U.S. crop insurance participation grows

- by Erik O'Donoghue

- 12/2/2014

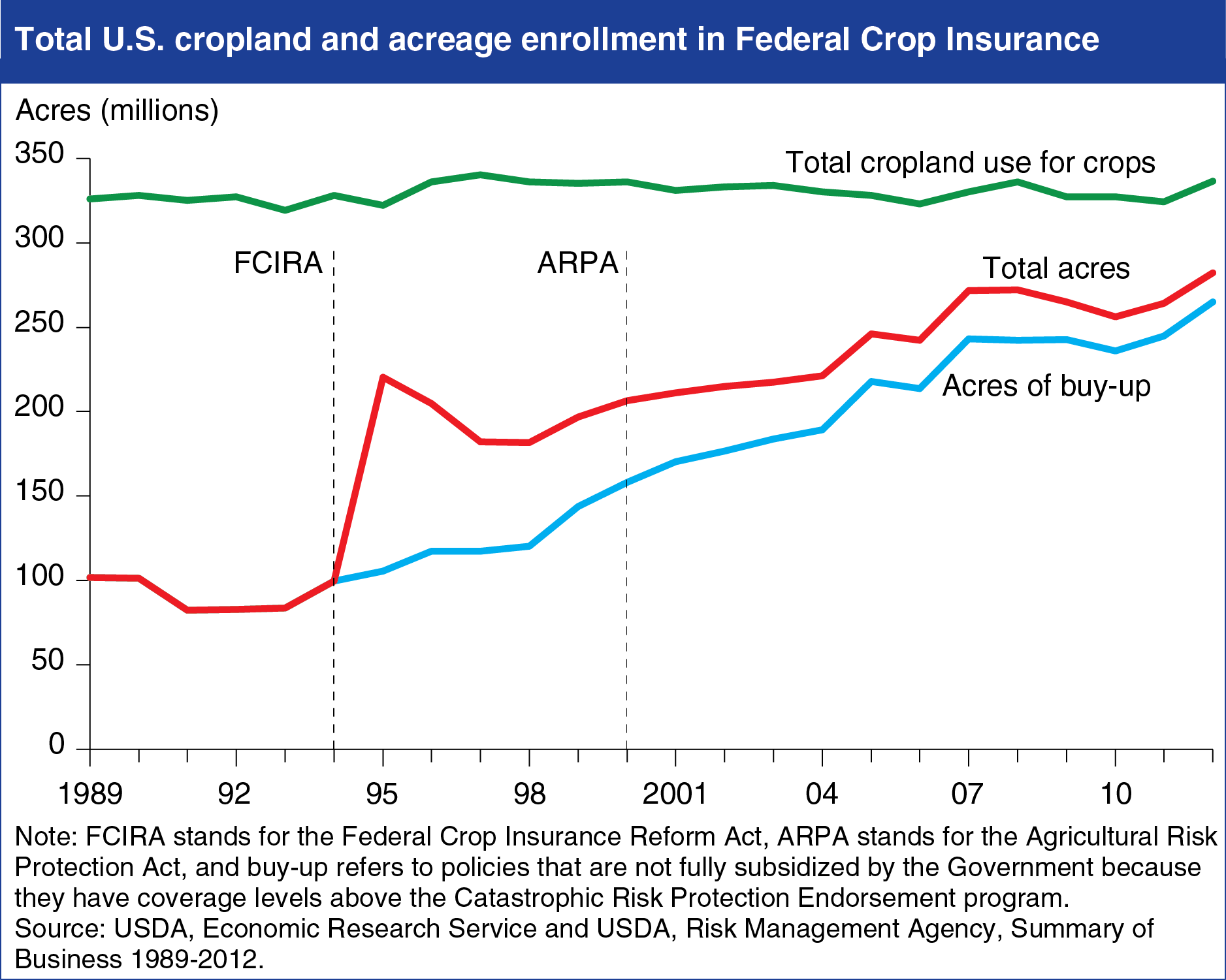

Participation in the U.S. Federal Crop Insurance (FCI) program has continued to expand since the early 1990s, in response to changes in laws that have broadened the number of crops covered and altered incentives for program participation. Enrollment in crop insurance grew sharply after the 1994 enactment of the Federal Crop Insurance Reform Act (FCIRA) increased premium subsidies and required producers to enroll in order to receive support from other Government programs. At that time, producers enrolled the majority of these new acres under a fully subsidized new policy called Catastrophic Risk Protection Endorsement (CAT) which provides low-level coverage (i.e., that only pays indemnities when losses are high), with the remaining acres enrolled in buy-up policies—those that are not fully subsidized. ERS research suggests that the increased premium subsidies introduced through the 2000 Agricultural Risk Protection Act did more to induce farmers to select higher levels of coverage than to enroll new acreage. Find this chart and additional analysis in The Importance of Federal Crop Insurance Premium Subsidies in the October Amber Waves.