U.S rice imports in 2019 are projected at a record high for third consecutive year

- by Nathan Childs

- 3/30/2020

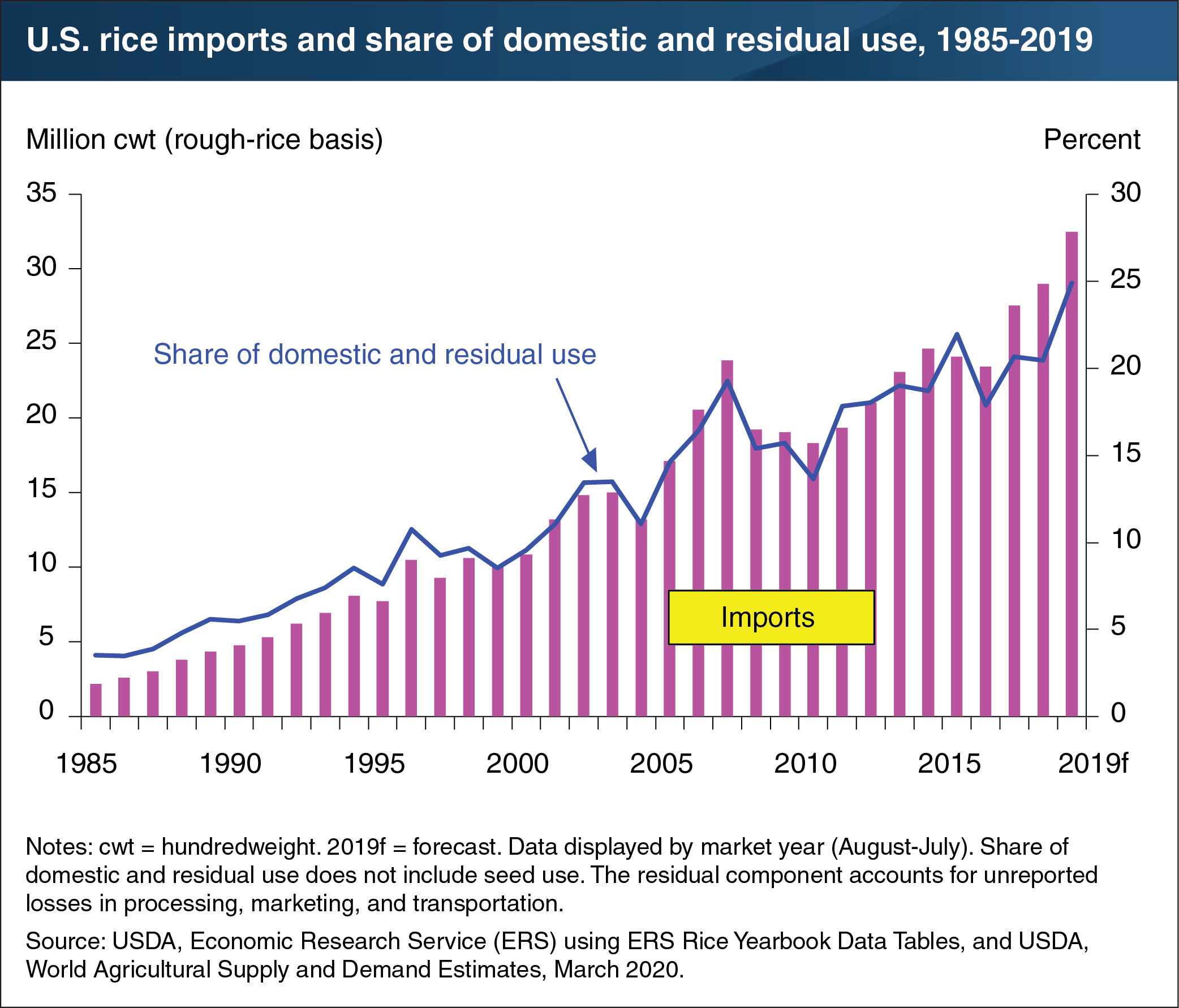

Although rice is not considered a staple food in the United States, Americans are turning to the global rice market more than ever, with imports now accounting for about 1 percent of the value of all U.S. agricultural imports. In 2019/20, U.S. rice imports are projected at 32.5 million hundredweight (rough basis), up 9 percent from a year earlier and the third consecutive record. Imports now account for more than 20 percent of the total domestic rice market with two factors driving the recent records. First is a large increase in demand for Asian aromatic varieties, primarily jasmine rice from Thailand and basmati rice from India and Pakistan. These specific Asian aromatic varieties are not grown in the United States and account for around 70 percent of U.S. rice imports. Second, Puerto Rico is once again importing cheaper rice from China—about 8 percent of total U.S. rice imports—and largely replacing U.S. suppliers. Nearly all of China’s rice exports to Puerto Rico are from its Government-accumulated stocks of older rice that are sold at well below current trading prices. Also, freight costs are lower for rice shipped from China because of provisions of the U.S. Jones Shipping Act of 1920 (Merchant Marine Act of 1920, Section 27), which effectively raises the of cost of shipments between any two U.S. ports (such as New Orleans to San Juan, Puerto Rico). The United States also imports broken kernel rice for processed uses, with Brazil now the largest supplier. Finally, Italy regularly supplies small amounts of its Arborio rice to the United States. The information in this chart is based on information in the Economic Research Service Rice Yearbook Tables.