Rising stocks weigh on world cotton prices

- by Leslie Meyer

- 7/2/2014

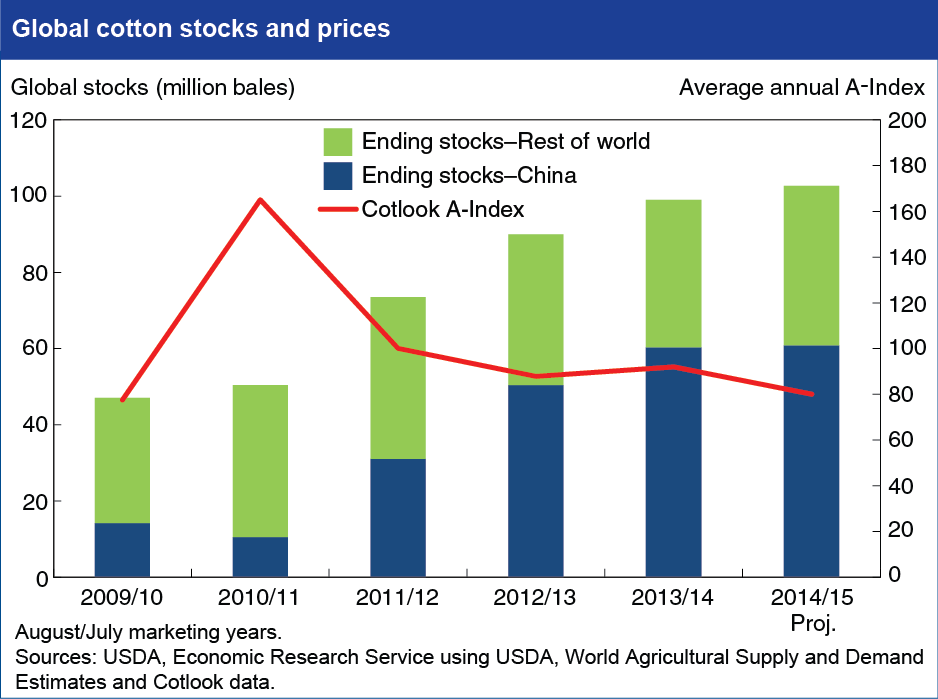

USDA projections for 2014/15 indicate that world cotton stocks will rise for a fifth consecutive season in 2014/15 (August/July marketing years), leading to continued downward pressure on global cotton prices. Global ending stocks are now projected at a record 102.7 million bales for 2014/15, nearly 4 percent above 2013/14, with China accounting for the bulk of the world total. Cotton stocks increased over the past several seasons after relatively high cotton prices led simultaneously to higher global production and slowed growth in cotton mill use. The rise in global stocks has largely occurred in China due to government policies, including national reserve purchases, that have supported global cotton prices by effectively keeping supplies out of the marketplace. Stocks in China at the end of 2013/14 are estimated at 60.3 million bales, or 61 percent of global stocks, and are not projected to change significantly in 2014/15. Cotton prices jumped to average $1.65 per pound in 2010/11 in response to tight global stocks, but have weakened since. The world cotton price is expected to decrease from an average of 92 cents per pound during 2013/14 to about 80 cents per pound in 2014/15. Find this chart in the Cotton & Wool Chart Gallery and additional analysis in Cotton & Wool Outlook: June 2014.