Farm sector debt ratios remain near their post-1970 lows

- by Mitch Morehart

- 9/5/2014

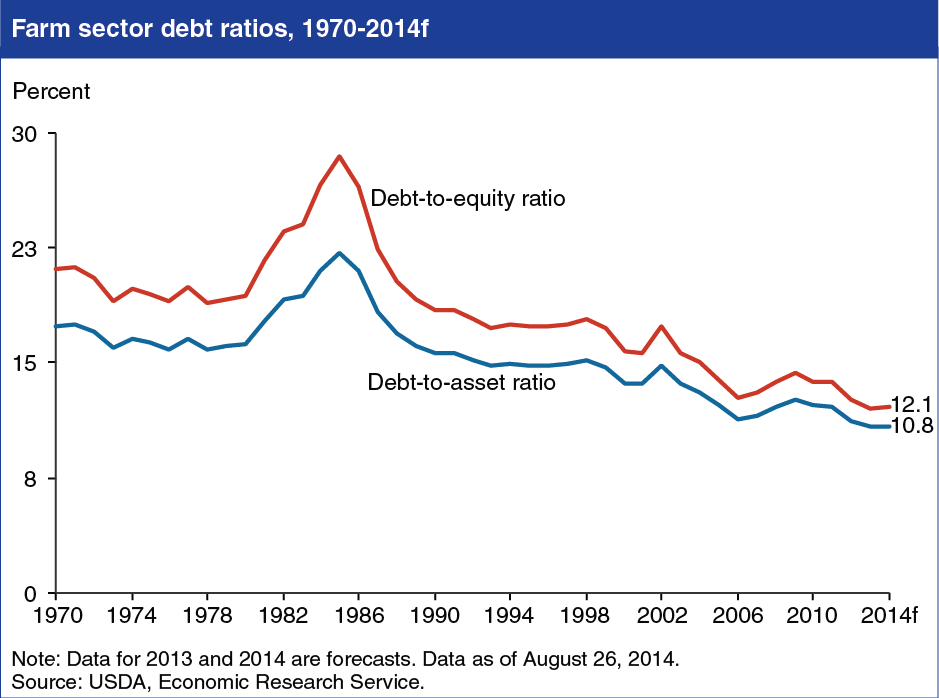

The rate of growth in farm assets, debt, and equity is forecast to moderate in 2014, the result of an expected decline in net farm income, higher borrowing costs, and moderation in the growth of farmland values. The value of farm assets is expected to rise 2.3 percent in 2014, while farm sector debt is expected to increase 2.7 percent. Even with the expected slowdown in asset growth, the sector’s financial position remains strong due to the historically low level of debt relative to assets and equity. The sector continues to be well-insulated from the risks associated with commodity production (such as adverse weather), changing macroeconomic conditions in the United States and abroad, as well as fluctuations in farm asset values that may occur due to changing demand for agricultural assets. This chart is found in the topic page for Farm Sector Income & Finances, and the underlying data are available in Farm Income and Wealth Statistics, updated August 26, 2014.