China’s soybean imports from around the world expected to dip after a long-running expansion

- by Mark Ash and Mariana Matias

- 8/27/2018

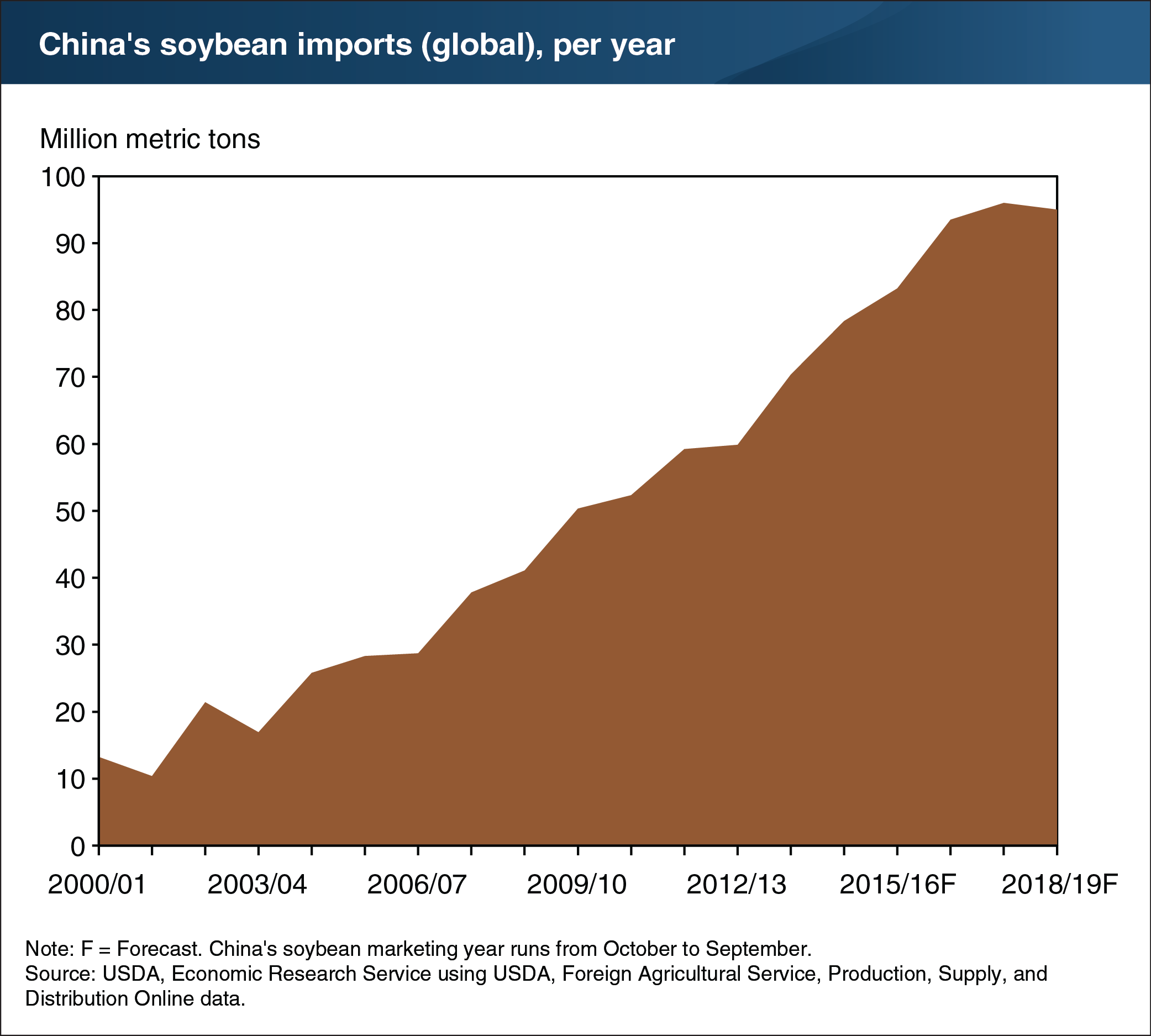

Recent declines in China’s use of soybeans reduced expectations for the total volume of soybeans China imports for the 2018/19 marketing year. By early July, the price of U.S. soybeans imported by China spiked after the Government raised import tariffs on U.S. soybeans by 25 percentage points. Also, because of a 10-percent decline in the value of China’s currency (the renminbi) relative to the U.S. dollar since April, the relative prices of U.S.-sourced soybeans have risen. Chinese soybean processors have seen their profit margins decline because of (1) the direct effects of the higher tariffs and U.S./China exchange rate changes and (2) the indirect effects of these same factors, as other soybean exporters, such as Brazil, experience higher demand and, in response, may raise their prices. The cumulative imports for October 2017 to July 2018 virtually matched the year-earlier level at 77 million tons, and imports are expected to total 96 million tons by September, a modest increase from the previous year. In 2018/19, the volume of soybeans imported to China are expected to decline relative to a year earlier, totaling 95 million tons. This would be the first annual decline in Chinese soybean imports since 2003/04. This chart appears in the ERS Oil Crops Outlook newsletter released in August 2018.