Ukraine, Later Returning to 2021 Levels

Russia mainly supplies five types of fertilizers to markets around the world:

- Potassium chloride, or muriate of potash (MOP)

- Phosphate rock

- Diammonium phosphate (DAP)

- Urea

- Triple superphosphate (TSP)

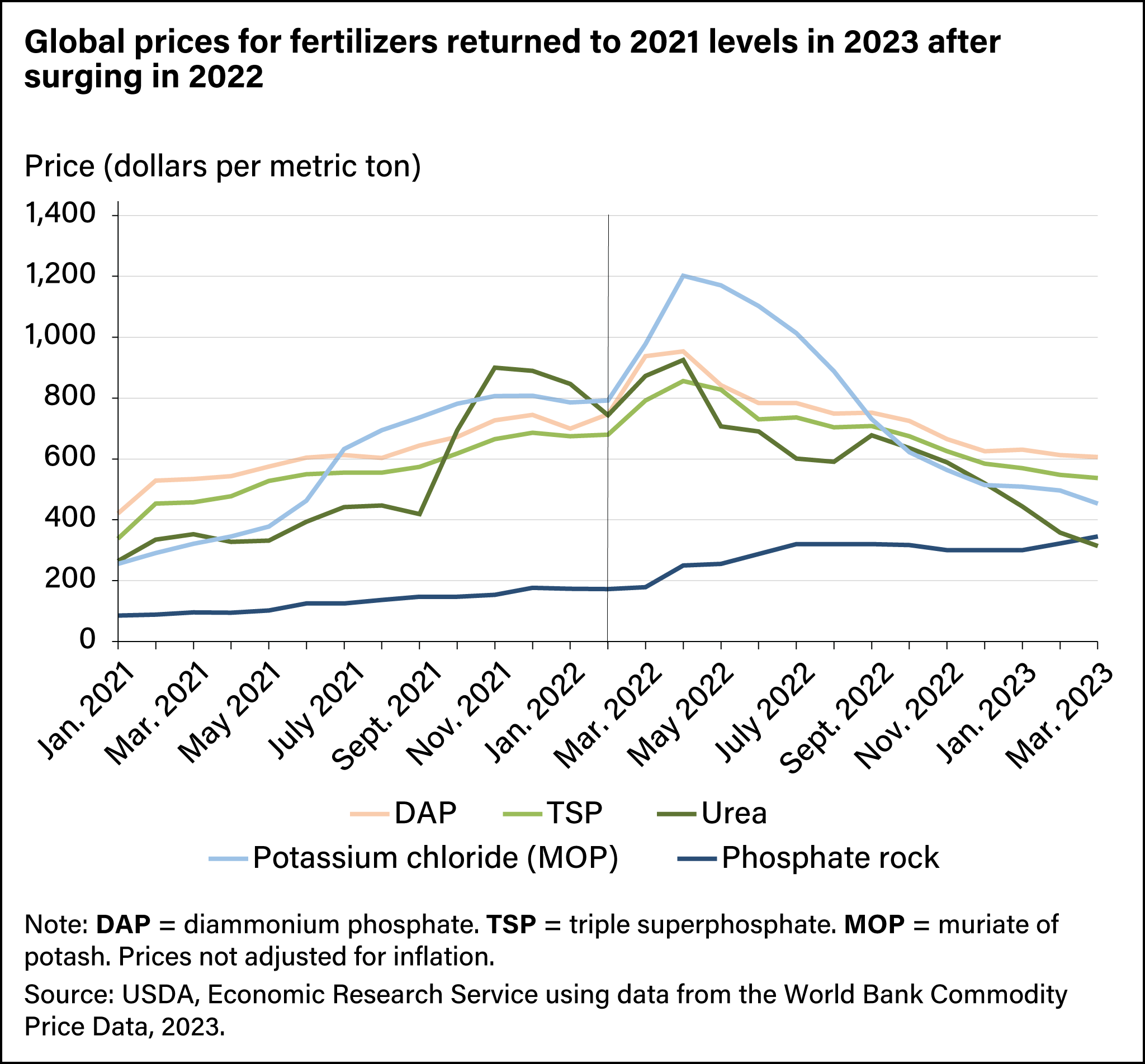

During spring 2022, prices rose for all five fertilizers, but the increase for MOP was more pronounced. The price of MOP, mainly exported by Russia and Belarus, was 53 percent higher in April 2022 compared with January 2022, a larger increase than any of the other fertilizers. In those 3 months, prices rose 38 percent for phosphate rock, 36 percent for DAP, and 9 percent for urea. The price for TSP rose 27 percent, although countries other than Russia also export that type of fertilizer.

When sanctions on Russia and Belarus impeded fertilizer trade, importers and other suppliers made adjustments. Top fertilizer importers, such as Brazil, imported from other suppliers to manage shortfalls, according to the International Food Policy Research Institute. In response to increasing demand for their fertilizer, other suppliers, such as Canada and Morocco, increased their production capacity for potash or phosphate. In addition, prices of natural gas, vital to the manufacture of fertilizer, fell in Europe, accommodating increased fertilizer production.

By March 2023, fertilizer export prices had returned to levels seen before the invasion. MOP and urea prices returned to 2021 levels, dropping 62 percent and 66 percent, respectively, compared with the peaks in April 2022. While the price decrease in MOP was steady, urea prices fluctuated moderately in mid-2022. Prices for DAP and TSP also declined by more than 36 percent compared with April 2022. Conversely, the phosphate rock price continued to increase.

