Market fundamentals have been the primary driver of recent wheat price spikes

- by Michael K. Adjemian

- 5/13/2014

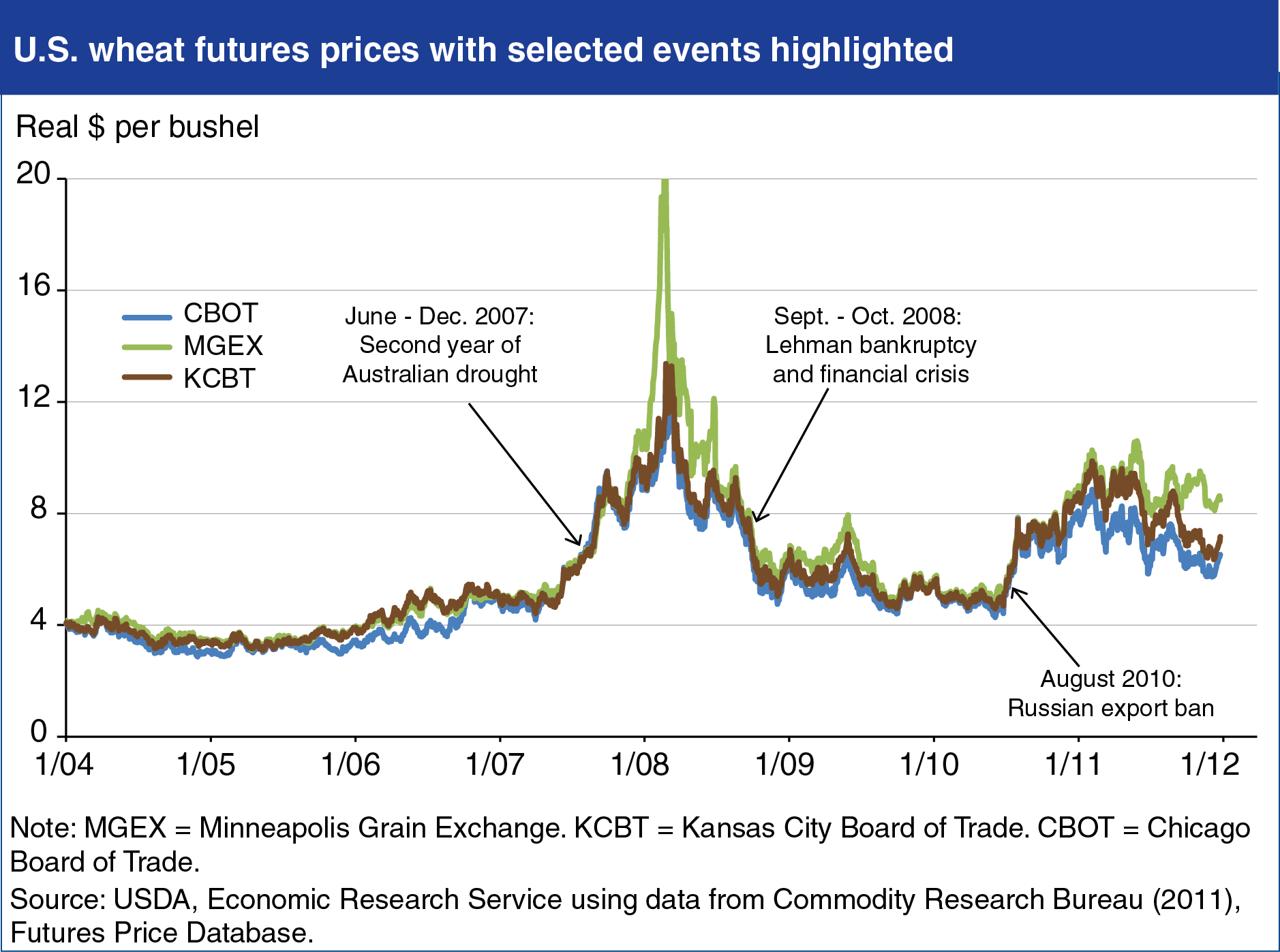

U.S. wheat prices have spiked and then fallen along with prices for other commodities over the last 5 years, leading to questions about how factors such as market fundamentals, macroeconomic events, and increased commodity index trading have contributed to these price swings. Recent ERS research measures the relative contribution of different factors to observed price changes during 1991-2011. Findings show that market-specific shocks related to supply and demand for wheat, such as drought impacts on consecutive Australian wheat harvests in 2006-07 and a Russian ban on wheat exports in August 2010, were the dominant cause of price spikes in the three U.S. wheat futures markets. Fluctuations in the global economy associated with broadbased demand shocks such as the Lehman Brothers Holdings, Inc. bankruptcy, were relatively less significant, and there is little evidence to suggest that increased commodity index trading activity contributed to recent price spikes. Find this chart and more analysis in Deconstructing Wheat Price Spikes: A Model of Supply and Demand, Financial Speculation, and Commodity Price Comovement.