Changes in U.S. Dairy Commercial Exports and Domestic Commercial Disappearance

- by Jerry Cessna and Lindsay Kuberka

- 2/2/2015

Traditionally, the U.S. dairy industry was driven by the domestic market; only a small fraction of dairy products was exported. Since about 2004, however, exports have accounted for a growing share of U.S. dairy product demand, reaching a value of nearly $7 billion in 2013. Export growth has been greatest for dry manufactured dairy products with relatively high skim-solids content (protein, lactose, minerals, and trace elements found in milk), such as nonfat dry milk (NDM) and dry whey. These products are typically easier to transport, in contrast to bulky, perishable products, such as most beverage milk products, which are more expensive to transport. Domestic demand has grown more for products with relatively high milk-fat content, such as butter and most types of cheese.

Milk-Equivalent Measures

Dairy manufacturers separate and reassemble milk components to produce a wide array of diverse products. To analyze the dynamics of domestic and foreign demand for U.S. milk products, the products are converted to a common milk equivalent. On average, cow’s milk in the United States consists of about 87.5 percent water, 8.8 percent skim solids, and 3.7 percent milk fat. ERS uses two measures of milk equivalence: one based on the milk-fat content and the other based on the skim-solids content of the milk used to produce the various products.

For example, based on the milk-fat content of typical cow’s milk, it takes a relatively large amount of milk (21.8 pounds) to produce 1 pound of butter, but butter contains only a small amount milk skim-solids (the equivalent of 0.12 pounds of milk). Therefore, the milk equivalent of butter is much higher on a milk-fat basis than a skim-solid basis. By contrast, 1 pound of NDM requires a large amount of skim solids (the equivalent of 11.6 pounds of milk), but very little milk fat (the equivalent of only 0.22 pounds of milk).

What Is Commercial Disappearance?

USDA’s Economic Research Service (ERS) measures dairy demand using commercial disappearance. Total commercial disappearance is calculated as a residual after accounting for production, imports, USDA net removals, and changes in commercial stocks. The proxy is called “commercial” since it excludes USDA net removals (price support purchases plus subsidized exports, minus USDA sales to back to the commercial market).1 Commercial exports are subtracted from total commercial disappearance to calculate domestic commercial disappearance. ERS provides estimates of these measures on both milk-fat and skim-solids milk-equivalent bases.

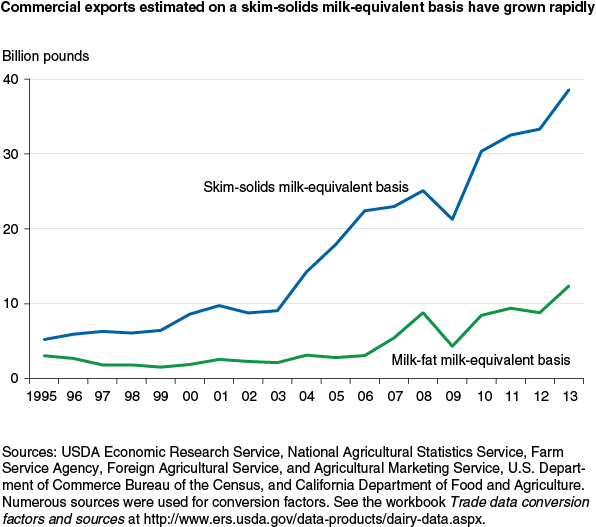

Growth in Commercial Exports

U.S. commercial exports have grown since 2003, largely due to increased world demand, particularly from Mexico and Southeast Asia. Also, as the European Union and the United States have reduced export subsidies, commercial exports have replaced Government-subsidized exports. Commercial exports have grown much more on a skim-solids milk-equivalent (m.e.) basis than on a milk-fat m.e. basis. In 1995, commercial exports calculated on a skim-solids milk-equivalent-basis exceeded the milk-fat milk-equivalent by 2.1 billion pounds per year. By 2013, the difference had grown to 26.2 billion pounds per year. In recent years, the United States has become a leading exporter of dry whey products and NDM, products with very high skim-solids content.

