What Role Do Food and Beverage Prices Have on Diet and Health Outcomes?

- by Jessica E. Todd and Biing-Hwan Lin

- 9/20/2012

Highlights

- Food preferences, nutrition knowledge, and access to stores and restaurants all share a role with food prices in consumers' food purchasing decisions and related health outcomes.

- Consumers' responses to price change depend on income, the size of the price change, the availability of substitutes and complements, and other factors.

- Price changes have limited effects on food choices and health outcomes, but the effects may be larger when paired with information and other reinforcing policies and programs.

The Centers for Disease Control and Prevention estimates that over one-third of U.S. adults are obese, while about 17 percent of children are obese. The high cost of obesity-related illnesses--medical costs as well as lost productivity from disabilities or premature deaths--motivates the public health community and policymakers to identify causes as well as solutions.

Some public health advocates have argued that falling real, or inflation-adjusted, prices for many high-calorie foods encourage people to buy and consume more of these foods, leading to poor diet quality and rising rates of obesity. A closer look at how consumers respond to food price variation--over time, across geographic markets, in different types of stores, and in response to taxes and subsidies--reveals how food prices affect people's food choices, and their waistlines. In short, price matters, but not very much, and it is not the only factor.

Food Purchase Decisions Are Complex

Economic theory suggests that prices should play a role in consumers' food choices. And maybe they do when consumers purchase more expensive foods or when they must decide between specific items, such as ground beef or ground turkey, or among different brands of the same item. Price may also be a major factor for consumers on limited budgets. For most U.S. consumers, food choices are also determined by a combination of food preferences, interest in nutrition, need for convenience, and general food knowledge. Consumers can have strong preferences for specific foods, in part because food provides more than simple nutrients and necessary energy. In many cases, food is closely linked to emotions through its role in customs, traditions, and other social interactions.

Since price is but one factor in a complex purchase decision, the big question is how effective price changes will be in changing dietary habits. Some public health advocates point to the successful use of large taxes on cigarettes--paired with informational campaigns on the dangers of smoking and widespread bans on smoking in public places--to curtail the number of smokers in the United States.

Researchers at the University of Minnesota's School of Public Health conducted a series of experiments in school cafeterias and found that school-age children changed their purchases when prices of healthy snacks were lowered and/or prices of less healthy snacks were raised. For example, when the prices of fruit and baby carrots were reduced by 50 percent, sales to high school students increased fourfold and twofold, respectively.

The successful use of cigarette taxes and pricing experiments in school cafeterias has encouraged policymakers to consider adjusting food prices, via taxation and subsidies, to improve food choices, diet, and health. For example, the Food, Conservation, and Energy Act of 2008 (Farm Act) authorized the Healthy Incentives Program (HIP) in Hampden County, MA. HIP provides households receiving Supplemental Nutrition Assistance Program (SNAP) benefits with 30 cents of additional benefits for every dollar spent on fruit and vegetables to encourage their purchase and consumption. The pilot program began in November 2011 and is scheduled to run through the end of 2012.

Many Sources of Variation in Food Prices

In addition to being affected by policy-induced changes, food prices are influenced by an array of supply-and-demand conditions. Food demand can shift when economic and other conditions vary, such as during a recession or following the release of new dietary and health advice. Shifting consumer demand will interact with supply conditions to determine prices. This interaction causes food prices to vary over the course of a year and over longer time periods.

ERS research finds that retail food prices also vary geographically. Many foods are produced in specific geographic areas, which can affect delivery costs, particularly to more distant destinations. Geographic variation in the distribution and concentration of store types (e.g., grocery stores versus corner markets versus membership club stores) can also affect food prices. Different store formats have different cost structures. In addition, each store type provides different services to its customers, affecting operating costs. Other sources of geographic price variation include differences in rent for store space and labor costs.

