ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Friday, March 29, 2013

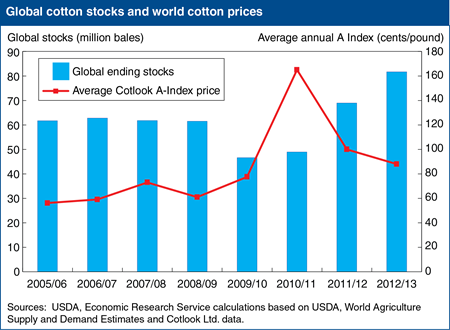

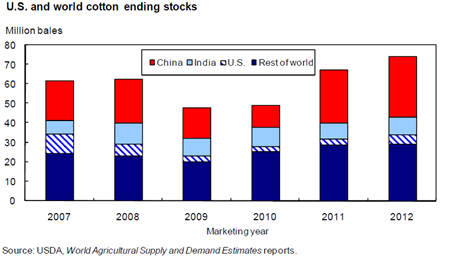

Despite rising global mill use, 2012/13 world ending stocks are estimated at a record 81.7 million bales, up 18 percent from the previous year, leading to a second consecutive year of lower world cotton prices. Higher global ending stocks are driven largely by China’s stocks purchase policy. China’s 2012/13 ending stocks are estimated at 44.1 million bales, up 46 percent from the previous year, accounting for 54 percent of world ending stocks. The United States is expected to carry 4.2 million bales in 2012/13 ending stocks, up 25 percent from the previous year. Higher stocks in China and the United States more than offset somewhat lower estimated stocks in other key countries, including Australia, Brazil, India, Pakistan, and Turkey. This chart appears in the Cotton and Wool Chart Gallery.

Tuesday, September 25, 2012

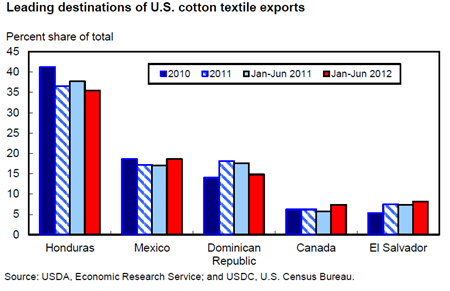

Cotton products continue to account for most of U.S. textile and apparel trade, although there have been recent declines as a result of fiber substitution. Through the first 6 months of 2012, U.S. cotton product imports and exports reached 3.8 billion pounds and 962 million pounds, respectively. For U.S. cotton product exports, the top five destinations accounted for a steady share of nearly 85 percent of total exports. Of the top five destinations, only exports to Canada were higher than the comparable period of 2011. The share of total exports was mixed for the top countries. Honduras was the leading destination but its share is declining, falling below 36 percent during the first half of 2012; the share also decreased for the Dominican Republic. For Mexico--the second leading destination--the share rose to nearly 19 percent, similar to calendar year 2010; the shares for El Salvador and Canada continued their trend higher during the first half of 2012. This chart is found in the Cotton and Wool Outlook, CWS-12g, September 2012.

Friday, July 6, 2012

The latest USDA projections for 2012/13 indicate that world cotton stocks are expected to rise for the third consecutive season, reaching a record 74.5 million bales for 2012/13, nearly 11 percent or 7.2 million bales above 2011/12. World cotton stocks have grown as a result of recent record cotton prices that encouraged area increases in 2010 and 2011 that subsequently led to large crops. Meanwhile, higher prices promoted substitution away from cotton by mills, and the slowdown in the global economy reduced demand further, exacerbating the rise in stocks. In China, stocks are projected to expand nearly 20 million bales over a 2-year period because of extensive purchases for its national reserve program, with these stocks likely to be used by Chinese mills as demand rebounds. This chart is found in the Cotton and Wool Outlook, CWS-12d, June 2012.

Wednesday, June 20, 2012

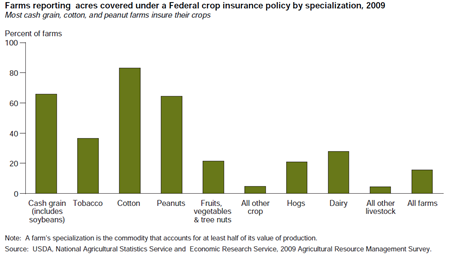

Most farms specializing in cash grains, cotton, and peanuts reported farmland covered under a Federal crop insurance policy in the 2009 Agricultural Resource Management Survey. Farms with other specializations participated in Federal crop insurance, but to a lesser degree. About a third of tobacco farms had insured land, as well as 20 to 30 percent of farms specializing in hogs, dairy, or fruits, vegetables, and tree nuts. Hog and dairy farms often grow crops to feed their livestock, and these crops are eligible for Federal crop insurance. This chart is found in Changing Farm Structure and the Distribution of Farm Payments and Federal Crop Insurance, EIB-91, February 2012.

