ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, November 29, 2023

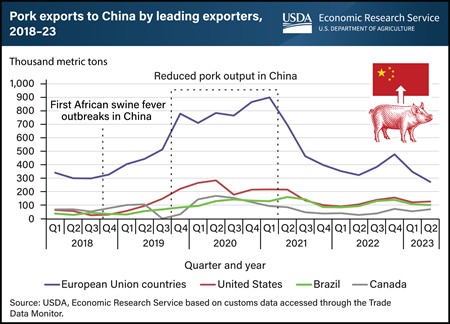

The 2018 spread of African swine fever (ASF) to China had reverberations in the global pork market. ASF—a virus often fatal to swine—caused an estimated loss of 27.9 million metric tons in China’s pork output from late 2018 to early 2021 and led to a doubling of China’s domestic pork prices. These high prices attracted a surge of pork exports from four major suppliers—the European Union (EU), United States, Brazil, and Canada. While the EU was the top supplier, U.S. pork exports were sizable and reached a record high of more than 287,000 metric tons in the second quarter of 2020. After surging, exports by all suppliers began declining during 2021 as China’s domestic production rebounded and associated prices plummeted. According to a recent report from USDA’s Economic Research Service (ERS), pork exports to China might have increased even more during the ASF outbreak if not for several factors. Specifically, China banned pork from some EU countries that also had ASF outbreaks. In addition, U.S. pork faced high retaliatory tariffs because of trade tensions, and China rejected some Canadian pork shipments. Also, during the COVID-19 pandemic, China launched stringent inspections of foreign meat suppliers and required decontamination of meat at Chinese ports. In aggregate, pork imports replaced about an estimated one-fifth of the domestic pork supplies lost in China during the ASF epidemic. Official data indicate that China’s pork production returned to its pre-ASF level in 2021. While exports to China are down from their peak, China is still one of the top 3 overseas markets for U.S. pork, with sales in the first 6 months of 2023 exceeding annual totals posted in years before ASF hit China. This chart first appeared in the ERS report How China’s African Swine Fever Outbreaks Affected Global Pork Markets, published November 2023.

Thursday, July 27, 2023

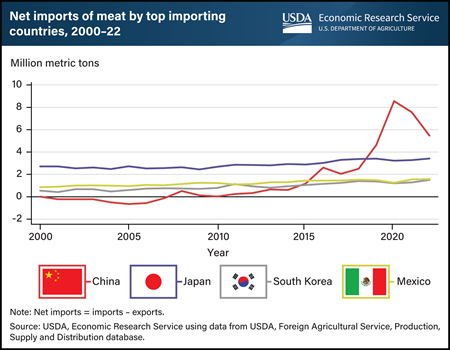

China has been the world’s largest meat importer since 2019. Despite recent reductions in imported meat volumes, the country remains in the top spot. In 2022, China imported 43 percent more than the second largest meat-importing country, Japan. Issues such as disease, tougher laws addressing environmental issues, and an exodus of small-scale farmers have constrained China’s meat supply, boosting domestic prices and incentives to import. As China’s most consumed meat, pork tends to dominate its meat supply and demand. China surpassed Japan to become the top meat importer after an African swine fever epidemic sharply reduced China’s pork supply in 2019. Pork output rebounded and meat imports dropped, but China remained the top meat importer in 2022. Meanwhile, beef imports have been on the rise. Longer beef production cycles, lack of grazing land, and chronic disease have constrained China’s cattle production, preventing it from meeting domestic demand. Poultry consumption also is rising, as chicken tends to be the least expensive meat for consumers to purchase, but rising feed costs and disease have increased domestic prices and boosted poultry imports. China’s meat consumption showed signs of peaking after 2014, but statistical model projections show that consumption will continue to grow through 2031 based on trends such as dietary change and moderate growth in Chinese income and prices. In the short term, the Coronavirus (COVID-19) pandemic and resulting economic slowdown in China weakened consumption and associated import prospects during 2022. In addition, factors such as ongoing disease risks and high feed costs—which reduce profitability for China’s livestock producers—continue to play a role in the market. This chart first appeared in the USDA, Economic Research Report, China’s Meat Consumption: Growth Potential, released in July 2023.