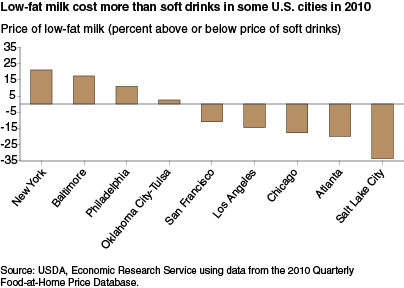

Consumers consider absolute prices when choosing which foods to buy, but they also consider prices relative to those of alternative or complementary products. Like absolute prices, relative prices can vary geographically. The price of soft drinks may be fairly stable across the country and over time, but if the price of milk, juice, or another alternative beverage falls, soft drinks become relatively more expensive to the consumer, even though their absolute price did not change. Data compiled by ERS show that in 2010, low-fat milk was 34 percent cheaper than soft drinks in Salt Lake City; in New York City, it was over 21 percent more expensive than soft drinks.

Thus, consumers face an array of different prices, depending on where they live and where they shop, even for the same food items. ERS researchers use data on this price variation to help identify how changes in food prices lead to changes in food purchases, food intake, and, ultimately, weight.

Price Responsiveness Varies

Consumers adjust their demand for a product in response to a change in the price of the item itself and in response to changes in prices of alternative and complementary products. For example, a consumer planning a cookout and deciding how many hot dogs to buy may make menu adjustments in response to higher hot dog prices, higher ground beef prices, or higher prices for hot dog buns. Knowing how sensitive consumers are to price changes is key to estimating the effects of price incentives or disincentives on food purchase decisions and, in turn, consumption and health outcomes.

Economists use regression analysis to estimate how consumers may respond to changes in prices. By estimating the price and purchase relationships for different groups of consumers, economists can then compare the responsiveness of consumers across various characteristics, such as race or income level. Several factors can affect demand responsiveness:

- Income of purchaser. The greater the share of income affected by the price change, the more responsive consumers are to the change. Low-income consumers spend more of their income on food than their high-income counterparts (36 versus 7 percent for households in the lowest and highest income quintiles in 2009), so low-income consumers tend to be more price responsive than higher income consumers.

- Size of price change. Consumers react more strongly to large price changes than to small price changes. A bigger price hike has a larger effect on disposable income and may induce a behavioral or lifestyle change. For example, some people may quit smoking when faced with a hefty cigarette tax, and some commuters who normally drive may switch to mass transit when gasoline prices surge. Interestingly, consumers may initially have a strong response to a price shock but grow accustomed to it, so demand responsiveness can change over time as well.

- Type of good and availability of substitutes. Consumers are less willing and able to alter purchase behavior when there are few substitutes for a good whose price has increased. For example, there are few substitutes for the general category of beverages, but within this broad category are many substitutes, such as soda, milk, juice, or bottled water. Thus, consumers' demand for all beverages as a broad category is less price responsive than the demand for individual beverage types.

- Expectations of how long the price change will last. When a change in the price of a food item is expected to be temporary, consumers are less likely to alter their consumption, particularly when the food is considered a staple or is highly preferred.

Personal characteristics--such as culinary skills, nutritional knowledge, and personal attitudes toward tradeoffs between instantaneous enjoyment and long-term health consequences--and availability of the product being taxed or subsidized can also affect consumer responsiveness to price change. For example, food shoppers who have difficulty accessing supermarkets likely would not increase their purchases of subsidized fresh fruit and vegetables as much as those who have easier access to supermarkets. By studying the quantity of food purchased and the associated price over time or across consumers, economists can estimate food demand models and use the results to predict consumer behavior when prices are changed, say due to a tax or a subsidy.