Friday, May 25, 2012

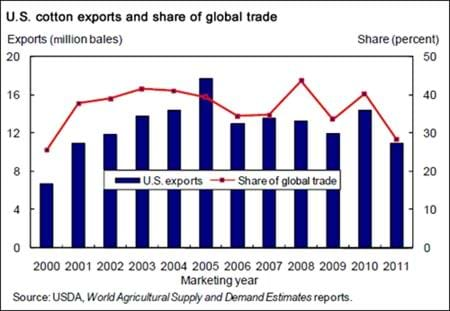

U.S. cotton exports are forecast to decrease about 25 percent this season. The drought-reduced U.S. crop lowered exportable supplies and competition from more abundant foreign supplies is expected to reduce shipments to their lowest level in a decade. As a result, the share of global trade is projected to fall to 28.4 percent in 2011/12, 9 percentage points below the 5-year average and the lowest share since 2000/01. This chart is found in the March 2012 Cotton and Wool Outlook, CWS-12a.

Friday, April 27, 2012

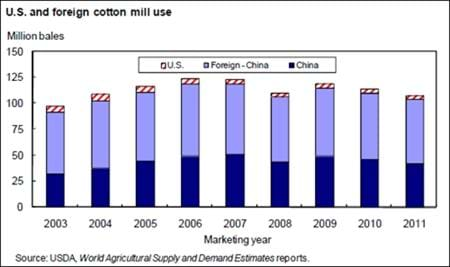

With recent high cotton prices that encouraged fiber substitution and the global economic uncertainty facing consumers, world mill use is projected to decrease to its lowest level since 2003/04. World cotton consumption in 2011/12 is forecast at 107.7 million bales, 6 percent below last season. Consumption is lower in most major cotton consuming countries this season with the notable exception of Pakistan, where cotton mill use is expected to rise 3 percent. Foreign consumption is projected to decline 6.3 million bales in 2011/12, with China accounting for more than half of the decrease. Despite the reduction, China still accounts for nearly 40 percent of the global cotton mill use in 2011/12. The U.S. is expected to contribute 3 percent of the total in 2011/12, compared with 6 percent as recently as 2004/05. The U.S. is expected to contribute 3 percent of the total in 2011/12, compared with 6 percent as recently as 2004/05. This chart is found in the April 2012 Cotton and Wool Outlook, CWS-12b.

Thursday, December 22, 2011

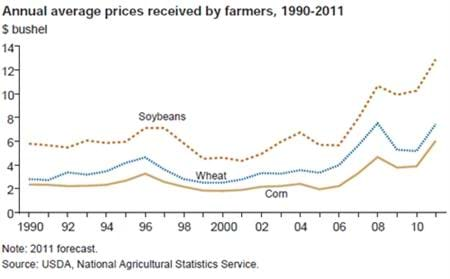

Very large gains in annual receipts are expected for wheat, corn, hay, and cotton in 2011, often reflecting prices that are forecast to exceed their previous records. The U.S. annual wheat price is expected to increase to $7.43 per bushel, a 44 percent increase from 2010 and 8 cents-per-bushel below its 2008 average, reflecting a large increase in wheat exports. The U.S. annual corn price is expected to increase from $3.89 per bushel to $6.04, a large increase over its earlier high of $4.66 in 2008, as corn continues to respond to the increased demand for ethanol. The U.S. annual soybean price is expected to increase from $10.24 per bushel to $12.89 ($10.65 per bushel in 2008) and soybean meal to $339.60 per ton. This chart may be found in Agricultural Income and Finance Outlook, AIS-91, December 2011.

Thursday, October 20, 2011

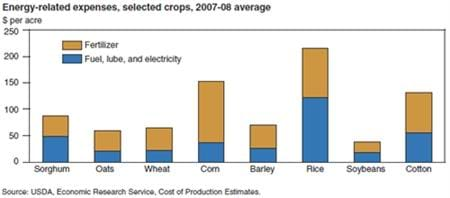

Per-acre operating costs are important for determining producer net returns, which influence farmers' cropping choices. Rice, corn, and cotton have the highest per-acre expenses for energy-related inputs. While rice and cotton have the highest per-acre costs for fuel, lube, and electricity, corn has the highest costs for fertilizer. Energy-related costs for soybean production are relatively low. This chart comes from the ERS report, Impacts of Higher Energy Prices on Agriculture and Rural Economies, ERR-123, August 2011.

