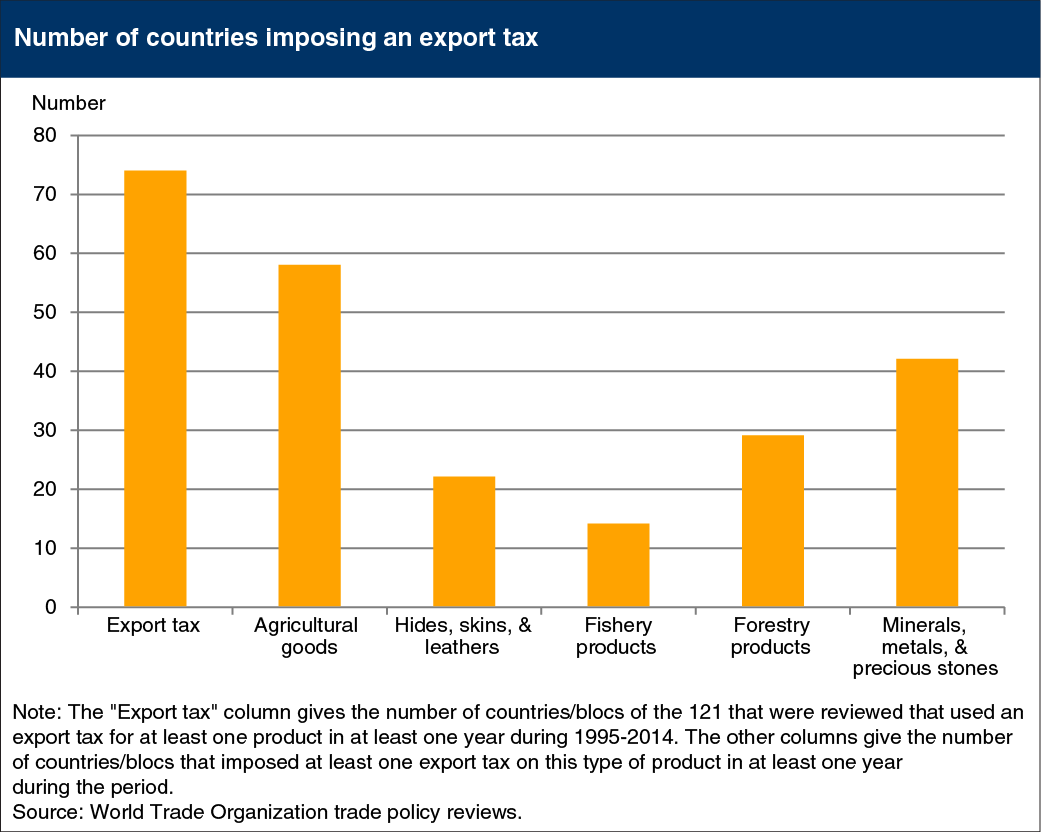

Agricultural goods are the most common target of export taxes

- by William M. Liefert

- 9/17/2015

During the surges in world agricultural and food prices over 2006-12, many countries restricted agricultural exports by implementing taxes, quotas, or complete export bans. Taxing exports is a longstanding practice among many countries. An ERS analysis of reports by the World Trade Organization found that from 1995 to 2014, 74 countries and trading blocs (out of 121 that were reviewed) applied export taxes for products such as agricultural goods, fishery/forestry products, and minerals/metals, with 58 of these countries taxing at least one agricultural product. Reasons to tax exports include obtaining revenue, supporting the domestic processing sector by reducing the price of raw materials, and—if the exported good is a food product—benefiting domestic consumers and improving the country’s food security. For countries that are important suppliers to world markets, export taxes can lead to higher prices worldwide due to the reduced volume of exports resulting from the tax, thus benefitting competing suppliers while hurting foreign consumers. The chart is based on the report Alternative Policies to Agricultural Export Taxes That Are Less Market Distorting, ERR-187.