Long-Term Agricultural Productivity Growth Lowers Agricultural Commodity Prices, Short-Term Productivity Changes Contribute to Price Variability

- by Sun Ling Wang

- 4/6/2015

U.S. food grain prices rose to more than 2.5 times their 2000 level by 2008, and the prices of feed grain more than doubled over the same period. While overall agricultural commodity prices briefly declined in 2009, they rebounded in the following years. To explain the rise of agricultural commodity prices, discussion has focused on demand-side factors, such as the growing demand for food in emerging countries and the increased use of crops in biofuel production. However, agricultural commodity prices also are affected by supply-side factors such as an unexpected increase or decline in agricultural productivity growth or oil prices.

USDA’s Economic Research Service measures total factor productivity (TFP), a measure of agricultural productivity that takes into account all outputs produced at the farm and all inputs used in the production process. TFP measures changes in the efficiency with which inputs are transformed into outputs. The estimated TFP growth rate is the difference between aggregate output growth and aggregate input growth. Productivity growth is the major driver of U.S. agricultural expansion. According to USDA-ERS’s productivity estimates, U.S. agricultural TFP in 2011 was nearly 2.5 times its 1948 level. This means that U.S. farms can produce 150 percent more agricultural output with the same level of total input use. Continuing growth in U.S. agricultural productivity can not only free land, labor, and other inputs for use in other sectors along the economic growth but can also help lower agricultural commodity prices for consumers.

Between 1948 and 2011, the real price (deflated by consumer price index (CPI)) of agricultural outputs declined by about 60 percent; this indicates that the price of agricultural produce grew much more slowly than the overall consumer price level. While long-term agricultural productivity is driven by innovations in animal and crop genetics, farm equipment, chemicals, and farm organization, short-term TFP growth can fluctuate considerably from year to year in response to unexpected changes in output produced, input use, or both, due to transitory events, such as adverse weather, pest or animal disease. The short-term fluctuation in TFP growth rates can affect agricultural commodity prices as well.

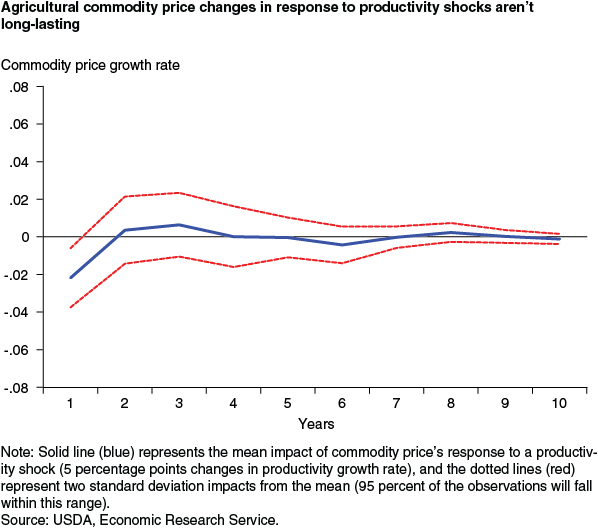

Given the complexity of agricultural commodity price variability, ERS researchers used historical data and a model that accounted for the impacts of unexpected changes in foreign demand, domestic food demand, oil price, and agricultural productivity growth to decompose unpredictable changes in real agricultural commodity prices into various sources. The findings show that a one-time unexpected 5-percent increase in productivity (a positive productivity shock) will lower overall agricultural commodity prices by about an estimated 2 percent in the year the shock initiated. The same would be true in reverse for a negative productivity shock. However, there is no long-term impact from a one-time productivity shock on agricultural commodity price variability.

This article is drawn from:

- “Impacts of energy shocks on US agricultural productivity growth and commodity prices—A structural VAR analysis”. (2014). Energy Economics.

You may also like:

- Agricultural Productivity in the United States. (n.d.). U.S. Department of Agriculture, Economic Research Service.