U.S. Exports for Most Major Meat Commodities Grew in 2018

- by Lekhnath Chalise, Kim A. Ha, Mildred Haley, Russell Knight and Alex Melton

- 5/1/2019

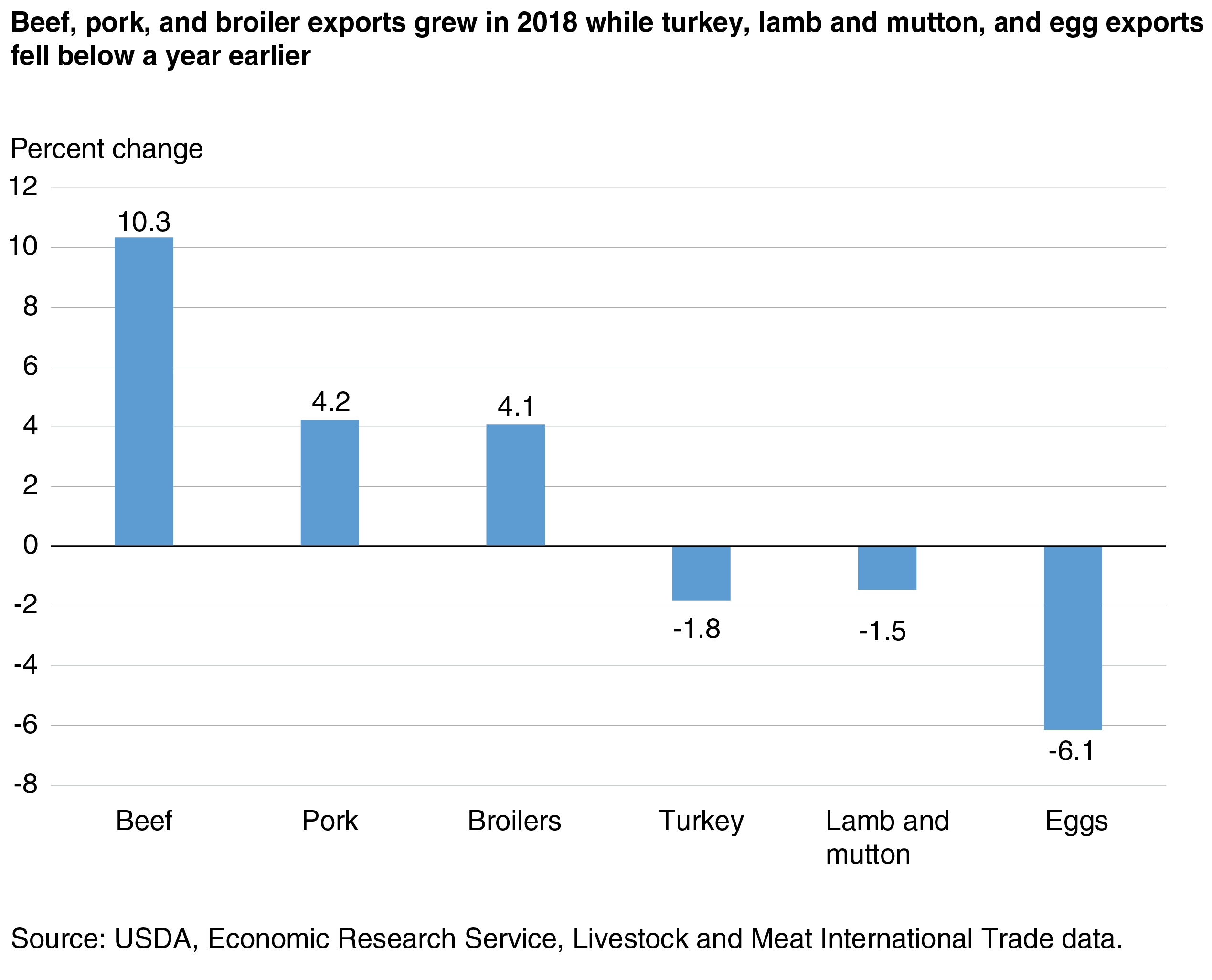

U.S. exports of beef, pork, and broilers (young chickens) were strong in 2018, driven by domestic production increases and favorable foreign demand. Compared to the previous year, beef exports increased 10.3 percent, pork exports increased 4.2 percent, and broiler exports were 4.1 percent higher than in 2017. Lamb and mutton exports were 1.5 percent lower despite stronger domestic production. Turkey exports declined 1.8 percent, with lower turkey production likely a contributing factor. Egg exports were 6.1 percent lower in 2018 than a year earlier, while production increased 2.1 percent year over year. The ERS Livestock and Meat International Trade Data product provides monthly and annual data on U.S. meat and livestock exports and imports. The data are broken down by country and commodity and are available for cattle, beef, hogs and pigs, pork, lamb and mutton, broilers, turkeys, and eggs. An analysis of the data helps explain the stories behind the numbers that drove up exports in 2018 for most major meat commodities.

Record U.S. beef exports continued in 2018, driven in part by substantial growth in exports to South Korea