Tuesday, November 29, 2022

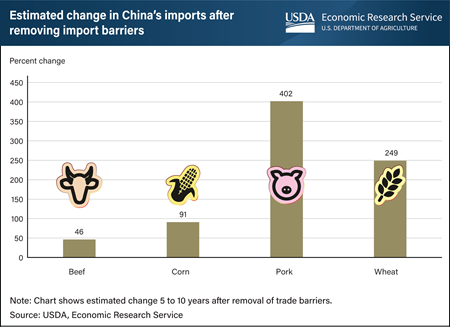

China imported more than $205 billion worth of agricultural products in 2021, including more than $37 billion from the United States, yet trade barriers deterred China’s imports from reaching even higher levels. China’s import barriers create what are called “price wedges,” in which domestic prices for agricultural commodities including beef, corn, pork, and wheat are higher than the world price. Researchers at USDA’s Economic Research Service (ERS) recently found that removing these price wedges would lead to increases in agricultural imports for the four commodities over the subsequent 5 to 10 years. For corn and wheat, removing price wedges was estimated to increase China’s imports by 91 and 249 percent, respectively. Both of these commodities are subject to a tariff-rate quota which could constrain additional imports. Removal of the beef price wedge was estimated to increase China’s beef imports by 46 percent, while for pork, it was estimated to increase China’s pork imports by 402 percent—the largest increase among the commodities considered. Overall, the benefits of removing these trade barriers would be widespread, increasing sales for producers in the United States and other exporting countries and yielding lower food prices for China’s consumers. This chart is drawn from the ERS report China’s Import Potential for Beef, Corn, Pork, and Wheat, published in August 2022.

Monday, January 24, 2022

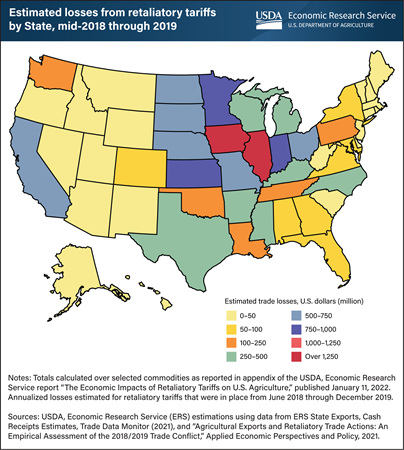

In 2018, six U.S. trading partners—Canada, China, the European Union, India, Mexico, and Turkey—announced retaliatory tariffs affecting agricultural and food products. The agricultural products targeted for retaliation were valued at $30.4 billion in 2017, with individual product lines experiencing tariff increases ranging from 2 to 140 percent. USDA’s Economic Research Service (ERS) estimated trade losses from retaliatory tariffs by State and commodity using data in the ERS State Exports, Cash Receipts Estimates. Estimated annualized losses from mid-2018 through the end of 2019 totaled $13.2 billion across 17 commodity groups, led by soybeans, sorghum, and pork. While retaliatory tariffs affected all States, those in the Midwest experienced the largest losses. ERS researchers estimated Iowa lost $1.46 billion; Illinois, $1.41 billion; and Kansas, $955 million, all on an annualized basis. Iowa and Illinois, which together produce 25 to 30 percent of U.S. soybeans, both experienced trade losses in excess of $1 billion for soybeans alone. The retaliatory tariffs followed the issuance of U.S. tariffs on imports of steel and aluminum from major trading partners and on a broad range of imports from China. This chart can be found in the ERS report, The Economic Impacts of Retaliatory Tariffs on U.S. Agriculture, published in January 2022.

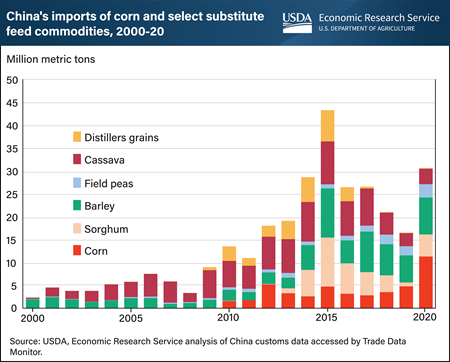

Wednesday, June 16, 2021

China’s corn imports jumped to a record 11.3 million metric tons in 2020, more than twice the volume imported in past years. The increase reflected rapidly increasing Chinese corn prices and China’s commitment to buy U.S. agricultural products under the Phase One trade agreement between China and the United States. Corn is the predominant ingredient in China’s growing animal feed production and is widely used in other food, starch, and alcohol products. In past years, a cumbersome import quota made it difficult for Chinese feed mills and processors to import corn, so they often imported substitutes such as sorghum, barley, distillers’ grains, cassava, and field peas that have low prices and no quotas. Imports of all feed ingredients were relatively low during 2019 because of high tariffs on U.S. commodities and a lull in feed demand due to a disease epidemic that reduced China’s swine herd. In 2020, imports of corn and its substitutes increased to a combined total of more than 30 million metric tons. Large purchases by Chinese state-owned companies and a rapid increase in Chinese corn prices appear to have driven the increase in corn imports—which exceeded the quota for the first time. Rebuilding of the swine herd and waivers of retaliatory tariffs on U.S. sorghum may have contributed to the increase in imports of substitutes. However, imports of U.S. distillers’ grains were still constrained by high duties imposed by a 2016 Chinese anti-dumping investigation. This chart appeared in the USDA, Economic Research Service’s Feed Outlook, May 2021.

