See the latest Fruit and Tree Nuts Outlook report.

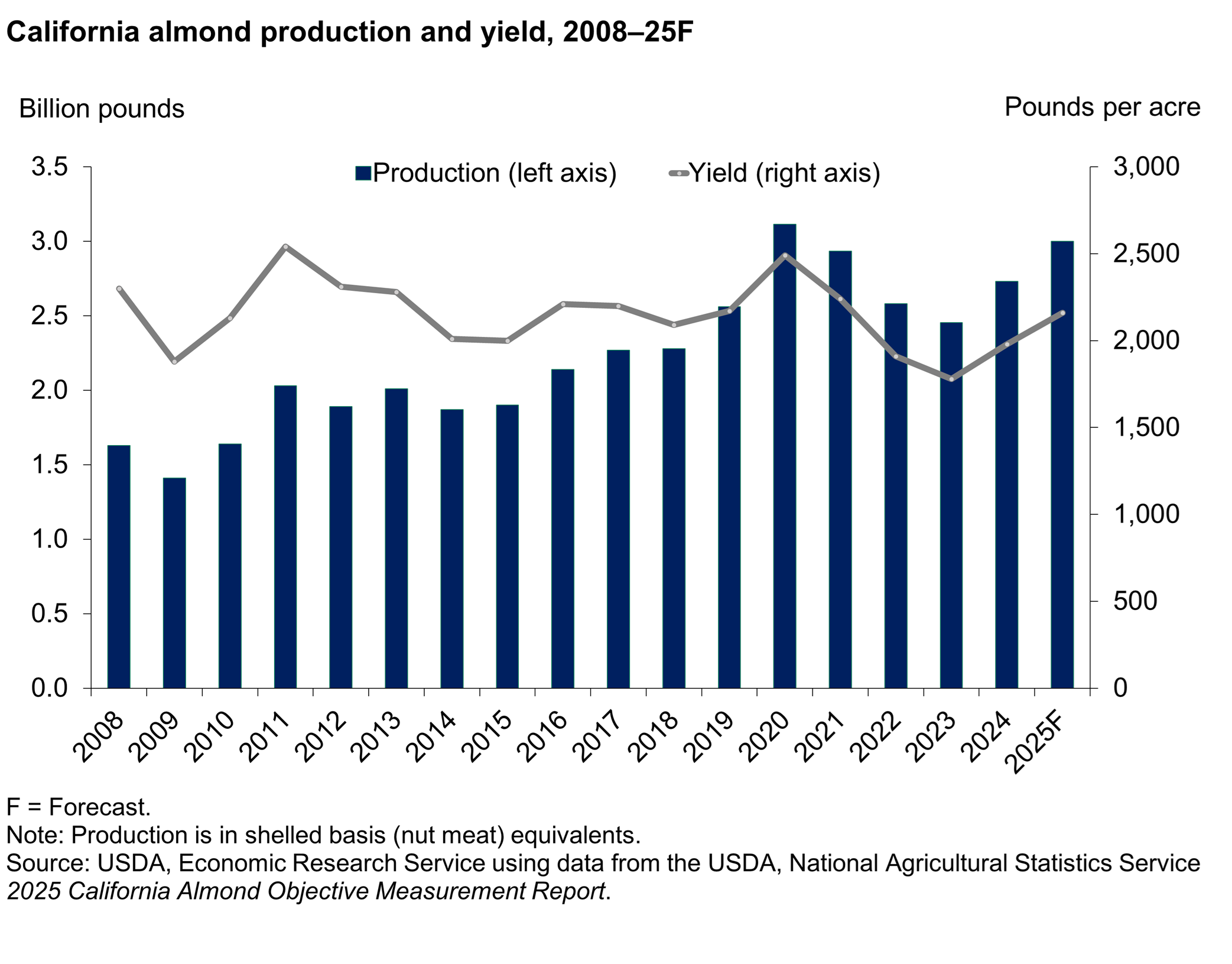

2025 California Almonds Set for Another Near-Record Crop

Note: Effective April 2025, Fruit and Tree Nuts Outlook will publish at 2:00 p.m. ET.

The USDA, National Agricultural Statistics Service (NASS) 2025 California Almond Objective Measurement Report predicts that approximately 3.0 billion pounds of almonds will be produced in 2025. If so, the 2025 almond crop would be the second largest on record, smaller only than the 3.1 billion pounds produced in 2020. The increase in production is due to a 9 percent year-over-year increase in yield. USDA, NASS projects the 2025 almond yield at 2,160 pounds per acre. This yield estimate is higher than the previous three seasons, but not statistically different from the 10-year average (2,123 pounds per acre). Preliminary 2025 almond bearing acreage is up less than 1 percent (10,000 acres) from last year, totaling a record 1.39 million acres

Download chart data in Excel format.