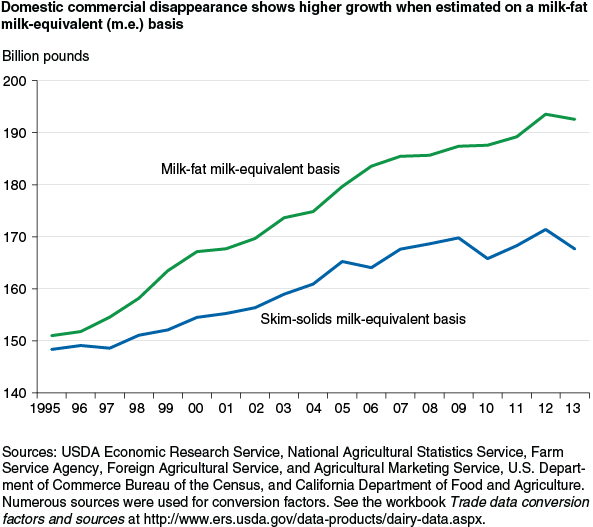

Growth in Domestic Commercial Disappearance

In contrast to commercial exports, domestic use has grown more on a milk-fat milk-equivalent basis than on a skim-solids milk-equivalent basis. In 1995, domestic commercial disappearance, calculated as a milk-fat equivalent, exceeded the skim-solids equivalent by 2.7 billion pounds. By 2013, the difference had grown to 24.9 billion pounds. Over time, Americans have increased per capita consumption of cheese, butter, and other products with relatively high milk-fat content. Per capita consumption of fluid beverage milk has declined, partly explaining the lower growth in demand for skim solids. Fluid beverage milk has lower milk-fat content and higher skim-solids content than milk as it comes from the cow. Changes in U.S. domestic dairy demand have contributed to the availability of high skim-solids products for export, such as NDM and dry whey.

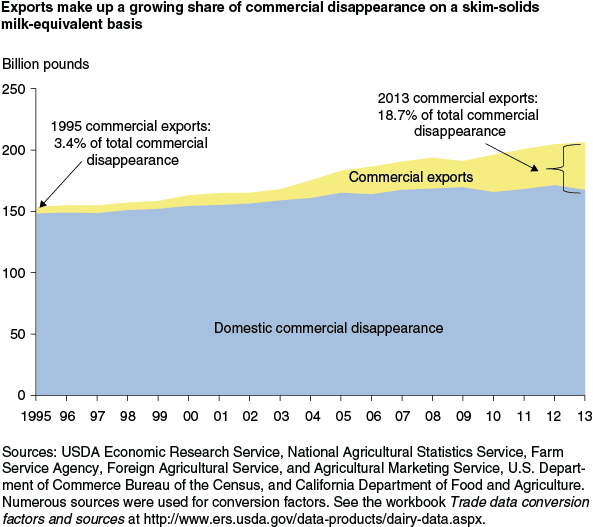

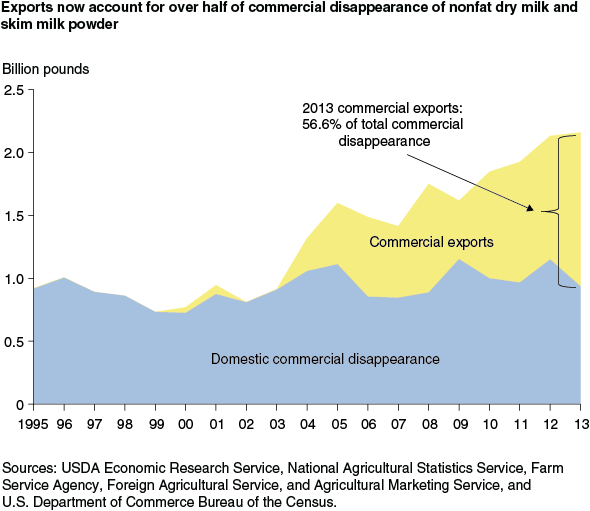

Commercial Exports as Growing Share of Total Commercial Disappearance

Exports have become a greater share of total dairy product demand over time. In 1995, on a milk-fat milk-equivalent basis, commercial exports made up 2.0 percent of total commercial disappearance. By 2013, the share had grown to 6.0 percent. On a skim-solids milk-equivalent basis, the commercial export share of total commercial disappearance grew from 3.4 percent in 1995 to 18.7 percent in 2013. Commercial exports of NDM and skim milk powder (SMP) played a large role in this increase. While commercial exports of NDM and SMP were very low in the 1990s (zero in some years), commercial exports exceeded domestic commercial disappearance by 2013, making up 56.6 percent of total NDM and SMP commercial disappearance. In recent years, major U.S. markets for NDM and SMP have been Mexico, China, Philippines, and Indonesia.

1USDA net removals were significant in earlier years but a minor factor since 2004. The Dairy Products Price Support Program and the Dairy Export Incentive Program were repealed by the Agricultural Act of 2014.

This article is drawn from:

- Dairy Data. (n.d.). U.S. Department of Agriculture, Economic Research Service.