U.S. farm sector assets and equity (inflation-adjusted) forecast to decline in 2015 for the first time since 2009

- by Kevin Patrick and Ryan Kuhns

- 3/2/2015

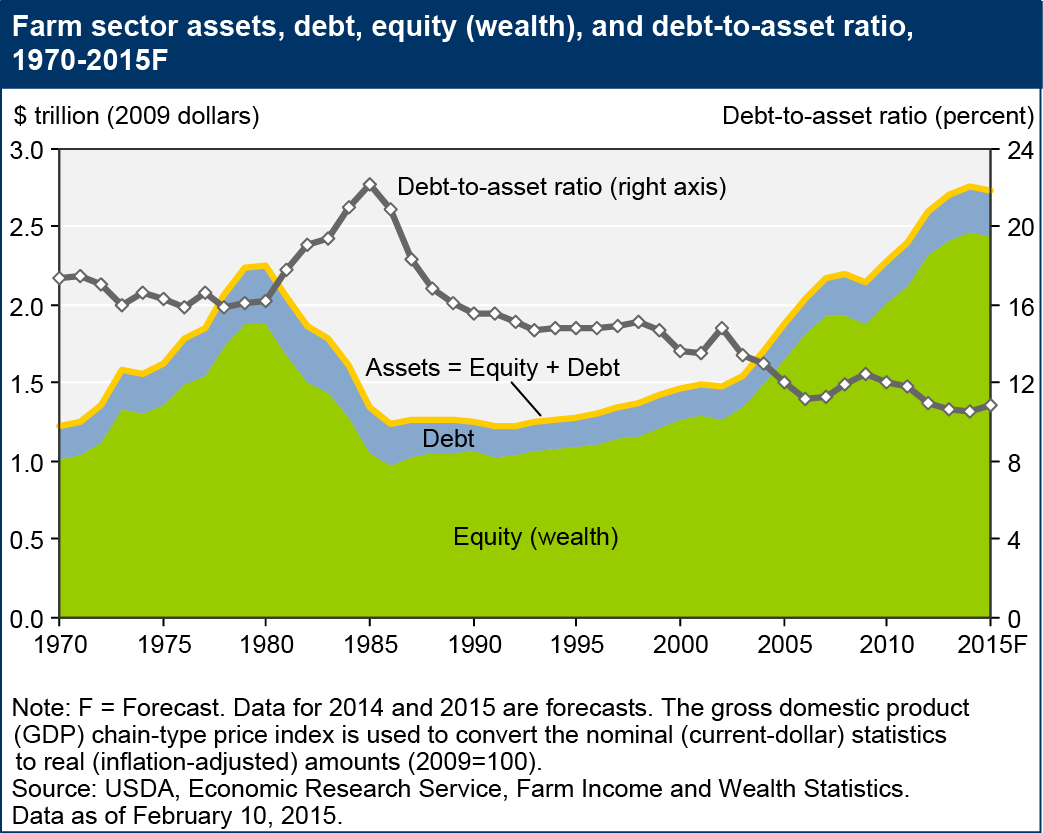

The rate of growth in U.S. farm sector assets and equity (assets minus debt) is forecast to moderate in 2015 compared with recent years, and to decline for the first time since 2009 after adjusting for inflation. Lower projected farm asset growth is primarily driven by decreases in financial assets and a small drop in farm real estate value. These declines reflect lower forecast net cash income for 2014-15, along with expectations of slightly higher interest rates. Farm sector debt is expected to increase in both nominal and inflation-adjusted terms in 2015. Debt is led higher by an increase in nonreal estate borrowing because lower cash income is expected to reduce cash available to cover operating expenses. As a result, the debt-to-asset ratio is expected to increase from 10.6 to 10.9 in 2015, marking the first increase since 2009. Dig deeper into the U.S. farm balance sheet with the data visualization released on February 10, 2015.