Taxes and Subsidies Have Limited Effects on Food Purchases…

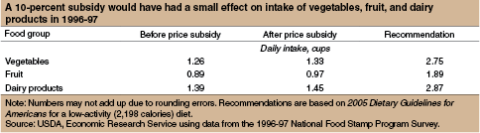

Given all the factors that can affect purchase behavior, estimates of consumer response can differ for each specific pricing policy proposed. To date, ERS research has focused on subsidies for vegetables, fruit, and fluid milk, and taxes on snack foods and caloric-sweetened beverages. Research on the effect of a subsidy on vegetables, fruit, and fluid milk on grocery store purchases by SNAP participants found that a 10-percent subsidy would increase consumption of these foods only marginally--0.07 cups for vegetables, 0.08 cups for fruit, and 0.06 cups for dairy products each day--and close the gap between actual and recommended consumption by 4 to 7 percent.

When estimating the impact of taxes on caloric intake, researchers recognize the importance of taking into account substitutions among alternative, but untaxed, foods and beverages. For example, when soft drinks are taxed, consumers can reallocate their budget among all beverage options, including bottled water, fruit juice, and milk. In fact, juice and 2 percent or whole milk are more energy dense than soft drinks. Failure to account for these substitute beverages would bias the estimates of consumers' responses to price changes, as well as estimates of the resulting dietary and health consequences.

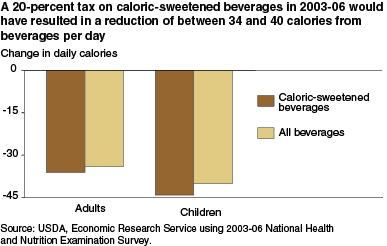

In a 2005 study, ERS found that a hypothetical 10-percent tax on salty snacks would reduce consumption of these foods by 5.5 ounces per person per year, or about 830 calories. In a 2011 analysis, researchers found that a 20-percent tax on caloric-sweetened beverages would lead to adults reducing their daily intake of caloric sweetened beverages by 36 calories (44 calories for children). Switching to alternative, nontaxed beverages would lead to a small increase in caloric intake from nontaxed beverages, but overall, both adults and children would have net declines in daily calories consumed (34 and 40 calories, respectively).

...With Similarly Small Effects on Weight and Other Health Outcomes

Economists use two approaches to estimate the effects of food prices on weight and other health outcomes. In the first approach, the estimated change in calories purchased is converted into pounds using a specific conversion factor. Based on a dynamic relationship between caloric intake and weight loss, ERS researchers estimated that the 34-calorie-per-day reduction resulting from a 20-percent tax on caloric-sweetened beverages could lead to an average reduction of 3.9 pounds among adults after 5 years, with the reduction leveling off to 4.1 pounds at the end of 10 years.

The other approach uses regression analysis to estimate the relationship between food prices and weight directly. In a recent study, ERS researchers linked information on children's body mass indices (BMI) with food price data from ERS's Quarterly Food-at-Home Price Database. The BMI data came from a nationally representative survey of 1998 kindergarten children followed through the eighth grade. Findings show that price increases for some high-calorie foods and beverages have small, but statistically significant, effects on children's BMI, and in the direction expected.

Specifically, a 10-percent increase in the price of carbonated beverages lowered children's BMI 0.42 percent 1 year later. The same increase in the price of 100 percent juices and starchy vegetables lowered BMI 0.3 percent; 10-percent reductions in the prices of low-fat milk and dark green vegetables lowered BMI by a similar amount. Average BMI growth for a boy at the 85th percentile for BMI (the cutoff for overweight) between age 8 and 9 is about 2.8 percent, while that for a girl is 3.3 percent. Thus, a 0.3-percent change in BMI is about 11 percent of annual BMI growth for a boy and 9 percent for a girl.

Other ERS research has found that higher prices for high-carbohydrate foods lower medical spending among diabetics, and that lower prices for vegetables and whole grains and higher prices for processed foods and whole milk lower bad cholesterol among adults.

Reinforce Pricing Policies for Maximum Effect

Just as the anti-smoking campaign relied on a combination of higher cigarette prices, bans on smoking in public places, and increased public awareness of the health risks associated with smoking, efforts to improve Americans' diet quality may be more effective if food price changes are accompanied by complementary programs.

