Crop Commodity Programs: Title I (Commodities); see also Crop Insurance

Provides benefits based on price or revenue targets for producers of corn and other feed grains, wheat, rice, soybeans and other oilseeds, peanuts, and pulses (all referred to as “covered commodities”); and transition assistance for upland cotton producers while a new cotton insurance program was implemented. Provides for the continuation of benefits through marketing assistance loans for covered commodities, cotton, wool, mohair, and honey producers. Non-recourse loans, marketing allotments, and other provisions are provided for sugar producers.

Highlights

- Repeals Direct Payments, Countercyclical Payments, and the Average Crop Revenue Election (ACRE) program.

- Creates two new programs—Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC). Producers of covered commodities can choose to enroll in one of the two programs.

- Upland cotton producers are not eligible for PLC or ARC, but they are eligible for a new crop insurance product under Title XI—the Stacked Income Protection Plan (STAX). Cotton producers received transition payments while new STAX policies were implemented (see Crop Insurance Overview for further details).

- Revises payment limitations and adjusted gross income eligibility rules.

- Continues the marketing assistance loan program unchanged, except for an adjustment in the loan rate for upland cotton.

- Continues the sugar program unchanged.

New Programs and Provisions

Errata: On March 18, 2014, the description of the Agriculture Risk Coverage (ARC) program was revised to: 1) correct an error in the price component of the county and individual ARC benchmark revenue calculation—the calculation uses the reference price, not the loan rate, if it is higher than the national price; 2) insert an omitted reference to the county ARC payment limit of 10 percent of the benchmark revenue; and 3) change the language describing the individual ARC benchmark revenue calculation to make it more clear that the individual ARC benchmark is the sum of average revenues for each covered commodity on the farm.

Price Loss Coverage (PLC)—Payments are provided to producers with base acres of wheat, feed grains, rice, oilseeds, peanuts, and pulses (covered commodities) on a commodity-by-commodity basis when market prices fall below the reference price (see table below). The payment rate is the difference between the reference price and the annual national-average market price (or marketing assistance loan rate, if higher). For each covered commodity enrolled on the farm, the payment amount is the payment rate, times 85 percent of base acres of the commodity, times payment yield. Producers may also receive payments on former cotton base acres (termed “generic base acres”) that are planted to a covered commodity. A one-time opportunity is offered to reallocate a farm’s base acres (except generic acres) based on 2009-12 plantings and to update the farm’s payment yields for covered commodities to their 2008-12 average yields. Producers may choose which of their covered commodities to enroll in PLC, but once the election is made, it remains in place for the life of the 2014 Farm Act. Payments will be reduced on an acre-by-acre basis for producers who plant fruits, vegetables, or wild rice on payment acres.

| Covered commodities | Reference prices | Unit |

|---|---|---|

| Wheat | $5.50 | bushel |

| Corn | $3.70 | bushel |

| Grain sorghum | $3.95 | bushel |

| Barley | $4.95 | bushel |

| Oats | $2.40 | bushel |

| Long-grain rice | $14.00 | cwt |

| Medium-grain rice | $14.00 | cwt |

| Soybeans | $8.40 | bushel |

| Other oilseeds | $20.15 | cwt |

| Dry peas | $11.00 | cwt |

| Lentils | $19.97 | cwt |

| Small chickpeas | $19.04 | cwt |

| Large chickpeas | $21.54 | cwt |

| Peanuts | $535.00 | ton |

| Source: Agricultural Act of 2014, Title I. | ||

Agriculture Risk Coverage (ARC) Program—Producers may choose county-based or individual coverage. For producers choosing county-based ARC, payments are provided to producers with base acres of covered commodities on a commodity-by-commodity basis when county crop revenue (actual average county yield times national farm price) drops below 86 percent of the county benchmark revenue (5-year Olympic average county yield times 5-year Olympic average of national price or the reference price—whichever is higher for each year), calculated separately for irrigated and nonirrigated crops. For each covered commodity enrolled on the farm, the county ARC payment amount is the difference between the per-acre guarantee (as calculated above) and actual per-acre revenue (but no greater than 10 percent of the commodity’s benchmark revenue), times 85 percent of base acres of the commodity.

