Export market key to demand for U.S. cotton

- by Leslie Meyer and Stephen MacDonald

- 5/9/2014

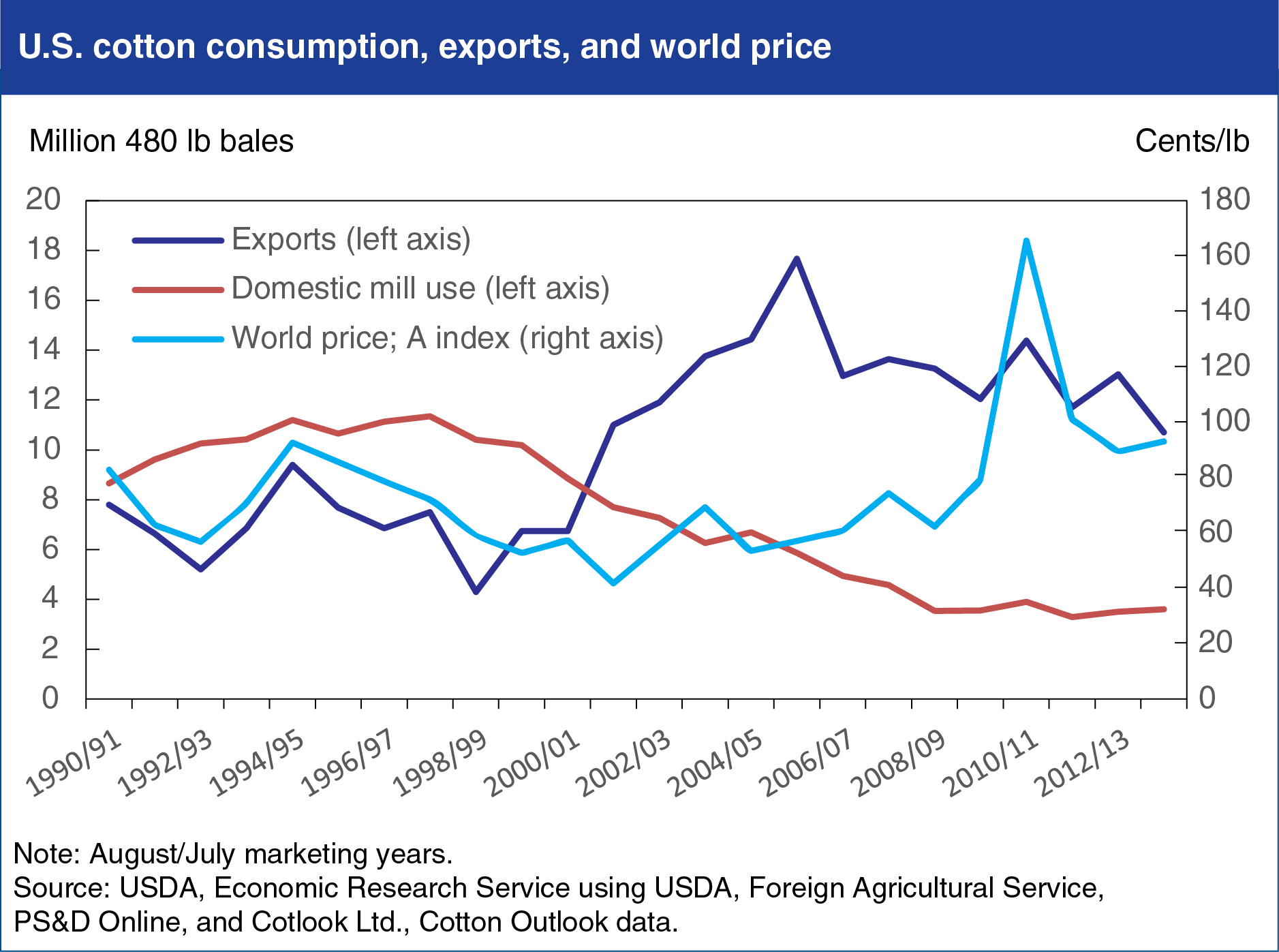

With the significant decline in cotton use by U.S. mills since the late 1990s, exports now account for about 75 percent of the demand for U.S. cotton, making global market developments key to the outlook for U.S. producers. The source of demand for U.S. cotton shifted with the elimination of textile and apparel import quotas that existed under the international Multifiber Arrangement—a process completed in 2005—leading to increased U.S. imports of textiles and apparel and reduced U.S. demand for raw cotton. Since 2005, there has been significant variability in the volume of U.S. exports and in world prices, much of it attributed to developments in China, the largest global and U.S. market for cotton. Large Chinese purchases contributed to the spike in world prices in 2010/11 (August/July), while large stocks and reduced buying by China are key factors in the outlook for reduced global and U.S. exports in 2013/14. Mill use of cotton in China has now declined for four consecutive seasons in response to government policies, with more consumption shifting to countries such as India, Pakistan, and Vietnam, who are exporting growing volumes of cotton yarn and other intermediate products to China and other markets. This is an updated version of a chart found in Charting the Essentials, with additional analysis available in Cotton and Wool Outlook: April 2014.