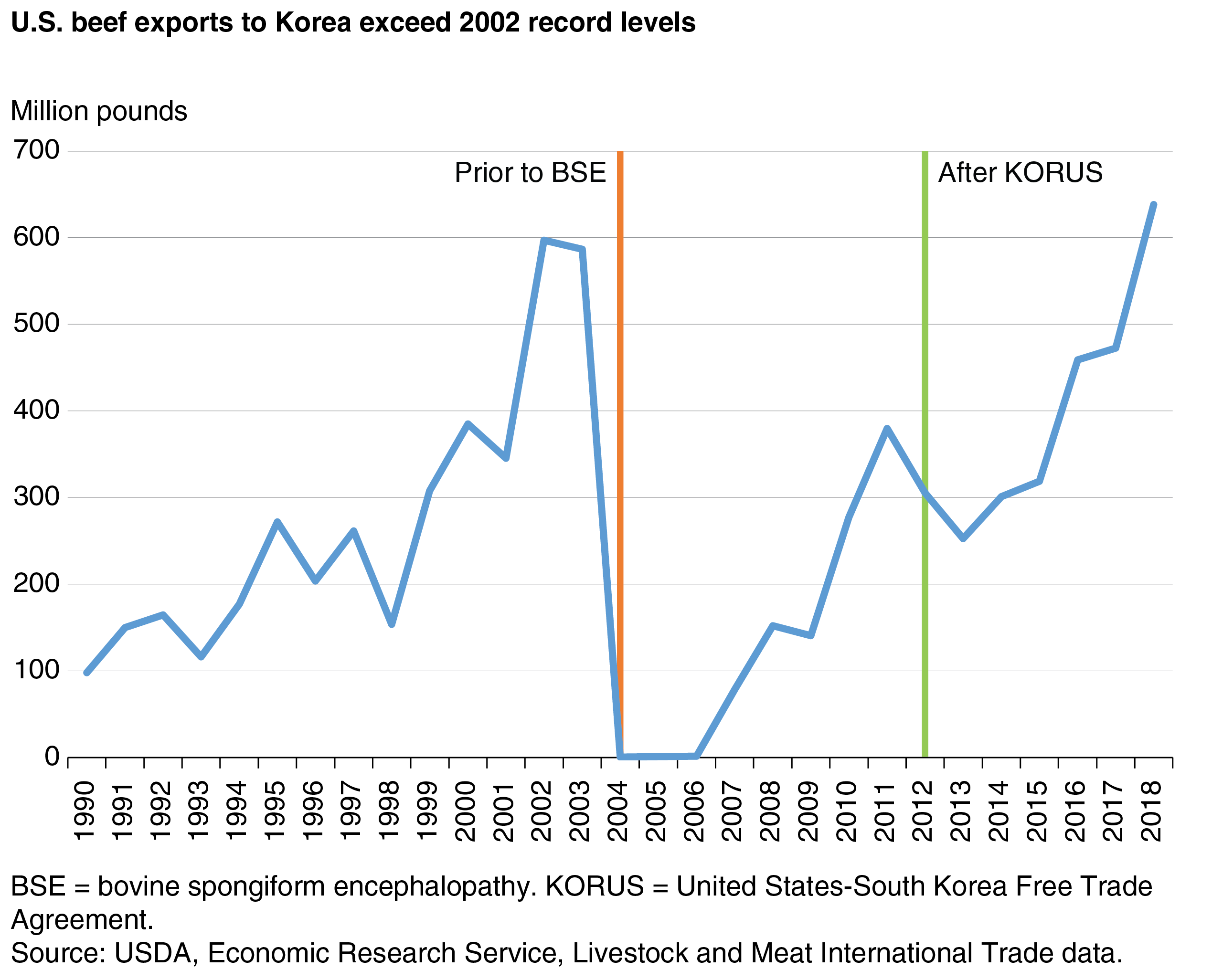

U.S. beef exports to world markets have grown sharply for 3 consecutive years. Since 2015, exports of beef have grown at over 10 percent per year. The 3.2 billion pounds of beef exported in 2018 marked a 10.3-percent increase from 2017. All major beef export destinations increased their imports of U.S. beef except for Hong Kong and Canada. Most notable of these increases was South Korea, which has significantly increased its U.S. beef imports every year since 2013.

Fifteen years ago, U.S. beef was banned in South Korea after the discovery of bovine spongiform encephalopathy (BSE) in the United States at the end of 2003. Although the United States gradually reentered the market after the ban was partially lifted in 2006, U.S. beef exports have markedly accelerated in recent years since implementation of the 2012 United States-South Korea free trade agreement (KORUS) that reduced tariffs and non-tariff barriers. South Korea has become a booming market for U.S. beef that contributed more than half of the increase in the volume of U.S. exports in 2018, with 35 percent year-over-year growth. Further, more than 20 percent of total U.S. beef exports were shipped to South Korea in 2018. Likely drivers of this growth included strong consumer demand; lower tariffs than the next largest competitor, Australia; greater exportable supplies in the United States; and a relatively weaker U.S. dollar in the first half of the year. As a result, exports exceeded the pre-BSE peak level of 597 million pounds in 2002 to reach 638 million pounds in 2018, becoming the largest supplier of beef to South Korea.

