Hog prices fall sharply in April as slaughter capacity is constrained due to COVID-19

- by Mildred Haley

- 5/6/2020

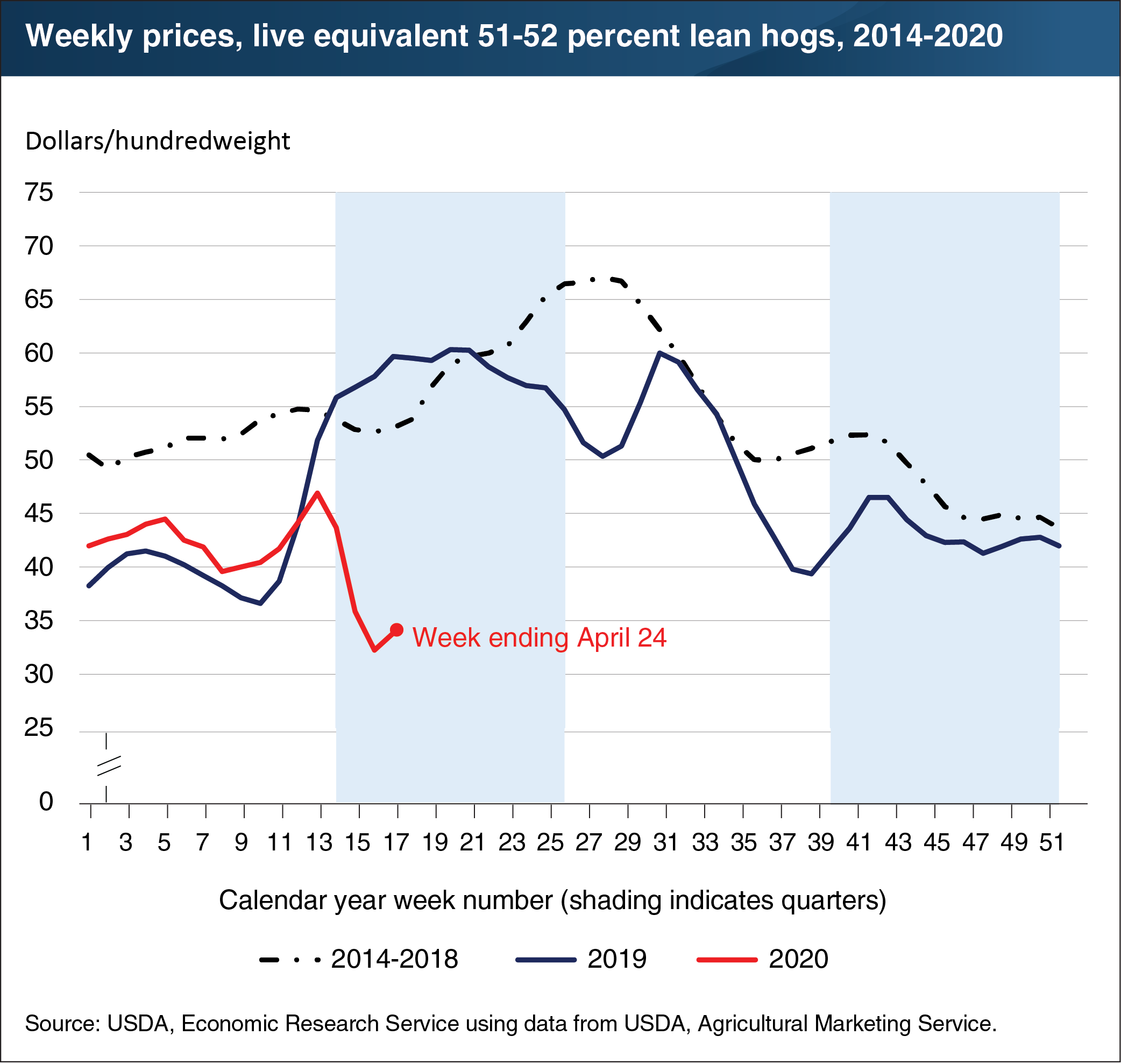

Closures and production slowdowns of several hog-processing facilities beginning in early April due to workforce absences caused by the COVID-19 virus decreased processor demand for hogs, reducing weekly hog slaughter numbers and driving April hog prices (prices paid to hog producers by processors) more than 35 percent below prices in April 2019. As of late April, the closures comprised more than a third of the industry’s processing capacity. At the time of the first plant closing, pork demand was already low, as much of the hotel, restaurant, and institutional sector had been shut down to block transmission of the virus. In 2020, between the weeks ending March 27 and April 24 (weeks 13 and 17 of the calendar year), prices fell $13 per hundredweight (cwt) as plants took measures to protect processing-plant workers from COVID-19, reducing the rates at which hogs were slaughtered. For the week ending April 24 (week 17), live hog prices averaged about $34 per cwt, the second lowest weekly price since November 2016, and significantly below most hog producers’ break-even price. Average prices for the week ending April 24 moved about 5 percent higher from the previous week, likely attributable to rapidly increasing wholesale pork prices (prices received by processors for sales of pork cuts), to which many hog sales transactions are linked. This chart is drawn from ERS’s Livestock, Dairy, and Poultry Monthly Outlook report from April 2020 and is updated using data from USDA’s Agricultural Marketing Service.