Producers may choose to participate in ARC using individual farm revenue instead of county revenue. In the individual ARC case, payments are issued when the actual individual crop revenues, summed across all covered commodities on the farm, are less than the ARC individual guarantee. The farm’s individual ARC guarantee equals 86 percent of the farm’s individual benchmark guarantee, defined as the sum across all covered commodities, weighted by plantings, of each commodity’s average revenue—the ARC guarantee price (the 5-year Olympic average of national price or the reference price—whichever is higher for each year) times the 5-year Olympic average individual yield. The payment amount is the individual farm payment rate (the difference between the individual farm guarantee and actual individual farm revenue, but no greater than 10 percent of the farm’s benchmark revenue) times 65 percent of base acres for all covered commodities for the individual farm.

Payment limitations—Payments are limited to $125,000 for each individual actively engaged in farming, without specific limits for individual programs. A spouse may receive an additional $125,000. The limitation is applied to the total of payments for covered commodities from the PLC and ARC programs, and marketing loan gains and loan deficiency payments under the marketing assistance loan program. A separate $125,000 limit is provided for payments for peanuts under these programs. Cotton transition payments are limited to $40,000 per year. Benefits under the Federal crop insurance program and the new Supplemental Coverage Option (SCO) and the Stacked Income Protection Plan (STAX) for upland cotton producers have no payment limitations (see Crop Insurance Overview for further details on the SCO and STAX programs).

Adjusted gross income (AGI) limitation—The limit on eligibility to receive farm program benefits no longer distinguishes between farm and nonfarm income. Under the single AGI limit, any individual with an annual AGI above $900,000 (including nonfarm income) is ineligible to receive farm program payments under commodity or conservation programs.

Repealed Programs and Provisions

Direct Payments program is repealed beginning with crop year 2014.

Countercyclical Payment program is repealed beginning with crop year 2014. The new Price Loss Coverage program provides a new form of reference-price-based coverage.

Average Crop Revenue Election program is repealed beginning with crop year 2014. The new Agriculture Risk Coverage program provides a new form of revenue-benchmark coverage.

Supplemental Revenue Assistance is not reinstated. The new individual ARC program provides a new option for whole-farm revenue-benchmark coverage.

Economic Implications

Errata: On March 18, the first sentence of the final bullet in this section was changed to clarify that ARC benchmarks, which are based on moving averages, will fluctuate over time, in contrast to PLC reference prices, which are fixed.