Higher Fertilizer Prices, Lower Yields, Higher Food Prices

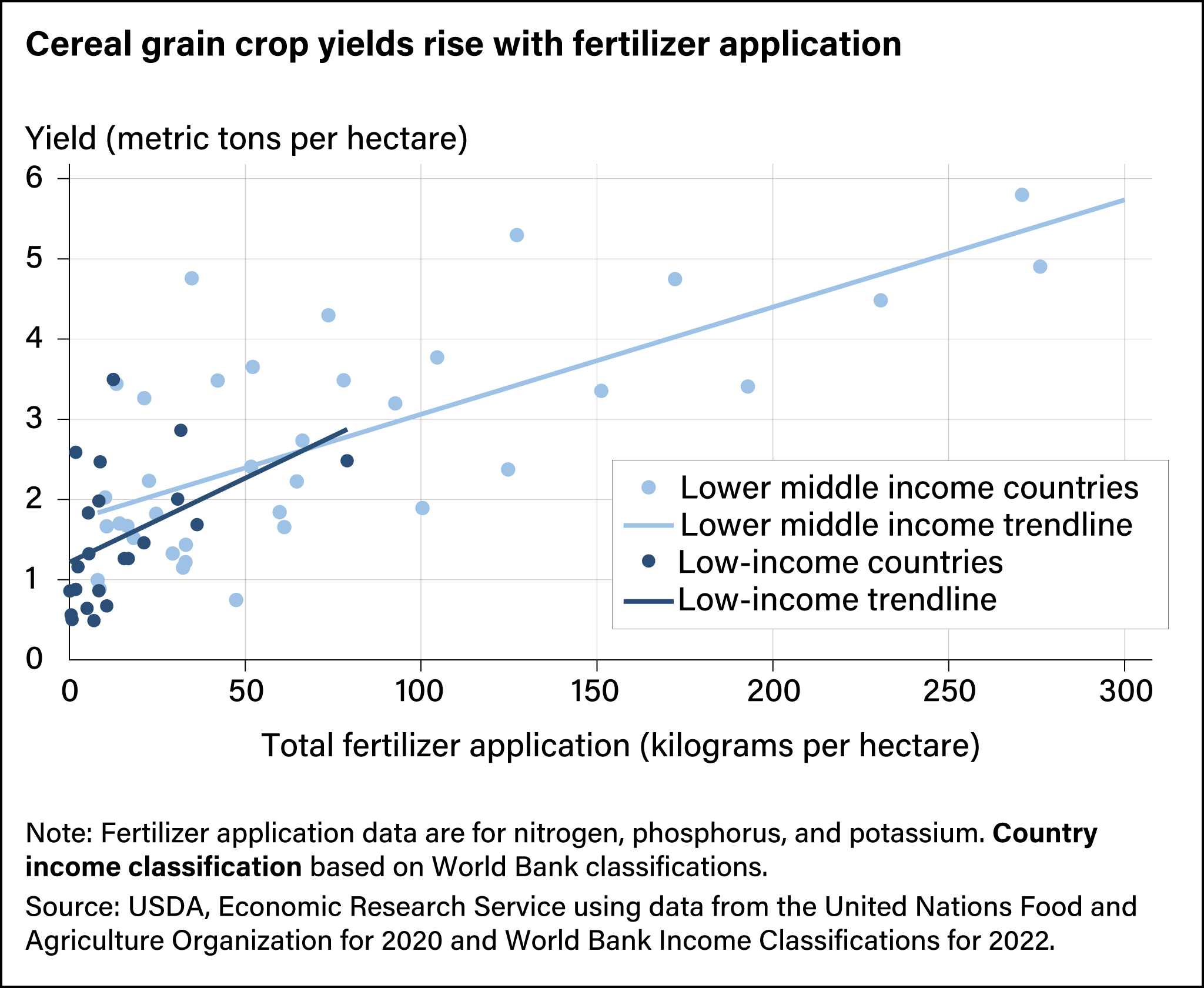

Fertilizer is a key input in food production, especially for staple grains, so rising prices can affect food supply. If farmers limit their use of fertilizer because of higher costs, their yields could decline. The chart below shows the relationship between fertilizer application and cereal yields, based on data from the Food and Agriculture Organization of the United Nations. The color of the dots corresponds with income categories for countries as defined by the World Bank. On average, cereal yields on fertilized acres are higher. Farmers in low- and lower-middle income countries tend to apply less fertilizer, so reducing the application may further reduce their crop yields.

Russia’s invasion of Ukraine drove up fertilizer prices, grain prices also increased, reaching a peak in May 2022. The easing of export restrictions and sanctions and the partial reopening of transit through the Black Sea contributed to the resiliency of grain markets in 2022. Wheat markets withstood reductions in Black Sea exports as importers found alternative supplies from Australia, the EU, and Canada. Although grain prices have fallen, as of March 2023, they were still about 20 percent higher than 2 years earlier.

This article is drawn from:

- Zereyesus, Y.A., Cardell, L., Valdes, C., Ajewole, K., Zeng, W., Beckman, J., Ivanic, M., Hashad, R.N., Jelliffe, J. & Kee, J. (2022). International Food Security Assessment, 2022–32. U.S. Department of Agriculture, Economic Research Service. GFA-33.

You may also like:

- Commodity Costs and Returns. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Market Monitor. (2023). Agricultural Market Information System. No. 106.

- EU sanctions against Russian explained. (2023). European Council/Council of the European Union.

- Food outlook: Biannual report on global food markets. (2022). United Nations, Food and Agriculture Organization.

- Hebebrand, C. & Glauber, J. (2023). The Russia-Ukraine war after a year: Impacts on fertilizer production, prices, and trade flows. International Food Policy Research Institute.

- Keithly, J. & Nti, F. (2022). Impacts and repercussions of price increases on the global fertilizer market. U.S. Department of Agriculture, Foreign Agricultural Service.

- Prospective plantings. (2023). U.S. Department of Agriculture, National Agricultural Statistics Service.

- Prospective plantings. (2022). U.S. Department of Agriculture, National Agricultural Statistics Service.

- Commodity markets outlook: Urbanization and commodity demand. (2021). World Bank.