A growing number of families receive the earned income tax credit

- by Economic Research Service

- 5/10/2013

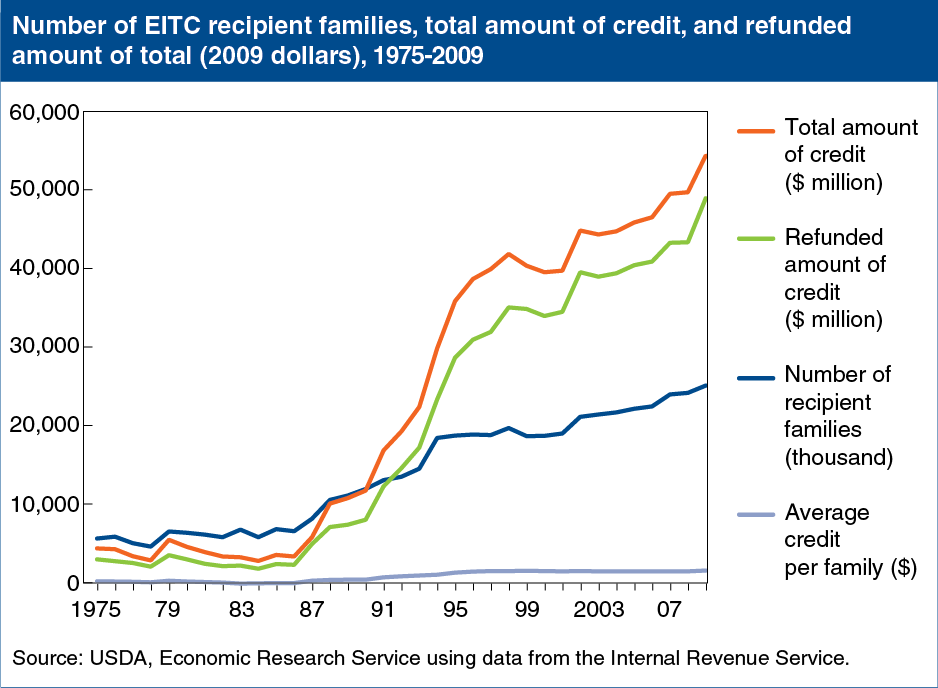

The earned income tax credit (EITC) was enacted in 1975 to reduce the burden of Social Security taxes on low-income workers and to encourage them to seek employment rather than welfare benefits. The amount of the credit depends upon the number of qualifying children in the household and the level of earned and adjusted gross income. As a refundable tax credit, the EITC results in lower tax liabilities for qualifying low-income households that owe Federal income taxes and cash payments to those owing no taxes. The EITC has expanded over the past two decades and represents an increasing share of total Federal support to low-income households. In 2009, the credit provided roughly $55 billion to over 25 million low-income workers and their families. Rural households have historically had lower incomes and higher poverty rates than urban households. As a result, a disproportionately large share of rural taxpayers benefit from the EITC. In 2008, 21.6 percent of rural taxpayers received EITC benefits, compared with 16.9 percent of urban taxpayers. This chart comes from the ERS report, The Potential Impact of Tax Reform on Farm Businesses and Rural Households, EIB-107, February 2013.