New Brazil wheat tariff rate quota expands marketing opportunities for the U.S. and other non-Mercosur exporters

- by Jennifer K. Bond

- 1/22/2020

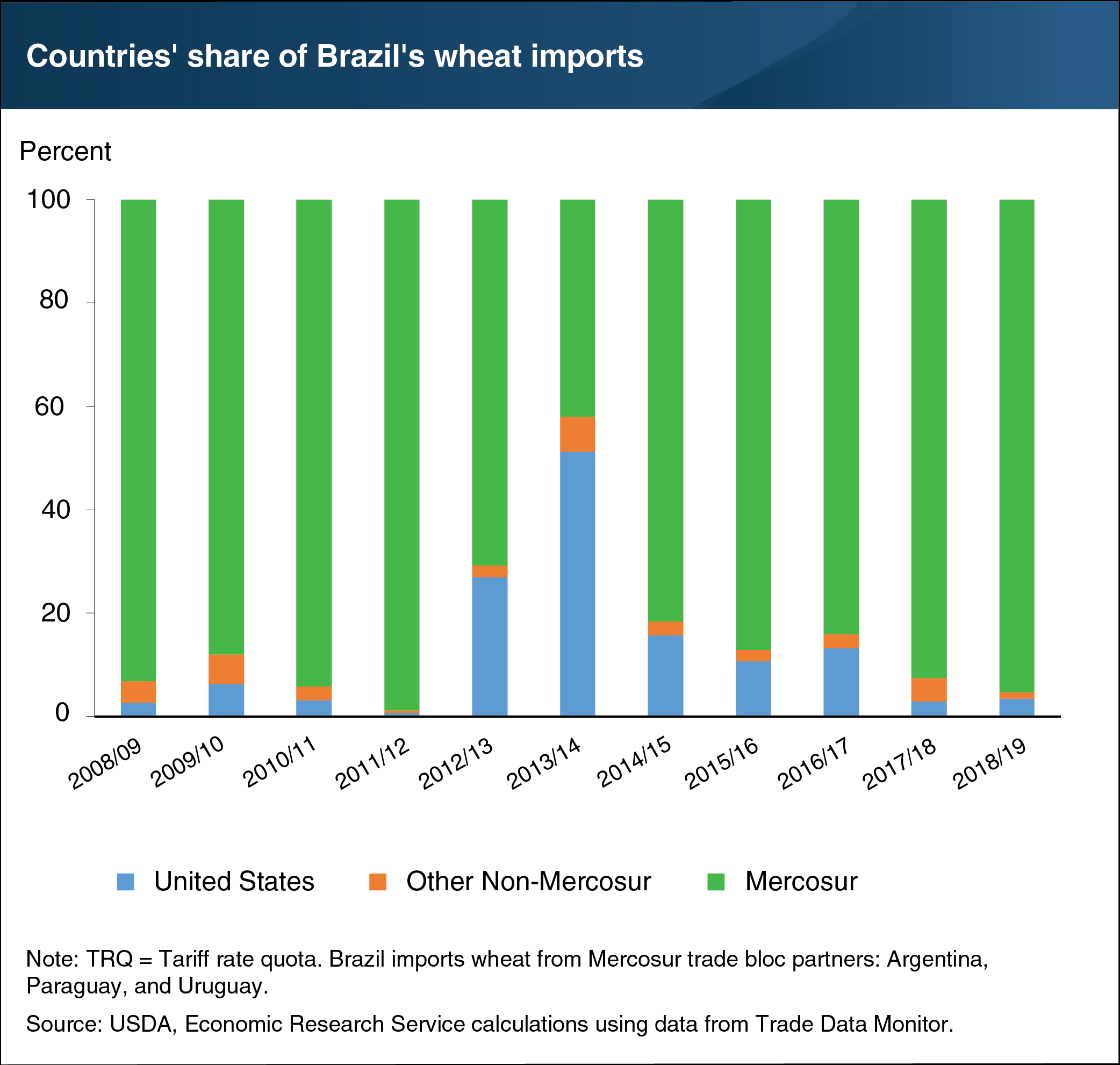

Brazil is the third-largest global importer of wheat. However, in recent years just one to six percent of U.S. exports have gone to this important South American market on average. In the past ten years, the bulk of Brazil’s wheat imports have originated from Mercosur trading partners (Argentina, Paraguay, and Uruguay) on which Brazil does not impose import duties. Mercosur partner Argentina enjoys proximity benefits and typically supplies about 65 percent of Brazil’s total volume of imports. During periods when Argentina’s exportable wheat supplies have been limited, such as 2013/14, Brazil has removed duties on wheat from non-Mercosur countries, increasing the competitiveness of their exports. As a result, in the 2013/14 trade year (July/June), the U.S. accounted for more than 50 percent of Brazil’s wheat imports. The U.S. has historically been the dominant non-Mercosur wheat exporter to Brazil and is noted for the high quality of its wheat. On November 14, 2019, the Government of Brazil removed a 10-percent duty that applied to the first 750,000 metric tons of wheat imports from non-Mercosur countries. This suggests the U.S. will be increasingly—though mainly seasonally—price competitive with Mercosur-origin wheat. This chart appears and is explained in more detail in the article, “Brazil’s Implementation of a TRQ (tariff rate quota) for Wheat Cracks Open the Door for Expanded U.S. Exports,” in the December 2019 issue of ERS’s Wheat Outlook newsletter.