The U.S. dollar-Brazilian real exchange rate is a key driver of changes in world raw sugar prices

- by Economic Research Service

- 6/5/2013

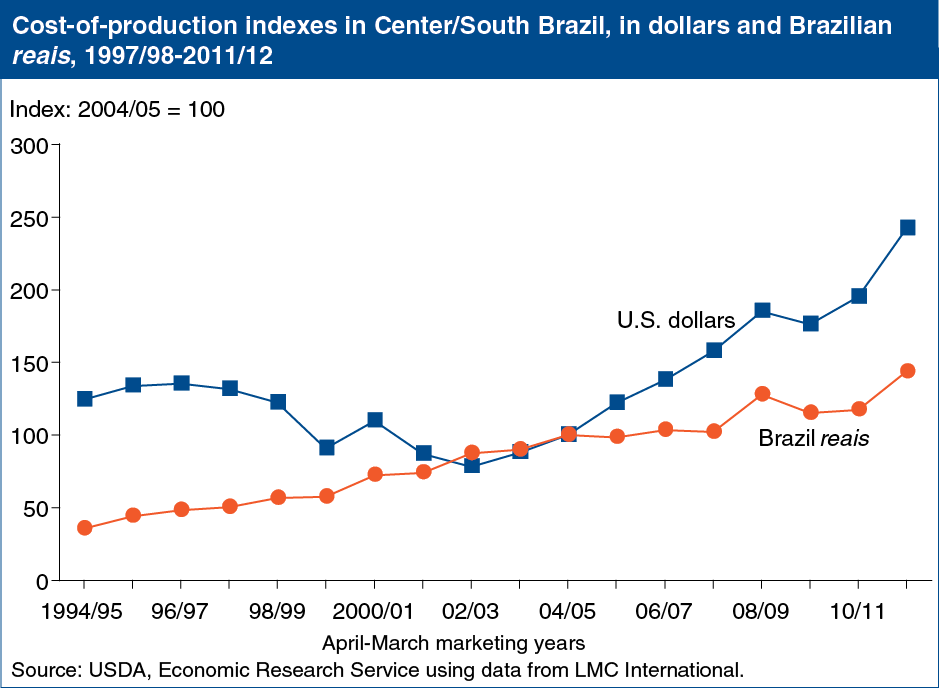

Brazil is the largest global producer and exporter of sugar and, over the long term, world sugar prices are closely linked to production costs in Brazil, as well as movements in the exchange rate between the U.S. dollar and the Brazilian real. Prior to 2003/4, the depreciation of the real against the dollar contributed to declines in Brazilian production costs when denominated in dollars. Since 2003/04, the real has appreciated against the dollar, leading to a 210-percent increase in dollar-denominated Brazilian production costs, while production costs in real terms rose just 64 percent. Rising dollar-denominated Brazilian production costs have contributed to the 316-percent increase in nominal world raw sugar prices from a 23-year low of 6.2 cents/lb in 2003/04 to 25.8 cents/lb in 2011/12. This chart appears in World Raw Sugar Prices: The Influence if Brazilian Costs of Production and World Surplus/Deficit Measures, SSS-M-297-01, released May 29, 2013.