Delinquency rates for agricultural loans remain relatively low during recession and recovery

- by Economic Research Service

- 6/26/2012

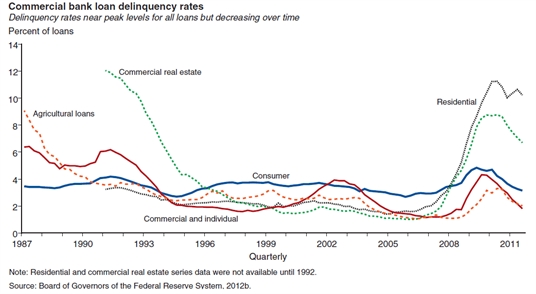

U.S. agriculture made it through the recession and uneven economic recovery better than other industries, aided by agriculture's relatively strong balance sheet and low overall use of debt entering and exiting the recession. In financial terms, while delinquency and default rates on agricultural loans at commercial banks increased in 2009, they have remained far lower than other sectors. Farm Credit System problem loan rates have been lower than rates on farm loans at commercial banks. The decline in farm delinquency rates in 2010, coupled with high farm income in 2010 and in 2011, indicates that farm loan charge-off rates are moving back towards long term trend levels. This chart is found in The 2008-09 Recession and Recovery Implications for the Growth and Financial Health of U.S. Agriculture, WRS-1201, May 2012.