Thursday, June 4, 2020

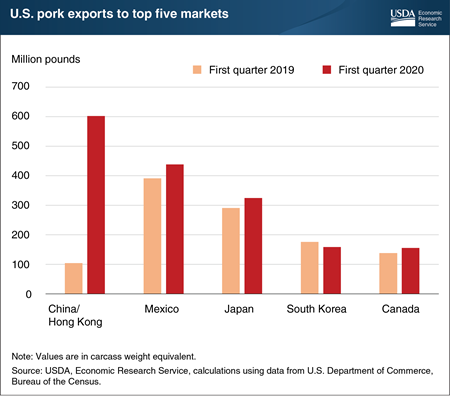

Errata: On June 4, 2020, the Chart of Note on growth in pork sales to China was reposted to correct a unit error in the text. U.S. pork exports during first quarter 2020 were corrected to 2 billion pounds. Pork sales to China, including Hong Kong, were corrected to 597 million pounds. The original graph was accurate.

Significantly larger pork sales to China boosted U.S. pork exports during first-quarter 2020 to a record-high volume of over 2 billion pounds. Sales to China (including Hong Kong) were a record 597 million pounds, up nearly fivefold, and more than 50 percent above earlier quarterly highs in 2008 and 2011. China/Hong Kong sales outpaced growth in pork exports to other top markets, which include Mexico, Japan, and Canada. China/Hong Kong was the top export market, accounting for almost 30 percent of first-quarter U.S. pork exports. The export boom is driven by a shortfall in China’s pork output, following an African swine fever (ASF) epidemic that shrank China’s swine herds by 40 percent or more during 2018-19. China’s COVID-19 lockdown, from January through March 2020, further constrained supplies. According to official Chinese data, the country’s first-quarter 2020 pork output was down almost 30 percent from a year earlier—a 9.3-billion-pound decline—and consumer prices for pork were up more than 122 percent. Robust sales to China are expected to continue. According to official statistics for March 2020, China’s swine herd was still more than 29 percent smaller than before the epidemic. Even if China avoids new ASF outbreaks and succeeds in rebuilding production capacity, biological lags in sow gestation and growth of finished hogs will delay China’s restoration of domestic pork supplies until 2021 or later. Exemptions to punitive tariffs imposed on U.S. pork were granted beginning in March 2020, giving a further boost to Chinese purchases. This chart was drawn from the Economic Research Service’s May 2020 Livestock, Dairy and Poultry Outlook report. The topic is also discussed in the February 2020 Amber Waves article, "African Swine Fever Shrinks Pork Production in China, Swells Demand for Imported Pork."

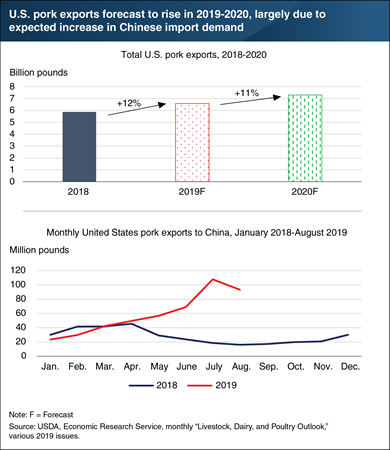

Wednesday, November 6, 2019

Forecasts for U.S. pork exports for 2019 and 2020 were recently raised, due in large part to expectations of continued significant growth in Chinese demand for U.S. pork. China’s demand for imported pork has accelerated as African Swine Fever (ASF) spread throughout China during 2018-19. While ASF does not affect human beings, it kills most infected swine and presently has no vaccine nor a cure. In September 2019, China’s inventory of swine was down 41 percent from a year earlier, as many farmers slaughtered swine to prevent herds from becoming infected. By mid-October, China’s hog and pork prices had roughly doubled from previous-year levels as pork supplies tightened. To partially fill its supply shortfall, China increased pork imports from the United States and about 10 other countries. Despite 2018 retaliatory tariffs and taxes imposed by the Government of China of up to 78 percent on most U.S. pork products, 2019 U.S. exports of pork to China have increased 91 percent, through August. Total U.S. pork exports in 2019 are forecast at 6.85 billion pounds, 12 percent higher than a year earlier. In 2020, total U.S. pork exports of 7.3 billion pounds are anticipated to be 11 percent above 2019. These charts were compiled from data in various 2019 issues of the USDA, Economic Research Service’s monthly “Livestock, Dairy, and Poultry Outlook.”

