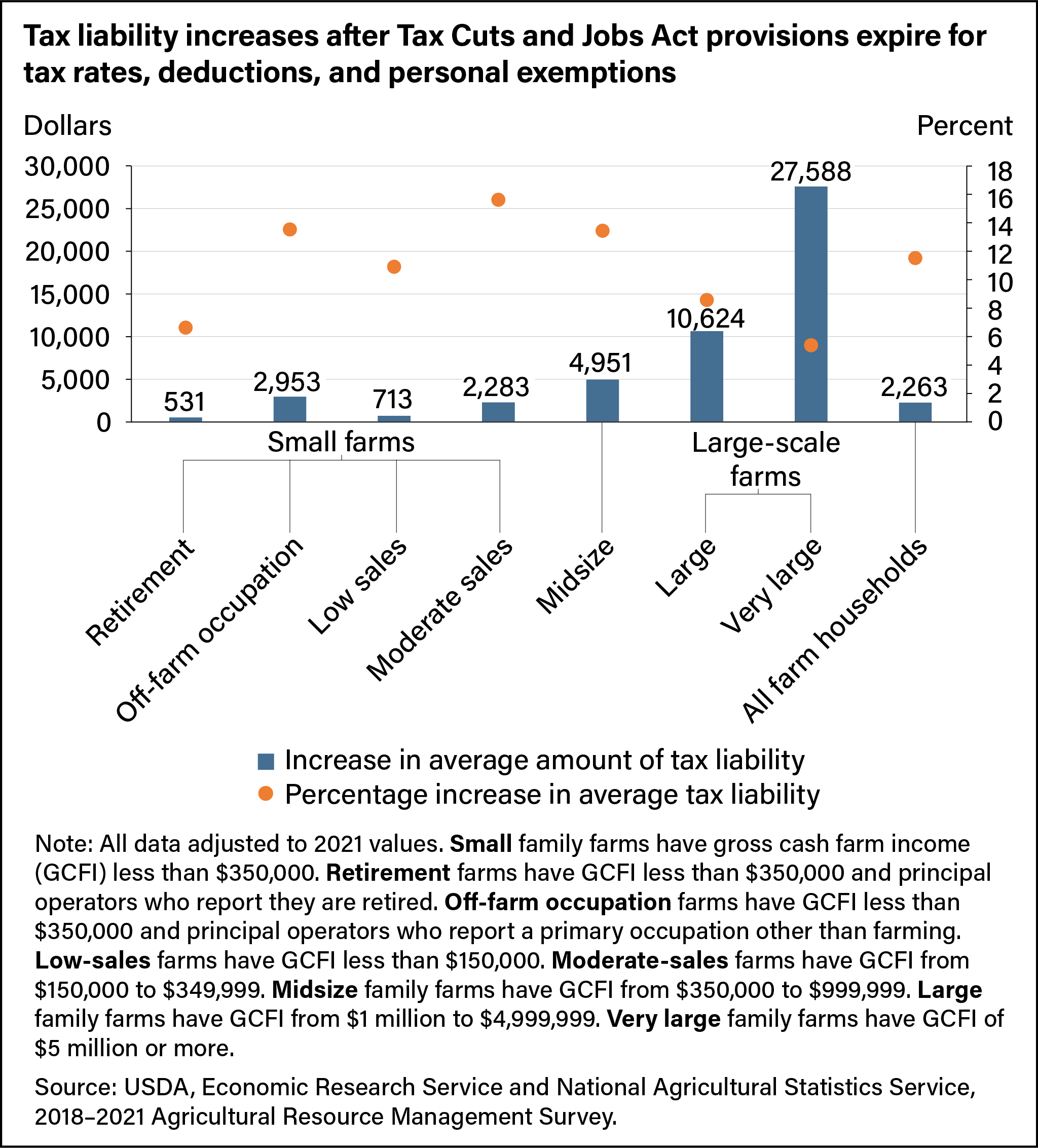

Tax liability increases after Tax Cuts and Jobs Act provisions expire for tax rates, deductions, and personal exemptions

- by Tia M. McDonald and Ron Durst

- 3/6/2024

The 2017 Tax Cuts and Jobs Act reduced tax liabilities through changes to several income and business tax policies. When those expire in 2025, the combined effect would raise tax liabilities for family farms, with moderate-sized farms experiencing the largest percentage increase.