Real estate assets play a major role in the U.S. farm sector financial outlook

- by Ryan Kuhns and Kevin Patrick

- 2/26/2014

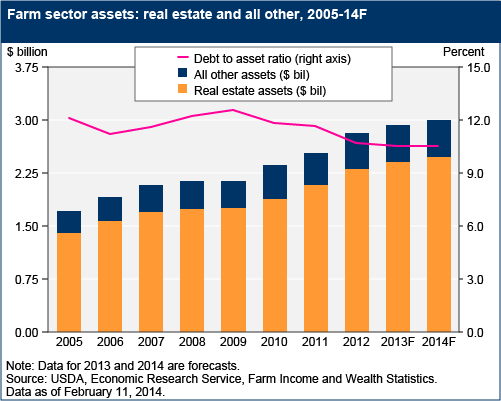

Reflecting land’s role as a key input in agricultural production, real estate assets (the value of land and buildings) play an important role in the farm sector’s financial health. Real estate has traditionally accounted for the bulk of the total value of farm sector assets—in 2014, real estate assets are expected to comprise 82 percent of total farm assets. When combined with generally lower annual increases in farm sector debt, the increasing value of farm real estate has helped the farm sector attain record low debt-to-asset ratios in recent years, a trend expected to continue into 2014. Change in the debt-to-asset ratio is a critical barometer of the farm sector's financial performance with lower values indicating greater financial resiliency. In addition, as the largest single component in a typical farmer's investment portfolio, real estate values affect the financial well-being of agricultural producers and serve as the principal source of collateral for farm loans. Data used in this chart are found in Farm Income and Wealth Statistics, updated February 11, 2014. Find additional information and analysis in ERS’ Farm Sector Income and Finances topic page.