For example, food price changes may be more likely to alter consumption patterns if they are concurrent with information or marketing to encourage consumption of lower calorie foods. Although a 10-percent subsidy on fruit and vegetables was found to have little effect on the purchases of SNAP participants, ERS research found that if the subsidy is delivered in the form of a coupon, purchases of these foods might increase by as much as 10 percent. This larger effect is likely a result of the additional advertising provided by the coupon.

Pricing Policies Only a Start

Price interventions do not offer a panacea for the obesity issue in the United States, but they may provide a slow and steady nudge, especially when paired with other complementary policies. Although a tax on foods may not have a large direct effect on calories and weight, the total effect could be larger if the tax revenues are used to implement other strategies to combat obesity. Taxing a food when consumer response is likely to be minimal would generate greater tax revenues than when demand is more responsive to the tax. ERS estimates that a 20-percent tax on potato chips in 1999 would have generated between $500 million and $700 million in revenues, while a 20-percent tax on caloric-sweetened beverages in 2007 would have generated an estimated $5.8 billion in revenues.

Two caveats are worth mentioning. Available data usually do not allow researchers to accurately estimate the effect of very large price changes (20 percent or more). Taxes or subsidies that alter prices dramatically may have very different effects than a simple multiplying of current research findings would suggest. Results from the HIP pilot in Massachusetts, where fruit and vegetable prices are subsidized by 30 percent, could provide insight into the possible effects of larger price changes.

Also, results from ERS and other national studies may not apply to individuals living in certain localities or among particular subgroups in the population. For example, subsidizing the price of fresh fruit and vegetables may not increase purchases among consumers residing in areas with low access to fresh produce. Establishing a farmers' market in such an area may be an effective complementary intervention. The increased affordability through substantial price subsidies may, in turn, help sustain farmers' markets and improve food accessibility for low-income consumers.

Pricing policies may also have different effects among school-age children. School cafeterias are distinct from the retail food market, particularly in the types of foods available. Experimental results from school cafeterias suggest that children have a strong response to price changes under these circumstances. Altering consumption patterns among children may have larger impacts if a lifetime shift in preferences to more healthful foods is achieved.

Like anti-smoking campaigns, efforts aimed at improving diet quality and health outcomes require not just the right food prices but also a shift in social norms and habits related to food, as well as a greater appreciation by consumers of the risks associated with unhealthy food choices.

This article is drawn from:

- Wendt , M. & Todd, J.E. (2011). The Effect of Food and Beverage Prices on Children's Weights. U.S. Department of Agriculture, Economic Research Service. ERR-118.

- Dong, D. & Leibtag, E. (2010). Promoting Fruit and Vegetable Consumption: Are Coupons More Effective than Pure Price Discounts?. U.S. Department of Agriculture, Economic Research Service. ERR-96.

- 'Measuring Weight Outcomes for Obesity Intervention Strategies: The Case of a Sugar-Sweetened Beverage Tax'. (2011). Economics and Human Biology. Vol. 9, No. 4, pp. 329-341.

- 'Economic Incentives for Dietary Improvement Among Food Stamp Recipients'. (2010). Contemporary Economic Policy. Vol. 28, No. 4, pp. 524-536.

- 'Taxing Snack Foods: Manipulating Diet Quality or Financing Information Programs?'. (2005). Applied Economic Perspectives and Policy. Vol. 27, No. 1, pp. 4-20.

- 'Food Prices and Blood Cholesterol'. (2012). Economics and Human Biology.

- 'A Spoonful of Sugar Helps the Medicine Go Down: The Relationship Between Food Prices and Medical Expenditures on Diabetes'. (2010). American Journal of Agricultural Economics. Vol. 92, No. 5, pp. 1271-1282.

You may also like:

- Quarterly Food-at-Home Price Database. (2012). USDA, Economic Research Service.

- Food Choices & Health. (2012). USDA, Economic Research Service.