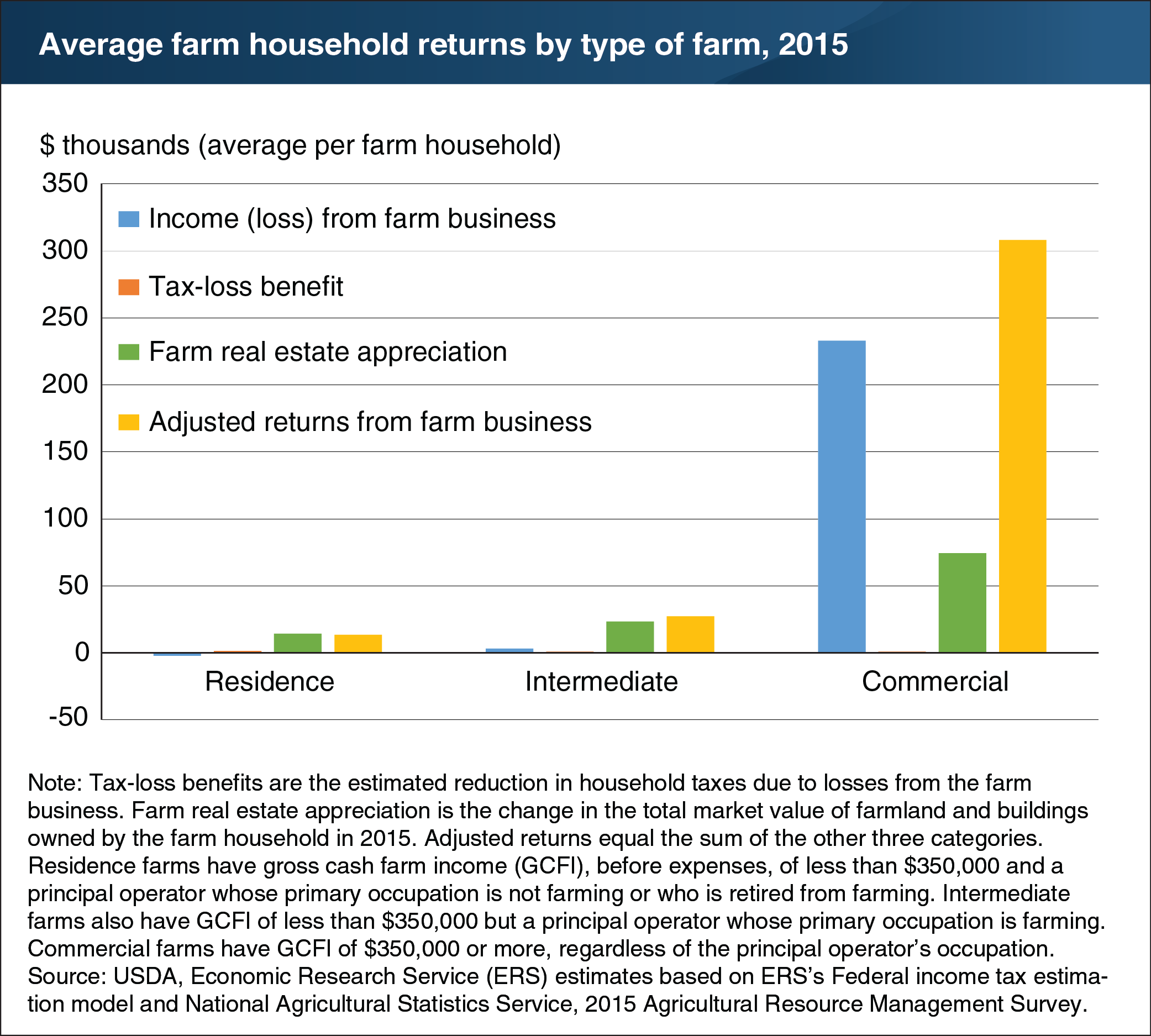

Including asset appreciation and tax-loss benefits raises average farm household economic returns for all types of farms

- by Daniel Prager

- 8/2/2018

Of the roughly 2 million U.S. farm households, more than half report negative income from their farming operations each year. Most farms are small, and the proportion incurring farm losses is higher for households operating smaller farms—where most or all of their income is typically derived from off-farm activities. However, many households offset their off-farm income with these farm losses, thus reducing their taxable income. Also, in many years, farm real estate values have increased, which bolsters the economic returns for farmland owners. When these tax-loss benefits and changes in farm real estate values are taken into consideration, the returns to farming increased in 2015. For example, for residence farm households, estimated average returns increased from a negative $2,241 to positive $13,619. The increases in average returns for intermediate and commercial farm households were even greater. Finally, the share of total farm households with positive returns from their farm operation rose from 43 percent to 70 percent, primarily due to the broad increases in farmland real estate prices in 2015. This chart appears in the August 2018 ERS report, Economic Returns to Farming for U.S. Farm Households.