Farm sector solvency ratios forecast to improve in 2012

- by Ken Erickson

- 12/7/2012

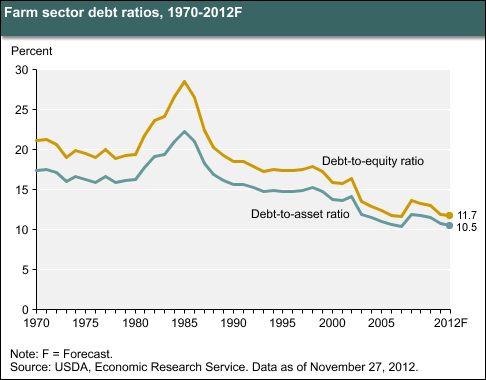

The debt-to-equity ratio and the debt-to-asset ratio are major indicators of the financial well-being of the farm sector. The debt-to-equity ratio measures the relative proportion of funds invested by creditors (debt) and owners (equity). The debt-to-asset ratio measures the proportion of farm-business assets that are financed through debt. Lower ratios signify that farmers are relying less on borrowed funds to finance their asset holdings. The farm sector’s debt-to-asset ratio is expected to decline from 10.7 percent in 2011 to 10.5 percent in 2012. The debt-to-equity ratio is also forecast to decline, from 11.9 percent in 2011 to 11.7 percent in 2012. The steady decline in both ratios since the mid-1980s is due to relatively large growth in the value of farm assets (driven principally by increases in farm real estate values), while farm-debt levels increased at a much slower pace. This chart is from the Farm Sector Income & Finances topic page on the ERS website, updated November 27, 2012.