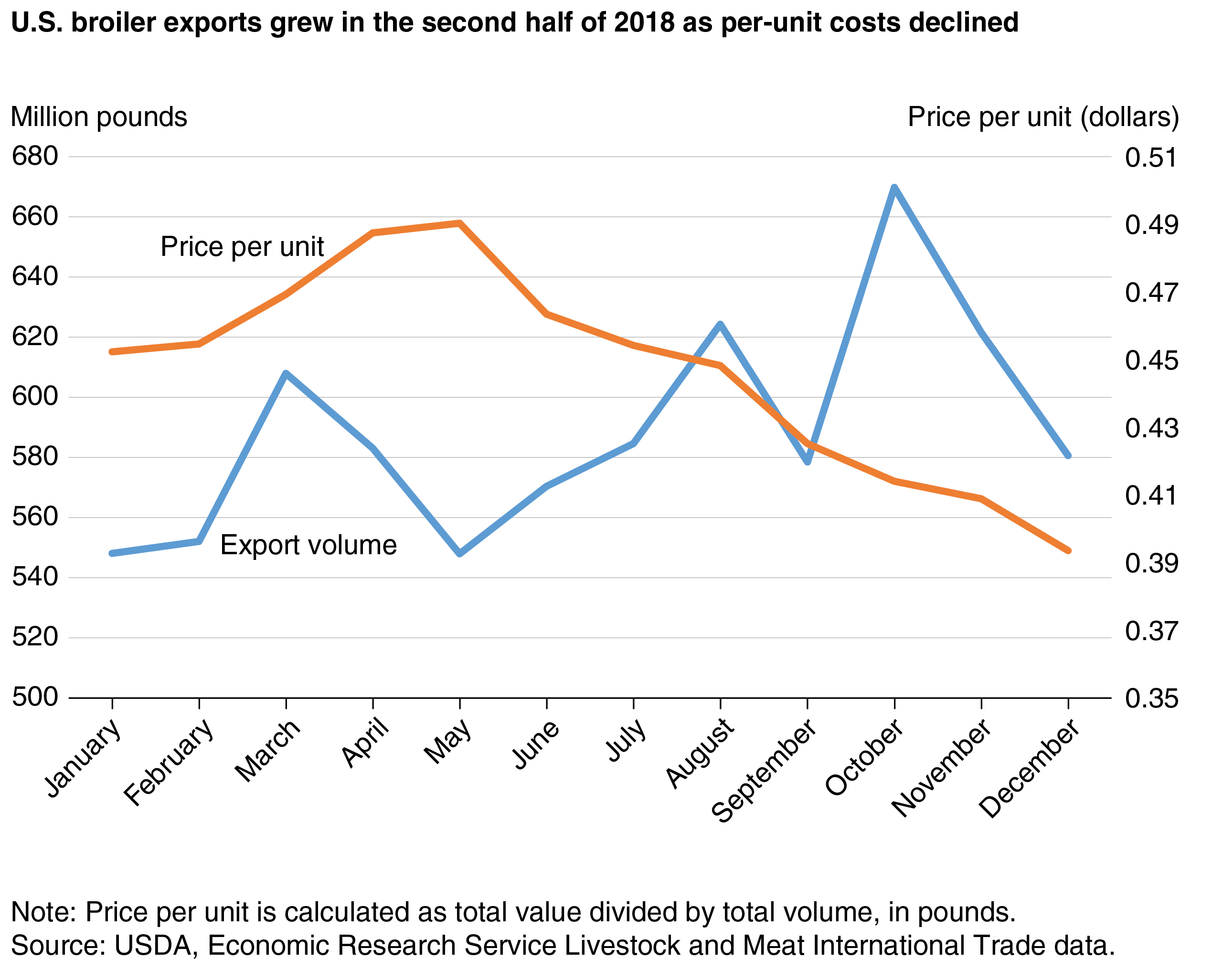

Declining unit values supported strong U.S. broiler exports in the second half of 2018

On an annual basis, U.S. broiler exports in 2018 increased 4 percent compared to 2017, but growth was much higher in the second half (+6 percent) of 2018 than in the first half (+2 percent). Broiler shipments in the second half of the year were encouraged by competitive prices of U.S. broiler meat. Beginning in May 2018, the average value per unit of U.S. broiler meat exports began to fall and continued downward through the remainder of the year, reflecting low domestic prices. As prices fell, monthly export volumes began increasing, reaching a peak of nearly 670 million pounds in October 2018 before falling at the end of the year.