Friday, September 16, 2011

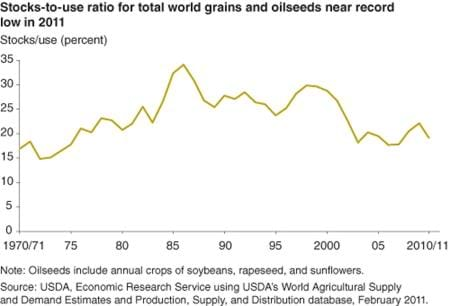

The ratio of global ending stocks to total use can be a reliable indicator of market prices (the lower the ratio, the tighter the market and the higher the price.) Currently, the stocks-to-use ratios for corn and soybeans are near record lows. The stocks-to-use ratios for wheat and rice suggest reasonably comfortable stock levels, but the shortage of milling-quality wheat has put strong upward pressure on wheat prices. Stock-to-use ratios for cotton, total oilseeds, total coarse grains, and sugar are also low. These low ratios suggest strong worldwide competition among crops for acreage in the 2011 planting season. This chart is found in the September 2011 Amber Waves feature, Why Another Food Commodity Price Spike?

Thursday, September 1, 2011

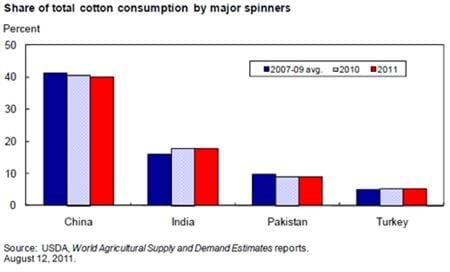

The latest (August 2011) USDA estimates for 2011/12 project global cotton consumption at approximately 115.2 million bales. After August reductions in both 2010/11 and 2011/12, cotton consumption for the current season is now forecast to grow about 1 percent after a decline of nearly 4 percent in 2010/11. The top four cotton-spinning countries-China, India, Pakistan, and Turkey-are forecast to account for nearly 72 percent of global cotton consumption in 2011/12, slightly below 2010/11 but equal to the average for the 2007-09 seasons. For China-the leading cotton spinner-the share of global consumption is forecast at 40 percent this season. Meanwhile, India-the second leading spinner-has seen its forecast share rise to 18 percent. This chart is from the Cotton and Wool Outlook, CWS-11f, August 12, 2011.

Tuesday, June 28, 2011

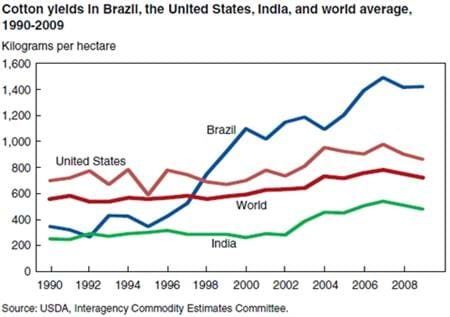

Brazil and India had similar yields in 1992, both below the United States and the world average. With the adoption of modern, large-scale farming and improved access to inputs-and due to the extremely favorable climate in Brazil's new production regions-Brazil's cotton yields have surged to more than double the world average. This chart is from the ERS report, Brazil's Cotton Industry: Economic Reform and Development, CWS-11D-01, June 2011.

Wednesday, March 23, 2011

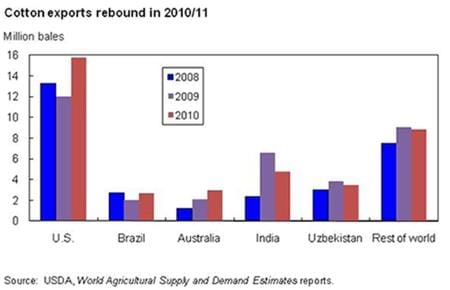

As of March 2011, world cotton exports in 2010/11 are estimated at 38.6 million bales, up 9 percent from the previous year and the second consecutive year of trade rebound. Exports in 2010/11 for Australia (3.0 million bales), Brazil (2.7 million), and the United States (15.75 million) are estimated to increase 42 percent, 36 percent, and 27 percent, respectively, from the preceding year. India and Uzbekistan are estimated to export 4.8 million bales and 3.5 million bales in 2010/11, down 27 percent and 8 percent, respectively, from a year ago. Export increases in several major countries more than offset declines in other exporting countries, resulting in one of the largest cotton trade volumes in recent years. This chart was originally published in Cotton and Wool Outlook, CWS-11a, March 11, 2011.