Interest expenses to EBITC ratio has increased in recent years, but remains below its longrun average

- by Carrie Litkowski

- 9/17/2018

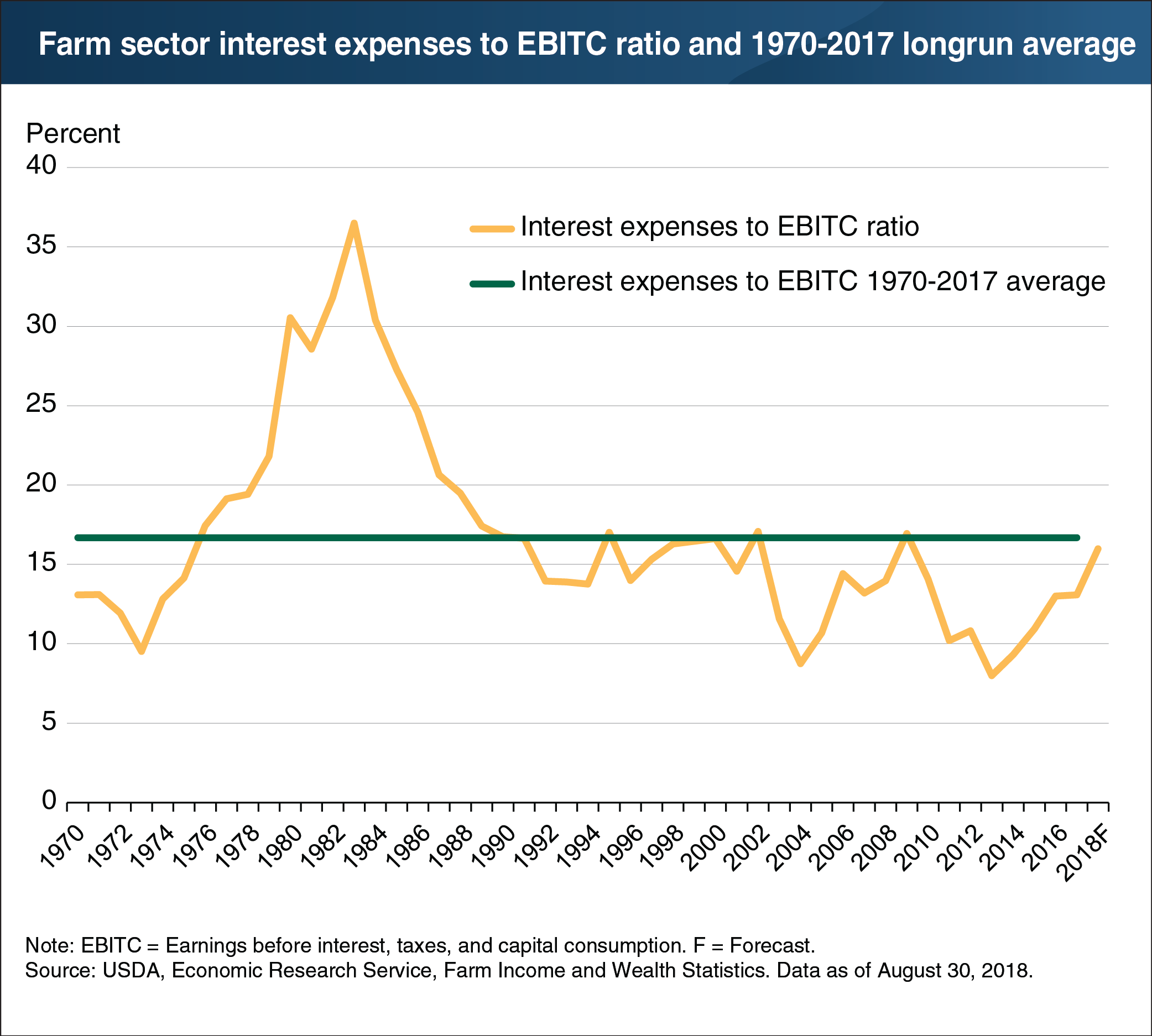

The ratio of interest expenses to earnings before interest, taxes, and capital consumption (interest-to-EBITC) measures the farm sector’s ability to pay interest expenses on outstanding debt out of its earnings—a useful metric of the sector’s financial durability. High interest rates and low farm income caused the interest-to-EBITC ratio to peak at 37 percent in 1983—a development that coincided with higher rates of farm bankruptcies and loan defaults. After 1983, the interest-to-EBITC ratio declined year after year until 1995 and reached its 1970-2017 low of 8 percent in 2013. ERS’s 2018 forecast of 16 percent remains below the longrun average of 17 percent. A 16-percent EBITC means that 16 percent of net farm earnings—before interest, taxes, and capital consumption—are spent on interest payments. Although inflation-adjusted farm debt increased 84 percent from 1994 (the lowest value since 1964) to 2017 (the most current estimate), interest expenses have remained relatively stable because of declining interest rates. If farm income remains near current levels and interest rates increase as currently forecast, projected interest expense-to-farm earnings ratios suggest that the farm sector as a whole is unlikely to face extensive debt repayment challenges by 2019. However, if farm income falls substantially, more farmers will find it difficult to meet their debt obligations. This chart updates data found in the July 2018 Amber Waves feature, “Current Indicators of Farm Sector Financial Health.”