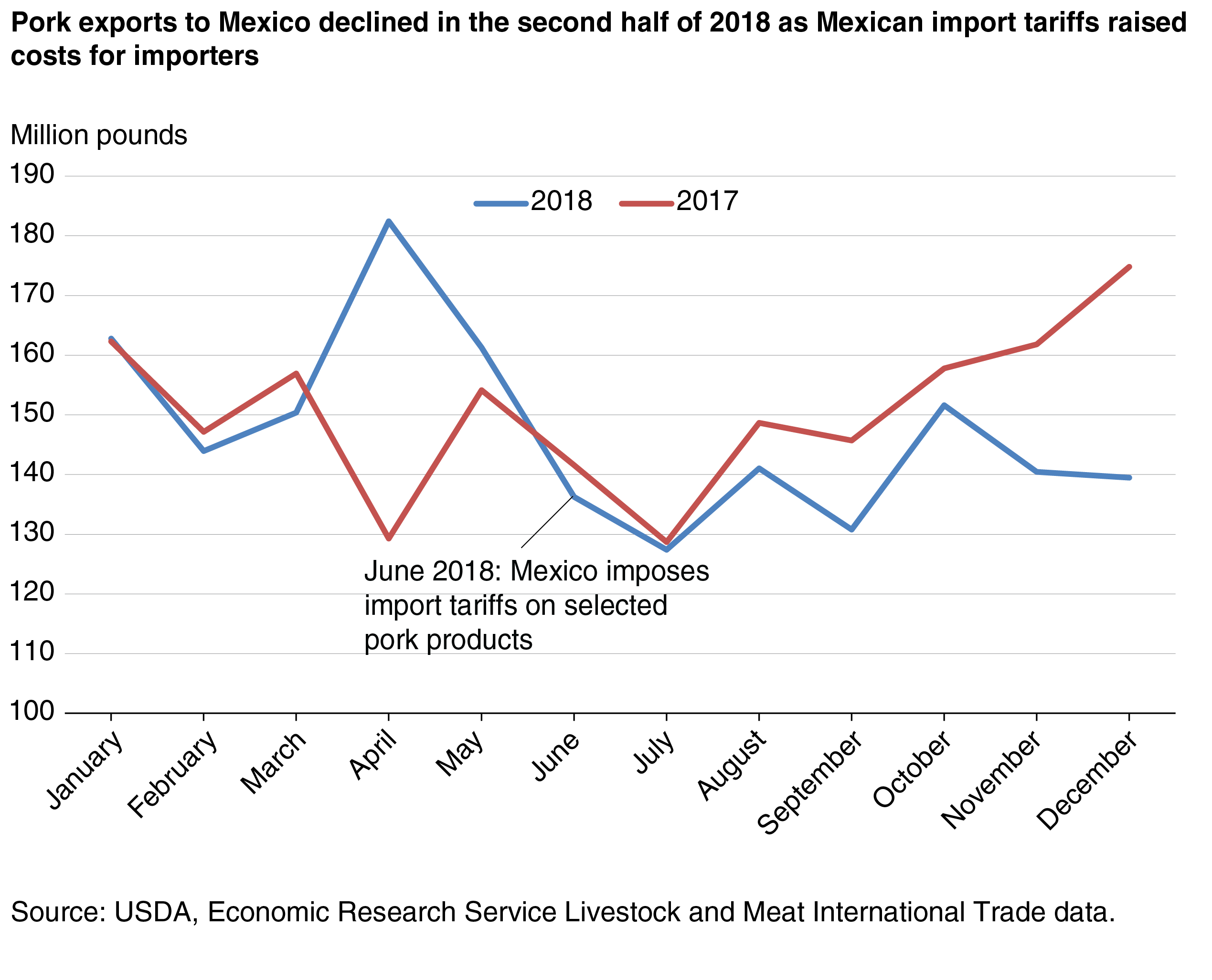

Pork exports grew, but exports to Mexico faltered in late 2018

U.S. pork exports grew by 4 percent in 2018 relative to 2017, but exports to its largest pork trading partner, Mexico, decreased over the same period. In contrast to broiler meat, which grew most strongly in the second half of 2018, U.S. pork exports to Mexico were much stronger in the first half of the year.

In June 2018, Mexico imposed tariffs on most U.S. pork products. Following the imposition of tariffs, monthly pork exports to Mexico fell below 2017 levels and remained below year-earlier levels for the remainder of 2018. Given that the tariff rate for most pork products was 20 percent, an even larger year-over-year decline could be expected. However, average U.S. pork export unit costs fell, compensating for the increased cost to importers from the tariffs. Prior to the imposition of tariffs, however, pork exports jumped relative to a year earlier. It is possible that demand from Mexican importers increased in anticipation of the impending cost increases that tariffs produce.

This article is drawn from:

- Livestock and Meat International Trade Data. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Haley, M. (2019). Livestock, Dairy, and Poultry Outlook: March 2019. U.S. Department of Agriculture, Economic Research Service. LDP-M-297.