Tuesday, August 6, 2019

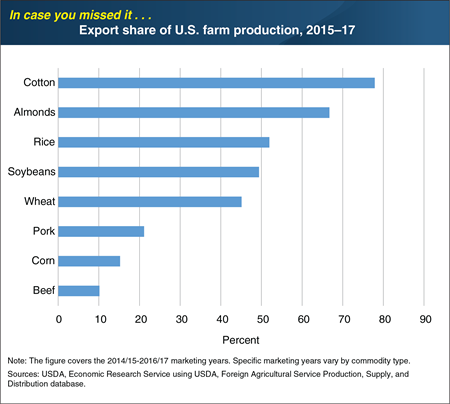

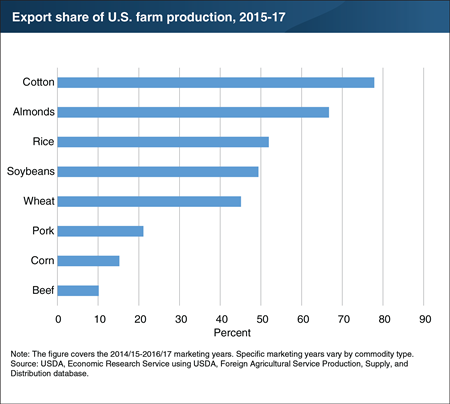

Exports are important for U.S. agricultural producers, as they make up a sizeable share of the market for many commodities. In the case of cotton and almonds, the United States sends more of its product abroad than it consumes domestically. Nearly 78 percent of all U.S. cotton is exported, with the bulk going to countries in Asia, including Vietnam and China. U.S.-produced almonds, grown almost exclusively in California, constitute nearly 80 percent of the global supply and are shipped worldwide, with 67 percent of production exported. Rice, soybeans, and wheat also depend heavily on export markets, with about half of domestic production destined for non-U.S. markets. The wealth of cropland throughout the Midwest and other parts of the United States gives domestic suppliers the capacity to scale production beyond the needs of the domestic market, allowing agriculture’s share of the U.S. economy to grow. This chart appears in the ERS publication, Selected charts from Ag and Food Statistics: Charting the Essentials, October 2018. This Chart of Note was originally published February 11, 2019.

Monday, February 11, 2019

Exports are important for U.S. agricultural producers, as they make up a sizeable share of the market for many commodities. In the case of cotton and almonds, the United States sends more of its product abroad than it consumes domestically. Nearly 78 percent of all U.S. cotton is exported, with the bulk going to countries in Asia, including Vietnam and China. U.S.-produced almonds, grown almost exclusively in California, constitute nearly 80 percent of the global supply and are shipped worldwide, with 67 percent of production exported. Rice, soybeans, and wheat also depend heavily on export markets, with about half of domestic production destined for non-U.S. markets. The wealth of cropland throughout the Midwest and other parts of the United States gives domestic suppliers the capacity to scale production beyond the needs of the domestic market, allowing agriculture’s share of the U.S. economy to grow. This chart appears in the ERS publication Selected charts from Ag and Food Statistics: Charting the Essentials, October 2018.

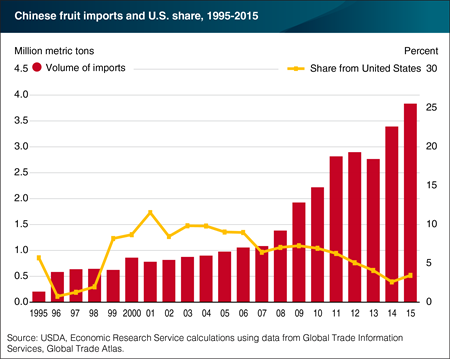

Thursday, October 20, 2016

The rise in Chinese living standards has spurred demand for a more diverse and nutritious diet, leading to a surge in China’s fruit imports. Fruit is a discretionary item consumed as a dessert, given as gifts, and distributed at meetings and banquets. With greater disposable income, demand for fruit (particularly fresh fruit) has grown rapidly. In the most recent 8 years, import volume grew more than three times to 3.8 million metric tons in 2015. The United States was a pioneer in opening China’s fruit market during the 1990s, but China’s recent surge of imports came mainly from tropical and Southern Hemisphere countries. The United States remains the predominant Northern-Hemisphere supplier, reflecting quality, extended seasonal availability, and other competitive attributes—but its share of total Chinese fruit imports declined for most of the new millennium. In 2015, there was a small uptick in the U.S. share moving from 2.6 percent to 3.5 percent, but far below the peak share of 11.5 percent in 2001. This chart appears in the ERS U.S. Fruit Competes for China Market Share special article published in September 2016.