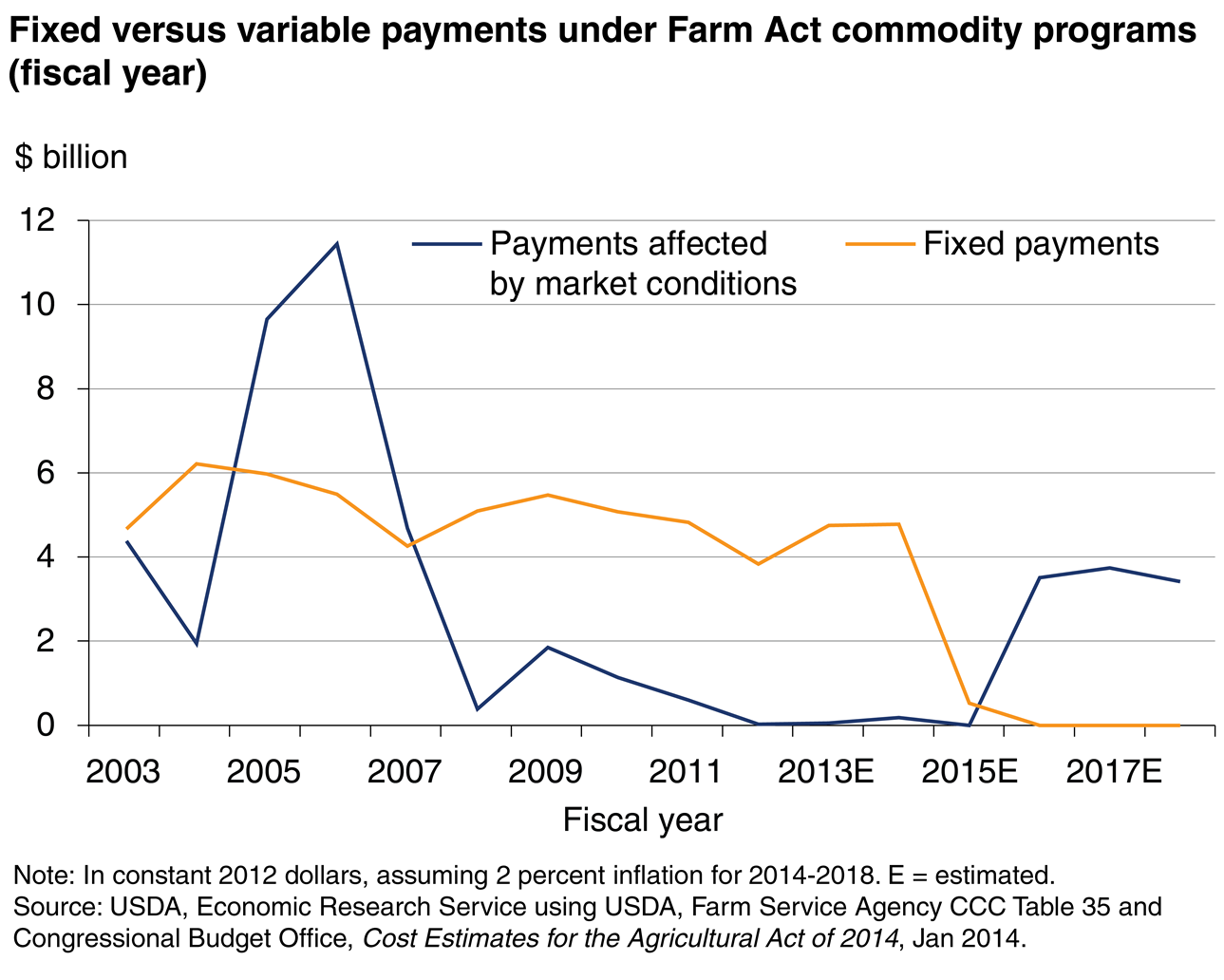

- Repeal of the Direct Payments (DP) program ends more than 15 years of fixed annual payments based on historical production. Over the last 4-5 years, fixed DP payments made up the bulk of commodity program payments to producers, as crop prices were generally well above Countercyclical Payment (CCP) program target prices and marketing assistance loan rates. That stream of fixed payments ends with the repeal of DPs.

Errata: On April 4, 2014, the vertical axis label was corrected from $ million to $ billion.

- Like the repealed Direct Payments and Countercyclical Payments programs, payments under the new Price Loss Coverage (PLC) and Agriculture Risk Coverage programs are made on historical base acres. The 2014 Farm Act allows reallocation of base acres to reflect more recent planting history and, in the case of PLC, allows updating of program yields used in calculating payments. Updates resulting from both of these opportunities will remain fixed for the life of the 2014 Farm Act.

- Reference prices for the new PLC program are higher than target prices under the repealed CCP program, which were effectively further reduced by subtracting DP rates in calculating payments. CBO projects that outlays under the PLC program will be $5.1 billion over 2014-18, compared with $489 million in payments that would have occurred under the CCP program.

| Commodity | CCP target prices | Reference prices | Unit |

|---|---|---|---|

| Wheat | $4.17 | $5.50 | bushel |

| Corn | $2.63 | $3.70 | bushel |

| Grain sorghum | $2.63 | $3.95 | bushel |

| Barley | $2.63 | $4.95 | bushel |

| Oats | $1.79 | $2.40 | bushel |

| Upland cotton | $0.71 | N/A | pound |

| Long-grain rice | $10.50 | $14.00 | cwt |

| Medium-grain rice | $10.50 | $14.00 | cwt |

| Peanuts | $495.00 | $535.00 | short ton |

| Soybeans | $6.00 | $8.40 | bushel |

| Other oilseeds | $12.68 | $20.15 | cwt |

| Dry peas | $8.32 | $11.00 | cwt |

| Lentils | $12.81 | $19.97 | cwt |

| Small chickpeas | $10.36 | $19.04 | cwt |

| Note: Upland cotton is not a covered commodity under PLC. Source: Agricultural Act of 2014, Title I; and Food, Conservation, and Energy Act of 2008, Title I. |

|||

- ARC revenue benchmarks are based on moving averages of prices and yields and will therefore fluctuate over time. This is in contrast to the fixed reference prices used to calculate support for the PLC program. Producers who make their one-time election in 2014 on a commodity-by-commodity basis will be faced with choosing between the certainty of fixed reference prices (PLC) and the flexibility of annually adjusted revenue coverage (ARC).